03 December 2022 | FinTech

A Microcosm for Fintech

By Alex Johnson

If you had to pick one company to use as an example to explain everything that has happened in fintech over the last decade, which company would you pick?

It’s a difficult question.

I’m not asking for the most successful company in fintech over the last 10 years. Or the most famous (or infamous). I’m asking for the company that is most representative of what has happened in fintech during that period.

Which company is a microcosm for modern fintech?

To answer this question, you’d want to answer a different question first – what are some of the most important trends that have shaped fintech in the last 10 years?

Here’s a non-exhaustive list:

- Customer-focused unbundling. This is where the modern era of fintech started – picking out a small piece of what an incumbent financial services provider offers (checking account, mortgage loan, investing, etc.) and creating a superior version of that product that better addresses the needs of at least one segment of customers in the market.

- Cross-sell-focused rebundling. The second half of the unbundling strategy – using the initial wedge product to acquire a large base of customers and then cross-selling them a bunch of additional products, thereby reducing CAC and increasing LTV.

- Cultural maturation. Immature, frat house-ish behavior has been, for much of the last 10 years, far too common inside fintech companies (Robinhood saying, “fuck it, we’re doing it anyways” when launching an uninsured, non-compliant checking and savings product is the example that sticks in my head). We’ve made some progress, but this is still a problem we’re struggling with today in fintech (and, to a much more spectacular degree, in crypto).

- Wildly optimistic private valuations. Low rates → yield-hungry LPs → VCs with massive funds and a founder-friendly attitude → enormous valuations that became disconnected from reality. This was the story in fintech for a large part of the last decade.

- Fintech entering the consumer consciousness. A large portion of the money raised by private fintech startups, especially in the last couple of years, was spent to establish awareness of those companies’ brands in the minds of consumers. This resulted in a lot of sports arena and jersey sponsorships, as well as copious amounts of commercials, billboards, and subway ads.

- A global pandemic. You can’t really tell the story of the last 10 years of fintech without talking about the impact of the COVID-19 pandemic, which provided a boost to fintech companies in many ways (drove consumers to digital channels/services, opened the door for addictive finance apps like Robinhood, etc.) but also came with some challenges (loan forbearance programs, an increase in fraud activity, etc.)

- Deeply skeptical public valuations. For all the enthusiasm of private market investors, public market investors have been somewhere between lukewarm and cold on fintech companies (especially lately) and have been utterly unwilling to buy the companies’ arguments that they should be valued like software companies, not banks.

- The merging of fintech and banking. This one has manifested itself in a number of different ways since the Great Recession – banking-as-a-service, bank-fintech product and/or distribution partnerships, banks investing in fintech companies, banks acquiring fintech companies, fintech companies acquiring banks, and fintech companies acquiring de novo bank charters.

- An explosion of fintech infrastructure. As I’ve written about many times in this newsletter and as I talked about a lot on The Fintech Factor podcast, we are living in the golden age of fintech infrastructure – BaaS, LaaS, CaaS, KYC, AML, LMS, no code, low code, whoa code (ok, I made that last one up) – you name it, there’s now a fintech infrastructure provider who wants to sell you a solution for it.

- Embedded finance. Every company will be a fintech company. $7 trillion opportunity. Yadayada. I feel like we’re well-versed in this one.

So, ok, which company are you picking? Which company covers all of (or even most of) these trends? Which company might we examine in order to get a glimpse into the opportunities and challenges that lie ahead for fintech?

I can only think of one.

Social Finance Inc.

SoFi!

This company is, for better and worse, the microcosm for modern fintech.

Let’s review exactly why I think that is, and then ask some questions about its future and what it might tell us about the future of fintech overall.

Customer-focused unbundling.

The initial idea for SoFi, back in 2011, was to create an alternative for financing higher education by connecting students and recent graduates at prestigious universities with alumni of those same universities. This peer-to-peer model would give students a competitively-priced option for paying for college (or refinancing their existing student loans), and it would give alumni the opportunity to help the students in their network and earn a good yield on their investment. The company started with a small pilot at Stanford Business School:

Mr. Cagney and four fellow graduate students at Stanford’s business school created SoFi last summer. The company registered as a lender in California and raised $2 million from 40 Stanford business school alumni who gave an average of $50,000 each, Mr. Cagney said. The money was loaned to 100 graduate business students, who borrowed roughly $20,000 each.

And eventually expanded into similar universities around the country:

SoFi — short for Social Finance Inc. — is branching out and expects to begin taking applications for consolidation loans in April from recent graduates of five business schools, using funds raised from alumni of those schools (Harvard, M.I.T., Northwestern and the University of Pennsylvania, in addition to Stanford).

SoFi also aims to begin taking applications in June for new student loans for undergraduates and graduate students at about three dozen schools for the 2012-13 academic year.

It was basically The Facebook of fintech.

Eventually, the company abandoned the peer-to-peer model (drop the “the”, it’s cleaner) and started doing private student lending and student loan refinance directly. However, SoFi’s origin left two important imprints on the company’s DNA:

- Focus on HENRYs. Unlike most B2C fintech companies from this era of fintech, SoFi has never focused on serving underbanked or low-income consumers. Instead, its initial focus on prestigious and expensive universities led it to develop expertise in serving HENRYs (High Earner, Not Rich Yet). This has occasionally caused PR headaches for the company, but it has also put it in an enviable position to serve a profitable customer segment.

- Early practice doing lending. The other distinguishing factor for SoFi early on was its focus on unsecured lending. Unlike many B2C fintech companies that started in deposits and are now just getting into lending (e.g. Varo), SoFi cut its teeth in lending at the very beginning of its life. This is an advantage for SoFi because consumer lending is both a.) profitable and b.) almost impossible to do well right out of the gate.

Cross-sell-focused rebundling.

In addition to being a great example of unbundling banking and building a compelling wedge product, SoFi is also perhaps the best example in fintech of rebundling.

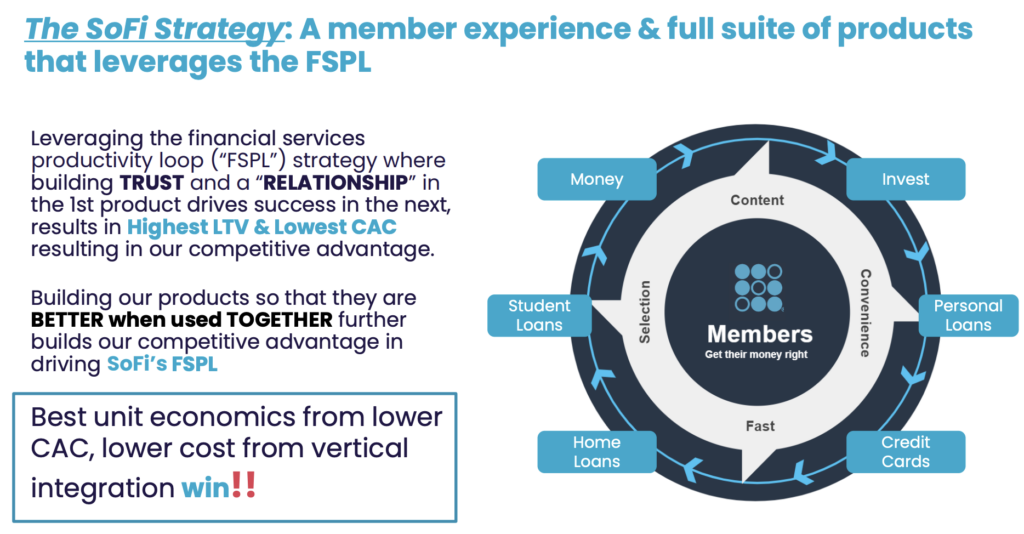

As the company likes to make clear in its investor materials, it sees consumer banking as a winner-takes-most business:

And it has rapidly added products to its consumer banking suite in order to provide a one-stop shop for all of a consumer’s financial needs:

Today, SoFi offers the following products:

- Student Loan Refinancing

- Private Student Loans

- Auto Loan Refinancing

- Unsecured Personal Loans

- Mortgage and Home Equity Loans

- Investing (active, automated, retirement, crypto, etc.)

- Credit Card

- Checking and Savings with P2P payments and no fees.

- Insurance (auto, home, life, etc.)

- A Membership and Rewards Program

- A Financial Insights Tool (credit score monitoring, budgeting, etc.)

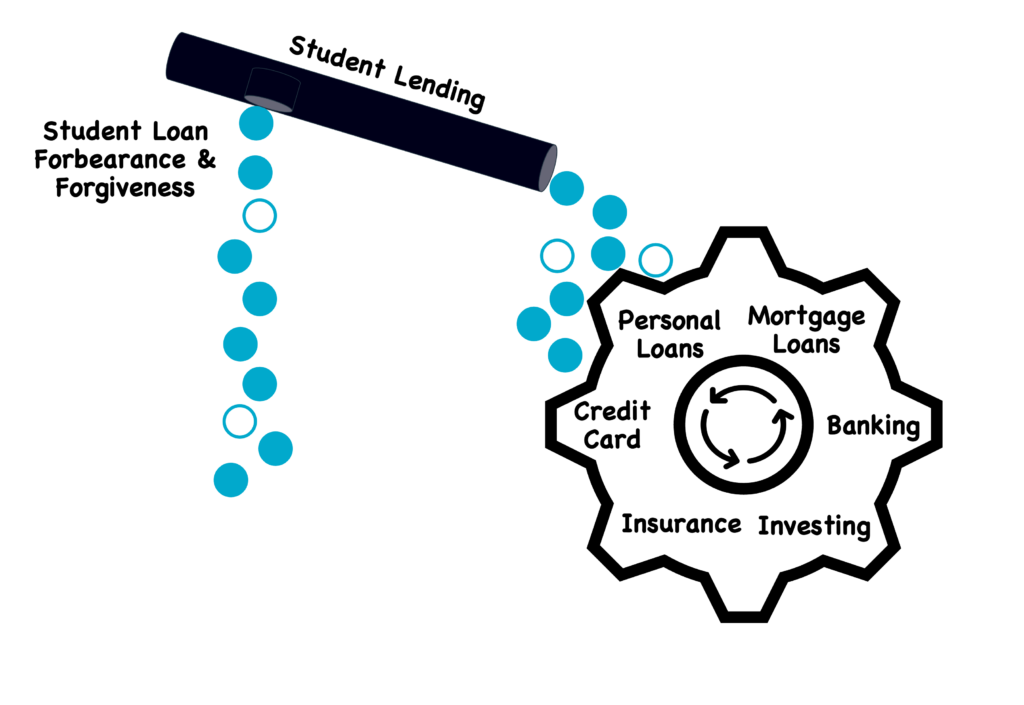

By offering all of these products, SoFi argues that it can dramatically reduce its customer acquisition costs and increase lifetime customer value, a concept that it has christened the “financial services productivity loop” (and what banks have been calling “universal banking” for decades):

I find “financial services productivity loop” to be a bit of a mouthful, and I’m not happy with SoFi trying to jam one more unnecessary acronym (FSPL) into my brain.

Having said that, I do find elements of SoFi’s cross-sell strategy to be legitimately impressive and worthy of emulation (by both banks and fintech companies). The best parts revolve around rewarding customers (SoFi calls them members, much to the delight of credit unions, I’m sure) for improving their financial health.

Take their credit card, for example. Customers earn 2% cashback on purchases if they elect to redeem their reward points for cash that is deposited into a SoFi deposit account, investment account, or as payment on a personal loan or student loan.

That’s pretty neat! Rewarding customers for financially responsible behaviors (with the exception of crypto investing … ignore that for the moment) while giving them incentives to use more of your products. I like it!

Cultural maturation.

Mike Cagney, a co-founder of SoFi and the company’s first CEO, stepped down from that role in 2017:

Social Finance, an online lender that is one of the more prominent financial technology start-ups, said on Monday that its co-founder and chief executive Mike Cagney planned to step down by the end of the year.

The resignation follows a lawsuit over claims of sexual harassment at the San Francisco-based start-up, which is known as SoFi. Several former employees said that Mr. Cagney, 46, had inappropriate relationships with SoFi employees, which helped foment a toxic workplace culture.

In addition, Mr. Cagney may have been overaggressive in expanding SoFi’s business, skirting risk and compliance controls, said people with knowledge of the situation, who asked not to be named because they were not authorized to speak publicly.

And was replaced by an adult:

The embattled online lender Social Finance has poached Twitter’s chief operating officer, Anthony Noto, to be its new chief executive

In Mr. Noto, SoFi has chosen a fast-rising executive in the tech industry. Mr. Noto, 49, was one of the most respected bankers at Goldman Sachs before becoming the chief financial officer of the National Football League and then Twitter.

Wildly optimistic private valuations.

Is SoFi a good example of the wild excesses in VC investment in fintech that we’ve seen over the last 10 years?

Why yes, yes, it is.

While a private company, SoFi raised $3 billion from investors, including a cool $1 billion Series E round led by the Michael Jordan of unhinged VC tech investing – SoftBank.

Fintech entering the consumer consciousness.

SoFi is also a wonderful example of the Great Gatsby-esque marketing spending that many fintech companies were committing during the salad days of 2019:

Social Finance Inc., a financial technology startup, will pay more than $30 million annually over 20 years to put its name on a new stadium that will be the home of the Los Angeles Rams and the Chargers, a person familiar with the deal said.

The amount is a record for any naming rights for a sports venue, the person said, declining to be identified because the information is not public.

A global pandemic.

The Covid-19 pandemic had a mixed impact on SoFi.

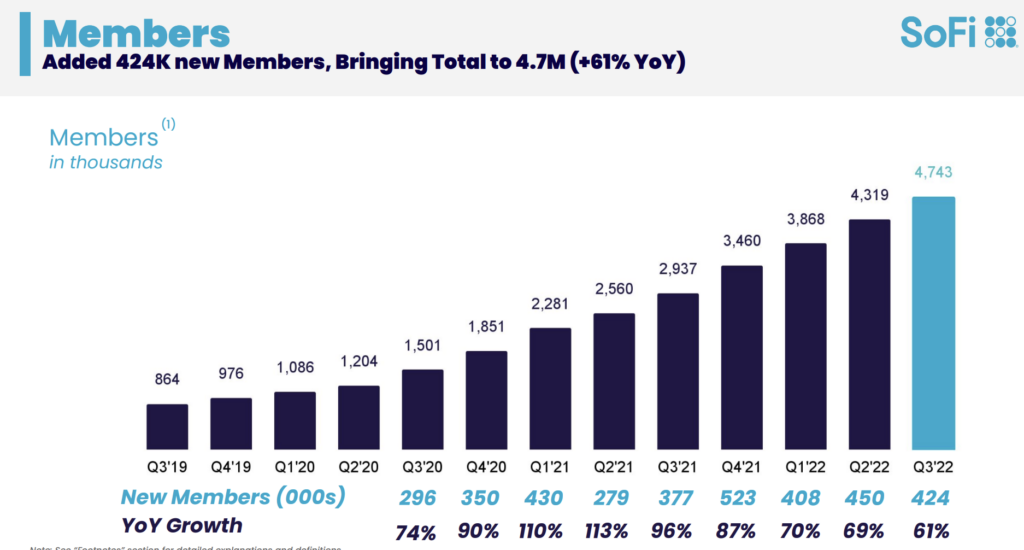

On the one hand, SoFi (like most B2C fintech companies) saw a surge in new customers during the pandemic:

On the other hand, certain steps taken to protect consumers during the pandemic have had a uniquely negative impact on SoFi, as Anthony Noto explained in SoFi’s most recent earnings call:

Student loan refi continues to be negatively impacted as federal borrowers await the end of the moratorium on federal student loan payments.

And beyond the payment moratorium (which keeps getting extended), SoFi also has to reckon with the more existential consequences of President Biden’s decision to cancel up to $20,000 in student loans for millions of Americans, which has the potential to introduce long-term confusion and uncertainty into the student lending market.

Additionally, home loans, which had been a big revenue driver for SoFi in recent years, saw a 50% decline in origination volume in Q3 2022 compared to the same quarter in 2021, due primarily to rising interest rates. This can be thought of as a more indirect consequence of the pandemic (to the extent that you believe that pandemic-era stimulus payments and supply chain disruptions played a significant role in driving up inflation).

Deeply skeptical public valuations.

With the benefit of hindsight, this is an absolutely terrifying sentence:

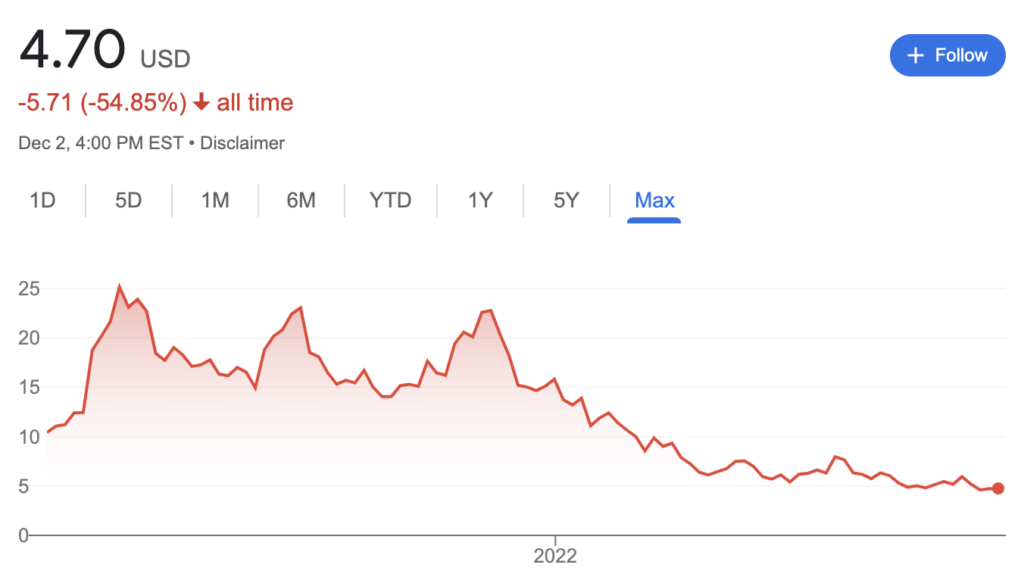

Online finance start-up SoFi is set to go public by merging with a blank-check company run by venture capital investor Chamath Palihapitiya

Fintech companies that recently went public have not performed well on the public markets. SPAC-led companies, especially so. Chamath SPAC-led companies, especially especially so.

Before going public, SoFi was valued at $5.7 billion. Chamath’s SPAC valued it at $8.65 billion. Today, SoFi’s market cap is $4.36 billion.

It has not been a fun ride:

The merging of fintech and banking.

On a more positive note, SoFi is a bank!

It is one of the few fintech companies in the U.S. to obtain a bank charter (through its acquisition of Golden Pacific Bancorp) and the only U.S. fintech company besides LendingClub to acquire a bank charter after developing competency in consumer lending.

There are two big benefits for SoFi:

- The company now has the ability to directly offer deposit products and utilize customer deposits as a stable and low-cost source of funding for its lending activities. SoFi has begun doing this, and, as shared in its Q3 2022 earnings call, it is seeing savings in funding costs of approximately 125 basis points, a margin that is growing thanks to the rising rate environment.

- The company now has the flexibility to keep the loans that it originates on its balance sheet longer and even to reacquire loans that it had previously sold off. This flexibility allows for SoFi to better optimize its net interest margin.

An explosion of fintech infrastructure.

SoFi is unusual among B2C fintech companies in that it also has made substantial investments in fintech infrastructure.

Its first big investment was Galileo, in 2020:

SoFi, the San Francisco fintech company whose products range from student loans to cryptocurrency trading, is buying Salt Lake City payments firm Galileo for $1.2 billion in stock and cash. Galileo powers payments for several big-name fintechs, including stock trading app Robinhood, money transfer service TransferWise and digital bank Chime.

It then supplemented Galileo’s card issuing and payment processing capabilities by buying Technisys, a provider of cloud-based core banking services, earlier this year:

SoFi Technologies will acquire Technisys, a leading cloud-based core banking system in an all-stock transaction valued at approximately $1.1 billion. SoFi had been using Technisys since last year, said Miguel Santos, CEO of Technisys.

“Technisys has built an attractive, fast-growth business with a unique and critical strategic technology that all leading financial services companies will need in order to keep pace with digital innovation,” said Anthony Noto, CEO of SoFi. “The acquisition of Technisys is an essential building block in delivering on our member-centric, digital one-stop-shop experience for SoFi members and our partners through Galileo, our provider of fintech cloud services.”

The strategy behind these acquisitions is to, in SoFi’s own words, turn the company into the “AWS of fintech”.

(Editor’s note – ugghh … can we please not ever say “AWS of fintech” ever again? Nothing that we build in fintech is going to be even remotely comparable to the money-printing machine that is AWS. Just stop, please.)

Essentially, SoFi becomes the first and best customer of Galileo and Technisys (like Amazon is for AWS), and Galileo and Technisys become diversified revenue drivers and product and partnership distribution channels for SoFi.

Embedded finance.

This is mostly theoretical right now, but phew boy, when you look at all the pieces that SoFi has assembled – the suite of consumer banking products, the bank charter, and the issuing, processing, and core banking capabilities – it’s not hard to see a path forward for the company to become a major player in the BaaS and embedded finance markets.

Indeed, there is one small example of an embedded finance offering, powered by SoFi, already in the market today:

Samsung has launched a new mobile-first money management system called Samsung Money, complete with an accompanying Mastercard and exclusive Samsung Pay benefits.

Samsung Money was designed in partnership with fintech company SoFi, and is known officially as “Samsung Money by SoFi.”

“Samsung’s goal is to make everyday life better by putting powerful tools in the hands of Galaxy users,” said Sang Ahn, Vice President and GM of Samsung Pay, North America Service Business, Samsung Electronics. “Now, users can access mobile-first financial services and earn exclusive Samsung benefits. We’re excited to help our users reach their financial dreams by allowing them to spend, save and grow their money and access it easily and securely.”

Hmmm …

Questions

Ok. We’ve established that SoFi is interesting. Uniquely interesting, perhaps.

But will it be successful?

In typical Fintech Takes fashion, let’s try to answer this question with some more questions!

Is consumer banking a winner-takes-most market, and can SoFi be that winner?

Let’s take this in reverse order.

Can SoFi win?

I have to say that I came away impressed after reviewing SoFi’s most recent financials. The company has 4.7 million customers, up from 2.9 million at this time last year. And its cross-sell strategy … sorry, its financial services productivity loop strategy … actually seems to be working. The company’s customer acquisition costs have been decreasing as it has added more products to its suite and its efforts to capture checking account customers’ direct deposits, while still nascent, look promising.

I think SoFi can win.

I just don’t think the prize will be as big as they say.

I’m skeptical that consumer banking is a winner-takes-most market, at least in the U.S. There’s just too much competition, including, increasingly, from non-bank brands doing embedded finance. And the value of network effects in financial services is blunted by the fact that consumers can take their financial data with them wherever they go (imagine how much more vulnerable Facebook would have been if we’d had the social media equivalent of open banking).

Every B2C fintech company wants to believe that super apps can thrive in America. I don’t see it.

Will SoFi be able to run a profitable bank?

SoFi is a bank now.

Cool!

But that doesn’t necessarily mean that it will be a profitable bank.

Operating and growing a profitable bank is hard! Especially in a rising rate environment with a potential recession on the horizon. Will SoFi be able to compete for the deposits that it needs to operate a profitable lending business without overpaying for them and crushing its net interest margin (it just raised its savings APY to 3%)? Will it be able to grow its lending portfolio without taking on too much risk, even as the credit cycle continues to shift rapidly?

Honestly? I think it will!

Quotes like this one from Anthony Noto in the Q3 2022 earnings call give me confidence that SoFi has learned a lot about running a profitable financial services business:

Sometimes it’s misleading when a company drives low CAC. It has been the case that it was in Lending. If we drive CAC too low, we lower the quality of the borrower that we bring in, and the life-of-loan losses of that portfolio can actually go up, which would more than offset the CAC savings. And so, it’s counterintuitive to think about CAC and Financial Services.

How big a deal is the student loan thing?

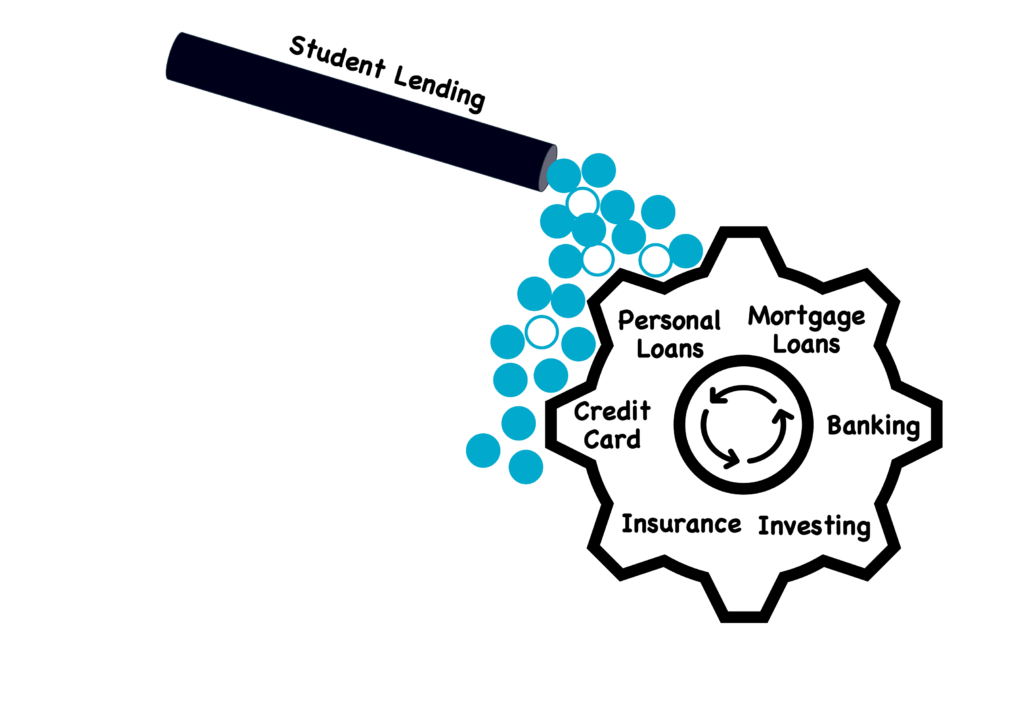

If we visualize SoFi’s financial services productivity loop strategy as a water wheel, it’s easy to understand the value that its student lending business plays in driving the growth of its overall ecosystem. It’s literally the pipe that feeds in the water and makes the whole thing work:

So, what would be the effect of pausing all federal student loan repayments and potentially introducing long-term uncertainty and instability into the student lending market with a one-time debt cancellation program? Would that poke a big hole in the pipe?

Overall, I’m not super worried about this. Again, SoFi has seen strong growth despite the ongoing moratorium on federal student loan payments. And the debt cancellation program, if it does go through, likely won’t impact a large number of SoFi’s customers (because their incomes are too high to qualify).

It’s just something to monitor.

Will SoFi customers outgrow SoFi?

A strategic concern I have about SoFi is whether its consumer banking product development will be able to keep pace with the needs of its customers.

On the surface, SoFi’s product portfolio appears quite comprehensive. However, if you dig under the surface a bit, you discover that quite a few of the products that it offers are, in fact, products provided by partners (insurance, auto loan refinance, crypto investing).

This is a cost-effective strategy for building out a comprehensive product suite quickly, but I do wonder if SoFi customers might be tempted, as their financial services needs become more complex, to seek out best-of-breed solutions from other providers in areas outside of SoFi’s core competency (installment lending).

Or, perhaps, SoFi’s product development strategy over the last couple of years was done out of necessity, and 2023 will prove to be a year of more focused internal product innovation, as Anothony Noto suggested in the company’s Q3 2022 earnings call:

If I reflect back in the last five years, every year, we’ve had a major company-driven initiative or an economic backdrop or a market backdrop that’s been somewhat volatile. Obviously, we’ve been dealing with the student loan monitoring for the last three years, and on top of that going public and on top of that switching to becoming a bank. We just haven’t had a year in which all of our businesses have the wind at their back. And that is possible in 2023, and I’m very aware of the current outlook for the economic environment and inflation and interest rates. But if things sort of hit where consensus is, we’re going to have a year in which all things could have a really strong tailwind.

Can SoFi stay focused on members’ financial health and avoid playing the customer engagement game?

Again, I love the design of the credit card’s rewards program. It provides a great incentive for customers to reinvest in their financial health (using other SoFi products, of course). It is actually walking the walk on SoFi’s mission to “help members get their money right.”

That said, I do wonder if the SoFi credit card will be able to compete for top-of-wallet position for its target customers (HENRYs), given the abundance of more rewarding (though less financially healthy) credit cards targeted at those same customers.

Will SoFi be able to resist the short-term temptation to optimize its products for engagement and usage and stay focused on fulfilling its long-term brand promise to customers?

I think the fact that SoFi jumped on crypto investing (through a partnership with Coinbase) as fast as it did (this wasn’t a common neobank feature back in 2019) suggests that it may not be able to resist this temptation fully.

Is the AWS of Fintech strategy a smart hedge or a money-wasting distraction?

I’m not a huge believer in the AWS of Fintech strategy (and not just because I don’t like that turn of phrase!)

Galileo is older than you’d think (launched in 2001), and the company didn’t invest a lot of money in keeping the platform modern (it didn’t bring on its first major round of venture capital until October 2019), which is why SoFi has been spending a lot of time and money upgrading it, as Anthony Noto shared in the Q3 2022 earnings call:

The major investment that we’ve made over the last two years of owning Galileo was transitioning from on-prem into the cloud. And that transition is largely done. I think the report I’ve seen most recently is 99% of our authorizations are now in the cloud. And that’s really going to provide great SLA performance for our partners and allow them to innovate faster and be more nimble using data real time to make more better decisions.

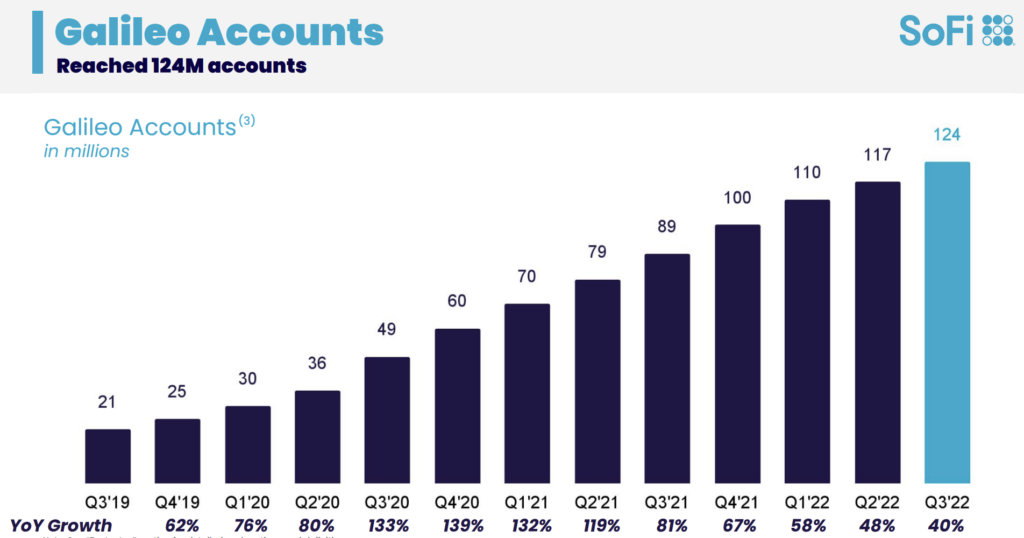

Painful as I’m sure they have been, these investments would seem to be necessary given that Galileo’s rate of growth is slowing:

So, how might SoFi turn Galileo’s fortunes around?

One approach would be to shift away from serving U.S.-based B2C fintech companies (who may not love the idea of using a platform owned and operated by one of their competitors, which, BTW, Amazon and AWS struggle with constantly) and move into more lucrative, less competitive markets. Mr. Noto suggested exactly this in the Q3 2022 earnings call:

We are definitely starting to migrate away from just pure B2C. We talked about the B2B customers that we’ve been able to attract on the last couple of quarters, and the pipeline there remains very robust.

And generally, the B2B companies already have existing payment systems and payment supply for us to process. So when we convert those over, there will be a faster time to revenue and also get much higher probability.

In addition to building products for B2B that are more controllable for them and meet their needs better in addition to just having the processing capability, we’re also continuing to expand internationally with really strong trends throughout Latin America, both on the back of Galileo as well as Technisys, which was where it was strong to begin with.

Another approach would be jumping into banking-as-a-service and embedded finance whole hog. I haven’t heard any whispers that SoFi is actively planning to do this, nor did it come up in any recent earnings calls, but it would make sense given the assets SoFi has acquired over the last 2-3 years (although I do wonder if their regulators would even allow them to do that, given the increasing concern from regulators on all things BaaS and sponsor banks.)

It’s hard to say what they will do. It’s too early to give up on the AWS of Fintech strategy altogether, but I do wonder if SoFi might trim its sails a bit in this area moving forward.

I guess we’ll see!