10 October 2022 | FinTech

Liquid Yield

By Alex Johnson

3 Fintech News Stories

#1: July 1, 2023: The Day Debit Interchange-only Business Models Die

What happened?

The Federal Reserve finalized a new rule:

The Federal Reserve on Monday voted to finalize a proposal to clarify a rule requiring more than one debit card network be available for routing all transactions, including those online.

In a statement on the 6-1 vote to finalize the rule, the Fed said “that debit card issuers should enable at least two payment card networks to process all debit card transactions, including ‘card-not-present’ transactions, such as online payments.” It noted that “the final rule is substantially similar to the proposal issued last year.” It will take effect July 1 of next year.

So what?

No one in fintech is really talking about this, but it’s a huge deal.

Here are the basics:

- As part of the Durbin Amendment, debit card issuers have (since 2011) been required to support at least two unaffiliated networks for processing debit card transactions. This requirement enabled savvy merchants to route transactions to domestic, single-message debit networks (NYCE, Star, Pulse, etc.) and take advantage of those networks’ willingness to undercut Visa and Mastercard on interchange rates.

- The problem is that this requirement has, in practice, only been implemented to support in-store transactions. Card-not-present (CNP) transactions have mostly not been supported. Back in 2011, the argument was that the technology didn’t exist to safely enable this requirement for CNP transactions (where fraud is a much bigger concern). What the Federal Reserve is now saying is that excuse is no longer acceptable.

- Starting on July 1, 2023, all debit card issuers will be required to support at least two unaffiliated debit card networks for processing CNP transactions (including those transactions happening through digital wallets or payment services like PayPal or Apple Pay). This will lead to a significant reduction in debit interchange for banks and significant cost savings for merchants (particularly larger and more sophisticated merchants). And like all things relating to Durbin, it is highly unlikely that much of these cost savings for merchants will flow to consumers.

Fed Governor Michelle Bowman was the only Governor to vote against the rule. Her objection was that it would disproportionally harm community banks.

Building on Governor Bowman’s concern, I think the group that will be most disproportionately harmed by this new rule will be the companies that community banks are increasingly partnering with – neobanks.

If U.S. neobanks needed another reason to expand beyond their Durbin-exempt debit interchange-based business models – besides the general 2022 shift to profitability in fintech – this is it. This rule is going to hit all debit card issuers hard, but given their target customers’ fondness for e-commerce, this rule has the potential to be devastating for neobanks.

(Editor’s note – if you’d like to dive a lot deeper into this topic, I’d recommend registering for this webinar, which is being put on by my former colleagues at Cornerstone Advisors. It is being held tomorrow at 3:00 PM ET and is really just an open forum to ask Cornerstone’s payments experts any questions you may have.)

#2: Global Equity

What happened?

Easop, a Paris, France-based startup, raised $2.5m in seed funding:

The company intends to use funds to further invest in product development, to build the team and expand into new markets.

Easop provides US-based companies with a solution to compliantly offer and manage equity incentives to employees, contractors and advisors in 50 countries and counting.

So what?

Two things are interesting to me about this:

- Compliance and operational infrastructure to support remote-first and global-first U.S. companies is a massive opportunity. We have a couple of newish companies that are focused on this opportunity (like Deel), but the amount of white space remaining is huge. I expect a lot more fintech and HR tech startups focused on this area to emerge over the next five years.

- Another related opportunity is fintech infrastructure focused on unlocking access to the U.S. stock market for consumers living in other countries. It may not feel like it right now given the somewhat turbulent economy we’ve been navigating, but the U.S. stock market remains one of the best tools for building wealth in the world. Infrastructure providers like DriveWealth and Alpaca have helped democratize access to this tool domestically, but it feels like we are in the very earliest innings of expanding this access to consumers in other countries.

#3: Liquid Yield

What happened?

Jiko, a provider of corporate treasury management services, raised a $40 million Series B:

Jiko started its life as a mobile bank for consumers. But over time, the fintech startup has evolved its model — mostly fueled by demand — and is now making a push into corporate money storage.

In 2020, Jiko made headlines by being the first fintech to acquire a nationally regulated U.S. bank. The company also was unique in another way: Rather than hold customer deposits, it used the funds to buy short-term Treasury bills (T-bills).

Jiko’s plans for the product, dubbed simply Jiko Money Storage, is to provide companies — from startups to multinational corporations across a range of industries — with “low-cost access” to T-bills. The advantage for companies, especially for startups that have raised or have large sums of cash, is that T-bills are an asset class that offer a “highly competitive” potential yield

So what?

I’ve been following Jiko for a while, and its evolution has been fascinating. It started as a consumer-facing neobank. It acquired a bank charter. Then it pivoted to providing BaaS services to other fintech companies. However, its core innovation – building the infrastructure necessary to convert deposits into T-Bills and make those investments easy to immediately transfer and liquidate – always felt a bit disconnected from its distribution strategies.

Corporate treasury management feels like the perfect fit, especially in this rising-rate environment where companies are all looking for stable sources of yield.

2 Fintech Content Recommendations

#1: Who Wins at Fintech in this Market? (by Simon Taylor, Fintech Brainfood) 📚

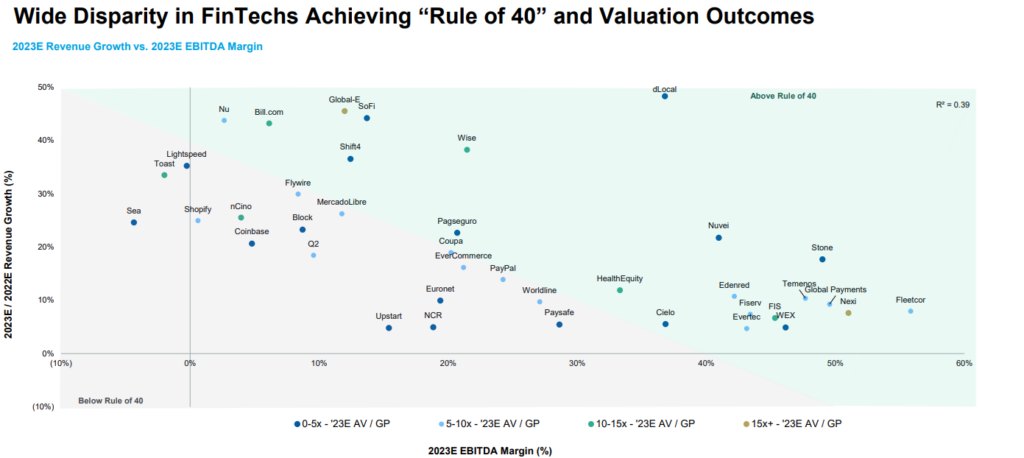

All of Simon’s rants are great, but this one was especially so. Simon provides a really interesting deep dive into the state of fintech funding, valuations, and the potential to continue creating new value for customers. I think I spent about 25 minutes studying this graphic (originally created by Morgan Stanley) on fintech companies that have exceeded the “rule of 40” (a goal for SaaS companies’ growth rates and EBITDA margins exceeding 40% when added together):

#2: Selecting a Bank Partner (Reggie Young & Matt Janiga, Lithic) 🎧

We’ve spent A LOT of time in this newsletter talking about the state of BaaS and fintech-bank partnerships, so if you are a subscriber to this newsletter I’m very confident that you’ll find the latest episode of Matt and Reggie’s podcast – Fintech Layer Cake – worth your time. They do a great job of walking through the history of sponsor banks in the U.S. and placing sponsor banks in different “tiers” based on their capabilities and level of experience working with fintech companies. This podcast is a must-listen.

1 Question to Ponder

My deep dive essay this week is going to be about the pathetically-low levels of VC funding in fintech that go to female founders and founders of color. To help with that essay, I would love it if you could reach out to me on Twitter or LinkedIn and give me one practical suggestion (as big or small as you like) for how we can steer more VC dollars to diverse fintech founders.