21 July 2022 | Investments

How Percent is Disrupting a $7 Trillion Market

By

Good afternoon!

Let’s all give a special welcome to one of my sisters who (finally) signed up for The Crossover after 6 weeks! I love you too!

Also, after you enjoy today’s interview with the an amazing CEO of an amazing company, get pumped for next week! Why?

We have a two part series breaking down Toast Inc. ($TOST). I have been deep in SEC Filings all week, and can’t wait to share Toast’s story with you all.

Showtime!

Want to get these in your inbox to never miss an edition? Subscribe to The Crossover today!

Percent: A Conversation With CEO Nelson Chu

Introduction

When I am looking at prospective angel investment opportunities, one of my favorites to analyze is ventures that are looking to disrupt massive industries with archaic, pen & paper processes.

One of my favorite examples of a company like this that I have covered in my time @ Workweek is a company called Whoosh. Whoosh is a company that develops a suite of modern golf software tools that is looking to take the post it note businesses of private club owners ($25B industry) and move them into the cloud.

If I had my own fund at this stage, I would have looked to participate in the company’s $6M Series A a few months back.

Today, I am excited to share with you another venture called Percent that fits a similar bill of disrupting an archaic, pen & paper industry.

Last week, I sat down with the CEO of Percent Nelson Chu and received a great overview on the company, some sweet golden nuggets on the company’s performance, as well as some tips for founders & angel investors in these unique times. Let’s do this!

Percent

Percent is a technology platform that is transforming the private credit markets by uniting the investor, the borrower, and the underwriter in one place. Private credit is an asset class of privately negotiated loans and debt financing from non-bank lenders including small business and consumer loans, venture debt, and more.

The $7T private debt markets have been mostly reliant on emails, phone calls, and Microsoft Excel – mechanical, old school processes.

Percent’s platform is looking to standardize the processes & data in the private debt markets. They do so by enabling every party involved to access a deep inventory of deal flow along with the transaction histories of these parties & displaying comparable deals occurring in the marketplace.

Overall, the company has executed over $900M in transactions on the platform.

Specifically, Percent is looking to scale their platform to an even higher level through the launch of “Percent Underwriter.” This SaaS product automates the human capital intensive underwriting process, allowing buy-side & sell-side firms to complete transactions in a fraction of the time.

Part of what is so exciting about Percent’s approach to disrupting the private credit marketplace is their business model.

The company does not take on any significant default risk of the loans themselves. Rather, they are facilitators and executioners of the deals as well as generating revenue from the SaaS products.

This partnered with the fact that there is still significant demand in the private markets – even in these difficult macro economic times, has allowed the company to grow their revenue & ARR by 3x YoY.

Nelson also shared with me that the default rate on the platform is just 1.64%, even with high yields of 10-18% on the platform, displaying the power of Percent’s vetting & back end processes.

Nelson Chu

“Common sense is uncommon.”

-Charlie Munger, Berkshire Hathaway

Percent was founded by Nelson Chu in 2018. Since the company was founded they have only raised $18.5M and most recently raised a $12.5M Series A @ a $43.5M post money valuation in March of 2021.

For a company seeing as much success as they were early on and the wild funding environment that was occurring back in spring of ‘21, I was blown away by Nelson’s disciplined approach – especially when it was clear that Nelson was closer to being a contemporary of mine than my parents.

When I asked Nelson how he stayed so disciplined last year, he told me that he has always been “pragmatic” and since he was young “always surrounded himself with people a lot older than him.”

Back when I was writing for Just Raised, I wrote a special edition breaking down how the most successful entrepreneurs were in their 40’s & 50’s (I plan on resharing this piece over the coming weeks/months to The Crossover!). In my advice to younger founders I wrote:

Surround yourself with mentors and advisors that not only look good on the pitch deck, but are also willing to invest in you and impart serious wisdom. Find mentors who are willing to tell stories about the best and the worst moments in their career—the big moments that defined their careers, but also the small moments that had much bigger consequences than they thought they would.

Gather advisors that will be real with you and tell you exactly what you do not want to hear before what you want to hear. Try and mentally get closer to being a 35-year-old founder than a 25-year-old one.

And I bet if I followed up with Nelson, he would agree that this statement would sound very relevant to his own thought processes.

The lack of growth at all costs model and raising money at reasonable terms has enabled Nelson & Percent to be loved by their VCs & also in a position where they can seek capital opportunistically.

“We are well capitalized at the moment and because of our pragmatism and our growth, no matter what market we’re in, we will be able to raise at an upround.”

Talking about keeping company morale high & strong momentum going!

Staying even keeled, pragmatic, and using common sense when the rest of the world is listening to the music, can have very very strong positive consequences! Percent is a perfect example of that.

Angel Investing

In Nelson’s young career, he also has had some significant success as an angel investor including an investment in BlockFi. I took advantage of connecting with him to ask him about his thoughts on the current angel investing environment.

Interestingly, before he answered the question he shared that he is not actively investing now in the market as a significant amount of his wealth is tied up in Percent – which as an investor, I would love to hear! This means he is taking a reasonable salary and not looking to become a “career CEO.”

What he did share was that he would not be looking to invest in new companies but rather established ones that at one point had significant momentum but would now be experiencing significant down rounds.

Why take a chance on a brand new startup when you can invest in an established, and humbled one, at a more reasonable price? I love it.

Wrapping It Up

Percent is exactly the type of company I would be looking to invest in as an angel or VC investor:

- Targeting a not yet disrupted, massive industry

- Recurring Revenue

- Experienced, hungry, and trusting founder

- Explosive growth @ a reasonable valuation

This company is definitely one to watch, and I look forward to keeping Percent on everybody’s radar!

-Alan

In The News: A Tough Week For Invitae

Article: Invitae ($NVTA) Announces Leadership Transition

TL;DR: Invitae announced that CEO Sean George will be replaced by COO Ken Knight along with other significant operational changes

3 Key Points:

- Sean George will not get the chance to see his vision for building the genomics platform of tomorrow as the cash burn and growth at all costs model proved to be too costly

- Ken Knight has significant operational experience with positions at Amazon, Caterpillar, and General Motors. Specifically, at Amazon, Ken was in charge of transportation services, global delivery services, and fulfillment

- Ken will be tasked with getting the company’s cash burn under control and ensuring that the company can survive the current economic environment

My Thoughts:

I have many thoughts on not only this move, but also the significant $326M cost cutting measures that the company announced. You can expect a newsletter dedicated to these changes in the near future!

(I personally did lighten up on my position in the company.)

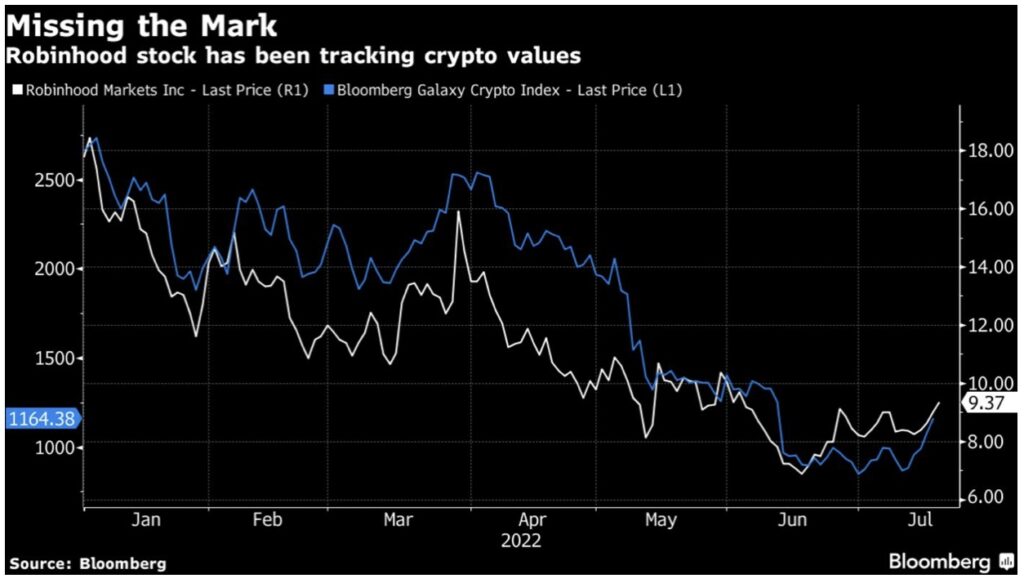

Chart of the Day: A Crypto Correlation

- Crypto values have been dropping consistently and significantly since January from ~$18 to $9.37 (Bloomberg Galaxy Crypto Index)

- Angel Investor Jason Calacanis says that VCs who invested in crypto better lawyer up, as many knowingly flipped worthless tokens to unsuspecting retail investors.

- Calacanis compared the crypto space now with the dot-com bubble bursting. He also expects there to be greater crackdown by the FBI on some of crypto’s biggest frauds

Golden Nuggets

- Shoutout to my All-Star Cleveland Guardian Andres Gimenez on this amazing play during the MLB All-Star Game

- I cannot stop laughing at this giant golf putter (if we can even call it that)

- I laughed out loud at this video making fun of how glitchy Paramount Plus is

- Peanut Butter & Jelly Sandwich or pureed nut spread with a grape relish reduction paired on a brioche bun?

Meme of the Day

Thanks for the read! Let me know what you thought by replying back to this email. See you in your inbox every Monday and Thursday.

— Alan

Disclaimer: This analysis is for educational and entertainment purposes solely and is not professional investment advice. The author of this piece and/or members of Workweek media could be invested in companies discussed.