11 May 2023 | FinTech

Redefining Diversity Blueprints In Fintech

By

40% of C-Suite execs think diversity, equity, inclusion, and belonging efforts are a “waste of time”.

Let’s change that. Fintech Is Femme exists for people like me who have ideas that will change the fintech space, but historically haven’t been heard. Are you one of those people, too? Together, we CAN drive real change in fintech.

The first step?

Understanding why fintech companies should care about DEIB…

Whether you’re convincing yourself, your boss, or your team, the answer is simple:

DEIB drives innovation and growth. When fintech companies embrace DEIB, they are better able to reflect the diverse needs and preferences of their customers. This can lead to the development of unique and innovative products and services that cater to the needs of underserved communities.

Diverse teams encourage innovation by bringing different perspectives and experiences to the table. Companies that promote DEIB benefit from increased creativity, better problem-solving skills, and faster decision-making.

DEIB can positively impact your company’s bottom line. According to the McKinsey report Diversity Wins: How Inclusion Matters, companies with gender diversity are more likely to have financial returns above their industry average. Furthermore, the report reveals that companies with ethnic and cultural diversity in their leadership ranks are 36% more likely to outperform their peers in profitability.

The Link Between Growth and DEIB

By engaging with customers from diverse backgrounds, fintech companies can gain insights into their unique financial challenges and develop solutions that are more relevant and effective.

This can lead to increased customer loyalty and retention, as customers are more likely to remain loyal to companies that understand and cater to their specific needs.

As consumers become more socially conscious and prioritize supporting companies that align with their values, companies that prioritize DEIB can benefit from a positive reputation and increased brand loyalty.

Just Ask the Experts…

To get into it deeper, I caught up with Leena Kulkarni, Head of DEIB at Array to help dive deep into:

- What makes a successful DEIB strategy

- Roadblocks you need to look out for

- How to interpret the transformative results of strong DEIB efforts

Here’s a few of Leena’s key takeaways from our conversation…

#1. Fintech’s Identity Crisis

The industry is facing an identity crisis when it comes to aligning itself to tech or finance. Few companies have come out to represent what the call to action should look like, leaving those that are striving for change feeling like they are on their own.

However, there is immense potential and hope for progress when it comes to diversity, equity, and inclusion. It is essential for companies to come together to make meaningful change, to enable the industry to reach its full potential. Only when we work together can we make real, lasting improvement.

#2 Employee Experience Matters First

Your customer experience will never be better than your employee experience. Inclusion should always be the primary goal for any organization. When striving for meaningful inclusivity, it’s important to consider exactly how to leverage it. Additionally, it is essential to ask yourself, what would this look like?

There are many successful Employee Resource Groups (ERGs) out there, but it’s important to remember that if not crafted with care, these groups can be detrimental and even place a burden on those they are meant to uplift. Ultimately, there are a lot of possible ways to strive for inclusivity, but the best approach should be driven from internal values and what will provide the most value.

#3 Focus on the Goal You Want To Achieve

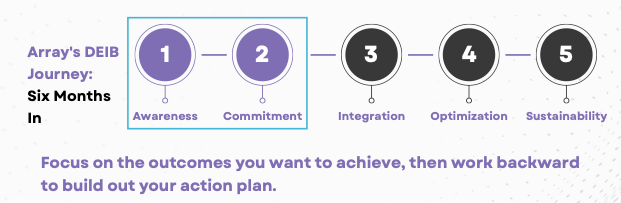

When approaching a new project, it’s important to focus on the goal and work backward. In the case of Array’s diversity, inclusion and belonging initiative, they had two main objectives: raising visibility and awareness and learning, as well as making sure DEIB was not seen as a separate entity, but rather deeply interconnected to the business.

To ensure relevancy, Array initiated monthly trivia events for each of the heritage months. Not only was this a great way to engage and have some friendly competition, but the questions were focused on topics relevant to the industry we serve, such as equal credit, wealth management and wealth transfer.

Feedback from these trivia events was incredibly rewarding, as many commented they knew less about women’s history than they thought they did. This is exactly what we wanted to achieve: making this work feel connected and embedded, rather than siloed or irrelevant.

#4 Data Is Quantitative & Qualitative

Data collection goes far beyond quantitative metrics. Array, for example, not only collects Sentiment Survey data but also looks at cultural sentiment, representation across levels and industries, management levels, and functional areas within the organization.

This multi-faceted approach allows the company to have a more comprehensive picture of how people experience the organization. To further disaggregate the data, you can look at the different ways people feel in certain fields or departments.

It’s important to flip the narrative and look at the different sentiments within different groups. This is especially crucial in a startup environment, where culture is highly sensitive to change and the data needs to stay up-to-date in order to represent how people are truly feeling.

There is SO much more to be learned from Leena. This is just a taste!

That’s why I partnered up with the Array team to create the first Fintech Is Femme diversity report. In creating this report, it was essential to understand that knowledge is power. Rather than shaming companies for being at the beginning of their DEIB journey, this report provides transparent guides as a starting point or benchmark.

Knowing where we stand as an industry, even if we’re imperfect, is a valuable tool to help circumvent a lot where DEIB gaps persist. It’s much harder to achieve equity when we don’t realize how far away we are.

Get your copy of the report here.

And remember: Progress takes time and progress is continual. There is not one fintech company that is doing everything right, all of the time. However, we can learn from those fintech companies that are investing in DEIB and continuing to improve.