03 September 2022 | Healthcare

Biden Admin Invests $100M into Marketplace Enrollment

By workweek

The Biden administration is investing a significant $100 million into the Affordable Care Act to increase insurance coverage for underserved communities. Specifically, the funding will go into care navigators, which is expected to increase enrollment as it did so this year. Recall, the ACA marketplace has been riding high following a year of record-breaking enrollment.

The Deets

The Biden admin’s $100 million investment into ACA marketplace navigators is the largest funding to date. Last year, the admin invested just $80 million into the navigators. Navigators are organizations trained to help consumers, small businesses and their employees navigate insurance options through the ACA marketplace. This includes outreach and hosting local community events to educate people on their insurance options.

The priorities of the $100 million investment are two-fold:

- Navigators will improve outreach to underserved communities.

- Navigators will help eligible Medicaid beneficiaries transition to ACA marketplace plans, given the impending end of the public health emergency may force millions on Medicaid out of coverage.

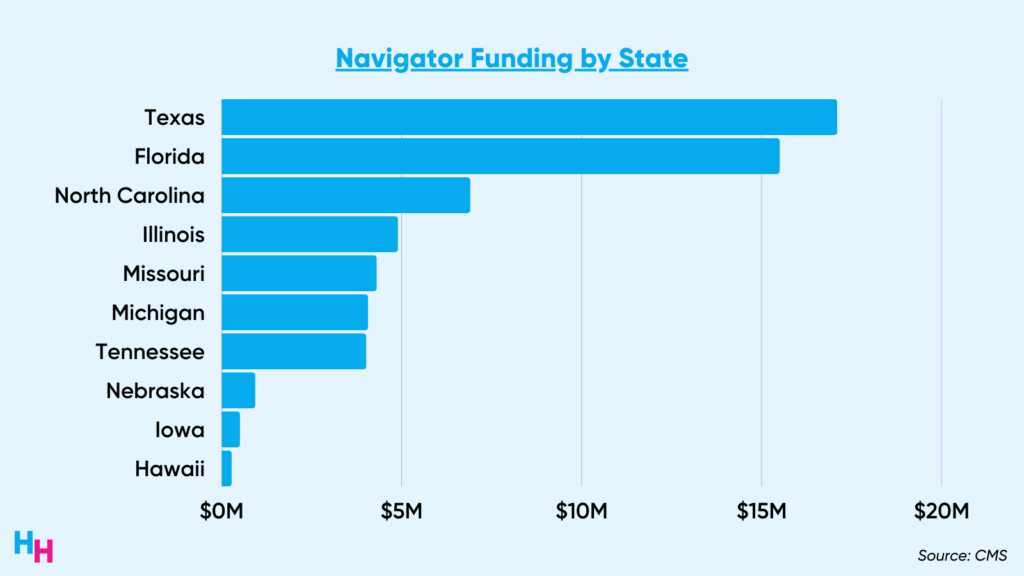

The $100 million won’t be disbursed equally to states. While Texas, Florida and North Carolina will receive the greatest funding, Hawaii, Iowa and Nebraska will receive the least funding.

This makes sense, given Texas, Florida and North Carolina have some of the highest uninsured rates in the country while Hawaii, Iowa and Nebraska have some of the highest insured rates.

Dash’s Dissection

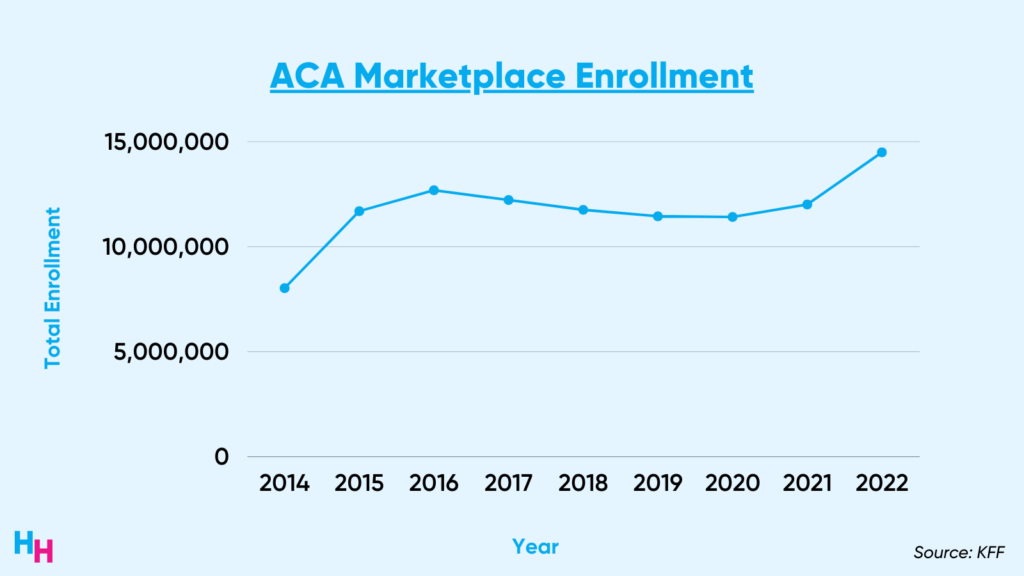

A record-breaking 14.5 million Americans signed up for health insurance during open enrollment for the Affordable Care Act Marketplace in 2022, a 21% increase from 2021.

You can thank the American Rescue Plan (ARP) for the uptick in enrollment.

- The ARP expanded tax credits for Marketplace insurance by eliminating what’s known as the subsidy cliff.

- Pre-ARP, tax credits for Marketplace insurance were capped at 400% of the federal poverty level (FPL)—if you made more than 400% FPL, you were on your own for insurance.

- The ARP removed that subsidy limit and capped Marketplace insurance premiums at 8.5% of household income. So, if you make more than 400% FPL, you won’t pay more than 8.5% of your income in premiums.

- The recent Inflation Reduction Act extended these tax credits through 2025.

What also helped increase enrollment was this enhanced focus on areas of friction for learning about and enrolling in the ACA Marketplace (read: navigators!) The government added significantly more tools to Marketplace navigators, using unconventional media to target underinsured communities and hosting in-person outreaches at local libraries, Covid-19 clinics and job fairs.

If it ain’t broken, don’t fix it. But that doesn’t mean you can’t enhance it. I predict the Biden admin’s large investment into navigators will improve the consumer experience when selecting an insurance plan and increase Marketplace insurance enrollment this upcoming enrollment period.