I was all hyped up to start off this newsletter with “How bout them Cowboys?!?!?” But alas…hello darkness my old friend.

The real question is whether Dollar General is a fraud just like the Cowboys, or if they’re actually doing something in healthcare.

Let’s find out!

Join 16,500+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!

Dollar General: The Rural Healthcare Savior, or a Fraud?

What to know: Dollar General is partnering with non-emergency medical transportation provider DocGo under its DG Wellbeing brand to begin providing care outside its stores in mobile clinics. The pilot will start with 3 stores at Dollar General locations outside of Nashville, Tennessee and will mostly care for low-acuity, urgent care level conditions. Note that the initial offering is extremely limited in scope – the mobile clinic will rotate between each site every two days – closed Tuesdays – with hours from 10am – 8pm.

Context: Dollar General (DG) is slowly getting into the rural healthcare game, and is acutely positioned to do so.

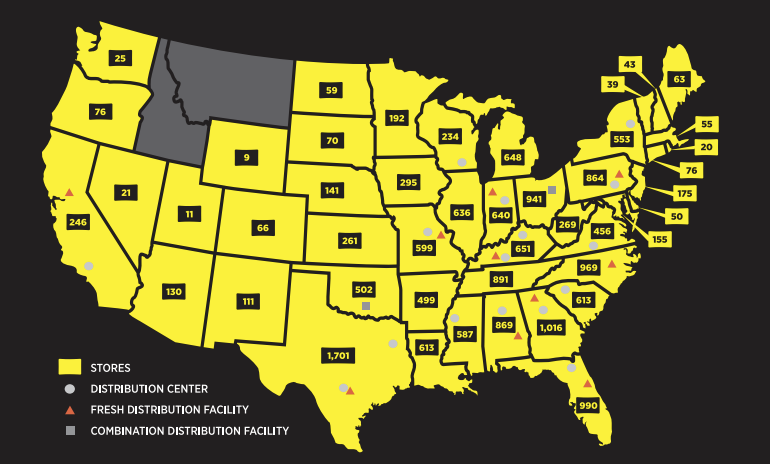

Dollar General execs have long noted that 65% of its almost 19,000 stores are located in areas with little to no access healthcare and pharmacy deserts. At the same time, 75% of Americans reside within 5 miles of a DG store. With these data points combined, DG wants to gut rural America address healthcare shortages in rural communities. So far since 2021, here’s what they’ve done in healthcare and related areas to that end:

- Launched DG Fresh in 2019, a program to distribute fresh groceries into stores, aimed to counter criticisms over what DG historically offered in food deserts;

- Hired a CMO in 2021 and expanded in-store options to include health and wellness offerings like cold medicine;

- Partnered with Babylon on telehealth services and Higi on blood pressure machines;

- Worked with GeniusRx on prescription delivery and online pharmacy services; and now,

- Piloted this mobile clinic partnership with DocGo (the company formerly known as Ambulnz, the realest name ever)

Dollar General footprint from January 2022

Bigger Healthcare Picture: Retail health’s entrance into healthcare services is well documented at this point. If you want a primer, I wrote up recent activity from Walmart, CVS, Walgreens, and Amazon here.

As CVS and Walgreens decrease their stagnant retail footprints but double down on healthcare, Dollar General is doing both by taking over rural markets – an area where even Walmart seems to have failed. DG is opening stores throughout rural America, downturn or not, with 1,000+ new store openings planned in 2023. It can enter and win in these markets like other retail chains can’t. And the markets are quite literally too small for other players to enter profitably, which gives DG a sustainable moat.

Blake’s Take: The Dollar General playbook is well documented and ruthlessly efficient. DG enters rural towns with low populations. Then, it leverages its national scale to operate at razor-thin margins, taking out local businesses like independent grocery stores or local shops that simply can’t sustain on such a low price competitor down the street. “Dollar General sells some items at a lower price than he can get them for wholesale.”

And thus, DG achieves monopoly-level market share in 500-person towns across the U.S.

In general, dollar stores have gained a bit of notoriety for who they target and what they decide to sell to those communities. AKA, people in poverty with little access to much else.

- Here’s the burning question. Will Dollar General do enough to address healthcare and food deserts to justify its economic destruction of rural small biz’s?

As far as healthcare is concerned, so far, Dollar General isn’t planning to repurpose physical space in its stores. Rather, DG is focused on care delivery segments that fill in gaps in rural care (telehealth, mail order pharmacy, mobile clinics). It’s the perfect business model. Sell sodas and cigs to your community of 500 people, then treat them for chronic conditions like high blood pressure and diabetes. Talk about a flywheel!

- Dollar General holds vast potential to serve rural communities well, but it’s not even close to moving the needle on healthcare – yet. Jokes about junk food and tobacco aside, there’s a huge, obvious need here. I’m glad something is being done. But at the same time, everything DG has done so far has been quite limited in scope. If health initiatives were actually a priority for the ~$36 billion in sales, $68 billion company, we should’ve seen a hell of a lot more going on in healthcare – a hell of a lot sooner.

- That being said, if the pilot shows promise and takes off, the sky is the limit for DG and rural healthcare.

Final point – this seems like a tentative, big win for DocGo. The NEMT player has been quietly executing, announcing a number of partnerships in 2022 and most recently partnering with Redirect Health prior to the Dollar General announcement. If the model is successful, DocGo may find itself in a primary care joint venture slowly scaling to 19,000 stores, many of which I’d speculate would hold local care monopolies.

What are your thoughts on Dollar General, retail health, and the pilot? Let me know.

Join the thousands of healthcare professionals who read Hospitalogy

Subscribe to get expert analysis on healthcare M&A, strategy, finance, and markets.

No spam. Unsubscribe any time.

Partnerships and Strategy Updates:

- Privia Health launched 2 more accountable care organizations (ACOs) and also announced a partnership with Beebe Healthcare in Delaware (12.4k lives in Delaware). (Read more)

- CivicaRx, the nonprofit generic pharmaceutical company, announced a partnership with AmerisourceBergen. The pharmaceutical giant will act as Civica’s exclusive distribution partner and provide supply chain support for Civica members, which include a consortium of nonprofit hospitals. (Read more)

- CVS and Rush University System for Health announced a partnership to allow ACO REACH participating Minute Clinics to refer patients to RUSH primary care physician & specialists. (Read more)

- Ardent Health is partnering with Cadence to launch a chronic disease management platform across 30 hospitals, 200 sites of care, and 6 states. (Read more)

- Jefferson Health underwent an organizational restructuring, moving its 18 hospitals into 3 divisions, along with some layoffs. (Read more)

- Humana and CenterWell announced plans to open 3 de-novo clinics in the Charlotte, North Carolina area. (Read more)

- The US Oncology Network added 56 physicians to its footprint through the acquisition of Epic Care and Nexus Health. (Read more)

- Optum released a new product called Price Edge, which will automatically choose the lowest price generic drug available to patients. (Read more)

- Included Health partnered with Tufts Health Plan and Harvard Pilgrim Health Care. (Read more)

Finance and M&A Updates:

- Elevance Health is acquiring Blue Cross Blue Shield of Louisiana, joining Elevance’s family of BCBS brands. (Read more)

- LHC Group and Optum are inching closer to regulatory approval, but according to a conversation I had, it’s more of a ‘no news is good news’ scenario meaning that nothing major has been brought up during regulatory review that would prevent closing the deal. So…all engines go?

- LCMC Health and Tulane University (HCA) finalized their merger – 3 Tulane hospitals will join LCMC to the dismay of clinicians in/around the New Orleans market. (Read more)

- Healthcare bankruptcies rose 84% when compared to 2021, with senior care and pharmacy companies comprising half of those bankruptcies. Very few hospital bankruptcies in 2022. (Read more)

- NMS Capital’s Urology Partners acquired Urology of Indiana, the largest urology group in the state comprised of 40 physicians and 20 APPs. That’s gotta be a massive acquisition. (Read more)

- Pipeline Health restructured its debt and is emerging with a new leadership team and $330M lower in debt obligations. (Read more)

- BayCare Health System acquired Northside Behavioral Health Center. (Read more)

Digital Health and Startup Updates:

- Story Health partnered with Intermountain Healthcare on cardiac disease and specialist virtual care cardiovascular access. (Read more)

- Oklahoma hospitals banded together to launch Canopy HealthTech, a new multi-year initiative to accelerate the commercialization of virtual health innovations from Oklahoma universities. (Read more)

- Crescendo Health launched in early January with $3.4M in funding to improve the way patients contribute data to clinical studies. (Read more)

- Virtual intensive outpatient programming operator Charlie Health announced its expansion into Florida. (Read more)

- Teladoc laid off 6% of its workforce and reducing some of its office spend. (Read more)

- A bunch of Blues banded together to form Synergie Medication Collective, which is a new medication contracting organization aimed at improving affordability and access to expensive drugs. (Read more)

- Datavant and Socially Determined announced a partnership centered around social determinants of health. (Read more)

- Iterative Health and Gastro Health are teaming up to bring Iterative’s AI-enabled gastroenterology technology to Gastro Health’s endoscopy centers throughout the country. (Read more)

- Pear Therapeutics’ reSET and reSET-O prescription digital therapeutics are available to Florida’s five million Medicaid patients via its Preferred Drug List as of this month. (Read more)

Policy and Payment Updates:

- MedPAC fee for service payment update recommendations per Axios:

- Hospitals: 1% bump

- Physicians: Tie reimbursement to 50% of the Medicare Economic Index

- Home Health: 7% cut

- SNFs: 3% cut

- IRFs: 3% cut

- OP dialysis: in-line with current statutes

- Hospice: Adjust aggregate payment caps for wages, then reduce it by 20%

- MSSP, ACO REACH, and Kidney Care Choices will cover 13.2 million Medicare lives in 2023. (Read more)

- Physicians are seeking a permanent fix from Congress to address payment cuts in Medicare. (Read more)

- Gorilla Health released its 2023 state of interoperability report chock full of interesting information from CIOs and other execs on everything clinical data and health information. (Read more)

- Merger filing fees are set to skyrocket and were included in the passage of the Omnibus spending package: “Filing fees for the largest transactions valued at over $5 billion, are expected to increase to $2.25 million, up from $280,000. Fees for the smallest deals valued at between $101 million and $161.5 million would decrease to $30,000 from $45,000. The new fees are expected to go into effect in 2023, the statement said. The exact timing is uncertain.” Fees will go toward funding antitrust enforcement. (Read more)

- UPMC is under fire from two Pennsylvania lawmakers related to monopolistic practices. (Read more)

- California is suing PBMs over insulin price collusion. COLLUSION! (Read more)

Costs, Data, and Other Updates:

- Healthcare added 55k jobs in December, 30k of which were outpatient. (Read more)

- More Americans than ever – 38% – are putting off care due to cost. IT’s a 12 point increase from the past 2 years. (Read more)

- Telehealth utilization fell 4% in October 2022. (Read more)

- Medical residents are unionizing in increasing numbers. (Read more – paywall WSJ)

- Here’s a overview of Medicare spending and financing from KFF. Total payments in 2021 were $829B, 48% of which goes toward Part B (outpatient, physician admin drugs). Medicare is 21% of national health spending and 10% of the federal budget. (Read more)

- The city of New York is trying to move city retirees into an Aetna MA plan without their consent. Yikes. (Read more)

- Healthcare worker pay satisfaction is the lowest across all 27 industries in the US. (Read more)

- While enrollment in the ACA marketplace as a whole in the Open Enrollment Period for 2023 is on pace to finish about 13% higher than in OEP 2022, enrollment in the eighteen states that run state-based marketplaces (SBMs) is on course to come in about 3% below the OEP 2022 total. (Read more)

Miscellaneous Maddenings

- Alright since it’s now officially the offseason, we need to make some major changes to the Cowboys’ roster. I am now the official, unofficial GM. Here’s what we need to do.

- Offload Zeke somehow. Dude can’t break an arm tackle to save his life and it’s painful watching him run. It’s like he has 10 pound ankle weights on AND he’s wading through molasses. Dude doesn’t belong on an NFL roster.

- Draft an elite WR alongside CeeDee

- Seriously consider whether we should move on from Kellen Moore…and I’m on the fence about Dak. Dak is so mid that it hurts. 12 points in a playoff game smh.

- Someone get Jerry to step down man!!

- Alright listen up folks! A comet is coming that hasn’t been seen in 50,000 years. It’ll be at peak brightness on February 1st, so mark your calendars! The comet’s name is C/22 E3 (ZTF). (Read more)

Hospitalogy Top Reads

- McKinsey released a comprehensive report detailing things to expect in US healthcare in 2023 and beyond. Despite the profit pool chart crime, it’s a solid look at what’s ahead. (Read more)

- The mental health burden athletes face – a nice read on the NFL and the pressure that athletes face in competing. (Two Docs and a Stack)

- Silicon Valley Bank dropped its 2022 report on healthcare investment, IPO, and trend insights. (Read more)

That’s it for this week! Join 16,500+ executives and investors from leading healthcare organizations including HCA, Optum, and Tenet, nonprofit health systems including Providence, Ascension, and Atrium, as well as leading digital health firms like Tia, Carbon Health, and Aledade by subscribing here!