Key Takeaways

- Through offerings like One Medical (pending) and now Amazon Clinic, launched Nov. 15th, Amazon is focusing most of its healthcare efforts on what it knows best: the consumer. It’s a healthcare play that meshes well with the core strengths of the retail giant.

- Amazon Clinic is a direct competitor to the Hims & Hers and Ro’s of the world.

- Though users can choose their own pharmacy, Clinic clearly benefits Amazon Pharmacy and a scaled offering could potentially disrupt retail pharmacy players.

- Big Tech is getting better at understanding what it can and can’t do well in healthcare.

Join 11,000+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!

Amazon Launches Amazon Clinic

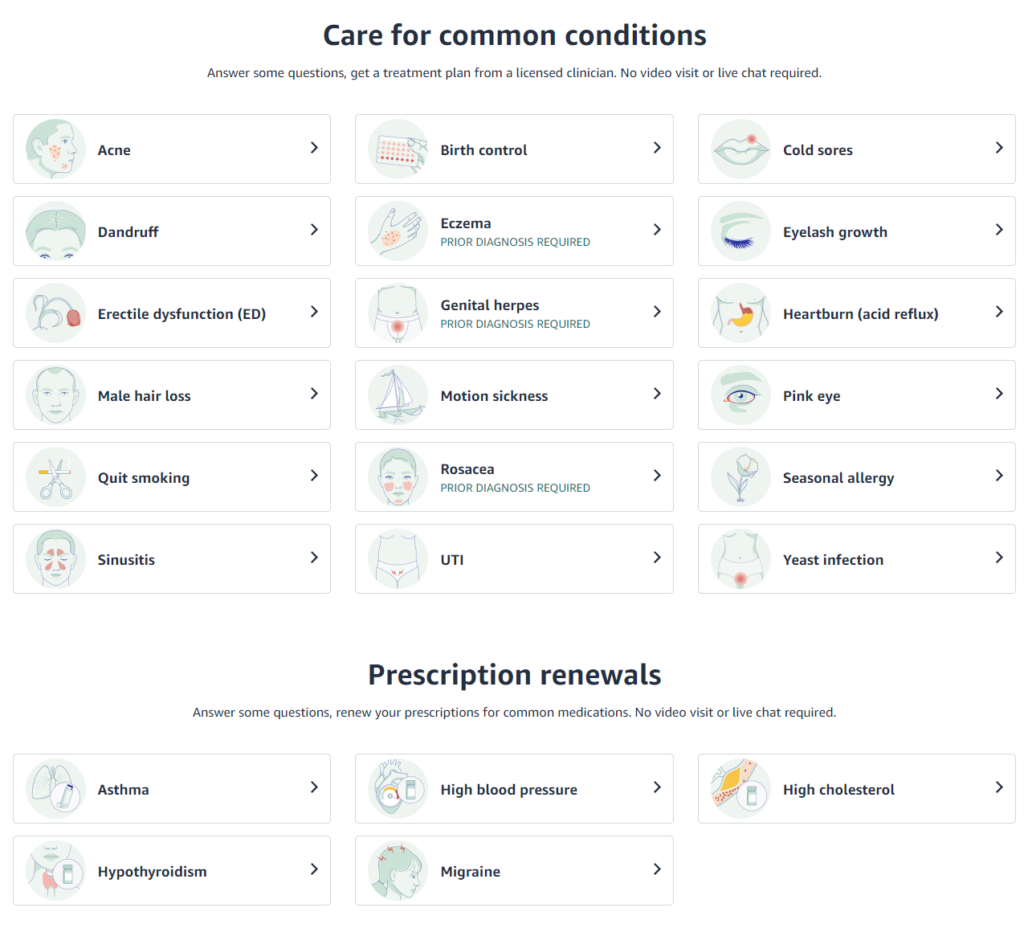

After Business Insider leaked (paywall) Amazon’s plans to create a DTC telehealth offering (codenamed Project Katara) and following the leaked-and-now-released Clinic launch video, Amazon Clinic has officially launched. Given its list of treatable conditions, Clinic is a direct competitor to rival the likes of Hims and Ro, meaning that it’s a pill mi- er, treats conditions like acne, ED, male hair loss, and other ailments with a nice combination of low-acuity but high drug volume.

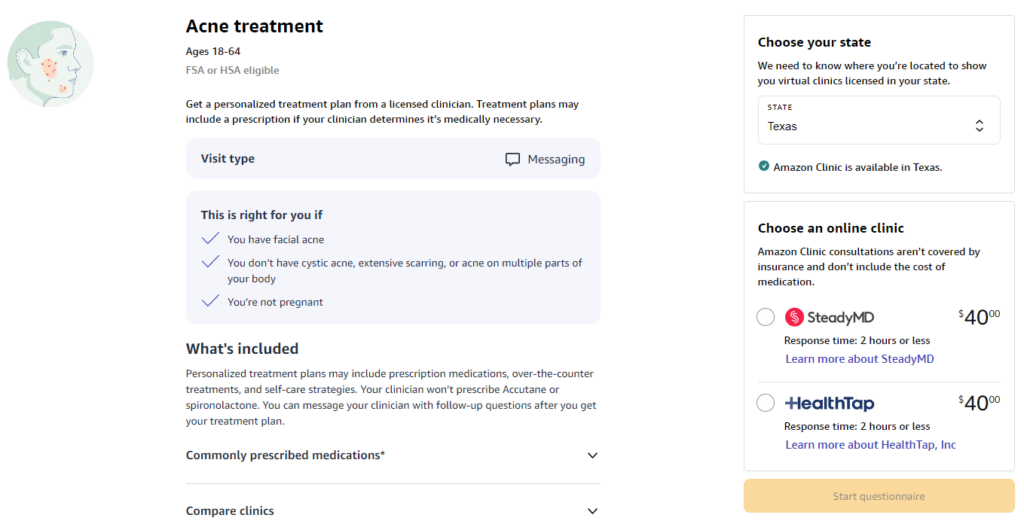

Amazon Clinic is a re-skinned version of Amazon Care. It’s cash pay exclusive, meaning no insurance. Consumers will pay around $30-$40 per consultation depending on the state (for me in Texas, it was $40), and prices could vary beyond that. It’s notable that Amazon is charging for the consultation given that Ro and Hims both seem to provide it for free, but I’d speculate that this pricing strategy could be a way to attract & pay providers more.

So here’s where things get interesting. Amazon Clinic’s telehealth offering will function as a platform and online marketplace, working with companies like SteadyMD, HealthTap, and others as they choose whether or not to participate. I imagine more will as physician reimbursement cuts are looming. The marketplace style setup benefits both sides – Amazon doesn’t have to staff Clinic itself, and Clinic is cash pay, which means providers looking to make more $$$ will get it faster. This is also the biggest question mark in my mind. In setting up a marketplace, Amazon has to attract both consumers and providers to its platform. How sticky are customer relationships with Hims, Ro? How many others can Amazon attract through its massive customer base? The easiest way to answer this (in my mind) is to latch it on to Prime somehow. Adding Clinic as opposed to a more robust healthcare offering like One Medical makes more sense given that telehealth is low cost and has more of a ‘consumer’ feel (AKA, Hims, Ro biz models).

I expect Amazon Clinic to be successful. Amazon’s overall distribution and low customer acquisition costs will fuel Clinic’s expansion, which will attract more providers to the platform. The synergies are pretty amazing here. Beyond Amazon Pharmacy, Amazon now has even more touchpoints with consumers using Clinic and can leverage that to upsell health and wellness products or offer HSA-eligible items.

Beyond the DTC focus, Amazon holds another opportunity for market expansion. Health systems are always looking for ways to capture downstream referrals to specialized services (traditionally they’ve done so through urgent care, freestanding EDs, and physician practices of course). Now, systems seem to be focusing more and more on enhancing their ‘digital front doors’ as is Optum, other payors, and everyone in between. Gag me for using that trope.

Anyway, we’ve seen the start of this ‘hospital consumerization’ trend given recent partnership announcements from Hims. On November 10, Hims announced a partnership with ChristianaCare, a 4-state health system in / around the Delaware area and has also announced partnerships with Carbon (not a health system but notable) and Ochsner (thanks Kevin O’leary for this callout) in the past, giving Hims a 10-state presence in these types of deals.

As part of the deal, ChristianaCare gets access to Hims’ membership base for any higher acuity needs, giving Hims users a better experience across a greater spectrum of health conditions. Really this seems to be a much better deal for the health system since they get downstream referrals and revenue for …free? Maybe a small service agreement for licensing? I’d love to hear more thoughts on how folks thinks this benefits Hims long-term.

I wouldn’t be surprised to see Amazon pursue a similar strategy with Clinic. After Amazon’s deal with One Medical closes (expected Q4 but dumb FTC delays possible), Amazon will hold a pretty nice foothold of partnerships with key health systems across the country. Here’s a graphic I put together at time of deal announcement:

I wouldn’t be surprised to see Amazon latch on its Clinic to these partnerships as well given the attention on virtual care delivery for health systems in a Hims-like fashion. On the One Medical note, will Amazon leverage the One Medical care team to add to the Clinic marketplace (8k clinicians, unclear how many physicians)?

Final note – is the Amazon effect losing its luster? Hims’ share price was completely unaffected by the Amazon Clinic announcement. Clinic is probably the most direct competitor that Amazon has launched or bought in a minute, so I was surprised not even to see a blip on the chart. Investors must think that other players have nice long-term staying power and stickiness with consumers.

Conclusion

Bottom line, Amazon is capitalizing on the consumer healthcare market, an area it should be able to excel in. The main plays here revolve around competing with Ro and Hims and taking traditional retail pharmacies head on through Amazon’s powerful distribution flywheel. There’s a ton of margin to capture here, and Amazon seems hyper focused on the healthcare consumer.

What do you think? I’d love to hear opinions and thoughts on Amazon’s recent moves from Hospitalogy readers and what’s going to move the needle vs. what isn’t.

Resources:

- Amazon Clinic press release (Read more)

- Great Business Insider article on Amazon Clinic (Read more)

- Graham Walker, MD’s thread on Amazon Clinic’s strategy (Read more)

Join 11,000+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.