I’m finishing up this newsletter after a couple of nooners and witnessing the Georgia utter shellacking of TCU. For my Horned Frogs in the audience, I’m sorry. I know how it feels. Great season nonetheless!

Maybe I can get your mind off the game with some fascinating healthcare news and M&A. No? Welp…I tried.

Here’s the upcoming content calendar!

- Thursday 1/12: First Dollar deep dive

- Tuesday 1/17: JPM coverage and lit healthcare news

- Thursday 1/19: GE HealthCare breakdown

Join 13,500+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!

CVS invests $100M, partners with Carbon Health in primary care

Announced January 9, Carbon is partnering with CVS and received $100M from CVS Health Ventures. As part of the deal, CVS Ventures is investing $100M into the primary & urgent care platform. Along with the investment, CVS will scale Carbon’s new Connective Care primary care model into new markets and will look to launch Carbon’s operating model inside select CVS stores.

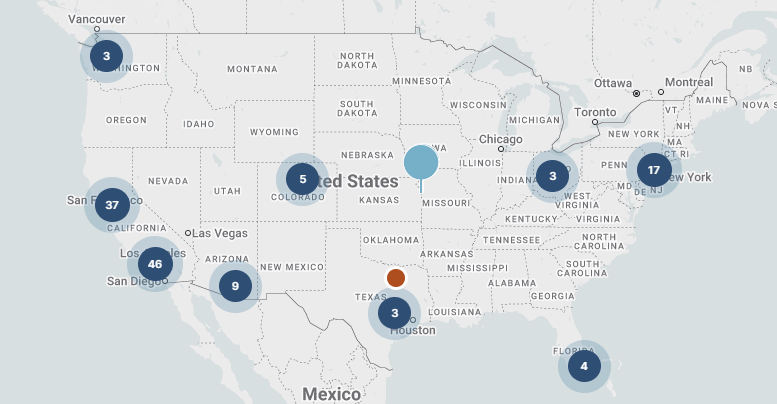

About Carbon: Carbon is a digital health darling, One Medical-esque, and holds ambitious growth plans in primary care. Today it sits at 125 locations across 13 states and holds valuable assets like its custom-built EMR that it apparently plans to license. In 2021, Carbon raised $350M in a Series D at a $3B valuation and now gets another $100M (presumably at the same valuation, although numbers were not provided).

Like many in digital health, it struggled in 2022, laying off 250 FTEs in June (8%). In early January 2023, Carbon decided to lean up its operation, unwinding certain losing business segments like ‘public health, remote patient monitoring, hardware, and chronic care programs.’ Along with the decision, Carbon unfortunately had to lay off another 200 employees. While this sounds suspect, I’m speculating that Carbon likely had to show investors it had a quick ramp to profitability and/or lower cash burn for its growth objectives. These programs were likely a part of that decision.

Deal Context: CVS has been under pressure to do SOMETHING in primary care but after losing out on One Medical to Amazon amidst valuation and growth concerns, speculative bidding wars have prohibited further primary care activity. For Carbon, it’s a win to secure another $100M infusion during tough market conditions and a major growth/capital partner in CVS to work together on future initiatives.

Madden’s Musing: What initiatives will the collective C team target? 2 thoughts here:

- They lean into the retail health, HealthHUB urgent care model, building a better, tech-enabled urgent care platform

- They integrate Connective Care into a broader primary care strategy over time, with a focus on enabling risk for Aetna’s network and aligned primary care physicians. Don’t forget that CVS purchased Signify Health for $8B back in September. Higher risk scores unlocked.

CVS also seems to have quite a few primary care pilots and programs going on. The health giant is gonna have to keep making moves to keep up with the Joneses since there’s a rapidly changing market entering 2023:

- VillageMD / Walgreens bought Summit Health for $8.9B (with an Elevance minority investment likely in the lower teens)

- Amazon bought One Medical for $3.9B as mentioned

- Optum is up to 70k physicians and way ahead especially given its splash acquisitions this year (LHC, Refresh, Kelsey) – but don’t forget about its physician tuck-ins behind the scenes that fly way under the radar

- Humana has CenterWell with Welsh-Carson and Kindred at Home

- Now, CVS and Carbon are partnering in a very capital efficient fashion.

The vertical alignment war continues!

Oak Street Health Acquisition Rumors

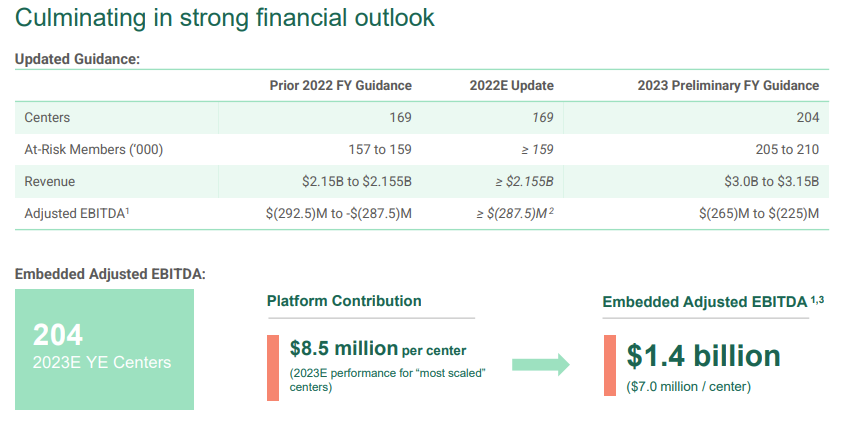

CVS decided to hog headlines during JPM week I guess – from Bloomberg, the behemoth is ALSO rumored to be exploring a $10-billion-plus acquisition of Oak Street Health (including debt). According to the report, “Talks between the companies are ongoing and could end without an agreement.”

Madden’s Musing: This is all pure speculation on my part of course, so take it with a grain of salt, but I’m doubtful a deal with CVS would happen, especially at such a high valuation (3.2x 2023E gross revenue, 47,620x EV / 2023E at-risk members if we want to go there). In fact, I’m just going to come out and say it – this is not gonna happen. What do you think – would you buy Oak Street at that price? There’s a value that makes sense for an acquisition but it’s not $10B (at least not yet). And not right at the same time as the announcement with Carbon.

It makes way more sense in my mind to drop $100M on a primary care partner than it does to drop $10B for a cash-burning (but very impactful operator, don’t get me wrong) in Oak Street Health. For instance:

- Oak Street raised $180 million in a secondary offering (selling more stock) in August

- Then just 3 months later, Oak Street secured another $300 million from Hercules Capital and Silicon Valley Bank – which oddly is not on their investor relations site but was disclosed in a press release

Oak Street Health has had wonderful results in serving its patient populations. It was the number one DCE performer on net dollars saved and its ACOs perform admirably. Finally, its de-novo centers are maturing, which, according to the VBC thesis, should generate positive platform contribution (margin) over time. I have a ton of respect for what they’re building and have built. But right now…it’s burning a lot of cash.

Here’s OSH’s 2023 guidance:

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

FTC looks to ban non-competes

In a fascinating move, the FTC released a new proposed rule aimed at banning non-compete clauses.

- “The Federal Trade Commission proposed a new rule that would ban employers from imposing non-competes on their workers, a widespread and often exploitative practice that suppresses wages, hampers innovation, and blocks entrepreneurs from starting new businesses. By stopping this practice, the agency estimates that the new proposed rule could increase wages by nearly $300 billion per year and expand career opportunities for about 30 million Americans.”

- This Fierce article had a helpful breakdown. The non-compete would be a complete ban on agreements, post employment. Meaning that it stays in affect while employed. But any physician or other worker who wanted to leave their current employment and work for a competitor within the service area would now be able to do so.

- Apparently nonprofit hospitals wouldn’t be subject to the FTC act – but insurers would – in its current form.

Madden’s Musing: Alright, this has huge implications for healthcare. When physicians enter into an employment agreement, there’s typically a clause ‘not to compete’ with the employer for a certain amount of time (2 years usually) and mileage radius from ANY campus that organization operates. So, pretty restrictive and designed to prevent the physician from leaving the employer for obvious reasons.

Non-competes aren’t enforced everywhere, they vary state by state, and states like Florida have banned physician-specific non-competes (in rural areas for now), citing the promotion of anti-competitive business behavior that hurts patients by controlling the supply of physicians, restricting access, hurting continuity of care, and increasing the cost of care (market share dynamics).

But banning all non-competes nationwide would create a wild west scenario for physicians. According to Modern Healthcare, 40% of physicians hold non-competes, which seems low considering the number of employed physicians is near 80%. If all those agreements suddenly became null and void…how would things change? Some thoughts:

- Physicians would have all the power in the employer-employee relationship. So I’d wager that most organizations would find new, creative ways to retain physicians

- Assuming the law maintains its current form, nonprofit hospitals would gain a major leg up on corporate entities employing and aligning with docs

- I’d wager that physician referral patterns and market share dynamics would grow volatile

- Physician practice M&A would fall apart. Would PE-backed groups crumble? Physicians would have no obligation to stay and constantly tell their financial backers, “we can leave whenever we want” = this creates an incredibly risky asset on the investment side. Why provide capital for a business whose core asset could leave the next day? That dynamic leads me to believe that in a future with no non-competes, more organizations might become physician-led, or investment would change drastically.

In all likelihood, given the level of uncertainty and the need for some level of retention and stickiness in the relationship between employers and employees, the non-compete will narrow in scope but stay in the picture.

What are your thoughts on the non-compete rule and its implications for healthcare? It’s a crazy thought experiment with lots to unpack!

Market Movers

Updates from JPM:

Sounds like it’s going to be ‘year of the cohort’ for risk names as their markets mature and more folks transition to value-based care arrangements:

- agilon raised its membership guidance and significantly raised its adjusted EBITDA guidance. (Read more) (nice little thread from LCRM)

- As mentioned, Oak Street’s presentation provides updated guidance and a really nice look at the cohort maturity for the business. (Read more)

- $1 billion of Teladoc’s $2.4 billion in revenue came from BetterHelp

- Modern Healthcare coverage (Day 1)

Partnerships and Strategy Updates:

- Omada launched a new partnership with Intermountain Healthcare, working with Castell (remember this name), Intermountain’s value-based care wing, to enroll members into Omada’s diabetes care management program. (Read more)

- Kaufman Hall acquired Gist Healthcare in a deal they’ll regret once Hospitalogy overtakes the content world (kidding, kidding, Gist is great go subscribe) – (Read more) – (p.s. Hospitalogy is available for partnership)

- HCA’s Medical City (ayy Dallas) is in exclusive talks to potentially acquire Wise Health System, a hospital serving 5 North Texas Counties with 450 clinicians. (Read more) Fun fact, I infiltrated the HCA Nurses Facebook page by saying I was a travel nurse working for Medical City. Secret’s out, but I gotta get the intel!

Finance and M&A Updates:

- GE HealthCare completed its spinoff! I’ll be writing about the biz in the coming weeks. It’s massive. (Read more)

- HCA completed its sale of 3 hospitals to LCMC Health despite pushback from local nurses. It received approval from the state of Louisiana on Jan. 3rd. (Read more)

- A healthcare SPAC between self-directed home care services company Consumer Direct Holdings and DTRT Health Acquisition Corp was terminated in early January. The deal would have formed a $681 million company. (Read more)

- Excela Health and Butler Health System finalized their merger, creating a $1B health system in the Pennsylvania area with 1,000+ clinicians and 7,300 FTEs. (Read more)

- Baxter is planning to spin off its global kidney care operations into a separate publicly traded $5B company. Kidney care analysts rejoice everywhere! (Read more)

- Kaufman Hall’s December 2022 hospital flash report showed a small increase in operating margins for November, stemming from expense improvement in labor. (Read more)

Digital Health and Startup Updates:

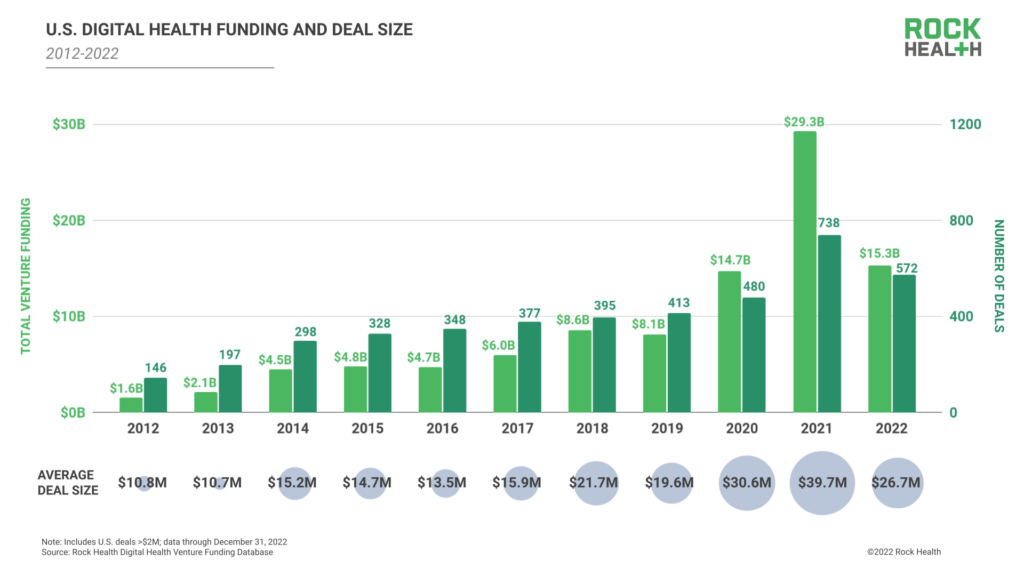

- Rock Health released its 2022 year end fundraising recap (Read more) – really solid write-up – and noted the following trends:

- Total 2022 funding: $15.3B across 572 deals (down from $29.3B and 738 deals respectively)

- Average deal size: $27M (down from $39.7M; likely an indication that deals have moved downstream to Series A + seed)

- Q4 deals dragged majorly given macro conditions – $2.7B vs. $7.4B in Q4 2021

- Lots of other great analysis in their report!

- Monogram Health, a chronic kidney and end-stage renal disease provider, raised $375M from CVS, Cigna, Humana, Memorial Hermann, SCAN, and others. (Read more)

- Teladoc launched an app refresh at the CES show. (Read more)

- Direct primary care provider Hint Health partnered with fellow direct PCP Nextera Healthcare to join Hint’s Connect platform (used by employers and third-party administrators) – (Read more)

- Array Behavioral Care raised $25M with CVS leading the round. (Read more)

- Duo Health partnered with Deserty Kidney Associates to help manage ESRD and CKD patients in Arizona. (Read more)

- MediView partnered with Mayo Clinic to continue to explore ways to advance procedural augmented reality solutions. Tech! Healthcare! (Read more)

Policy and Payment Updates:

- Healthcare stuff in the Omni Bill you should know: (Read more)

- Hospital-at-home program extended thru 2024

- Physicians get pay cut reduced from 4.5% to 2% in 2023 and 3% in 2024. Sequestration delayed for 2 years. Incentive payments stay in place for alternative payment model participation thru 2025.

- Flexibilities for Medicare telehealth: in-person requirement delayed, FQHCs and rural health clinics can provide telehealth, PTs, OTs, and STs can provide telehealth

- Expanded certain mental health provisions and treatments like opioid use disorder

- Revamped pandemic response agencies and national stockpile

- Medicaid redetermination unwind beginning April 2023, delinking from the end of the public health emergency (significant – this affects 18M people)

- Extended CHIP funding til 2029

- The Justice Department cleared USPS to deliver abortion drugs to states that have restrictions on terminating pregnancy, in an issue that will undoubtedly make its way to the Supreme Court. (Read more)

Costs, Data, and Other Updates:

- The American Academy of Pediatrics released new guidelines on January 9th stating that earlier obesity intervention in children via drugs and/or surgery is necessary – ‘watchful waiting’ doesn’t work. The AAP asserts that childhood obesity is a problem that needs earlier intervention. Bullish on the new obesity drugs coming to market, eh? Lots to digest for parents and America as we deal with a crisis of nutrition as well as potential long-term side effects of these drugs. (Read more)

- Who owns this hospital? Now you can find out, thanks to CMS! (Read more)

- The new ‘Rona variant is estimated to be causing about 72% of infections in the Northeast. Yikes. (Read more)

- The Atlanta Medical Center closure timeline is a good story to follow. (Read more)

Miscellaneous Maddenings

- I’ve been told that my Miscellaneous Maddenings have been utter sh*t lately, so I apologize. MM’s will be back with a vengeance in 2023!

- Any Cosmere / Sanderson fans among Hospitalogy readers? I just finished the Lost Metal so I’m fully caught up, but man, those novels are page turners. Wayne and Steris have to be some of the best characters Sanderson has written.

- So we got a Costco membership from the in-laws for Christmas and let me tell you…my first shopping experience in there was out of this world. I went down every. single. aisle. In that store to see what all the hype was about and boy, I was not disappointed. 24 count of Waterloo for $8.99. 18-count of Celsius for $22 (this is how I write Hospitalogy, I don’t want to hear it, docs!!). 12-pan stainless steel set for $100! And the hot dog. $1.50. Is this what joining a GPO is like?

- I’m in Dallas, which means that I play golf year round! My buddy Travis and I are playing the Texas Star this Saturday, one of the best muni’s in the DFW area. Really looking forward to being out there!

Hospitalogy Top Reads

- If you have the WSJ, a highly recommended read regarding the NFL’s Damar Hamlin incident and the growing mental health concerns facing the NFL. (Read more)

- I enjoyed this overview of AI in healthcare headed into 2023 (Read more)

- Why are clinical trials so expensive? (Read more)

- ICYMI: I posted the Hospitalogy healthcare 2022 year in review. Read it here! (Read more)

- Finally, this article was a nice overview from McKinsey of the value-based care landscape and predictions for growth into 2027 – a $1 trillion opportunity. (Read more)

That’s it for this week! Join 13,500+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!