11 July 2022 | Investments

Tiger Global: A Crossover Collapse

By

Hello from Denver, Colorado!

I am out West for a conference and am having a blast.

Two thoughts on Denver:

1. Red Rocks Amphitheater lives up to the hype

2. I have never seen so many one way streets in one city

Alright, enough about me!

Showtime!

Want to get these in your inbox to never miss an edition? Subscribe to The Crossover today!

A Not So Intimidating Roar?

Tiger Global

If you follow either the venture capital space or the public markets relatively closely, you have heard that Chase Coleman’s Tiger Global has come upon quite difficult times.

Tiger has two main hedge funds that they manage – a long/short fund & a long only fund. The long/short fund had a value of around $20.5B at the end of 2021 & is now down 52% YTD while the long only fund, which was valued at $8B at the end of 2021, is now down over 61% YTD.

Now Tiger expects significant write downs in their $64B venture portfolio as the realities of the market come into play. The WSJ had a great read breaking down Tiger’s misfortunes that you can read here.

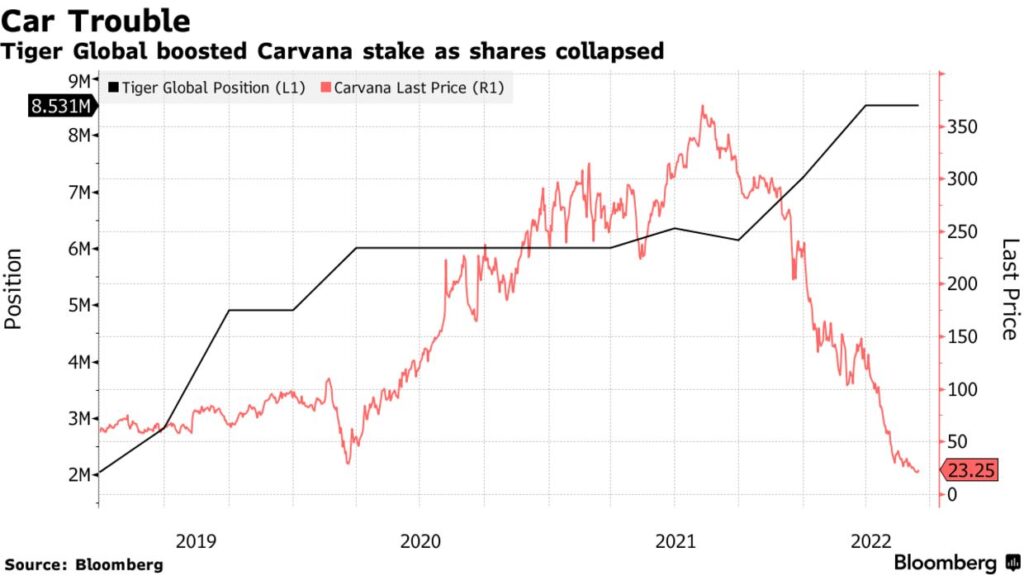

Below, I am going to be sharing a few thoughts on one of the companies biggest public investment misses, Carvana, and the fact that Tiger continues to expose themselves to significant risks.

Carvana

One of the biggest and most notable losses hitting Tiger was a failed investment in used car retailer Carvana.

Tiger started building up a position in Carvana in 2019 between $50-$100 a share.

Carvana was a significant beneficiary of COVID as people were looking to buy in general more used cars as well as doing so online.

This helped the company post solid revenue growth of 40% in 2020 to $5.5B before posting a monstrous 2021 that displayed nearly 130% in revenue growth and $12.8B in revenue. As you might have guessed, this sent Carvana’s stock flying and originally had Tiger looking brilliant sending the stock over $375 a share.

Interestingly, instead of taking some profit or letting the investment ride, the crossover investors ended up deploying even more capital ultimately growing their position to over 6M shares, still buying when the stock was over $300.

As inflation started kicking in and demand for used cars started dropping, Carvana’s unit economics collapsed and the stock price did too – ultimately sending the stock crashing down to ~$20 a share, representing a 90% collapse from its all time highs.

At its height, Tiger owned over 8M shares @ an average cost basis of $105.80. Nasty.

Sam Harland, the partner behind the Carvana investment has left the company.

Check out the great chart below from Bloomberg breaking down Tiger’s position in Carvana over the years:

Existential Threat

One of the main reasons that Carvana’s stock has collapsed to these levels is the fact that the company is facing a true existential threat.

In all of 2021, Carvana lost $135M. In Q1 ‘22 alone, the company lost $260M– even while posting a 14% increase in cars sold.

Additionally, Carvana cited company specific issues including “reconditioning and logistics network disruptions” showing that issues at Carvana were more than just the macroeconomic forces the rest of the world was facing.

The company also announced a $2B issuance of stock – $1B for the company & $1B to pay for a questionable acquisition of Adesa, an online used car auction website, for $2.2B.

Without going too deep, it is clear that an acquisition like this would make sense strategically due to the synergies between Adesa & Carvana.

What is the questionable part?

The fact that they are paying for the other half of the acquisition through a $1B unsecured note with a 10.5% yield! That is a junk bond!

With only $950M in cash on the books, more than $3B in debt, and looking to add an additional debt with an extraordinarily high interest rate and no cash flows to pay it down, Carvana is at true risk of defaulting on their debt.

Carvana has outlined an incredibly dense and complex plan (50 slides!) to achieve adj. EBITDA profitability that you can see here. Some highlights from the plan include laying off 12% of the workforce and Carvana executive team forgoing their salary for the rest of the year.

Making a nice powerpoint is one thing but executing on it is another. If Carvana cannot execute and turn around the car quickly, more pain for both Carvana & Tiger could be on the horizon.

Risk On

If you look at Tiger’s public holdings at the end of Q1, you will see that the fund’s 5 biggest positions are:

- JD.com (11% of portfolio)

- Microsoft (8.5%)

- Crowdstrike (7.5%)

- Nu Holdings (7.4%)

- Sea Limited (6.1%)

There are two main things that jump out to me about these holdings. First, that only one of these companies, Microsoft, was profitable last year representing the risk on nature that the firm takes to public market investing.

Interestingly, Coatue Management, another crossover fund, 4 out of 5 of their top holdings were profitable last year (Tesla, Rivian, Moderna, Block, Meta).

The second point regarding Tiger’s portfolio is the fact that JD.com is Tiger’s #1 holding. JD.com, the largest chinese retailer, is a risky place to put your money.

There is a significant history of the Chinese government regulating bigtech as well as having significant influences on companies.

From an investors perspective, especially someone like Tiger who has had a nasty run of late, it is interesting to see them put more than 10% of their chips, almost $3B, in a chinese company.

It is interesting to note that other crossover funds are very bullish on China like Leading Edge Capital and their bullishness on Alibaba. Crossover investors likely have a higher risk threshold due to their venture experience.

Two main reasons that Tiger is likely a believer in JD.com outside of the business fundamentals is due to the quantitative easing (unlike America) that is occurring in China as well as the fact that a JD.com executive shared that tech regulation in China is getting more “rational.”

We shall see.

Wrapping It Up

Even though Tiger has had a questionable run as of late, it is important to recognize just how successful the company has been over the past couple of decades – even after the recent collapse.

As of March, investors that invested in their hedge fund in 2001 would have still averaged 16% annual returns while early venture investors have seen 20% annual returns.

It is clear Tiger knows what they are doing and maybe just maybe they got caught up listening to the music over the past couple years.

I look forward to keeping you updated on Tiger’s investments and how they perform over the coming months & years.

-Alan

In The News: Klarna Krumbles

Article: Klarna Valuation Plunges 85% To $6.7B (CNBC)

TL;DR: After a couple months of rumors, the funding details on Klarna’s round are out and they are not pretty

3 Key Points:

- Klarna raised $800M in funding at a $6.7B valuation vs. the $45.6B valuation the company raised at last year in a round led by Softbank

- The CEO of Klarna shared that the raise was a “testament to the strength of Klarna’s business.” (Yes. You read that right.)

- Existing investors Sequoia & Silver Lake participated in the round as well as new investors like the Canada Pension Plan

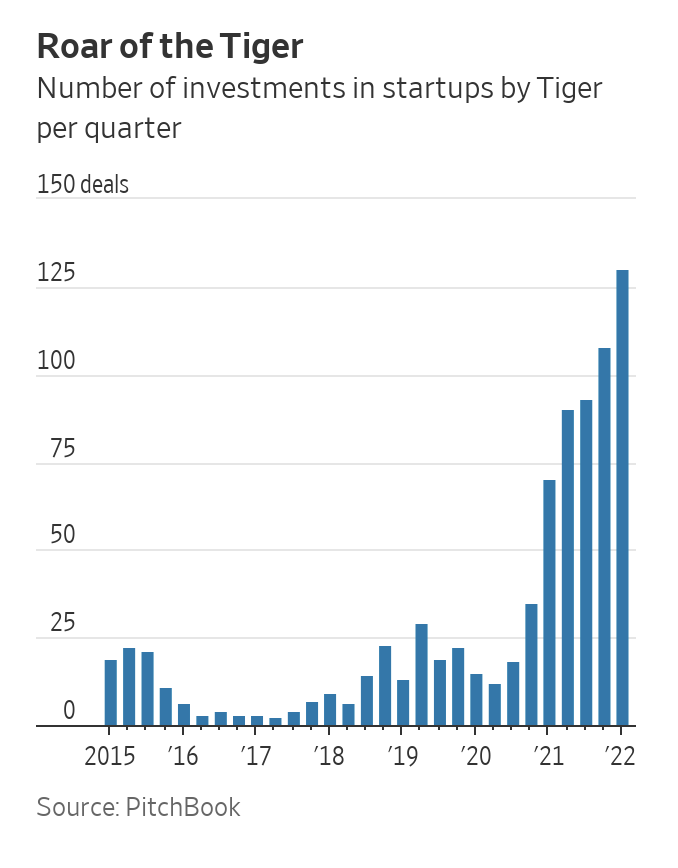

Chart of the Day: More Tiger!

- One of the most interesting aspects of Tiger’s VC investments over the past few years is the sheer quantity of deals they did over the past couple of years

- Specifically, in Q1 ’22 the crossover fund did 130 deals vs. 70 deals in Q1 ’21 & 15 deals in Q1 ’20

- Tiger’s timing of being even more aggressive in the VC marketplace could not have been worse and will lead to significant write downs in valuations

Golden Nuggets

- Novak Djokovic won Wimbledon again! Absolutely love this picture of him holding the trophy

- I watched Inglorious Bastards for the first time in about a decade and it was incredible

- After Elon Musk pulled out of the Twitter deal, he has been firing off some amazing tweets like this one here

- MLB twin pitchers Tyler & Taylor Rogers playing catch before the game on the field is everything!

- Bill Gates saying that NFTs and crypto are based on “greater fool theory”

Meme of the Day

Thanks for the read! Let me know what you thought by replying back to this email. See you in your inbox every Monday and Thursday.

— Alan

Disclaimer: This analysis is for educational and entertainment purposes solely and is not professional investment advice. The author of this piece and/or members of Workweek media could be invested in companies discussed.