10 April 2022 | Cannabis

How Big Can Cannabis Be?

By

To understand the future, it’s essential to study the past.

Over 5,000 years ago the Chinese emperor Emperor Shen-Nung recognized that cannabis had medical benefits, and cannabis was added to a book referencing the plant among many other natural remedies in the ‘Pen T’sao’ (The Great Herbal).

The highs & the lows

100 yearss ago, cannabis was sold in pharmacies across the United States without the need for retailers to hold licenses.

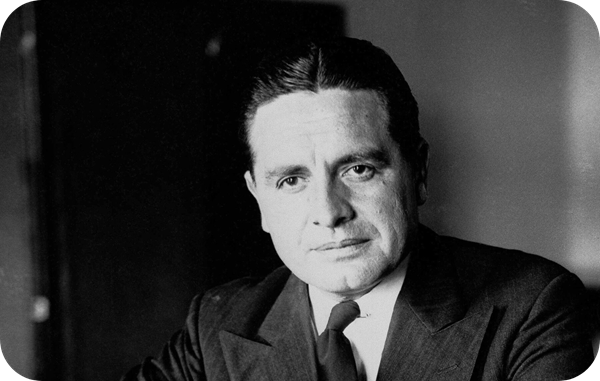

Unfortunately for society, Harry J Anslinger saw an opportunity to increase the authority he yielded by becoming the first commissioner of the U.S. Treasury Department’s Federal Bureau of Narcotics.

The cost of his new title? The war on drugs, and the criminalization of cannabis.

Unfortunately, the war on drugs became a core component of multiple presidents campaigns to win the white house, and the U.S went on to expand its war on drugs policy to the rest of the world under the single convention on narcotic drugs in 1961.

As of February 2018, 186 nations have commitments to Single Convention , however, Canada is currently in breach of its commitments courtesy of having legalized cannabis for adult use purposes in October 2018.

The stigma remains strong

During this time, cannabis or marijuana was made out to be an extremely dangerous drug, however, in 2022 we know cannabis is very safe to consume.

Following this 100 years of misinformation whereby the true safety profile of cannabis was concealed there are many people who still think cannabis is a dangerous drug that serves as a gateway drug to consuming harder drugs.

Nonetheless, in certain parts of the world cultivating and consuming cannabis are both becoming very acceptable once again.

So much so that the global legal cannabis sales hit $37.4 billion USD in 2021.

The cannabis economy

Currently, we are building the cannabis industry.

The industry continues to grow at a very rapid rate as more & more nations are taking action to legalize both medical & adult use cannabis programs with Canada & Uruguay having already federally legalized cannabis for adult use purposes.

Understanding category growth

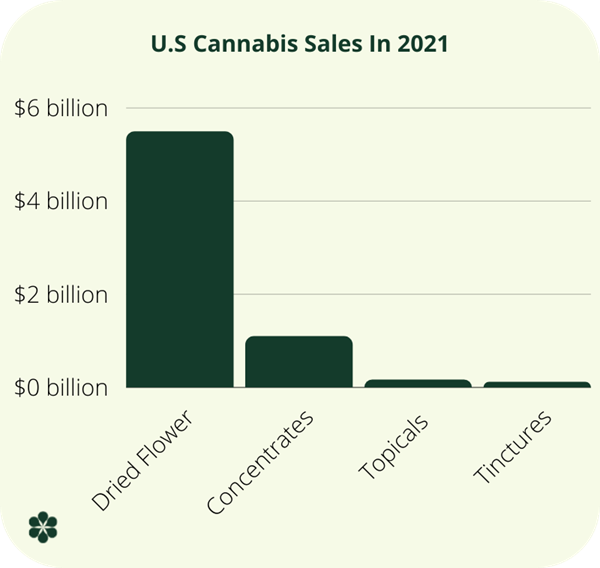

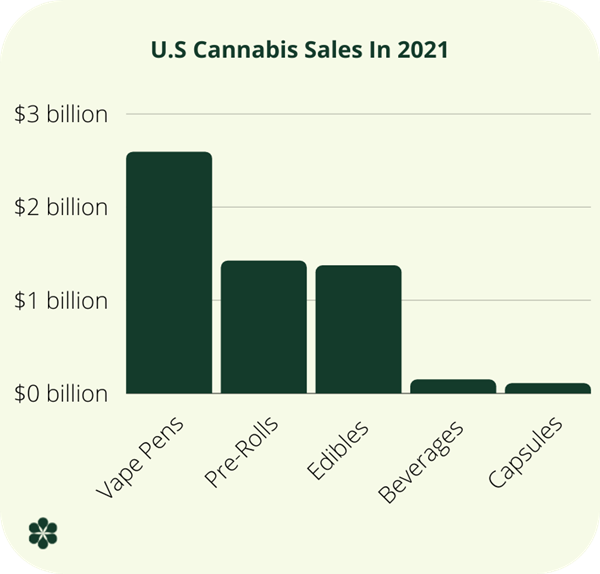

In the U.S in 2021, the average sales growth per category of cannabis was an estimated 18%, such that any category that didn’t experience 18% under performed.

Per the previous edition of The Green Paper,

The following categories of cannabis failed to beat this threshold:

- Flower: 12% sales growth, total sales = $5.49 billion USD

- Topicals: 2% sales growth, total sales = $102 million USD

- Concentrates: 12% sales growth, total sales = $1.09 billion USD

- Tinctures: negative 8% sales growth, total sales = $159 million USD

The following categories beat this threshold:

- Flower: 12% sales growth, total sales = $5.49 billion USD

- Topicals: 2% sales growth, total sales = $102 million USD

- Concentrates: 12% sales growth, total sales = $1.09 billion USD

- Tinctures: negative 8% sales growth, total sales = $159 million USD

The cannabinoid economy

If step 1 is creating the cannabis industry then step 2 is creating the cannabinoid economy, which I think will be many times larger than the cannabis industry.

As we can see from the above data, 4 out of the 5 categories of cannabis that are growing faster than 18% each year are products produced from extracting cannabinoids from cannabis plant matter (flower).

Additionally, topicals and tinctures are using cannabinoids extracted from cannabis flower, however, brands are very limited when it comes to the number of cannabinoids they have access to when producing products.

Big changes are coming

The biggest change to pay attention to in cannabis is going to be the dramatic increase in the number of cannabinoids brands will soon have access to.

Currently, we cultivate cannabis plants to produce cannabinoids, however, the truth is that this method is very inefficient relative to certain systems that are currently being built by companies such as Cellibre who will help the cannabis industry gain access to 120+ cannabinoids using biosynthesis vs the 4 we have access to in a large enough quantity to be commercialized ie. THC, CBD, CBN & CBG.

Once these systems to produce cannabinoids have been commercialized, there will very likely lower the barriers to create a cannabis / cannabinoid brand as companies will no longer need to cultivate cannabis plants to have access to the cannabinoids they need to produce their products.

The full implications

It’s important to point out when I say there are over 120+ cannabinoids, I understand not all of them will provide as much value as THC or CBD.

With that in mind, even if 10% of the new cannabinoids we will soon have access to provide as much value as the current cannabinoids companies use to produce products then brands and consumers will have access to 3x more cannabinoids.

Additionally, with an on demand cannabis supply chain it will be much easier for larger consumer packaged goods companies to enter this space which I suspect will have a very positive impact at erasing the stigma associated with cannabis.

Is this priced in?

Very likely not.

Cannabis companies are lazer focused on the short term (as they need to be), however, there are a few companies who are seeking to allow the cannabis industry access any & all cannabinoids on demand within the next five years.

During this time, I expect to see many consumers beginning to label themselves as cannabinoid consumers as opposed to cannabis consumers — which has already happened in my home country of Ireland where people who consume CBD would in no way say that they consume cannabis sativa ie. hemp.

Instead, they simply state that they consume CBD, however, as consumers begin to incorporate additional impairing & non-impairing cannabinoids into their routines, it would only make sense for them to categorize this consumption as cannabinoids.

Looking Forward

The coming years will continue to prove difficult for cannabis companies.

In Canada, the over supply of cannabis products is hurting both good and bad cannabis companies as the market is driving down the price per gram of cannabis.

In the United States, there will be certain states that will adopt the right polices for cannabis, however, we will continue to see large cannabis companies struggle to produce profits in key markets such as California.

Nonetheless, even with these market conditions and the uncertainty off the implications of federal legalization long term, there are very few industries that will rival the growth of the cannabis and soon to be cannabinoid industry.

Our Take

When it comes to predicting global cannabis sales in the coming years, there are many companies who can accurately forecast the demand for cannabis products.

When it comes to estimating total sales, when cannabinoids are viewed as an ingredient we add to products to improve people health and to improve how people feel — i don’t think anyone’s best guess is even close to how big the industry will be.