11 February 2023 | Healthcare

From Fitness to Vital Signs: A Deep Dive into Wearable Tech

By workweek

Wearable technology will soon become widespread and as regularly used as putting on shoes before leaving the house. Heck, I’m writing this newsletter with my Garmin watch on my left wrist and my WHOOP band on my right bicep. All I need is a wearable to measure my electrolytes. Then I’m set.

I’m not the only one with wearable tech: more than a quarter of Americans are expected to use wearable technology in 2023. That’s 83 million Americans!

Given the vast market penetration of wearable technology, it’s necessary to discuss its current state. In this article, I’ll provide a general overview of wearable technology, discuss the business landscape, and touch on why wearable tech companies need to pick a lane.

The Deets

Wearable technology allows continuous monitoring of three general domains:

- Fitness Activity: GPS capability, pace/speed, stride length, power, run/bike cadence, steps, elevation gain.

- Physiology: resting heart rate (RHR), heart rate variability (HRV), blood pressure, oxygen saturation, respiratory rate, one-lead EKG, sleep, blood sugar level.

- Behavior: fall identification, time spent sedentary, gait monitoring, close-contact detection (think Covid-19).

Some of the most common forms of wearable tech to monitor these domains include wristbands, watches, jewelry, clothing (bra, underwear), and skin-attached (continuous glucose monitoring).

While some wearable tech focuses on just one of the domains, other wearable tech focuses on all three. For example, Dexcom’s continuous glucose monitor focuses on monitoring glucose levels (physiology). The Garmin Forerunner 955, on the other hand, focuses on physiology and fitness activity: this watch measures RHR, HRV, oxygen saturation, respiratory rate, sleep, and fitness activity, including GPS, power, cadence, and stride length.

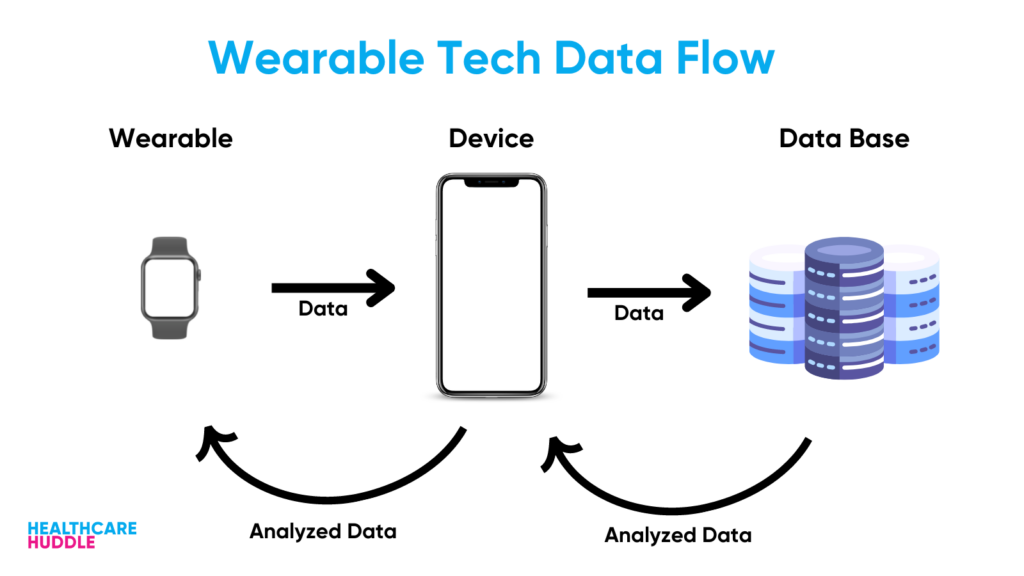

All wearable technology—from Dexcom to Garmin—uses the same schema. Data from the wearable is passed to a device (your phone, for example), then passed to a database that crunches the data to give you or your physician the analysis.

While wearable technology shares the same end-user—the consumer or patient—the business models differ. I like to classify the wearable tech business models into three categories:

- Direct to Consumer (D2C): this is wearable tech delivered right to the consumer, like the Apple Watch.

- Business to Physician (B2P): this is wearable tech targeting physicians so they can prescribe said tech to their patients, like Dexcom’s continuous glucose monitor or VitalConnect’s VitalPatch.

- Business to Business (B2B): similar to B2P, this is wearable tech targeted to businesses to adopt said tech for their employees, research participants, or beneficiaries. For example, Roche and Sysnav Healthcare announced a new partnership, allowing Roche to use movement-tracking tech to monitor disease progression in several neurological disorders.

Current State of Wearable Tech

The global wearable technology market was valued at $61 billion in 2022 and is expected to grow 15% annually until 2030.

The growth of wearable tech parallels technological advancement. Wearable tech has reached major research milestones over the past decade, from contact lens biosensors for glucose monitoring to microneedle biosensors for real-time drug monitoring. Such progress is credited to robust telecommunication technology, bioengineering, artificial intelligence, and consumer buy-in.

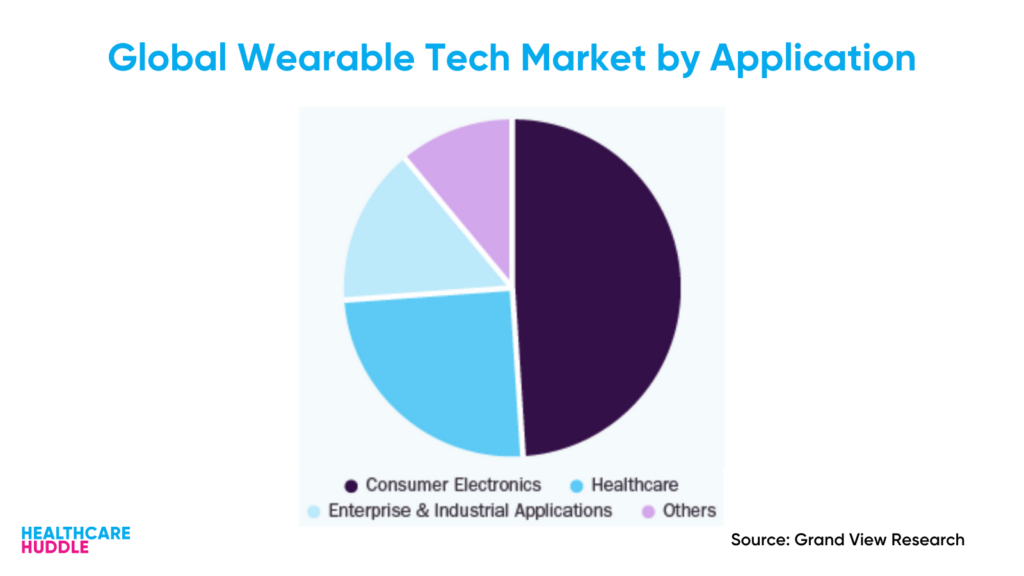

Consumer electronics and healthcare made up around 75% of the global wearable tech market in 2022. I’ll place consumer electronics in the D2C category and healthcare in the B2P or B2B category.

The number of first-gen D2C wearable tech on the market has an estimated annual growth rate of 11%, and is expected to reach 250 million units this year. These first-gen wearables can now capture high-quality physiologic measurements comparable to regulated medical technology. They come in the form of watches, clothing, and jewelry, and all use micro-electro-mechanical sensors to capture data (accelerometer, gyroscope, magnetometer, GPS, HR sensors, pedometers, pressure sensors).

A recent Deloitte consumer survey found 41% of respondents own a smartwatch or fitness tracker, up from 39% in the previous year. Ninety percent of these folks use wearbles to track fitness and monitor health metrics, and 30% of them report these wearables have significantly improved their fitness and health. Most interesting is that 55% of wearable tech users in the survey reported sharing their data with medical providers.

Similarly, the first-gen B2P/B2B wearable tech on the market is projected to grow 19% annually, and is predicted to hit 130 million units this year. Unlike consumer wearable tech, which provides a broad range of insights covering fitness activity, physiology, and behavior, medical-grade devices typically have one focus (e.g. physiology).

Annual B2P/B2B wearable technology growth may outpace D2C because of high-level healthcare trends, including the shift to value-based care and health at home. For example, BioIntelliSense—a remote patient monitoring company with medical-grade wearable tech—partnered with Medically Home Group, allowing physicians to monitor patients’ vitals in their homes. Similarly, Orlando Health announced a partnership with remote patient monitoring company Biofourmis (medical-grade tech) to improve its hospital-at-home program. Biofourmis’ tech will allow Orlando Health physicians to gather patients’ physiological data from their homes to determine their health trajectory.

So, as healthcare continues its push to value-based and home-based care, we’ll see an increased need for these B2P/B2B wearable tech companies, allowing for continuous monitoring of patient physiological or behavioral data.

Dash’s Dissection

An interesting phenomenon we’ll see is the blurring of “consumer” and “medical” wearable technology: consumer wearable tech can now perform high-quality measurements on par to medical-grade wearable tech.

I briefly chatted with Dr. Jonathan Slotkin—whose opinion on healthcare I value tremendously—about wearable technology. He proposed that wearable tech companies must make an identity choice: be a consumer-grade device maker or medical-grade device maker. Said another way, companies like Apple and Fitbit need to decide whether to stick to providing consumer-grade technology or pivot to medical-grade tech. They can’t do both.

I’ve thought about this over the past couple of days, and I figured the best way to think about it is to ask this question: is the compatibility of consumer-grade wearable tech and medical-grade tech beneficial? I think it depends on the perspective you take.

From the consumer or patient perspective, the democratization of high-quality data analytics may be beneficial, allowing consumers to understand health trends to improve their health.

From the physician’s perspective, the question is: should medical-grade technology solely be for them to analyze, not patients? I think about Apple Watch’s EKG feature. The average Apple Watch user does not understand an EKG, how it works, and how to interpret it. So should consumers be privy to such medical data if its utility is low for the average user or should it be left to the physician to analyze and interpret?

Furthermore, a team of physicians and engineers developed a wearable ultrasound device—the size of a postage stamp—to assess cardiac structure and function. This technological advancement is incredible. But, one of the researchers said the goal is to make ultrasound more accessible to a larger population. While the specific “large population” wasn’t specified, I’m assuming it’s consumers. Ultrasound tech shouldn’t be democratized to consumers with zero formal cardiac ultrasound training. What’s the point?

So, wearable tech companies need to choose a lane. Either offer consumer-grade devices (think basic physiological data) or medical-grade technology (more complex physiological data like EKG, continuous glucose monitoring, or ultrasound). Depending on their approach, companies can either take the D2C, B2P, or B2B routes. I believe the B2P and B2B routes will prove more robust as we shift to value-based and home-based care where minimally invasive remote patient monitoring is critical.

D2C metabolic health company Levels is a good example of a company that picked a lane. Levels offers an arm patch that continuously monitors blood glucose levels. Historically, continuous glucose monitoring patches were solely prescribed for those with diabetes (B2P/B2B). But Levels decided to “democratize” continuous glucose monitoring for the consumer instead of using it for medical purposes.

The “identity” wearable tech companies choose will become more important as we quickly move into second-generation wearable tech. This next generation of wearable tech includes on-skin patches (ultrasound tech), tattoos, tooth-mounted films, contact lenses, textiles, invasive microneedles, and injectable devices. Such technology can use biofluids to detect electrolyte and protein levels in interstitial fluid to measure (by proxy) blood level concentrations. It will be exciting for physicians, to say the least. For consumers, I’m not so sure.

In summary, the wearable tech market is booming, with an estimated one-quarter of Americans owning wearable technology. As a result, the industry is proliferating (15% annually) as technology advances. However, essential questions for wearable companies to decide as the tech advances are whom their technology is for and what type of technology will be offered (consumer-grade or medical-grade).

If you enjoyed this deep dive, share it with colleagues. Sign up for the Healthcare Huddle newsletter here.