20 March 2025 | Media

Perpetual: My Take on theSkimm’s acquisition

By Adam Ryan

Why theSkimm Mattered

In 2012, theSkimm launched with a simple yet powerful idea: making news digestible for young millennial women. Founders Danielle Weisberg and Carly Zakin, both former NBC News producers, struck what seemed like gold almost immediately.Within their first year, they landed a spot on the Today Show.

By September 2014, Reese Witherspoon was a fan. A month later, Oprah called herself an avid reader. By December, they had raised $6.5M from RRE, Homebrew Ventures (Hunter Walk’s firm), and celebrities like Chelsea Handler.

Their growth wasn’t just about star power. The Skimm’bassador program, their referral engine, was a masterclass in organic growth, pulling in tens of thousands of new readers at an incredible pace.

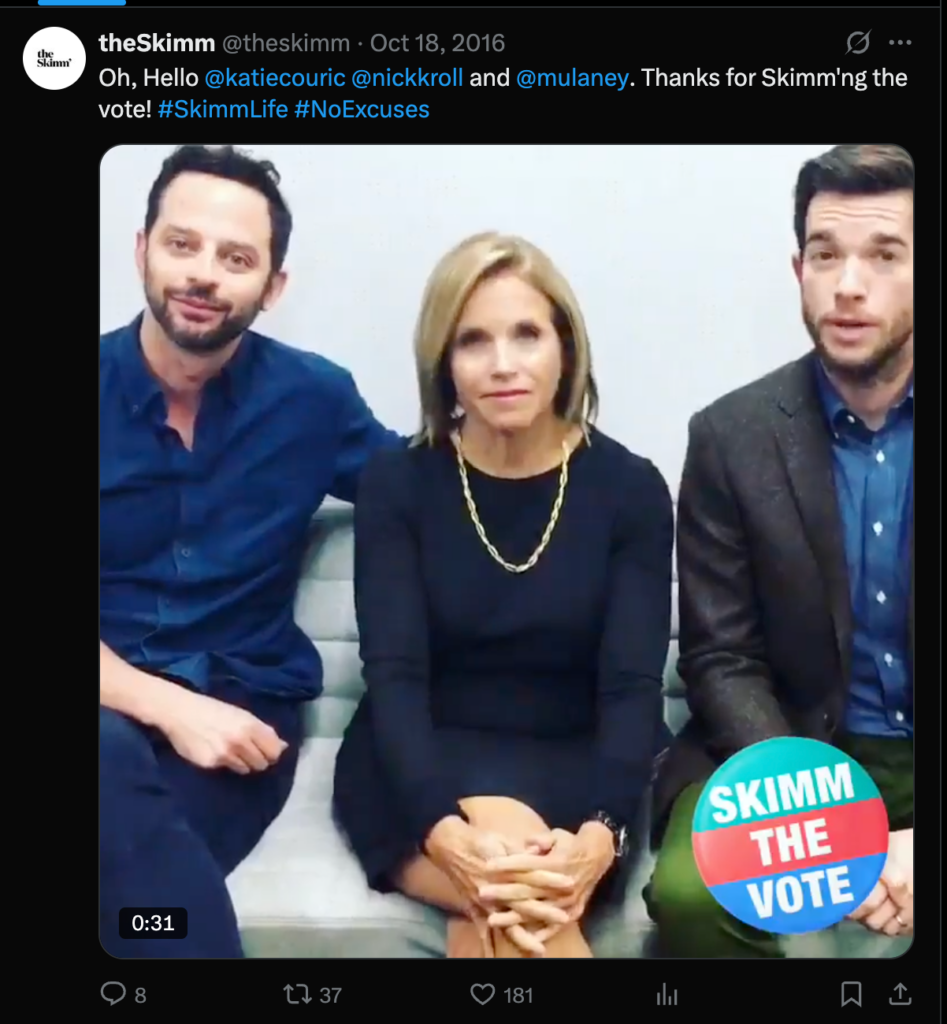

By 2016, they had 4M subscribers and raised their Series B—$8M from 21st Century Fox.

In 2018, they hit 6M subscribers and raised another $12M from Google Ventures, Tyra Banks, Sara Blakely, and Shonda Rhimes.

In total, they’ve raised about $29M in venture capital and, potentially, a few million more in debt.

TheSkimm didn’t just prove newsletters weren’t a low-value channel for media companies, they proved it could be the main channel.

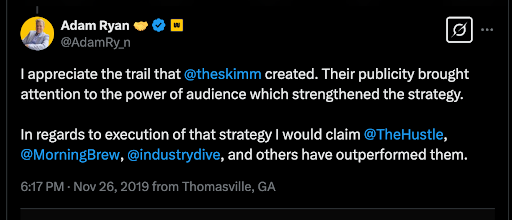

They walked so others could run

As theSkimm brought celebrities, well known investors, and millions of subscribers, they brought credibility to newsletters. They are a key reason why newsletters are viewed as a channel to build a relationship with an audience, as I wrote in my last edition.

At The Hustle in 2016, I used to tell people we were the “theSkimm for Silicon Valley.” Morning Brew likely had a similar pitch early on.

And just like theSkimm benefited from DailyCandy before them (though everyone forgets about them), the rest of us benefited from theSkimm’s work. They laid the foundation for what newsletters could be.

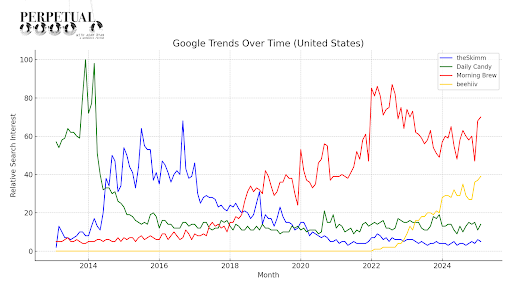

But the landscape started to shift. Morning Brew overtook theSkimm in search around 2018-2019. Today, Beehiiv has 3x their search interest, despite launching in 2021.

The world and its attention moved on. And when that happens in media, enterprise valuations fall faster than your open rates.

What was the acquisition worth?

The acquisition details weren’t disclosed—because they likely weren’t pretty.

I’ve seen this play out before. Spiceworks, where I started my career, raised too much venture capital, stopped growing, and similar to theSkimm, also sold to Ziff Davis. Spiceworks sales price was less than its preferred stack.

What’s a preferred stack? It’s the order in which investors get paid when a company sells. Typically, if a company sells for less than what it raised, employees and founders often walk away with nothing because investors are on the top of the stack.

Ziff Davis doesn’t buy based on hype, they buy based on financials. When asked if they were profitable, theSkimm told Axios they had a “track record of profitability.” Which, let’s be honest, sounds like “not really.”

Unlike Industry Dive, who sold for $500M and had almost $30M in profit, or Morning Brew, who sold for $70M+ and was profitable, theSkimm was never really profitable. And there were signs of poor execution for years.

So what’s the number? If I had to make my best guess on the amount they sold for, I’d use the following context clues:

- Based on the non-answer around profitability

- No major press around revenue in years

- Selling to a media company, which they wanted to avoid

- Ziff Davis buying Spiceworks for 1x revenue and less than the preferred stack

- Being in the distressed assets category

Probably somewhere between $30-$35M.

Which also means they barely returned money to investors and no one made any money. Ouch.

Why did this happen?

There’s a quote from theSkimm’s early days in 2014 that stuck out to me:

“Though theSkimm’s approach is decidedly low-tech, it has paid dividends.”

Newsletters don’t need to be high-tech businesses. The model is simple: get readers, sell ads, repeat. It has great margins and, if run well, can be an incredible businesses.

But by 2018 and $25M raised later, they started changing their tune:

“Tech is at the foundation of what we’re building.”

This is where things started going sideways. The business model was never going to support a venture-scale return. And instead of chasing a tech identity to please investors, they could have doubled down on premium brand partnerships, diversified ad offerings, and expanded into events earlier.

These decisions would have sustained margins and positioned them for a strategic sale, instead of a distressed one. Over the years, they tried to become a membership company. Launched a subscription. Went hard into video. Partnered with an AI company. Threw spaghetti at the wall, hoping something would stick.

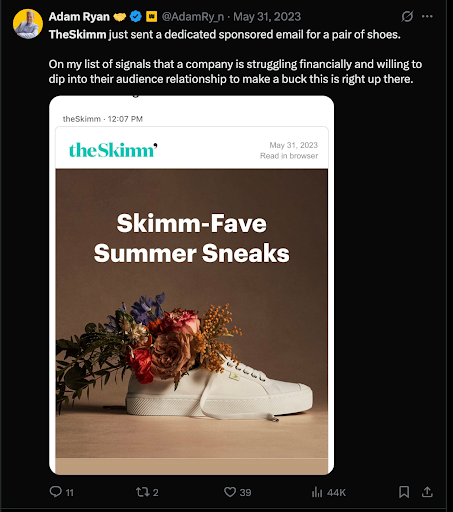

When their growth slowed and media appeal faded, they doubled down on revenue extraction instead of audience trust. They started sending dedicated emails hawking consumer goods like shoes, kitchen gadgets, and whatever else they could sell.

Key Lessons:

- Build for a mindset, not just a demographic. Millennials loved theSkimm in their 20s, but by their 30s, their lives changed. Enter kids, careers, new priorities. theSkimm didn’t evolve with them. Your audience won’t stay 25 forever—build something that grows with them.

- Don’t raise venture capital if you’re a publisher selling ads. The economics won’t meet investor expectations, and the outcome won’t be a win. Instead, use ad revenue to reinvest in new opportunities.

- Be stubborn with your vision but adaptable in execution. Don’t let outside pressure shift your long-term strategy. Stay the course if you truly believe in it.

- Don’t over-engineer a simple business. A low-tech product is an advantage, lean into it. Hiring engineers just to appear “tech-driven” is a mistake.

- 7M subscribers doesn’t mean you can sell them anything. Audience size alone isn’t enough. Focus on engaged, high-quality subscribers over vanity metrics.

Why I owe theSkimm a ‘Thank You’

It’s easy to criticize decisions in hindsight. But I owe theSkimm a lot.

Because of them, I could explain The Hustle to my wife on our honeymoon and convince her I should quit my job at MyFitnessPal to join the team in 2016.

Because of them, I started thinking about memberships. In 2018, I saw their Series B deck and it was all about becoming a membership company. That idea stuck with me. Workweek is scaling memberships today, and I don’t think that happens without that early inspiration.

Morning Brew and The Hustle get a lot of credit for referrals, but let’s be real: theSkimm did it better. Their ambassador program grew faster and more organically than any newsletter at the time. Their success gave the rest of us the confidence to compete.

They paved the way for big brands to spend money in newsletters. At The Hustle, almost every agency deal I won, like Microsoft, Cole Haan, and countless others, happened because those brands first spent with theSkimm.

They legitimized the space for all of us.

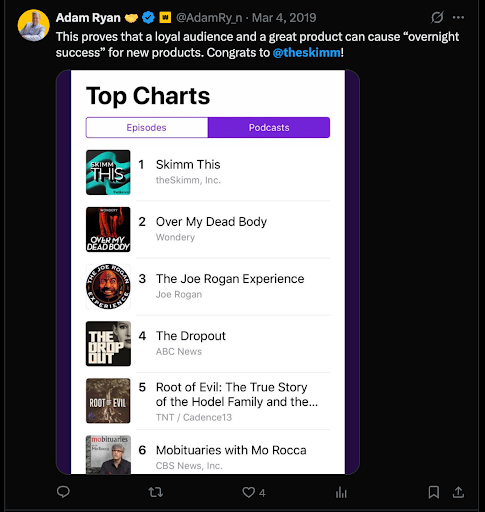

Their podcast shot to the top of the charts and I was amazed that day. It shaped how I thought about content, community, and creators.

I imagine Danielle and Carly have a mix of emotions with this chapter ending. There were a lot of highs, and as most venture backed companies, the ending wasn’t what they probably had hoped.

But the ending shouldn’t hide the journey. They shaped our industry. They changed narratives. They built something people loved.

And that’s something that media needs more of.