13 September 2023 | Climate Tech

A trillion-dollar carbon removal industry

By

For this piece, I was excited to invite Jack Andreasen, Manager of Carbon Management and U.S. Policy at Breakthrough Energy, to co-author with me. I also weaved in perspectives from other experts. Together, we covered one major newer category of infrastructure. Specifically, we’re discussing how to build a trillion-dollar carbon removal industry in the U.S.

The past few years have seen a sea change in carbon removal. At the beginning of 2020, what we’re discussing today would have been unimaginable. Significant private and public sector funding has kickstarted an industry where there effectively wasn’t one previously.

Last month, the U.S. government made a $1.

As part of the recently announced Direct Air Capture (DAC) hubs program, this investment was monumental for direct air capture technology, the nascent carbon removal industry, and the cadre of advocates and stakeholders working on these climate solutions as a whole.

It’s also worth noting that total DAC hubs investments will top $3.5B once the second funding round is announced in the coming years. Behind the scenes, the Department of Energy (“the DOE)” – in particular the National Energy Technology Laboratory (NETL), the Office of Fossil Energy and Carbon Management (FECM), and the newly formed Office of Clean Energy Demonstrations – worked tirelessly in concert to deploy billions of dollars in funding across different geographies, tech providers, and supportive partners.

The who’s who of carbon removal check cutting

The major awardees in this round of funding were 1PointFive Ventures, an Occidental Petroleum and Carbon Engineering joint venture, Climeworks, and Heirloom.

The first two companies are “veterans” of the DAC business, having started their work over a decade ago. In addition to the government funding they’ve secured, they’ve made significant moves in the intervening weeks.

After the DOE funding announcement, also Occidental Petroleum formally acquired Carbon Engineering for a total investment of $1.1B. The purchase price in and of itself is another signal of validation for the DAC industry and should provide tailwinds for companies as they grow from pilot projects to fully-fledged facilities.

Plus, the fact that Occidental Petroleum committed to purchasing rather than merely working with Carbon Engineering exhibits a longer-term commitment to DAC in general. That’s a noteworthy move for an oil and gas company to make.

Similarly, 1PointFive Ventures also announced this week that it pre-sold 250,000 tons of carbon removal to Amazon. While that’s a six-figure tonnage number, the deal likely represents eight figures in revenue for 1PointFive Ventures based on prevailing market prices.

The other companies that were major winners in this initial round of DAC hub funding are no slouches in their own right. Last week, for instance, Microsoft pre-purchased 315,000 carbon removal credits from Heirloom, which uses limestone to remove carbon directly from the atmosphere. That deal was also likely worth eight figures of bankable revenue for Heirloom based on prevailing market prices. And Climeworks has ‘long’ established itself as a leader in DAC in its own right; last year, it broke ground on what will become the largest existing DAC facility in the world in Iceland.

All of this also follows a wave of private sector funding in recent years, which BCG expertly outlined in the graphic below from a recent “Climate Needs and Market Demand Drive Future for Durable CDR” report. You’ll note that some of the larger funding rounds covered in the below are for companies the U.S. government is now also supporting, including Heirloom and Climeworks.

To back up one step, the raison d’etre for massive investments in carbon removal are (at least) two-fold. For one, there’s the elephant in the room: The accumulating (also elephant-sized) amount of greenhouse gasses in the atmosphere that are warming the planet. In addition to the need to mitigate future emissions, the planet has crossed thresholds that necessitate cleaning up legacy emissions from the atmosphere as well.

Secondly, there’s significant demand for carbon removal from corporate buyers who want to balance the scales of the emissions their businesses are responsible for. BCG also projected supply and demand dynamics for durable carbon removal out to 2030, and found there’ll be a significant gap. That portends well for companies the U.S. government is now supporting; there should be no shortage of demand for the services they’re selling.

Beyond the headlines: A new American industry

Make no mistake, the DAC hubs announcement is a big deal. As Giana Amador, the Executive Director of the Carbon Removal Alliance, noted to Nick in a recent conversation:

DAC Hubs will define the public’s perception of carbon removal. These are the first major projects in the U.S., so they need to be outstanding examples of what carbon removal can be. If not, they’ll be Solyndra-esque ammunition for people skeptical of these technologies.

Still, there’s much more than meets the eye among recent government announcements for carbon removal. Given the billion-dollar headlines, it’s no surprise that other announcements from the DOE were slightly overshadowed. One policy, in particular, may have a more significant impact on DAC, carbon removal, and the climate than the headline billion-dollar numbers.

Last month, the DOE also released a long-awaited Notice of Intent (NOI) outlining the kinds of carbon removal programs, projects, and technologies they seek to fund over the coming years. The NOI contains several new programs:

- Support for non-DAC carbon removal pathway pilots, such as biomass removal and storage, ex-situ and surficial mineralization, and marine and multi-pathway solutions.

- A program for monitoring, reporting, and verification (MRV) research and development. MRV is an acronym that encompasses a suite of technologies, standards, processes, and reporting mechanisms that accomplish key outcomes in carbon removal. To put it crudely, MRV allows us to know how much carbon dioxide is removed, where it is removed from, how long it is removed for, where it is at any given time, and ensures that it stays removed.

And in addition to all that? It included a single sentence that will have significant ripple effects in the U.S. and worldwide for carbon removal:

Carbon removal Purchases: Funding expectation up to $35M from BIL funds to support a prize for carbon removal purchasing contracts for a portfolio of carbon removal pathways consistent with the objectives of the Carbon Negative Shot.

While a smaller dollar amount, this program represents the first time in history that a national government will purchase carbon dioxide removal directly. The program was quietly approved last December in the 2023 Appropriations Act, which gave the DOE the authority to “establish a competitive purchasing pilot program for the purchase of carbon dioxide removed from the atmosphere or upper hydrosphere.”

While the program will start small, it has the chance to shape the global carbon dioxide removal markets for decades. The upstream and downstream effects of this program cannot be understated.

To hint at why this program is so essential, the DOE has spent and will continue to spend the next months choosing what criteria they will use to include or exclude carbon removal pathways from this purchasing program. As they enumerate and elaborate these criteria, they will significantly impact how all stakeholders in the carbon removal industry develop solutions, invest in them, and build systems for robust measurement, verification, and reporting (‘MRV’).

Upstream impacts

The DOE has spent and will continue to spend the next months choosing what criteria they will use to include or exclude carbon removal pathways from this purchasing program. Carbon removal pathways tend to fall into forestry, soils, DAC, biomass, and ex-situ mineralization – also called enhanced rock weathering – and ocean-based approaches.

The breadth of technologies within each one of these pathways is a bit of a Russian doll. Take biomass, for instance. You can ‘decompose’ (get it!) this area into many approaches. For example, you can take waste biomass–like corn stover–and turn it into a bio-oil, as Charm Industrial does. You can turn it into biochar or bury the biomass to prevent decomposition. Other proponents suggest sinking biomass in the anoxic zones of the ocean.

The same goes for enhanced rock weathering. You can set it out to mineralize as Arca does by spreading minerals on farm grounds as UNDO does or placing it on beaches like Vestas does. Ocean-based carbon removal has many pathways, too, ranging from sinking kelp and other biomass to increasing the alkalinity of ocean water.

The DOE is now tasked with deciding which of these carbon removal matryoshkas will fall under the purview of its new purchasing program. They are de facto deciding what counts as U.S. government-quality carbon removal. What programs and technologies the DOE selects will have massive impacts. But what does U.S. government quality mean? What will the DOE look for and why?

We can look at usual culprits here to start: Cost, maturity, scalability/potential. These will undoubtedly be considered. Still, given the nascency of this program and, more importantly, the program’s potential, the DOE will likely hone in on one criterion most keenly: Certainty. By this, we mean relative certainty that carbon will be removed and reliably sequestered for the long haul.

The U.S. government may well (and understandably so) be risk-averse with its carbon removal purchasing activities. They are spending taxpayer dollars on new technologies. Subsequent oversight committees are something everyone wants to avoid. Certainty gives the purchasing program support; certainty gives it political legs; more importantly, certainty gives it the ability to transcend a pilot project at DOE and become written law.

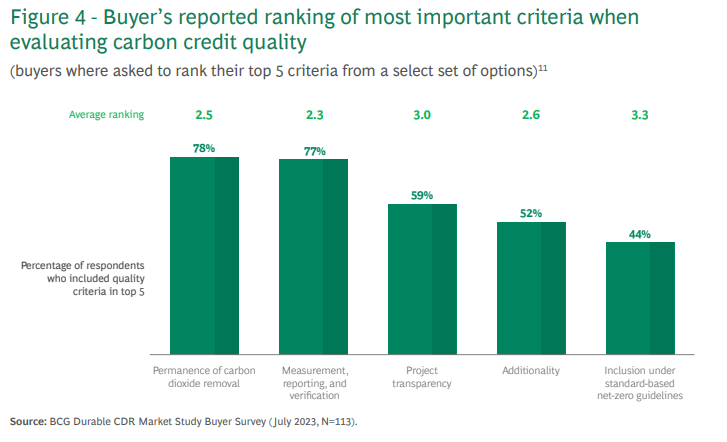

On another front, the pillars of ‘certainty’ are also primary purchasing criteria for corporate buyers as they evaluate the carbon market. To pull from the same BCG report referenced earlier, durability (the certainty removed carbon won’t return to the atmosphere) and the strength of measurement, reporting, and verification systems (‘MRV’) are priorities for most corporate buyers:

MRV is all about providing certainty. Technologies with robust MRV are more likely to be included in the DOE’s program. On the front, this almost assuredly means DAC is “in,” considering it has MRV standards approved by the U.S. government via Class VI injection well regulations. Said more plainly, it’s easier to prove direct air capture removes and sequesters carbon reliably. It brings a certain level of fidelity to the table.

Other carbon removal technologies will have to fight for their inclusion, demonstrating that they can prove carbon dioxide is removed and stays removed. And the DOE must develop a clear framework and pathway for technologies to satisfy necessary criteria in service of certainty. The DOE will need to provide objective measures for companies to achieve via MRV. This is vital for the downstream effects. The frameworks the DOE develops will indubitably impact many other carbon market participants’ due diligence processes as they evaluate carbon removal credits and companies.

Downstream impacts

As alluded to above, for the first time, we will now see what criteria a national government uses to distinguish purchase-grade carbon removal from non-purchase-grade carbon removal. The most immediate impact of this should be a net benefit to companies the government deems purchase-grade. They should see heightened demand from the private sector, for whom purchasing and investment will be de-risked by government diligence and standard setting.

A second-order effect is that companies, buyers, and voluntary markets must now justify whether and to what extent carbon removal that the government hasn’t yet deemed purchase grade continues to develop and receive investment. As some large buyers inevitably align their purchases with the government’s, it will beg the question, who will support other novel carbon removal approaches and technologies that the government isn’t ready to? All of this may also drive greater stratification between more mature and less mature carbon removal technologies and companies.

Even if a technology or pathway isn’t deemed purchase-grade by the government, we shouldn’t throw it out or discount its value. Many carbon removal approaches have ecosystem benefits outside of carbon removal, and we should find a way to ensure they are compensated for those benefits.

For instance, beyond technological certainty, a key measure for carbon removal projects and infrastructure includes community benefit questions.

Giana Amador also weighed in on this topic in her conversation with Nick, reflecting the following:

There’s a risk that government procurement standards create incentives that are too narrow and don’t grow with the field. Carbon removal companies today are maturing and the broader private sector is moving quickly. It will be important to future-proof incentives so they continuously drive outstanding outcomes. That means ensuring standards don’t prematurely pick technology winners today, are flexible enough to account for the technologies of tomorrow, and can be updated to reflect the best-available science.

In another sense, government procurement will also create an even more significant gap for venture capital and philanthropic dollars to fill. In speaking with Adam Fraser, the new CEO of Terraset, a non-profit 501(c)(3) for carbon removal, he described how their organization won’t necessarily try to align their purchases with the government’s. They view their role as fundamentally catalytic to earlier-stage carbon removal companies and technologies:

We’re really excited by the government piece coming in. This is a ‘yes and’ situation, and the more resources coming into this area, the better—it’s all needed. There’s a demand problem and a supply problem. The government funding fixes some of the demand problems, but we’re also focused on increasing the supply component. We want to help more organizations reach the point where they can scale and access that sort of funding.

Here, Adam is referring to the impact early pre-purchases of carbon removal credits can have for early-stage companies. Even if a technology isn’t rubber-stamped by Uncle Sam, that doesn’t mean it might not be ‘worthy’ if it can continue developing and refining its processes. Catalytic capital, whether from philanthropic dollars or venture dollars, offers the runway to make that possible.

Finally, across the pond, the U.S.’s new government procurement program should also send a message to the European Union, which is in the process of deciding how to integrate carbon removal into its emissions trading system (ETS):

- Will the E.U. decide to use similar criteria as the United States?

- Will they take a more broad or narrow approach?

- Given either of those outcomes, what does it say for voluntary carbon markets if a carbon removal pathway is approved for purchase in the U.S. but not in Europe? Or vice versa?

These questions are more of a wait-and-see situation, but they point to the monumental potential impact of the purchasing program.

Of course, it’s also possible that the long-term impact of government procurement is muted. The DOE’s pilot procurement may come and go. It’s possible no more money will be appropriated to DOE to purchase carbon dioxide in the future. Governments change, and with them, so do priorities and policies. The whole thing could be a flash in the pan of our net-zero future.

More optimistically, the initial $35M procurement number should spur a more extensive purchasing program by the U.S. government, especially if and when it is codified into law. We may look back at this moment as the beginning of massive market growth for carbon removal. If you believe, as many organizations do, that we will need up to ten gigatons a year of carbon removal capacity, we will need up to $1T per year to pay for it.

Carbon removal as an industry is moving down a trillion-dollar path. We may veer off it at some point soon or in the future. But the DOE’s one-line, $35M pilot purchasing program is a firm step forward.

The net-net

Everything we’ve discussed today and will discuss next week has profound implications for where, how, and when steel gets put in the ground, carbon dioxide pipelines get built, and injection wells get opened up to store carbon for centuries.

Now, we get to watch what type of fruit all these programs and investments bear. Carbon removal volumes are still relatively small, especially in the grand scheme of global emissions. But the next three years should see meaningful infrastructure deployed to make good on pre-purchase commitments and scale up carbon removal in the U.S.

Whether and how it all ‘works’ will be a bellwether for whether the U.S. can return to its infrastructure-building ways. And if carbon removal does scale with any degree of success, there will be significant opportunities to follow the carbon removal industry’s – and the government’s role in catalyzing it – playbook to scale other critical clean energy infrastructure.