23 June 2022 | Investments

MoneyLion: Sitting Down With The CEO

By

Good Afternoon!

I cannot stop laughing at the absolute chaos going down in this clip from a little league baseball game.

I have watched the video many times & discover something new and hilarious every time!

Alright, time to get down to business.

Showtime!

Want to get these in your inbox to never miss an edition? Subscribe to The Crossover today!

MoneyLion: A Case For Crossover Investing

Introduction

“I think it has been more of a rallying cry. I don’t think there is anyone that works at MoneyLion that thinks the stock price is an accurate representation of the fundamental value of the business.”

-Dee Choubey, CEO Moneylion

In the first Crossover, which launched only 3 weeks ago, we broke down the disparity in valuation between MoneyLion (Public) & Acorns (Private).

The positive feedback was remarkable and the interest from Crossover readers to learn more about MoneyLion was requested! And today, I am happy to share that I have a whole lot more.

Specifically, I will be breaking down how MoneyLion is the perfect example of the power of crossover investing, two key acquisitions MoneyLion has made, and why I think the stock is undervalued.

MoneyLion

I want to start off by looking at the valuation of MoneyLion on 3 key dates:

- August ‘18 – MoneyLion raises ~$28.9M Series B2 @ $450M pre-money valuation

- February ‘21 – MoneyLion goes public via SPAC @ $2.4B post-money valuation

- June ‘22 – MoneyLion has a ~$430M valuation

The key takeaway from the dates above is the fact that MoneyLion is trading at an equity valuation level lower than they were in August of 2018.

After looking at the facts, this makes no sense.

Revenue – Leaving 2019, MoneyLion did $40M in revenue. In 2021, the company did $165M in revenue and in 2022, the company is projected to do $325-335M in revenue, representing 97-103% annual growth.

They have done all of this while maintaining 60%+ margins and expecting to be adjusted EBITDA break even leaving 2022.

Customers – At the end of Q1 2020, the company had 1M active customers vs. at the end of 2021, MoneyLion had 3.3M customers.

How is this a company trading at a discount to its reasonably valued 2018 Series B2? More on this later.

There were also two key acquisitions the company has made that fortified their position both from a strategic lens as well as from a financial perspective that was not part of the company in 2018: Malka Media & Even Financial.

Malka Media

One of the most difficult aspects of running a successful consumer business, specifically FinTech, is just how expensive it is to acquire customers.

Dee Choubey, CEO of MoneyLion told me “They used to say Chase, Citi, and Wells Fargo were all marketing businesses with a balance sheet attached to it.”

I laughed out loud when Dee said this, but in many ways, he is right.

In 2021 alone, Capital One spent $2.87B on marketing & in 2020, Citi spent over $1.22B.

Also, with advertising costs skyrocketing on Facebook, Google, etc. due to the Apple privacy changes, legacy banks as well as neo banks are seeing their margins squeezed.

MoneyLion understood they needed a unique way of acquiring and engaging customers to avoid this spending frenzy and create a business with profitable unit economics.

The first part of the answer to this opportunity was Malka Media.

Malka is a creator economy company/platform that has a network of top creators across many industries whose monthly reach hits over 40M monthly consumers. Malka has over 30 professional athletes on their platform, helped launch over 100 Twitch brands, and has plenty of finance creators too!

After working with Malka for several years, MoneyLion acquired the company on November 16, 2021 for $10M in cash & $30M in MoneyLion stock. This has given MoneyLion the unique opportunity to create financial content and embed it in their app.

Another way to think about it: A built in TikTok finance page where consumers can engage with the best finance creator content while in the MoneyLion ecosystem. Brilliant.

The best part is, the content is personalized to every single consumer based on their financial habits.

The Malka platform is already paying off big time helping the company decrease their CAC. From Q4 ‘21 to Q1 ‘22, the company’s CAC decreased from $25 to $16, allowing the company to achieve a less than 6 month payback period. Powerful.

It is important to recognize how this will improve the amount of time consumers spend on the app. This will likely also increase the likelihood that they use a greater range of the company’s products in the short term, and keep them as customers for the long term.

From Klarna to Sofi, no other neo bank has something like the Malka asset, and I think this will be a key to the company’s success as time goes on.

Even Financial

MoneyLion made a second major acquisition to bolster the company’s app.

“We are very good at creating banking, investing, crypto, credit products, but we are not going to do everything (insurance, mortgage, personal loan products), so let’s go and get network effects that can take care of that, which is Even Financial, Dee told me.

On December 16, 2021, MoneyLion acquired Even Financial for $15M in cash & $345M in preferred shares.

Even Financial is a financial marketplace with over 400 product partners & 500 channel partners. The company has widgets/calculators embedded on mainstreaming websites like CNBC, PennyHoarder, US News, and many more where millions of consumers can interact with it.

After individuals interact with the widgets, they are then matched with product partners like Sofi, LendingClub, etc.

Not only are there affiliate fees & Saas revenues from the external sites, within the MoneyLion app, consumers can interact with third party products through these Even Financial products. This is especially powerful, as MoneyLion can leverage the consumer’s data and provide them with the optimal loan options.

Together, Even Financial & Malka Media represent, what MoneyLion calls, Enterprise Revenue, a $24B – $164B TAM opportunity, and gives them a “real walled garden around their offering.”

And just to reiterate, these two assets with their serious TAM were not part of the company when they raised their Series B2 in 2018.

On top of the synergies for the consumer app, it is important to point out just how powerful Even Financial & Malka are as stand alone entities.

In 2021, Even did $50M in revenue & is expected to grow to $90M in 2022 which would represent 80% growth. Also, Even is expected to be EBITDA positive in 2022.

Additionally, Malka Media was expected to do more than $25M in 2021 revenue & expected to be cash flow positive in 2022.

This has the equity analyst in me wondering if these two assets alone should be worth more than the ~$420M market cap today.

Wrapping It Up

The MoneyLion story is a perfect example of why crossover investing will be on the rise.

Dee mentioned that the majority of MoneyLion’s cap table are investors that backed the company while they were in the private markets.

I do not know if the investors in the deal have the ability to invest in the public markets from a fund level, however, it is clear why the crossover model will become more & more prevalent over time.

The same investors that believed in MoneyLion in 2018 would be able to invest in the same company at the same valuation, but with 8x more revenue, approaching profitability, millions of more customers, and a significantly stronger strategic position boosted by the two acquisitions.

Overall, I am very bullish on MoneyLion & their push into the next generation of banking – specifically at ~$1.50 a share. I think their enterprise business is unique both from what it brings to the consumer app as well as the financial profile for the company.

***For full disclosure, I am not currently a shareholder in the company but could see that changing in the future because I think $ML is rocking & rolling!***

In The News

Bitcoin Billionaire Bailout

TL;DR: Sam Bankman-Freid, founder of $30B crypto exchange FTX, opened the bank to bailout struggling crypto firms BlockFi & Voyager

3 Key Points:

- FTX provided BlockFi with a revolving $250M credit facility after earlier this month BlockFi shared they would be laying off 20% of its employees

- FTX also provided Voyager $500M in financing including $200M in cash/USDC stable coins & $300M in Bitcoin

- Bankman shared the he feels he has the “responsibility to seriously consider stepping in, even if it is at a loss to ourselves, to stem contagion.”

Key Excerpt:

“Elsewhere, crypto hedge fund Three Arrows Capital has been forced to liquidate leveraged bets on various tokens, according to the Financial Times.

On Wednesday, Voyager revealed the extent of the damage inflicted by 3AC’s troubles.The company said it was set to take a loss of $650 million on loans issued to 3AC if the company fails to pay. 3AC had borrowed 15,250 bitcoins — worth more than $300 million as of Wednesday — and $350 million in USDC stablecoins.”

1. In many ways, it looks like Bankman-Freid is taking the place of a central bank/mimicking what Warren Buffett did during the Great Financial Crisis of 2008. I also do think that if companies like BlockFi & Voyager would start collapsing, it could bring down FTX too. In many ways, I think Bankman-Freid is looking out for himself here.

2. The way speculative asset classes like Bitcoin come crashing down is when there is a significant amount of borrowing and margin involved. The Key Excerpt from above highlights just this and shows the dangers of the current crypto ecosystem.

Hot in Africa!

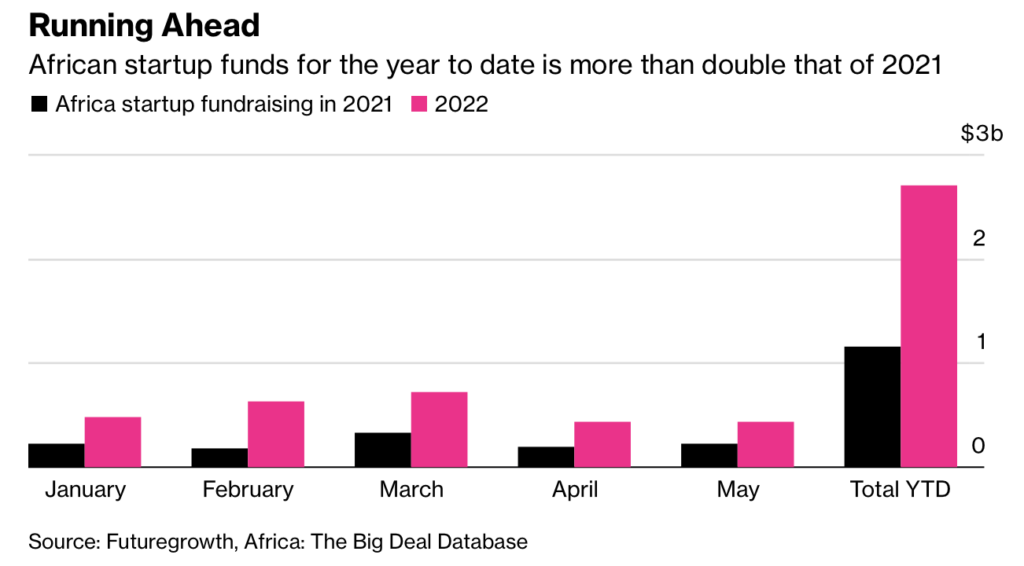

- In the first 5 months of 2021, African VC backed companies brought in $2.7B in investments

- This compares to $1.2B in the first five months of 2021

- Even with the global macro economic headwinds globally, experts expect Africa to still see significant growth in VC fundraising this year, albeit at a slower growth rate

- More stats on Africa VC coming Monday!

Golden Nuggets

- My Cleveland Guardians are on absolute fire winning the last 17/21 games & are in first place. Are you ready for a crazy stat? We have the youngest team not only in the MLB, but also, we are younger than any AAA! Wild.

- This video of “The Minions” as if they were in “The Office” is hilarious & probably the most underrated video on the internet currently

- These two baseball fans are giving me hope in humanity.

- 16% of Top Gun 2’s audience has seen the film more than once & 4% have seen it 4x or more. Woah.

Meme of the Day

Thanks for the read! Let me know what you thought by replying back to this email. See you in your inbox every Monday and Thursday.

— Alan

Disclaimer: This analysis is for educational and entertainment purposes solely and is not professional investment advice. The author of this piece and/or members of Workweek media could be invested in companies discussed.