I’ve been looking into the retail health players recently (Walmart, CVS, Walgreens, Amazon) and wanted to use today’s send as an update on what all the big players have been up to.

Join 9,500+ thoughtful healthcare professionals, executives, investors, and consultants from leading organizations and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!

Key Takeaways

Walgreens, CVS, Amazon, and others are upping their investments big-time into healthcare footprints.

CVS and Walgreens want to own every aspect of delivery (outside of hospitals).

Consumerization of healthcare is driving these investments along with providing a faster growing avenue to pitch to investors.

CVS

If you’ve followed CVS and Hospitalogy for a while (appreciate u), you would know that CVS has been one of the more active players in healthcare and retail health since its acquisition of Aetna in late 2017 (note: was this one of the best acquisitions in healthcare ever? Debate!)

Since then, CVS went on a grand mission to morph into a vertical integrated delivery system. In the beginning, CVS wanted to expand its healthcare offerings in stores, revealing a huge project to convert store space into HealthHUBs and opening 1,500 locations in the short term. But it looks like the rollout stalled somewhat with Covid and other operational challenges. To be clear, it looks as if this is a long-term goal for CVS, but I haven’t heard updates re: the rollout in recent months.

For other projects, CVS has been making major moves on a number of other healthcare fronts in an effort to own the entire spectrum of care delivery. It’s pushing to expand the role of the pharmacist (to the collective dismay of r/pharmacy) as a major touchpoint for patient-provider interaction.

Further, CVS has been very vocal about wanting to acquire primary care assets, noting that it pretty much has to pursue a ‘buy’ strategy here. We’ve seen that play out with CVS wanting to buy One Medical and its interest in acquiring Cano (which seems not to have panned out). I wouldn’t be surprised to see CVS snatch up some regional primary care players to build out its services footprint as this goal seems the highest priority to the org.

Honestly, CVS probably didn’t do itself any favors on the valuation front by being so vocal about wanting to buy a primary care platform. Investors bid up public players on the speculation of major buyers swooping in which hurt takeover prospects (all speculation on my end).

Finally, CVS acquired Signify Health in September (my breakdown here) whose main operation involves contracting with clinicians to perform in-home assessments to boost its risk scoring. Signify also operates a tiny risk platform, Caravan.

CVS has also dealt with some bad business news lately:

- Aetna’s MA plan’s star ratings declined. The drop was material enough for CVS to issue an 8-k related to the downgrade as the plan won’t earn quality payouts in 2024. It’s a big hit to profitability – likely around 4% to 5% of earnings in 2024. CVS stock dropped around 7% at the time of announcement.

- More recently, CVS’ PBM lost its contract with Centene covering $30B+ of drug spend to Cigna’s Express Scripts.

Walgreens

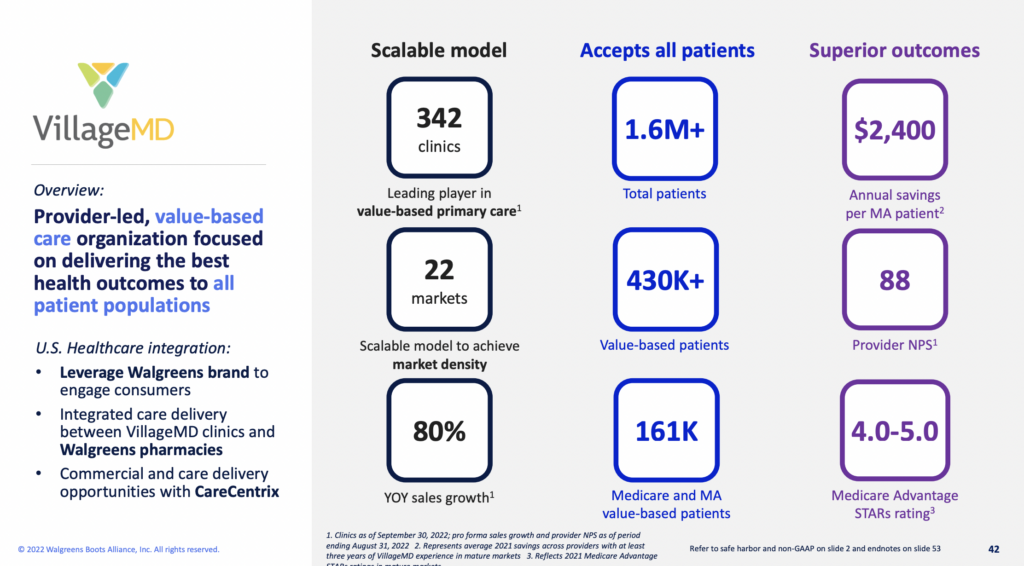

Walgreens is a bit more interesting of a story since its main pharmacy operation is stagnant. The retail player has fleshed out a major shift to focus on healthcare services using VillageMD, of which it owns a majority ($5.2B investment in late 2021 to increase ownership to 63%), as the main vehicle there.

Through VillageMD, Walgreens will continue to expand full-service primary care clinics into new and existing markets, like it did by opening 20 locations in Texas this year.

Along with its acquisition of VillageMD, Walgreens bought the rest of CareCentrix in early October – a 45% stake for $392 million. It’s a somewhat parallel acquisition to that of CVS and Signify given that CareCentrix operates in the home care and post-acute care coordination space.

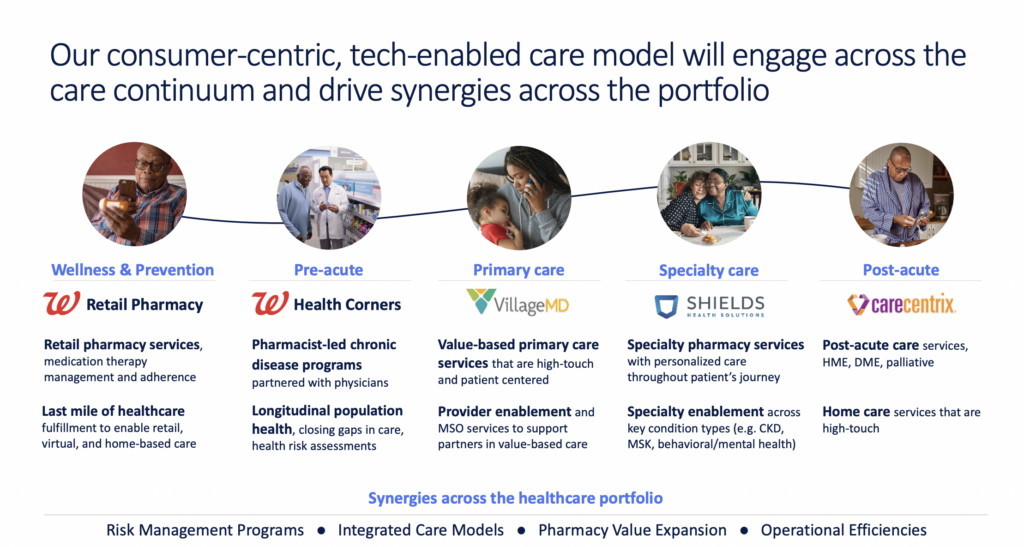

Maybe the most significant piece of the acquisition was Walgreens announcing an organizational restructuring to promote John Driscoll to President of Walgreens Health. As you can see in the graphic below, Walgreens also shares a similar vision to own multiple touch points in a faster-growing healthcare services sector since its pharmacy operation is mature.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

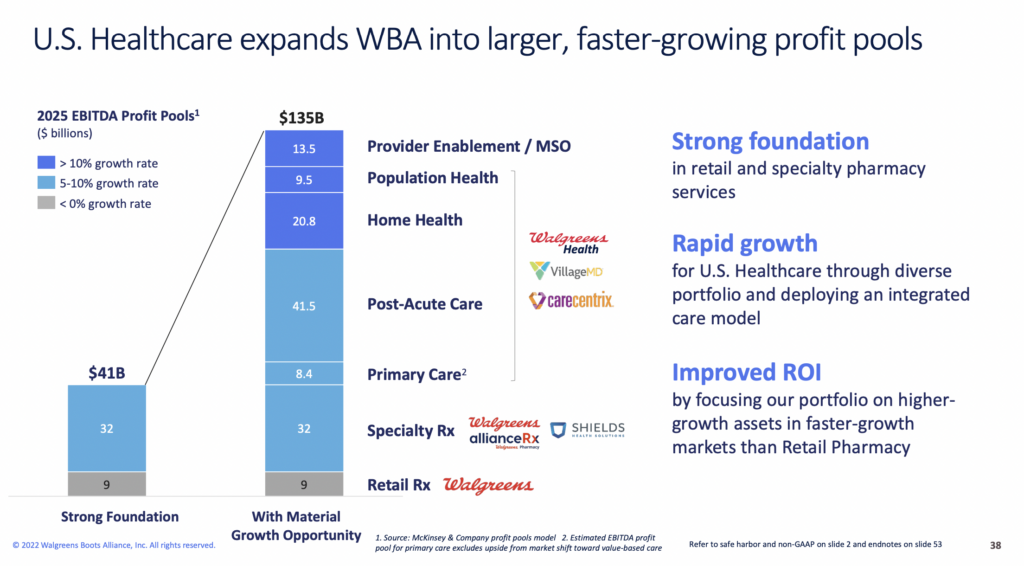

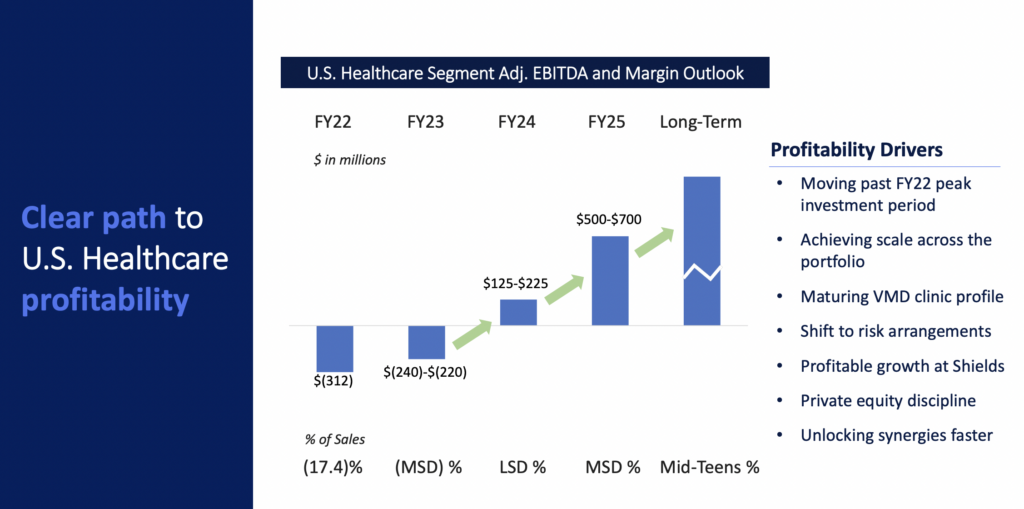

Here’s a nice slide from the WBA investor deck diving into the growth opportunity with expanding its healthcare services and specialty pharmacy footprint. Walgreens has noted several EBITDA opportunities by 2025 with >10% growth prospects. Other notable slides from the investor deck included below:

Finally, keep an eye on Walgreens in the health tech space, as execs have noted their desire to make an acquisition there.

Amazon

Here’s a quick timeline on Amazon’s healthcare moves since 2018 to get you caught up to speed:

2018:

- January: Amazon, Berkshire, and JP Morgan launch Haven, a joint venture aimed to improve employee access to healthcare and lower costs. Lotsa fanfare on this one as is the case with most things Big Tech and Healthcare.

- June: Amazon buys PillPack for $753 million

2019:

- September: Amazon launches Amazon Care, initially a virtual-first program for employees.

- October: Amazon acquires health API startup Health Navigator.

- November: After some intial operational challenges, Amazon rebrands PillPack into ‘PillPack by Amazon Pharmacy’.

2020:

- Haven shuts down operations after reports indicated that the three companies at the helm weren’t working in tandem and resources were better purposed elsewhere.

- Amazon also launches its wearable, Halo.

- November: Amazon officially launches Amazon Pharmacy.

2021:

- February: Amazon expands Amazon Care and nabs Hilton, others as a client as well as its existing Whole Foods employee base.

- March: Amazon expands its partnership with Crossover to five more states – Texas, Arizona, Kentucky, Michigan, and California.

- July: Amazon launches AWS for Health, including cloud services for services and biotech firms.

- October: Amazon pilots ambient documentation with Alexa into a few hospitals.

- December: Amazon launches Alexa Together, which is a subscription service that enables caregives to provide remote support to elderly folk through Alexa (fall detection, 24/7 emergency assistance, etc).

2022:

- February: Amazon rolls out Amazon Care nationwide, but ultimately gets shut down after its purchase of One Medical.

- July: Amazon partners with the Fred Hutchison Cancer Research Center on phase 1 trials for certain cancer vaccines.

- July: Amazon acquires One Medical for $3.9B in an all-cash deal.

- August: Amazon rumored to be involved in bidding process for Signify

So Amazon seems to be taking healthcare somewhat seriously in 2022. After several initiatives with Haven, Amazon Care, and Crossover, Amazon bit the bullet and bought a national primary care platform One Medical (my full breakdown here). Given its involvement in the Signify bidding process too, it looks like Amazon potentially has/had some plans to pursue the Medicare and senior space given One Medical’s Iora Health segment.

It makes sense why Amazon would want to get into healthcare to plug into the senior care market, capitalize on AWS cloud opportunities, and possibly expand into the MA space. Amazon also holds a nice potential synergy with co-locating One Medical’s within Whole Foods since they target similar demographics and are generally located in similar areas (maybe a nice MA supplemental benefit too? Hmm).

Walmart

Our final retail health contestant Walmart and Walmart Health has made some big moves recently. You might recall that Walmart had a huge vision to open up consumer-friendly Walmart Health clinics very quickly across a number of regions, announcing the vision to do so in 2019. Since then, Walmart has slowed its roll amid executive shake-ups and other rumored operating challenges. TL;DR – it’s slowing down its healthcare ambitions, but still marching forward. Heres how.

Walmart acquired little-known virtual care provider MeMD, which has since been renamed Walmart Health Virtual Care.

It partnered with UnitedHealthcare and Optum on a 10-year collaboration focused on Florida and Georgia, including a co-branded Medicare Advantage plan in Georgia. That’s a far cry from the cash pay direct-to-consumer vision that Walmart had initially laid out in its healthcare plan.

On October 26, Walmart announced plans to open 16 new clinics during 2023 in Florida around Jacksonville, Orlando, and Tampa.

Walmart also launched the Walmart Healthcare Research Institute on October 11, focusing on clinical studies for chronic conditions especially in rural and underserved populations. It also partnered with fertility provider Kindbody in late September.

Finally, in a big retail-focused move, Walmart and other retail providers are offering over-the-counter hearing aids to consumers after the Biden Admin and HHS loosened regs around the product.

Conclusion

That’s it for this week! What are you noticing in the retail health space? What are you excited about? Let me know!

Join 9,500+ thoughtful healthcare professionals, executives, investors, and consultants from leading organizations and stay on top of the latest trends in healthcare. Subscribe to Hospitalogy today!