11 July 2023 | FinTech

Twitter, Threads, and Fintech

By

Twitter has been like a bad boyfriend to me over the years – unreliable, unfiltered, and toxic.

Then Elon Musk’s reign added fuel to the fire with his questionable decisions, such as firing Rumman Chowdhury and her AI ethical researchers, showing support for Donald Trump’s account, and his failed attempt at announcing Ron DeSantis’ presidential run, I was done with Twitter and looking for a new platform to connect with the fintech community and express my thoughts.

I had been relying on Instagram and LinkedIn, but the emergence of Threads, which has become the fastest-downloaded app ever, got me wondering: Could this be the true competitor to Twitter that the industry needs?

We need to take a step back and evaluate the bigger picture, too.

What platform will be the first to embrace fintech and become an all-encompassing “everything app?” As an industry, can we even accept such an app, especially if it’s tied to social media?

Ultimately, the decision is up to us, but we must be mindful.

First impressions…

Meta’s launch of Threads had something that the other social media competitors like Clubhouse or BeReal didn’t: 2 billion existing users the company could push to use the new product.

The initial rollout was excellent. Zuck aligned Threads very smartly on Instagram, which is also a platform that is typically less polarizing than Facebook.

If you still need to sign up, here’s what happens: You can log in to Threads using your Instagram account rather than creating a new username, password, and profile photo. You can even populate your following with your Instagram following (I did not opt to do that) and upload your Instagram bio onto Threads. Easy.

And it wasn’t long before I saw even the most die-hard #fintwit users on Threads.

Who will become the “Everything App”?

As Threads launched, it’s hard for me to forget that the ultimate goal of these silly little billionaires, I mean, Big Tech companies is to create “everything apps” where people can do everything – like banking and social connecting – on one app.

To do this, Twitter has been awarded money transfer licenses in New Hampshire, Michigan, and Missouri. With this move, Twitter is attempting to join the likes of Apple, Meta, and Google to enter the fintech arena.

ICYMI: Apple ventured into consumer credit cards and savings accounts with Goldman Sachs (which the bank is now trying to get out of); Facebook launched Meta Pay and dedicated an entire department (F2) to payments across its Metaverse ecosystem; and Google, which continues to expand the capabilities of its digital wallet.

Looks like we have two options: Compete with big tech companies or partner with them.

But as traditional banks have struggled to adapt their UX to the digital landscape, consumers are clearly turning to neobanks like Chime, SoFi, and Varo. In fact, fintech companies are outpacing traditional banks, with fintechs capturing nearly half (47%) of all new checking accounts opened so far in 2023.

Fintech awareness with consumers is seemingly entering a good place, so here’s a third option: Forget what Musk and Zuck are doing.

Instead, let’s remember that both industries (social media and financial services) are ranked among the least trusted in the world, so it’s worth considering how they might interact.

On the one hand, fintech companies can use social media to spread awareness of fintech services, but on the other, it could come at the risk of combining two industries with such tenuous public trust. To separate the two, relying on social media partnerships for exposure or financial education is best.

Instead of thinking about social media apps becoming financial services, we should focus on using fintech to make financial decisions easier in our everyday lives. For example, dating apps are technological and have figured out how to match people, but then money is involved. How can a dating app help two people split a bill, or help them budget their move-in together, or invest?

The real innovation is in using fintech to touch industries outside of traditional finance so more communities of people can build sustainable lives for themselves.

Because “the economy” is not healthy when people have to go into life-altering debt to receive an education, go bankrupt because they get sick, can’t afford housing and food, and live paycheck-to-paycheck making $100,000 salaries.

Let’s keep our focus there.

As for Musk and Zuck’s ambitious plans to create “everything apps,” let’s just say that their egos may be their demise – and leave it at that.

The success of fintech companies as the industry becomes more recognizable and trusted by the public will be determined by whether or not they can onboard users and build a loyal community as quickly as Meta did with Threads – and that remains an open question.

Reflections on Twitter…

If I’m being candid, social media isn’t always my cup of tea. I’ve had difficulty conveying the lovely person I am in real life to my Twitter feed. But I know that I’ve talked with many influential female figures in fintech, and they’ve all said the same thing; they won’t be on the platform or don’t engage anymore due to the constant harassment and fear of it.

That being said, I recognize that social media has also been a key element in connecting me with some of my closest friends and colleagues. Twitter alone has helped me gain several amazing job opportunities (like this one), brand partnerships, and speaking engagements that have contributed to my personal and professional growth. All in all, it has proven to be a valuable tool.

But from the lens of a woman in the fintech and media industries, social media can be both a blessing and a curse. On the one hand, I’m proud to be publicly blazing a trail in a space that white males often dominate, but on the other, it can be disheartening to see that my white male peers are often more easily recognized and accepted.

Case in point, I’ve had some trolls on Twitter question my credibility because my Twitter following does not match my much larger (and more impressive, if I may say so myself) newsletter subscriber list. (News flash: Not everyone is on Twitter, let alone social media).

But I’m determined to keep pushing forward. After all, forging my own unique path to success as a woman of color is way cooler than fitting into someone else’s pre-existing blueprint.

So, here’s to us, continuing to blaze our own trails, no matter how long it takes me to get to the finish line. 🥂🥳

As for Musk, he has brought his own demise with his volatile behavior on Twitter. The platform has long been known for its toxicity, but Musk’s actions have only worsened it.

His firing of employees without proper non-disclosure agreements and non-competes set him up for failure, and now he’s seeing the consequences. Not to mention the numerous glitches that have come with his recent changes to the platform. People are looking for a safe platform, so it’s no wonder why alternative social networks like Threads are gaining traction.

Musk has no one to blame but himself for this mess, and it’s about time he takes Twitter seriously.

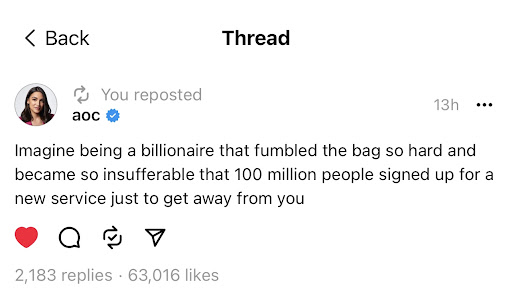

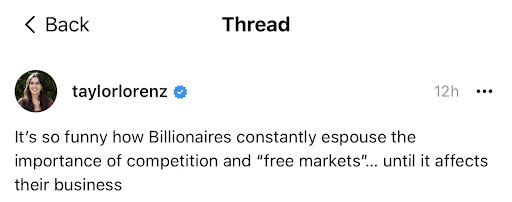

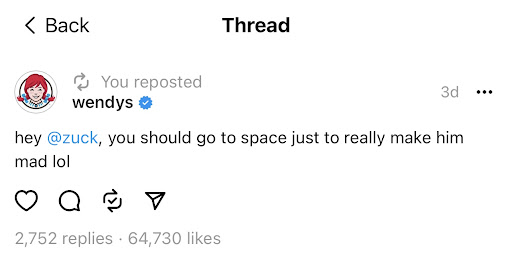

And now, a few of my favorite Threads…