13 March 2022 |

U.S Cannabis Consumers In 2021

By

2021 was another amazing year for the legal cannabis industry in the United States.

In addition to breaking records for the number of new full time jobs the cannabis industry created, 2021 set also a new record for the total cannabis sales in the U.S.

That said, this growth was not equally distributed across all categories:

The Data… (from Headset)

The average sales growth in the markets Headset examined was an estimated 18%, such that any category that didn’t experience 18% growth under performed.

The following categories beat this threshold:

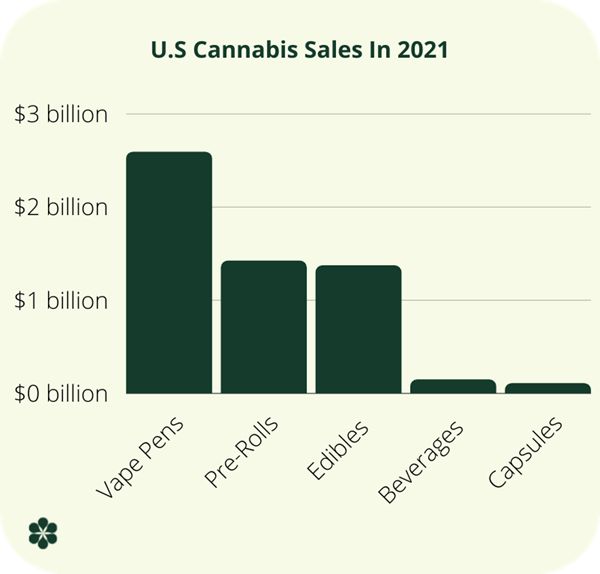

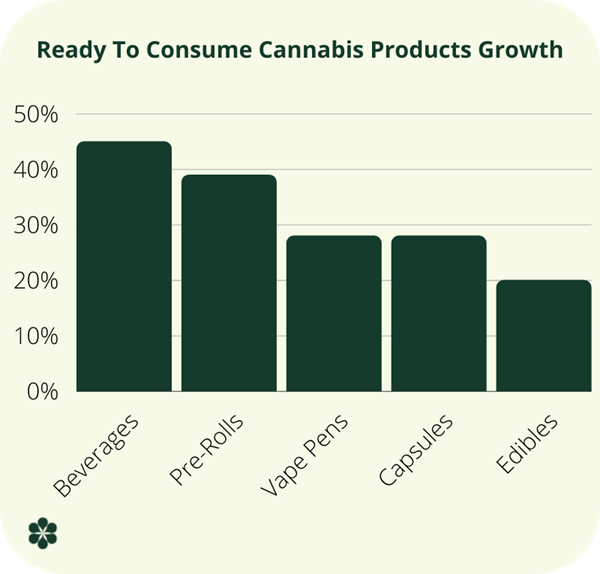

- Edibles: 20% sales growth, total sales = $1.37 billion USD

- Pre-rolls: 39% sales growth, total sales = $1.42 billion USD

- Capsules: 28% sales growth, total sales = $106 million USD

- Beverages: 45% sales growth, total sales = $145 million USD

- Vape Pens: 28% sales growth, total sales = $2.59 billion USD

The following categories of cannabis failed to beat this threshold:

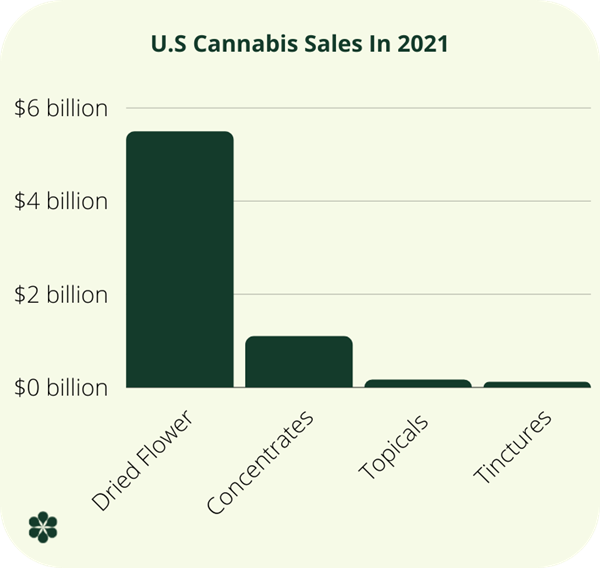

- Flower: 12% sales growth, total sales = $5.49 billion USD

- Topicals: 2% sales growth, total sales = $102 million USD

- Concentrates: 12% sales growth, total sales = $1.09 billion USD

- Tinctures: negative 8% sales growth, total sales = $159 million USD

Focusing On Flower…

There’s a number of ways to dissect this data, however, let’s focus on flower.

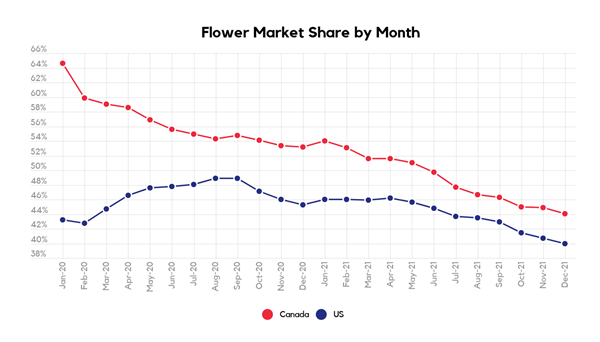

Flower is by far the most popular category of cannabis in the United States, however, during the same time dried flowers dominance is dwindling — cannabis pre-rolls are simultaneously gaining new market share.

There’s a plausible explanation as to why this is happening.

My hypothesis here is two fold:

First and foremost, when cannabis sales commence existing cannabis consumers make up the majority of all sales, and with flower being the most popular category of cannabis amongst legacy consumers – it dominates the initial legal cannabis sales.

That said, as a new cohort of consumers enters the cannabis market we see a sudden shift in the overall consumer preferences as new consumers seek out ready to consume cannabis products such as edibles, beverages, capsules & pre-rolls.

Unfortunately, there’s limited data available to validate this hypothesis, however, the success of both cannabis beverages & edibles in 2021 supports this point of view.

The Growth Of Beverages…

Ever since large alcoholic beverage companies began pouring billions of dollars into the legal cannabis industry, cannabis beverages have been hailed as the product that would bring cannabis into the mainstream.

Having worked in the cannabis industry since 2018, such claims have long been the subject of ridicule as beverages have failed to live up to these high expectations.

It’s my perspective that 2021 was a turning point for cannabis beverages.

In Canada the number of consumers who had consumed a cannabis beverage increased by 2.66x from 2020 – 2021, a data point that suggests this category of cannabis is finally finding its footing in Canada.

In the U.S, total cannabis beverage sales increased some 45% last year- the highest growth of all categories in cannabis in 2021.

While it’s possible that legacy cannabis consumers are contributing to this growth, I think it’s many times more likely that net new cannabis consumers are responsible for driving this growth.

Questions For Cannabis Companies…

It’s long been my perspective that we would see a day in the not so distant future whereby flower would no longer remain the most popular category of cannabis.

With 7,000 Americans trying cannabis for the first time, the influence new consumers will have on the market will continue to grow, and all signs point towards ready to consume products being the future of cannabis.

For cannabis companies this poses an important question – do you compete in the ultra competitive dried flower market, or do you focus on much faster growing categories in cannabis such as edibles & beverages?

Looking Forward…

As things stand today, dried flower represents the far majority of all cannabis products being purchased in both Canada & the United States, however, while this might be the case in 2021 – it’s unclear how long this will remain the case.

As such, the more interesting question is not when cannabis beverages will account for more sales than flower – it’s when will ready to consume cannabis products account for more sales than dried cannabis flower.

Per the data headset provided, the answer is 2021 – the first year whereby pre-rolls, beverages, vape pens, edibles & vape pens combined accounted for more sales than dried flower ($5.631 billion vs $5.49 billion).

Our Take

Companies would be foolish to overlook the ever increasing influence new cannabis consumers will have on the products cannabis retailers choose to stock.

The role of retailers is to curate an assortment of products that appeal to the customers they are targeting, and I am willing to wager we will continue to see more & more retailers catering to the needs of new consumers.

Such changes will negatively impact certain cannabis companies in the short term, however, long term I am confident that such changes are for the betterment of the cannabis industry as more consumers incorporate cannabis into their lives.