15 August 2022 | Investments

Usain Bolt’s Venture Collapse

By

Hello!

The Crossover is officially over 1,500 subs! We are on fire adding over 350 subs for the second week in a row. Thank you all for sharing the newsletter and all of the kind words.

We are just getting started.

Also, check out my uncle who was featured on the Washington DC local news discussing his Tesla. Uncle Keith you are a legend.

Yes. Keith is actually my uncle. No. we are not adding Tesla to the portfolio.

Showtime!

Want to get these in your inbox to never miss an edition? Subscribe to The Crossover today!

Leading Off: Farther, A $15M Wealth Tech Raise

The Rundown:

Farther, a wealth tech firm, raised $15M @ a $50M valuation led by Bessemer Venture Partners & included Khosla & MassMutual Ventures

3 Key Points:

- Farther is looking to change the wealth management game by offering a unique platform for advisors & clients

- Advisors have the ability to scale their firms by using Farther’s various resources including automation, ai, customization of fees, and a slick interface while clients have the ability to use the automation/ai features as well as being able to work directly with one of Farther’s 50 advisors.

- The innovative approach to wealth management has been scorching hot for the firm represented by a quadrupling in AUMthis year to over $250M

Fun Fact:

- Shoutout and congrats to my Cousin Jordan who is an advisor @ Farther! Looks like we got a whole family affair going today!

Scooter Mobility: Bolt & Birds

Introduction

Usain Bolt is stupid fast.

The 8 time gold medalist has been clocked @ reaching speeds of 27 MPH in just 60 meters. I genuinely think that is better acceleration than my first car had.

Usain might be no match for a Saturn (RIP), but a scooter is a whole different story.

Bolt Mobility, a venture backed scooter company co-founded by Usain Bolt, has abruptly ceased operations as it appears they have run out of cash.

Bolt has stopped operating in several US cities, without telling anyone, leaving hundreds of dead bikes in cities, putting local officials in quite the situation.

According to Crunchbase, Bolt had raised over $40M in the private markets, including a $10M venture round in October 2019 as well as a $30M Series A in March 2020.

All of this invested equity is now worthless.

The story with Bolt gives us a unique opportunity at a crossover analysis. During the SPAC boom, a couple of scooter/emobility companies went public and have performed horrendously in the public markets.

We are going to be taking a look at $BIRDS, the most well known scooter company, that is down a breathtaking 93% since completing its reverse merger.

Our question: Is $BRDS going all the way down to zero?

Let’s fly!

Overview

In 2021, Birds scooters were used for ~40M rides & the company did revenue of $205M.

Sounds solid right?

Not so fast.

Birds was very very aggressive in the private markets to try and make their vision a reality.

The company has raised $1.14B in the private markets since launching in 2017.

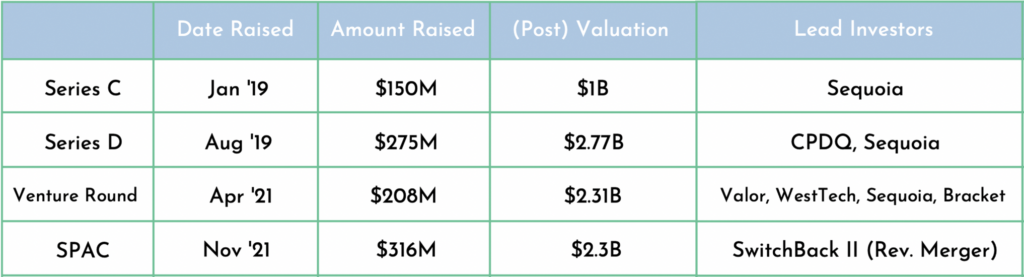

Below are some of their key rounds and valuations:

Takeaways:

- Birds was a massive bet by Sequoia Capital

- The company experienced some down rounds even before they were cool

- With a current market cap of $165M (Yup. You read that right.), almost all of the $1.14B has gone up in flames.

Why is the market cap of the company so low?

Because the financial viability of the company is in question and bankruptcy is in play.

Financials

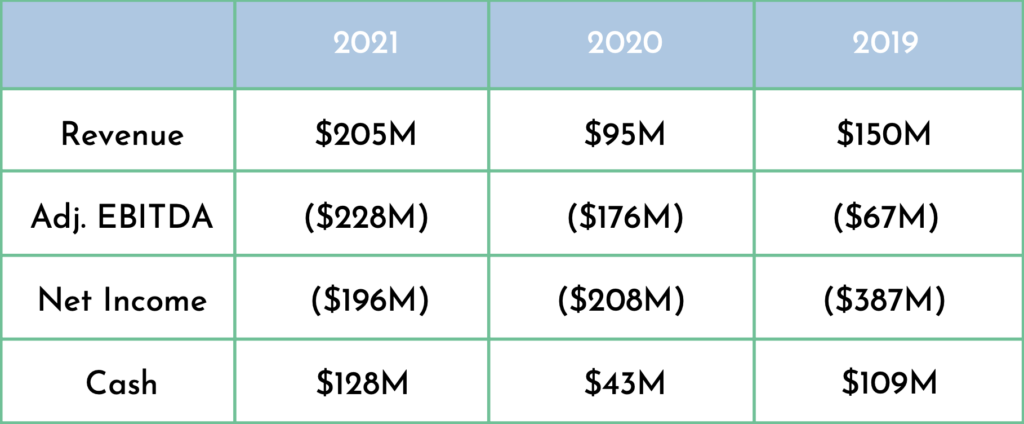

Birds Global is currently valued @ around a $165M market cap even though the company achieved $205M in sales.

Birds is trading at .5x sales valuation due to two key reasons:

- Unit economics – gross margins of 17%

- Risk of bankruptcy – significant cash burn

Check out some of the key financial figures below:

As you can see, Birds cash burn is off the charts. If they are to burn the same amount of money they did last year without raising additional capital, they would go bankrupt.

The company’s significant cash burn continued into Q1 as their FCF was ($106M) on $38M in revenue leaving them with a cash balance of just $68M.

BRDS is well aware of the situation and have streamlined their path to profitability by cutting $80M in annualized costs. CEO Travis VanderZandan shared that the company expects to be adj. EBITDA positive starting in Q3.

My question is how? That is a lot of burn to overcome in a very short period of time.

On top of the nearly $70M in cash, the company has a $77M of vehicle financing credit available to them via Apollo.

Finally in the Q1 earnings call, the company shared that they agreed to a $100M standby equity purchase agreement that gives the company access to $21M upfront.

SPAC

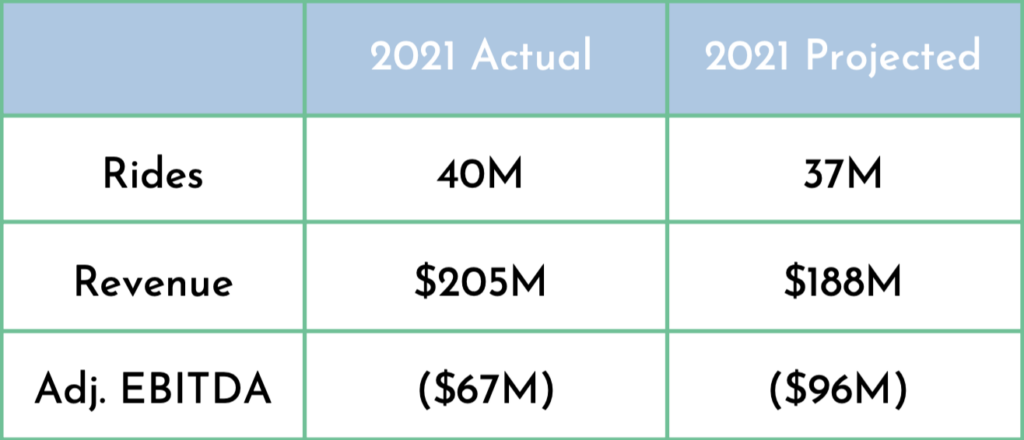

During my DD process on Birds, something interesting and unique jumped out – the company actually has outperformed the projections they shared during their initial SPAC presentation – something that is incredibly rare and is even more interesting when you remember just how much the stock is down.

These are pretty significant beats:

- Rides: 8%

- Revenue: 9%

- Adj. EBITDA: 30%

This has me thinking that Birds management team and ability to execute is actually really good. Rather, the reflection on this observation is just how crazy times were during the SPAC boom and just how rapidly and significantly the economy changed.

This also leads me to believe that Birds might be able to operate out of this mess and survive even with the current bumpy road.

Wrapping It Up

Before wrapping it up, I wanted to touch on another development in the public/private scooter space to keep your eyes on in the coming months.

Lime, the biggest operator currently in the space, is expected to IPO later in 2022.

Lime has actually consistently displayed the ability to be profitable in the private markets showing us that Birds issues could just be Birds issues and not the greater industry.

Another fun fact about Lime?

Uber actually owns more than 30% of the company as they led a $170M convertible note round in 2020 @ a $510M valuation(down 80% from $2.4B valuation pre-pandemic).

It is unclear what Lime’s valuation is today, but it sounds as if the company is not happy with the capital markets as it is getting later & later in 2022 without an S-1 being filed.

The Information also reported that Uber has the right to possibly acquire Lime in 2022 or 2024 as part of the convertible note in 2020.

If Uber were to exercise this option and Birds continues to struggle, maybe the company that made us move on from taxis has their eyes on an acquisition and becoming a giant in micro-mobility too.

-Alan

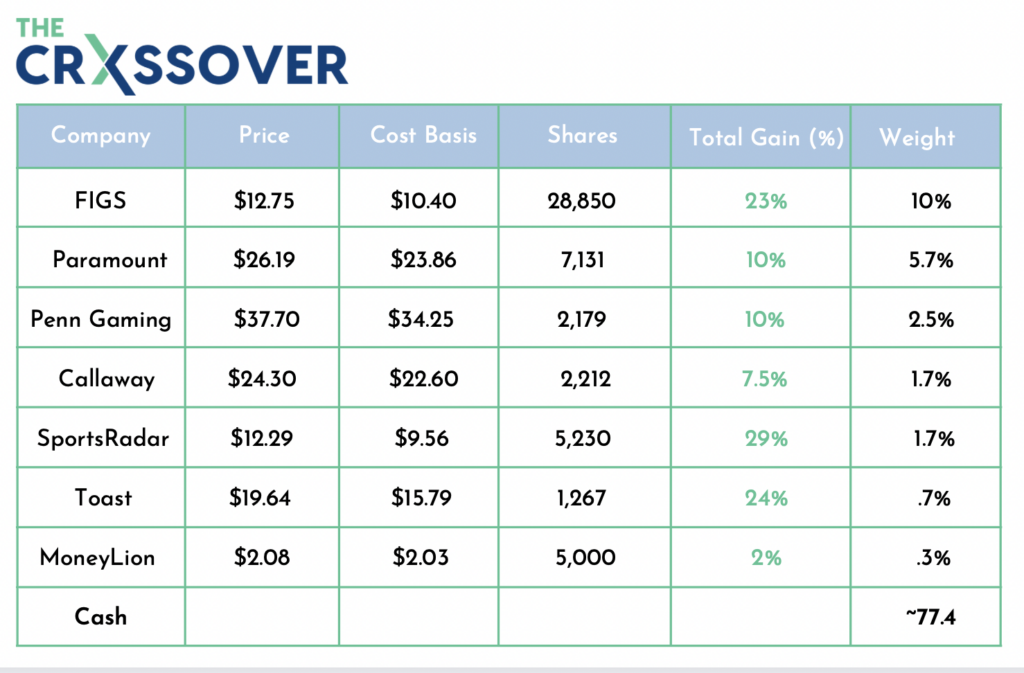

The Crossover Portfolio

- We added a new portfolio pick last week, MoneyLion!

- A couple months back, we sat down with Dee Choubey, CEO of MoneyLion, and I have been following the company closely ever since.

- After a strong Q2 and raising guidance, we are in!

Golden Nuggets

- Really enjoyed listening to Alex Morris of TSOH on Compounders & Friends where he discussed AirBnB, Netflix, & more

- I don’t think anyone in my fantasy league makes it this deep into the email. Loved these sleepers that ESPN+ put together

- Arsenal is absolutely on fire to start the EPL season & Gabby Jesus is a big reason why. Check out this sweet goal from Saturday

- We almost had a perfect game! TB P Drew Rasmussen had a perfect game going into the 9th until Jorge Mateo stepped up to the plate.

Meme of the Day

Thanks for the read! Let me know what you thought by replying back to this email. See you in your inbox every Monday and Thursday.

— Alan

Disclaimer: This analysis is for educational and entertainment purposes solely and is not professional investment advice. The author of this piece and/or members of Workweek media could be invested in companies discussed.