13 May 2023 | Healthcare

The Rise of Retail Health

By workweek

Giant retailers like Amazon, Walmart, and Dollar General are venturing into the $4.2 trillion healthcare industry.

Why would retailers be so attracted to this industry?

In this article, I’ll delve into retailers’ motivations, highlight major players, and discuss the implications for patients, physicians, and the healthcare system.

Why are Retailers Entering Healthcare?

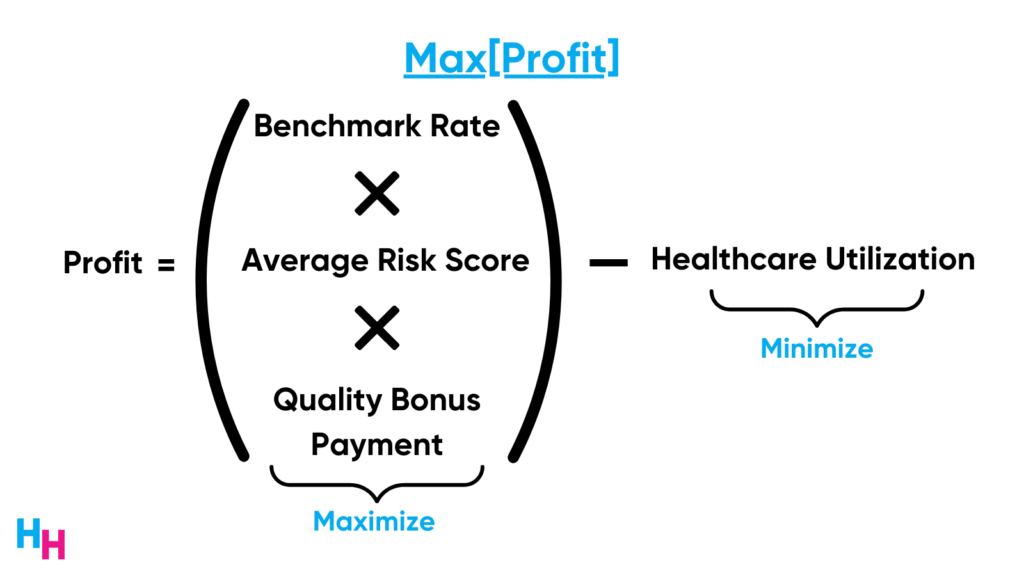

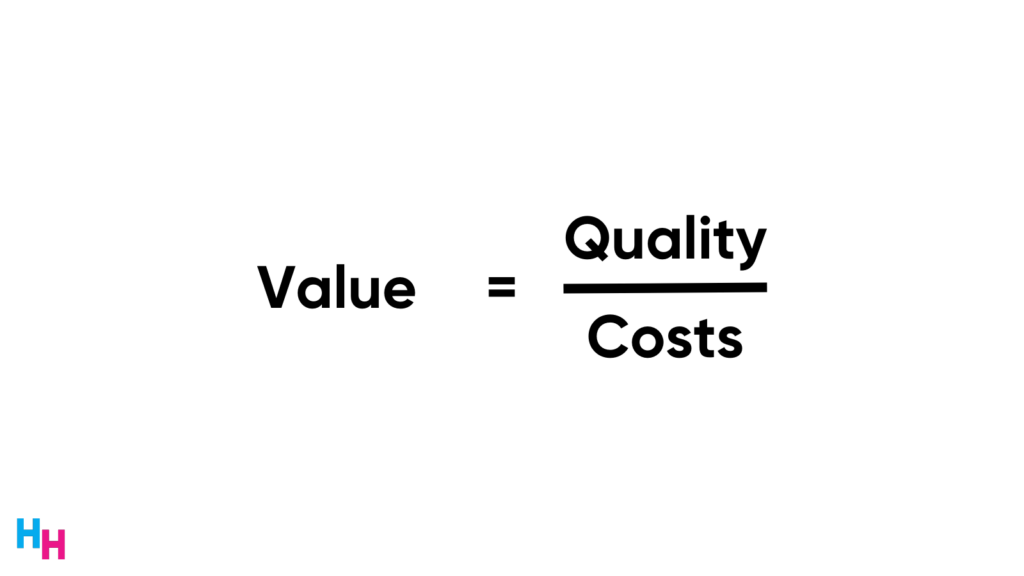

Prominent retailers are investing heavily in the healthcare industry to claim a share of the $4.2 trillion market, focusing on total-cost value-based care. In this model, physicians receive a capitated rate to manage the entire cost of care for their patients, adjusted for patient health risks and physician performance scores.

Medicare Advantage (MA) centers on this care model, with traditional Medicare and commercial insurers gradually adopting it. The total-cost value-based care model becomes an optimization problem, maximizing profit by increasing the covered MA population, risk scores, and performance metrics while minimizing care utilization. Primary care is an ideal target due to its role in managing chronic diseases and being the first step in a patient’s care journey.

Retailers’ mouths have been watering at the opportunity to tap into healthcare, particularly primary care and Medicare Advantage populations. Capital raised for private investment in primary care increased 1000x from $15 million to $16 billion between 2010 to 2021. Further, retailers like CVS Health, Amazon, and Walgreens have reportedly committed $50 billion into primary care, equivalent to $50,000 per patient.

MA’s reimbursement model offers significant profit opportunities for retailers, with over 50% of all Medicare beneficiaries now on an MA plan.

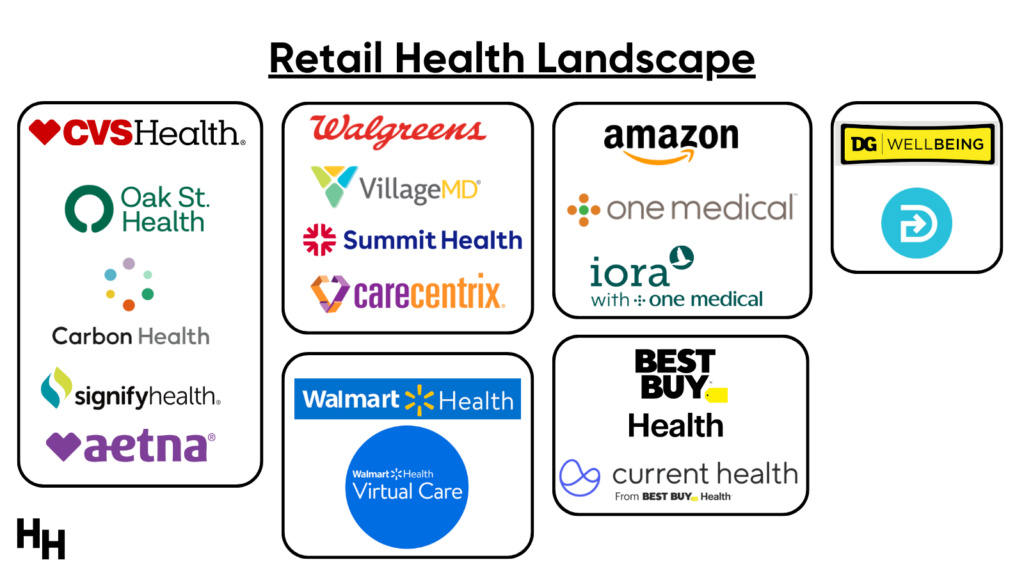

The Retail Health Landscape

Major players in the retail health space are CVS Health, Amazon, Walgreens, Walmart, Dollar General, and Best Buy. All of these retailers share a similar strategy: build or acquire platforms or companies that cover populations under a total-cost value based care model.

CVS Health

CVS Health started its healthcare push by acquiring Aetna in 2017 and has since launched more than one thousand HealthHubs to expand access to primary care.

Last year, CVS Health acquired home health company Signify Health for $8 billion, gaining access to 10,000+ clinicians for comprehensive health screenings, which will help Aetna risk-score its members. Higher risk scores increase reimbursements for Aetna and, therefore CVS Health. CVS Health also gained access to Signify’s Caravan ACO business (value-based reimbursement!), which they acquired in Q1 ’22. Caravan has over 700,000 Medicare beneficiaries.

Recently, CVS Health invested $100 million in a partnership with primary care platform Carbon Health and will help scale Carbon’s new Connective Care primary care model.

Additionally, CVS Health acquired primary care platform Oak Street Health for $10 billion. Oak Street Health primarily serves the Medicare Advantage population, offering lucrative value-based care reimbursement opportunities sought by CVS Health.

Walgreens

Walgreens holds majority ownership in value-based primary care company VillageMD. Late last year, VillageMD acquired Summit Health for around $9 billion, adding 2,000 primary care physicians across 700 locations, 7 million patients, and 125,000 full-risk Medicare Advantage beneficiaries.

Additionally, Walgreens completed its acquisition of home health company CareCentrix in October 2022, gaining full access to CareCentrix’s post-acute care and home services.

Amazon

Amazon has experienced both successes and failures in the healthcare space (read Blake’s coverage here). Recently, Amazon acquired primary care company One Medical for around $4 billion, gaining access to 8,000 clinicians across 180 clinics and numerous employee and health system partnerships. Notably, Amazon also gained access to One Medical’s Iora Health, which focuses on Medicare Advantage populations.

Earlier this year, Amazon launched Amazon Clinic, a direct-to-consumer platform targeting common conditions like acne, erectile dysfunction, and hair loss. Although Amazon Clinic doesn’t align with the value-based care model, it serves as a marketplace for telehealth companies and facilitates referrals.

Walmart Health

Walmart launched Walmart Health several years ago, serving as communities’ go-to clinic for affordable primary, behavioral health, vision, and dental care. Walmart Health’s rollout has been quite slow, but it plans to add 28 additional health clinics by 2024.

Last year, Walmart announced a 10-year partnership with UnitedHealth Group to co-brand MA plans to seniors in Georgia and work with 15 Walmart Health centers in Georgia and Florida using a value-based care model.

Dollar General Wellbeing

Dollar General partnered with non-emergency medical transportation provider DocGo to put up on-demand mobile health clinics outside its stores. This will be a pilot partnership, which Blake covered in-depth here

Best Buy Health

Best Buy Health’s remote patient monitoring company Current Health (acquired in 2021) will partner with Atrium Health to support its hospital-at-home program. Home healthcare spending was projected in 2018 to grow 7% annually from $103 billion to $173 billion by 2026. I covered the role of health tech in-home care here..

Dash’s Dissection

The primary driver of retail health is not necessarily benefiting communities but rather enhancing the bottom lines of businesses. Retailers are racing to dominate the value-based care market, which is expected to be worth over $1 trillion by 2027. Medicare Advantage (MA) is a key growth area for them.

Health systems, insurers, retailers, and private equity are all targeting the value-based care space by acquiring primary care companies. But is this good for the health system, physicians, or patients?

Patients

The growing number of MA beneficiaries raises concerns about corporations like Amazon or CVS Health investing heavily in primary care and MA, as profits may take precedence over patient needs. Research from the past decade indicates that MA is only modestly associated with higher-quality care.

To make retail health beneficial for patients, corporations must address challenges MA beneficiaries face, such as narrow physician networks, lower-quality care providers, and higher prior authorization rates. If retailers can effectively focus on improving quality of care and access, retail health can be advantageous for patients.

Physicians

The significant impact of retail health on primary care physicians is evident, as the number of practices owned by corporate entities (excluding hospital ownership) surged by 90% between 2019 and 2021, while hospital ownership growth remained stable. This uptick in corporate employment may stem from the expanding Medicare Advantage market, coupled with primary care practices seeking to reduce administrative burdens and enhance profitability through corporate support.

And it’s not just physicians joining retailers: incumbent value-based primary care companies have struggled with profitability. Recall from above that One Medical, Oak Street Health, Iora Health, and VillageMD have all sold to larger retailers and corporations.

It does make you wonder whether the government should invest more in rebuilding the primary care system or maintaining a fee-for-service system instead of focusing on MA.

Health System

MA is costly for the government and taxpayers. Since MA is a game of optimizing profit, upcoding practices have cost CMS an additional $12 billion to $25 billion annually, which is only expected to grow as the number of those under VBC arrangements increases. Upcoding refers to the practice of assigning higher diagnostic codes for patients than what is medically necessary or accurate, which inflates risk scores for beneficiaries, and thus leads to higher reimbursement.

Additionally, CMS continues to pay more for MA plans than for similar patients on traditional Medicare. What’s the point of value-based care if it costs more money than traditional fee-for-service Medicare with little to no improvement in quality of care? In fact, some researchers estimate MA will cost $75 billion more than traditional FFS Medicare in each of the upcoming years.

Here’s the big issue: now that large, powerful retailers have entered the MA space, they have massive political influence. Since money is involved, and retailers are making a lot of it through MA, taking such money away will be extremely difficult. I fear, as do others, that if CMS doesn’t correct these value-based care reimbursement models to limit overpayment and truly emphasize quality of care, it’ll be stuck using taxpayer money to fund MA with little improvement in the true quality of care. UnitedHealthcare already tried suing CMS for a rule requiring them to return billions of dollars in overpayments they received from CMS for incorrect diagnoses.

Overall, MA is hot and lucrative right now. Massive retailers and corporations are entering the space, hoping to outcompete one another and win the $50 billion to $60 billion increase in profits that McKinsey predicts the winner will achieve.

In summary, the rise of retail health is driven by major retailers entering the healthcare industry, particularly primary care and Medicare Advantage markets. These corporations, including CVS Health, Amazon, Walgreens, Walmart, Dollar General, and Best Buy, are vying for a share of the lucrative value-based care market. While the growth of retail health presents opportunities for improved access to care, concerns about patient well-being, physician employment, and the sustainability of the healthcare system persist. The primary challenge lies in balancing the financial interests of corporations with the need for high-quality, accessible healthcare for patients. Policymakers and stakeholders must address the issues of upcoding and overpayment in MA to ensure the long-term viability and effectiveness of the program.

Join Blake Madden and me for our upcoming virtual event: The Rise of Retail Health, sponsored by Guardian Medical Direction.

Discover how retail giants like Amazon, CVS, Walgreens, and Walmart are disrupting the healthcare industry. Explore their impact, strides made so far, and future implications with healthcare expert Blake Madden of Hospitalogy.

📅 May 17th @ 12 PM ET

➡ Register: here.

I’m grateful to have Guardian Medical Direction supporting this virtual event…

They’re a pioneering platform that equips healthcare businesses with the essential tools, support, and resources for success. They help you with legal structure and compliance–all the things that confuse the heck out of providers.

Check them out here.

Stay ahead in healthcare with my weekly Healthcare Huddle newsletter, covering digital health, policy, and business trends for 28,000+ professionals. Share with colleagues and subscribe here.