30 July 2022 | Healthcare

How the Inflation Reduction Act Will Lower Out-of-Pocket Drug Spending

By workweek

Democratic leaders agreed on a $433 billion spending package to combat climate change and lower healthcare costs. While the legislation isn’t approved just yet, it’s a significant step in the right direction to address climate change and curb rising healthcare costs.

The Deets

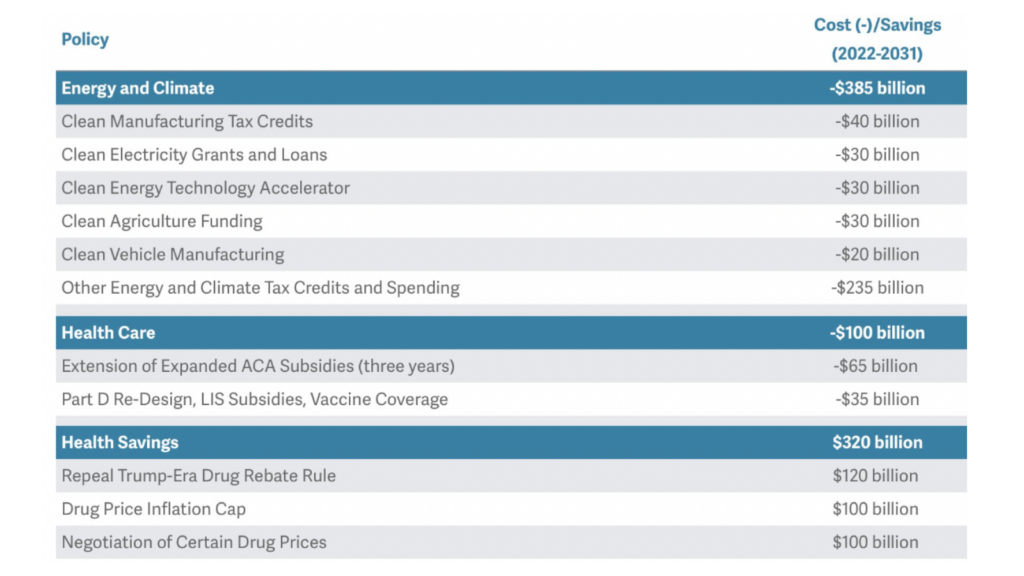

The Inflation Reduction Act of 2022 tackles three healthcare areas: climate change, drug pricing and insurance subsidies. Overall, the legislation is intended to save $305 billion over the decade, but below are the costs and savings for the health-related areas.

I talked last week about climate change’s impact on health. In this legislation, the government will provide tax rebates for Americans who make their homes more efficient and give tax credits for low- and middle-income people using electric vehicles.

The meat of the legislation’s healthcare components involves drug pricing and the Affordable Care Act. There are several measures targeting rising drug prices. I highlight the key areas below:

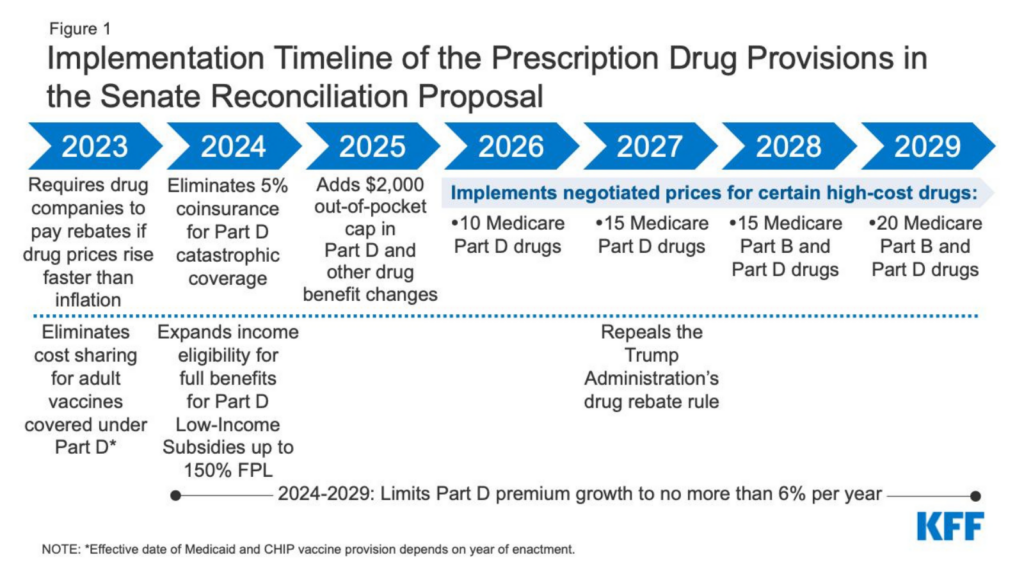

- $2,000/year out-of-pocket cap on drug costs for Medicare beneficiaries. Currently, no limit exists, forcing many to pay $10,000+ dollars per year.

- Direct negotiations between Medicare and pharma companies over certain high-cost drugs.

- Inflation rebates, requiring drug companies to refund Medicare beneficiaries and private insurance for increases in drug prices that exceed the inflation rate.

- Free vaccines for Medicare beneficiaries.

The legislation will add $64 billion for a three-year extension of enhanced premium assistance for Affordable Care Act insurance plans. Recall that the American Rescue Plan Act (ARPA) expanded Marketplace tax credits for patients with incomes higher than 400% FPL. This led to 14.5M Americans signing up for health insurance during open enrollment this year, a 21% increase from 2021.

While the ARPA isn’t linked to the public health emergency, it’s set to expire at the end of this year, which means millions of Americans may lose access to insurance or face steep increases in premiums. Although the legislation would extend subsidies for another three years, it won’t necessarily decrease premiums but would prevent a huge spike.

Dash’s Dissection 👨🔬

The most pressing legislative issue is the impending subsidy cliff from the expiration of the ARPA. According to KFF, a 60-year-old couple with an income of $70,000 pays $496 per month instead of $1,859 per month thanks to the ARPA. Essentially, they’re paying 8.5% of their income under the ARPA vs. 32% of their income without the ARPA. If government subsidies were to expire, this family would face a steep increase in monthly premiums, making health insurance unaffordable.

Additionally, the drug pricing legislation could be more encompassing to include caps on insulin. It seems congress can’t agree on proper terms to cap insulin prices, leaving it up to private companies and states to do so. For example, just the other week, California announced it would produce its own insulin to lower insulin prices for Californians.

Nothing is finalized in this package just yet. It will go through another review and then need to pass the Senate and House.

Subscribe to the Healthcare Huddle newsletter to read more content like this!