30 May 2023 | FinTech

Fintech Is Femme’s 10 Books To Level Up

By

If I’m being frank, I’m immediately skeptical whenever someone tells me they do not have time to read books. That’s because reading fosters a growth mindset, and we’re all about growing ourselves as humans here at Fintech Is Femme.

Reading is essential for every fintech CEO, founder, operator, and investor. It broadens your mind, helps with your written and verbal communication skills, and gives you a certain level of understanding and empathy.

So, since hot girls don’t gatekeep and I’m often asked by you what are some of the best books I’ve read to enter my growth mindset and gain my expertise on the intersection of gender parity, finance, and technology – I’m pulling back the curtain on my MUST reads for this summer and beyond.

The books I am sharing combine personal stories, research, fiction, and business-building insights. They are not listed in any particular order, but women write the majority of them.

Ready to grow? Let’s get into it.

#1 Invisible Women: Data Bias in a World Designed for Men

Data is a powerful tool that has immense implications for our lives, but its use cannot be divorced from the reality of gender inequality. As Caroline Criado Perez outlines in her book Invisible Women, the consequences of this bias are far-reaching and devastating.

Not only does it disproportionately affect women’s economic opportunities, but it impacts their safety as well. Criado Perez has done a remarkable job of synthesizing evidence from all around the world, in a witty and insightful manner.

This book is essential for anyone who wants to understand the true extent of gender inequality and its effects – it will truly transform the way you view the world.

#2 Level Up: Rise Above the Hidden Forces Holding Your Business Back

Any problem you may face as an entrepreneur has likely been dealt with in the past by another entrepreneur. Reading helps you find innovative solutions to problems before they derail your progress.

Stacey Abrams and Lara Hodgson became successful entrepreneurs and fintech founders through grit, determination, and many late nights. When Stacey’s part-time job in the Georgia House of Representatives wasn’t enough to make ends meet, she took the plunge and started her own consulting business – her first small business.

With a dash of ambition and a pinch of wit, they named it Insomnia Consulting because they did their best thinking at 3 am.

Now, fifteen years into their entrepreneurial journey, the dynamic duo have successfully tackled the obstacles that plague small business owners: how to grow sustainably, hire thoughtfully, and keep up with the big dogs in the industry.

Now, they share their inspiring story and hard-earned lessons in their revelatory guide to starting and scaling a small business.

BONUS: I had the incredible Lara Hodgson on Humans of Fintech. Hear about her journey as a fintech founder with Stacey, here.

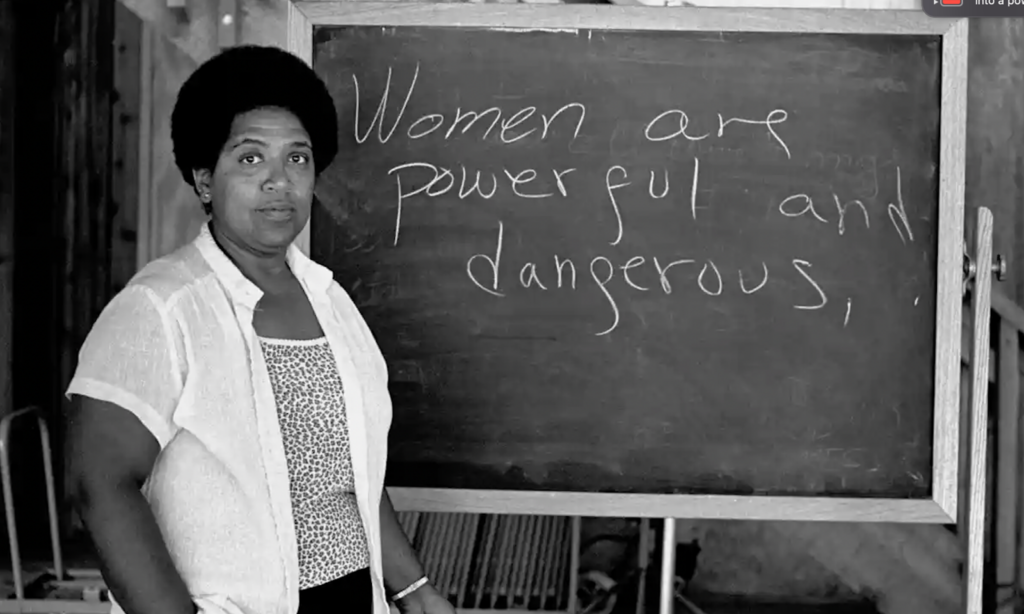

#3 Sister Outsider

This one is for my advanced readers and is hands down one of my favorite books. Sister Outsider is a compilation of essays and speeches by Audre Lorde, a black lesbian poet, and feminist writer.

In this work, Lorde addresses various issues, including sexism, racism, ageism, homophobia, and class. She argues that social differences can inspire action and lead to positive change. Her writing is both powerful and poetic, conveying her struggles while ultimately offering hope.

This edition includes a new foreword by Cheryl Clarke, a scholar, and poet who highlights the continued relevance of Lorde’s philosophy more than twenty years after its initial publication.

I also am thinking of making this book the first for the Real Talk community members book club.

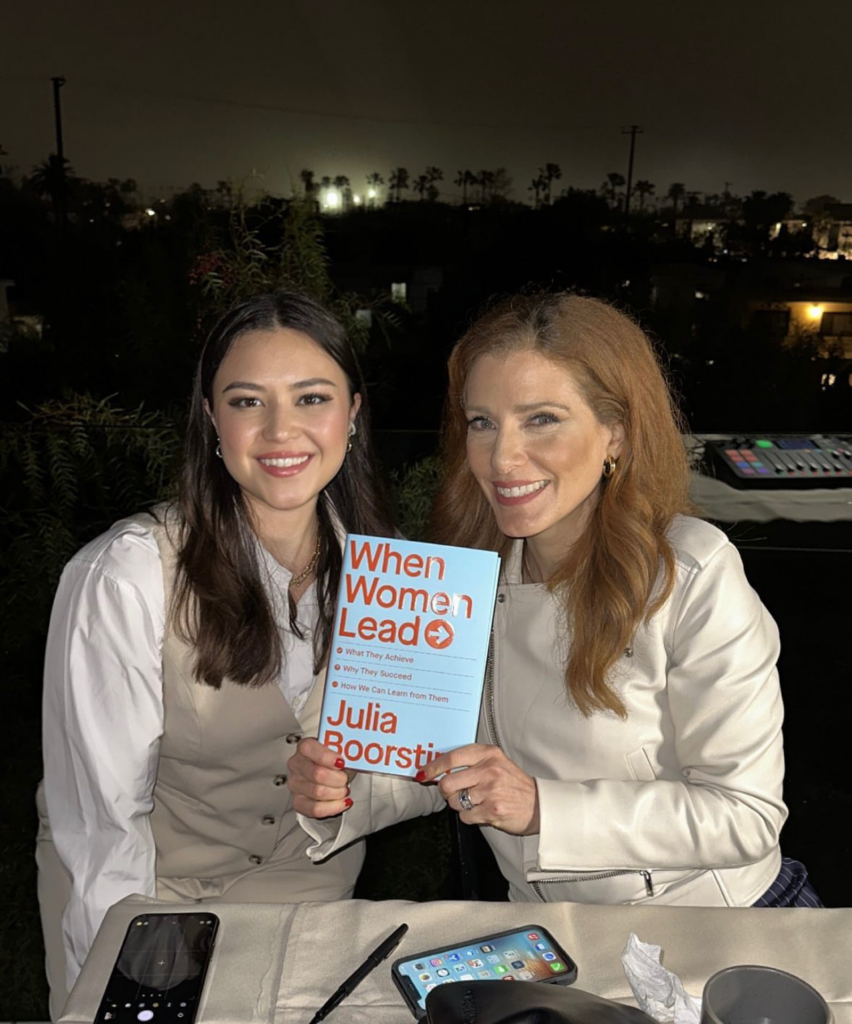

#4 When Women Lead: What They Achieve, Why They Succeed, and How We Can Learn from Them

Women leaders share key commonalities that make them uniquely equipped to lead, grow businesses, and navigate crises.

They are highly adaptive to change, deeply empathetic in their management style, and much more likely to integrate diverse points of view into their business strategies, filling voids that their male counterparts had overlooked for generations.

By utilizing those strengths, women have invented new business models, disrupted industries, and made massive profits.

Julia Boorstin shares insights from two decades of researching and interviewing some of the world’s foremost business executives in her new book. Instead of falling into conventional stereotypes, female business leaders discovered unique strengths, from vulnerability to adaptability, which allowed them to create disruptive business models and make large profits.

With her new book, When Women Lead, Boorstin is determined to prove that these are more than just ‘women’ skills – they’re essential for success. So she interviewed some of the world’s most powerful women; their stories demonstrate that anyone can use them to their advantage.

So whether you’re a CEO or an aspiring entrepreneur, Boorstin’s book is sure to become a radical blueprint for the future of business.

#5 There’s Nothing Micro about a Billion Women

The alarming statistic that nearly one billion women have been excluded from the formal financial system paints a stark picture of the global economic segregation many women face. Moreover, these women are denied access to even the most basic financial services, such as secure ways to save money, pay bills, and get credit.

Mary Ellen Iskenderian, leader of Women’s World Banking, a nonprofit that works to give these women access to the financial system, argues that the banking industry should view these one billion “unbanked” women as a business opportunity instead of charity cases. After all, these women are small business owners, heads of households, and purchasers of financial products and services.

Iskenderian explains how financial inclusion can be transformative, emphasizing the importance of economic and digital literacy, access to mobile banking, and women’s property rights.

In short, banks can do the right thing—and make money while doing so—benefiting both the banking industry and the women excluded from the formal financial system.

#6 Embedded Finance: When Payments Become An Experience

If you’re looking for the most comprehensive overview of the revolutionary technology of embedded finance, Scarlett Sieber and Sophie Guibaud’s Embedded Finance: When Payments Become An Experience is the book for you!

Covering everything from the current trends and technologies driving embedded finance to the potential impacts it could have on our lives in 2030, you’ll get an in-depth look at the opportunities and strategies for technology companies, banks, and brands to take advantage of this emerging market.

It’s full of practical examples of how embedded finance is being leveraged today, from industry giants such as Amazon and Google to niche players poised to revolutionize their own corners of the market.

If you’re looking to stay ahead of the curve, this book will equip you with the knowledge and insight you need to prepare for the embedded finance revolution – so, get reading!

#7 Building For Everyone: Expand Your Market With Design Practices From Google’s Product Inclusion Team

The economic “why” of diversifying and including all audiences in organizations and products has been firmly established, but how do businesses capture market share and develop products that suit their users’ core needs?

Building For Everyone, the practical guide developed by Annie Jean-Baptiste head of the Product Inclusion Team at Google, outlines strategies and step-by-step processes for inclusive product design that limits risk and increases profitability.

Through case studies, readers will learn the key tactics to make their organizations more inclusive, from understanding and implementing the “ABCs of Product Inclusion” into their culture to leveraging the team’s suite of tools.

With this book, businesses of all types will be able to identify new opportunities and make sure their products are designed in an inclusive way, while marketers, user researchers, and product managers will have the questions they need to ask about diversity and inclusion. Building For Everyone will show you how to infuse your business processes with inclusive design and make sure everyone is included.

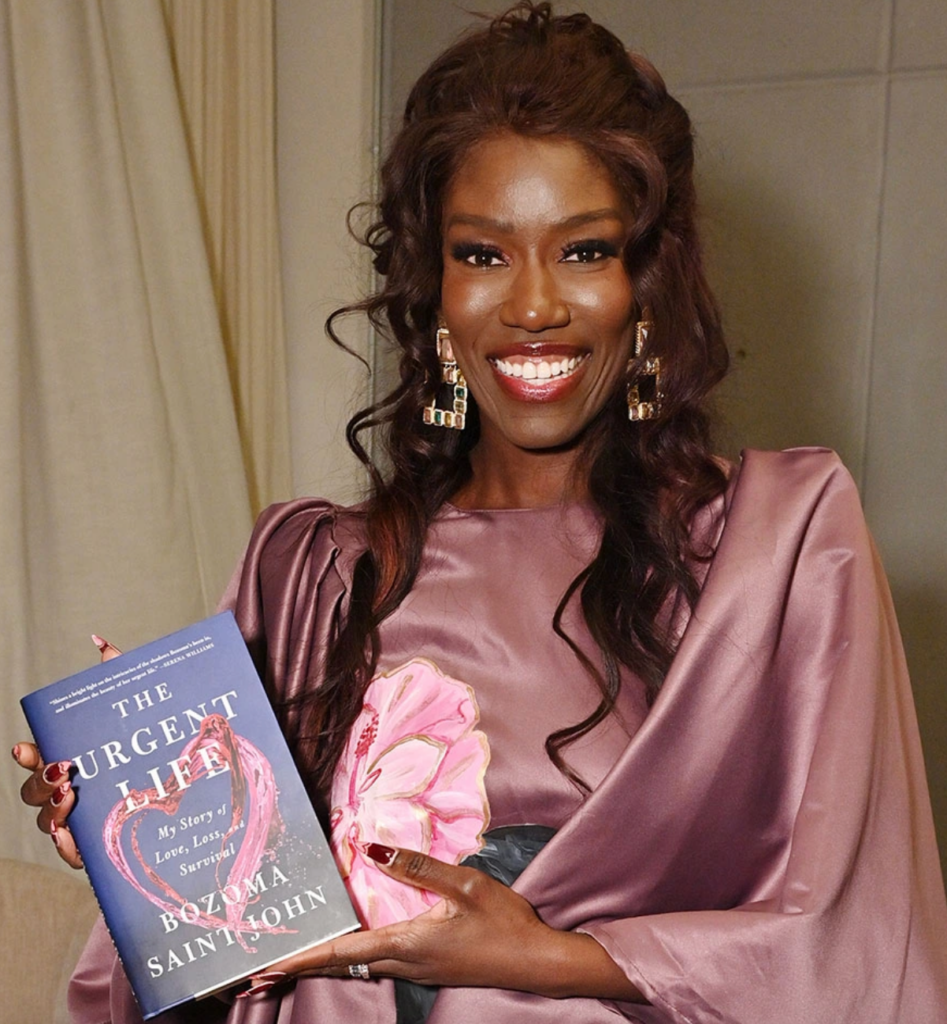

#8 The Urgent Life: My Story of Love, Loss, and Survival

Bozoma Saint John’s journey from tragedy to living life with urgency is as inspirational as it is relatable. When her husband Peter died of cancer, he gave her a short list of instructions—cancel the divorce and fix wrongs immediately—and she stepped up to the challenge. In her book, The Urgent Life, Bozoma takes readers through her dizzying grief, and her courage to continue living life in accordance with her deepest values. We see Bozoma’s highs and lows as she navigates life as a woman determined to use tragedy to craft a life worth living.

Her extraordinary story is sure to resonate with anyone who has experienced loss, grief, and the courage to pivot and live life to the fullest. Bozoma’s resilience in the face of adversity is inspiring, underscoring how even in her brokenness, she was determined to create a life full of love and joy.

And you can learn more about Bozoma and her badass-ary, here.

#9 The Laws of Wealth: Psychology and the Secret to Investing Success

NYT Best Selling author, diet coke enthusiast, and Humans of Fintech podcast guest Dr. Daniel Crosby takes a fresh, practical approach to behavioral finance in his book The Laws of Wealth.

Unfortunately, this field has tended towards theory more than application, and Daniel gives us ten rules of investor behavior, such as ‘Forecasting is for Weathermen’ and ‘If You’re Excited, It’s Probably a Bad Idea,’ to introduce us to timeless principles for managing money and investing process.

Daniel also provides valuable ‘What now?’ summaries at the end of each chapter, giving readers clear guidance on how to use behavioral research to their advantage. With a blend of his clinical psychology background, his experience as an asset manager, and his care for understanding other cultures, Dr. Crosby has crafted a revolutionary book in behavioral finance.

BONUS: Hear Daniel admit that I have my honorary Ph.D. in behavioral finance by tuning into his episode of Humans of Fintech here.

#10 The Space Between Us

I am currently reading this book as I travel around India. It couldn’t be more perfect. The Space Between Us, Thrity Umrigar’s captivating novel about two women from two different worlds, offers an insightful look at the harsh realities of class and gender roles in modern day Bombay.

Through the eyes of Sera, a Parsi widow living in an elegant home, and Bhima, the elderly housekeeper struggling to support her orphaned granddaughter, we gain a unique perspective of the deep bond that goes beyond employee and employer.

Sera’s seemingly luxurious life is not what it appears; after years of hardship, she faced physical and emotional abuse at the hands of her husband, which only Bhima could understand and help alleviate. Through their shared sorrows and joys, Sera and Bhima created an unbreakable connection that exceeded all boundaries of race and class, a bond in which they both had no control over their life’s fate.

If you start reading this one, let me know! I’m only on chapter 6 but it’s already so good.