08 June 2022 |

The Crossover #1: MoneyLion vs. Acorns

By

Want to get these in your inbox to never miss an edition? Subscribe to The Crossover today!

MoneyLion: A curious situation

“The elevator to success is out of order. You are going to have to take the stairs… one step at a time.”

– Joe Girard

On January 19th, 2022, Acorns Inc. announced that they will forgo their plans to go public via SPAC due to “market conditions.”

The FinTech savings platform had planned to merge with Pioneer Acquisition Corp. ($PACXU) valuing the company at $2.2B – a more than 2x increase from the company’s $1.03B valued Series E nearly a year prior.

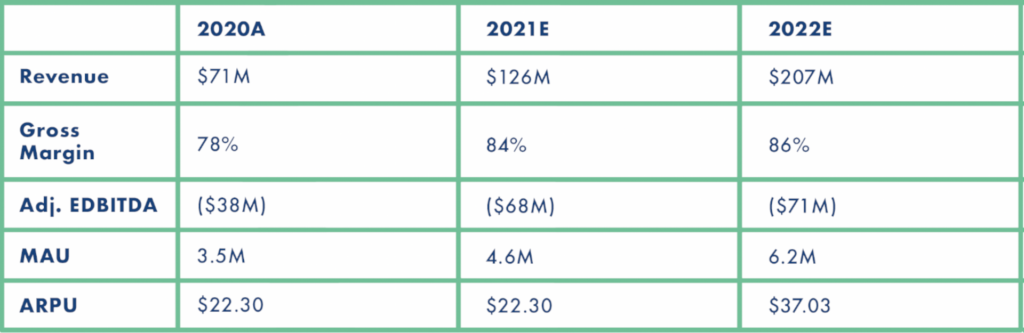

These were the company’s historical and projected financials at the time of the initial SPAC announcement:

Key Takeaways:

- Acorns was being valued at ~17.5x 2021 sales and ~10.5x 2022 sales

- ~80%+ Gross Margin business

- ARPU increased ~50% from 2019 to 2021

A FinTech SPAC trading at 10.5x sales losing $80M+ a year likely would have been sliced at least in half by the markets, so it appears as if Acorns made the right decision calling off the SPAC at the cost of a $17.5M termination fee.

Fast forward three months to March 9, 2022 when Acorns announced a $300M Series F led by Private Equity group TPG, valuing the company at “nearly” ~$2B — a ~15% discount to the SPAC’s valuation.

Back-of-Napkin Math: What valuation do you think Acorns would have today if it had SPAC’d?

Public Peer

What we do know for sure is that Acorns’ investors are happy they are not in MoneyLion’s situation.

MoneyLion is a FinTech platform with a plethora of capabilities and products including mobile banking, cash advance, crypto investing, loan applications, and more.

The company went public via SPAC at a $2.4B valuation on February 12, 2021. This represented a 3.5x valuation increase for moneyLion from their $675M valued Series C in March 2020.

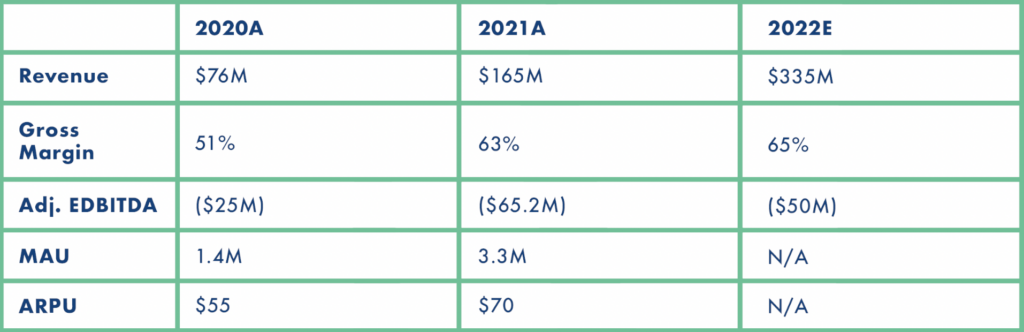

Here are the company’s current financials, including 2022 guidance:

Key Takeaways:

- Revenue poised to grow 100%+ for 3rd year in a row

- Gross Margins: strong margins, likely stabilizing around ~65%

- Profitability: decreasing loss as revenue 2xs, company expects to be EBITDA positive leaving 2022

With all of this data in mind, what would you value MoneyLion at? 5x 2022 sales? Yes, they are losing money, but they have a clear line to profitability and are growing revenue at an explosive rate.

What does Mr. Market say this company is worth? $345M — a ~1x 2022 sales multiple.

MoneyLion’s stock is down 85% since IPO, even though the company is firing on all cylinders, as represented in the table above.

Alan’s Angle

1. MoneyLion is dirt cheap: Mitchell Green, Founder of Leading Edge Capital, recently shared this: “The stock market gets too drunk and too hungover.” MoneyLion likely had no business being valued @ 30x sales in early 2021, but also should be trading more than 2x current year sales.

2. Acorns’ fate: If Acorns went public, the stock would have gotten cut in half (at least), but I anticipate they would not have seen a MoneyLion-like decimation. Why? Two reasons. First, Acorns has strong brand awareness for consumers due to great PR, celeb endorsements (Ashton Kutcher), and strong value-driven principles. That matters. Second, gross margins. Wall Street needs to see a company’s path to Free Cash Flow, but at the end of the day, 88% margins speak for themselves. We see this with GitLab, which is trading at ~20x sales, even though it’s losing serious $$$. Why? Explosive revenue growth and, like Acorns, 88% gross margins.

3. Crossover investors salivating: Over the coming months, we are going to be hearing more and more about crossover investors: investors who deploy capital in both public and private markets. The discrepancy between valuations in the public and private markets is growing greatly, exemplified by Acorns and MoneyLion perfectly. Leading Edge Capital (who we shouted out above), Tiger Global, D1, Cautoe, and others are chomping at the bit and will most definitely be deploying serious capital into the public markets.

In The News

Barron’s columnist Eric J. Savitz wrote a piece in this past week’s edition titled “The Tech Selloff is Causing Big Problems For Startups Too.”

TL;DR: The tech selloff has hurt VCs greatly, the IPO market is collapsing, and private valuations are starting to shrink.

3 Key Stats: NASDAQ composite index down 27% this year Last month, Softbank announced that they have lost $27B across their 3 large venture funds There have only been 34 IPOs in the US market in 2022, down 78% from this point last year

Key Quote: “Forge Global CEO Kelly Rodriques… notes that private transactions in pre-IPO shares still take place at prices above the last completed financing round – but the premium is shrinking. The average secondary transaction in this first quarter came at a 24% premium to the last round, according to Forge, down from a 58% average premium in the fourth quarter.”

If I could short the “premium to last round” percentage, I would. Two reasons: As the inflated valuations of private companies’ last rounds become more and more clear, no one will (or at least no one should want to) touch these companies. Phenomenal, hot, VC-backed companies that IPO’d like Peloton, Chewy, and DoorDash are all down more than 50%. It is only a matter of time until this hits the secondary transaction markets too.

Not only are the valuations off, but the liquidity in the private markets will continue to dry up. When you invest in the pre-IPO markets, you are likely banking on an IPO over the next couple of years, however, many many companies will not be looking to do so (eToro, FTX), which means that you are dependent on a Forge-like platform for liquidity — which is a dangerous bet, especially in a rough macro environment.

Chart of Day

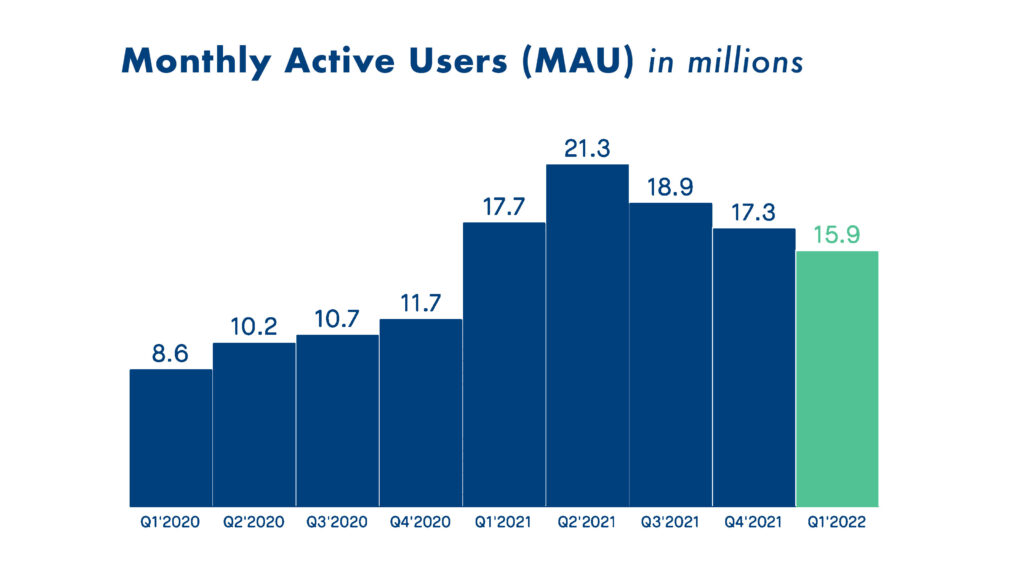

Robinhood’s MAU Issue

- Robinhood has a serious problem on their hands as MAUs are down ~5.5M in just 3 quarters.

- The stock is down ~90% since ATH, but with the market going down and trading becoming less fun, $HOOD’s problems might just be getting started

- Something else to watch: $127M out of $218M Q1 revenues are from options trading. I anticipate that options will become less and less common over the coming months for the retail investor, which could mean even more trouble for Vlad and co

Golden Nuggets

- Top Gun: Maverick: no words. Absolutely incredible. I cannot stop listening to “Hold My Hand,” the amazing song that Lady Gaga created for the film.

- Check out this letter that Y Combinator sent to their founders a couple weeks back.

- A walk-off home run to win your state tournament? Inject this video into my veins!

- Congratulations to my Maryland Terrapins on winning the Lacrosse National Championship!

Meme Of The Day

Thanks for the read! Let me know what you thought by replying back to this email. See you in your inbox every Monday and Thursday.

— Alan

Disclaimer: This analysis is for educational and entertainment purposes solely and is not professional investment advice. The author of this piece and/or members of Workweek media could be invested in companies discussed.