11 May 2023 | Climate Tech

An energy storage analogy

By

Imagine you didn’t have a bank account. Imagine you couldn’t have a bank account. Imagine bank accounts didn’t exist.

Imagine that this isn’t some post-monetary society. You still make money. You are gainfully employed with a wage-earning job. Maybe you earn as much as you do now. Maybe, if you want to make this imaginary scenario a bit more aspirational, you earn more. It’s just that you have no way of saving money. You either use your income as it comes in or you lose it. How would you navigate this?

Got your answer? Now this hypothetical is about to get worse. If, like many folks reading this, you get paid twice a month, then I can see how 23 seconds ago, you may have mused, “Well, if I have to spend my money as I earn it, I guess I can at least pay all my bills and rent on the day I get paid.”

That assumes you still get paid biweekly. Imagine you don’t. Imagine you get paid instantaneously whenever you’re actually working. Imagine you get paid proportionally, by the second; you earn fractions of dollars in direct, linear alignment to when you’re working and how hard you’re working.

And remember, you still have no way to save the money you earn. Quarters and dimes and nickels and pennies are constantly raining down on you from on high. And you’re just sitting there, inundated by the head-pelting downpour, weeping (I would be), unable to match income to spending.

How would you navigate this?

Building better energy ‘bank accounts’

OK, the above was a bit extreme. But in reacting to the question ‘How would you navigate this?’, hopefully, you kept returning to one answer. ‘Invent a goddamn bank account!’

While hyperbolic, the analogy explains some of the difficulty of integrating variable renewable energy sources into the power grid.

The grid was built around generating assets that generate power (or ‘income,’ to continue our analogy) in a highly controllable fashion. Thermal (e.g., coal, natural gas, nuclear) power plant operators have a lot of control over how much power the facility generates at any point in time, and they can match this to actual levels of power demand (or ‘spending,’ in our analogy).

Wind and solar power are different. I don’t need to repeat the oft-parroted line of ‘the sun doesn’t always shine and the wind doesn’t always blow.’ That isn’t news. But the full implications of the fact remain, at times, underappreciated.

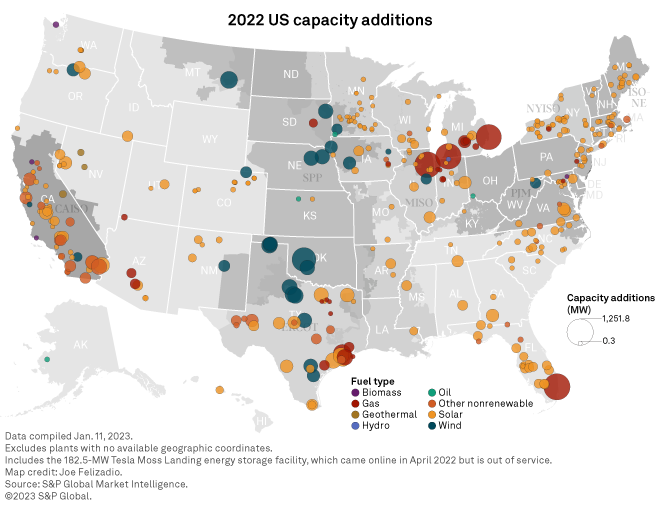

Despite the challenge inherent to harmonizing variable power generation sources with predictable and dispatchable ones, variable renewable energy has soared in the U.S., in part due to the falling cost of generating power with solar and wind (when the sun does shine and the wind does blow) plus ample government incentives:

However, as the level of renewable energy penetration increases, it gets harder to make full use of the power they generation with the rest of the systems and stakeholders involved in the grid.

As we discussed last week concerning California’s ‘duck curve’:

[Past a certain point] …An abundance of solar power during the day also does little to reduce emissions. Natural gas use in California (to make up for reductions in available solar power at night) is higher, not lower.

Hence why there are also still big red dots on the map above (new natural gas power plants), often right next to the solar and wind capacity additions.

To bring this all back to our analogy, the more ‘income’ that wind and solar generate in the U.S., the more important having a ‘bank account’ becomes. Absent the bank account, more ‘income’ isn’t worth that much if there’s nothing to spend it on and it can’t be ‘saved.’

To understand this better, let’s appreciate what will happen absent a rapid uptick in energy storage capacity in the U.S. At present, the DOE forecasts that regardless of how much renewable energy gets built in the U.S. over the next decades, the country will need:

… an additional 200 gigawatts of advanced nuclear power… to reach President Joe Biden’s goal of hitting net-zero emissions by 2050. (more here from Grist)

Part of the calculus here is that you can’t fully decarbonize the grid with renewable energy; there’s a cap to the percentage of variable power generation that’s useful (again, absent energy storage). Hence why the DOE has such a robust forecast for nuclear energy, which is ‘always-on’ or at least ‘always-available.’

Advancements and more deployment of energy storage could help raise the bar for the amount of renewables the power grid can make use of. Pairing energy storage with wind or solar helps turn them into a power source that’s at least closer to the ‘always-on or always-available.’

Here’s how NREL describes the dynamic at hand:

System operators and project developers have an interest in using as much low-cost, emissions-free renewable energy generation as possible; however, in systems with a growing share of variable renewable energy, limited flexibility of conventional generators and temporal mismatches between renewable energy supply and electricity demand may require renewable generators to curtail their output. By charging the battery with low-cost energy during periods of excess renewable generation and discharging during periods of high demand, BESS can both reduce renewable energy curtailment and maximize … value.

For all the reasons explored so far, without energy storage, some folks call wind and solar ‘fuel-saving technologies.’ By that definition, they can mitigate some natural gas and coal use when they’re ‘on.’ Not to replace those power plants entirely.

The good news: Energy bank accounts exist!

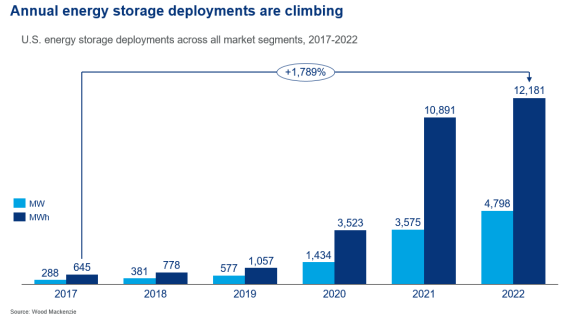

Here’s the upshot: Energy storage deployments in the U.S. are already picking up steam, as you can see below from Wood McKenzie:

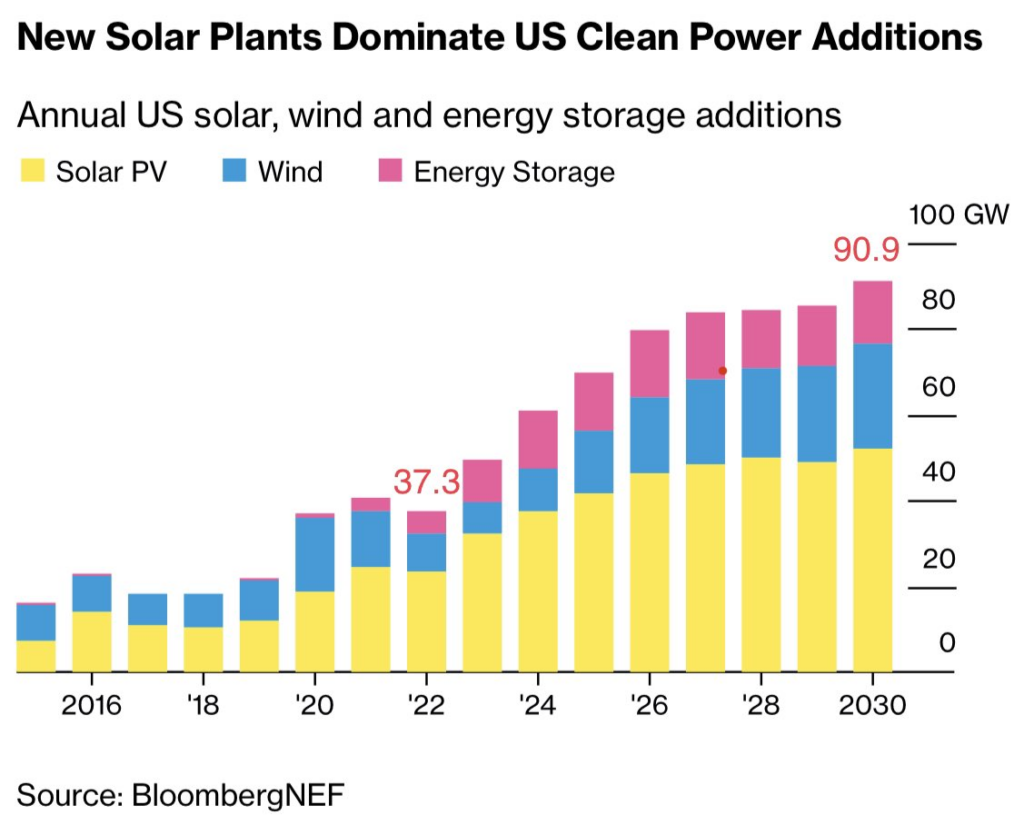

In the grand scheme of things however, even gigawatts of annual energy storage capacity additions pale in comparison to both the level of existing renewable energy capacity in the U.S. and what’s forecast as far as renewable energy capacity additions in coming years:

Suffice to say there is and will continue to be a significant mismatch in the deployment of variable renewable and energy storage capacity.

Some of this owes to tech readiness; wind and solar technologies improved and reached cost-attractive levels of efficacy earlier in this century than batteries did.

At some point today, you probably thought, “Don’t we already have batteries? Haven’t we for a while?” We do, and they lend themselves well to many applications, ranging from consumer electronics to, increasingly, EVs with sufficient range and reliability to make them competitive with internal combustion engines.

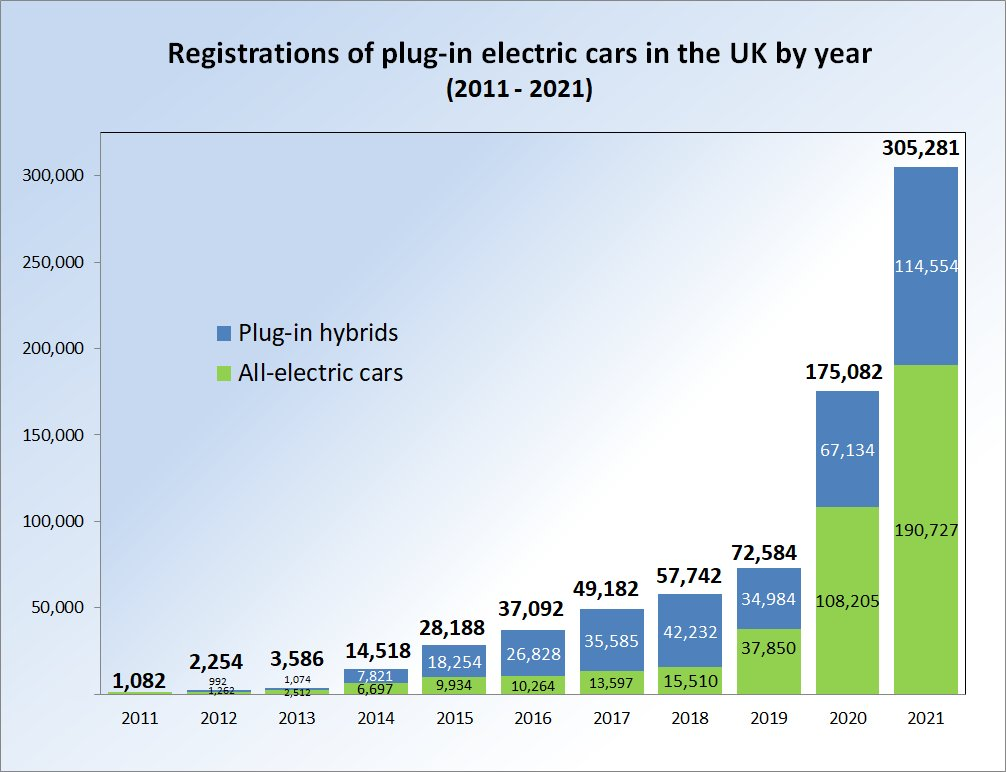

But while EVs are all the rage now, as recently as a decade ago (2013), range and reliability were limiting factors that kept EV sales in places like the U.K. <5,000 vehicles per year.

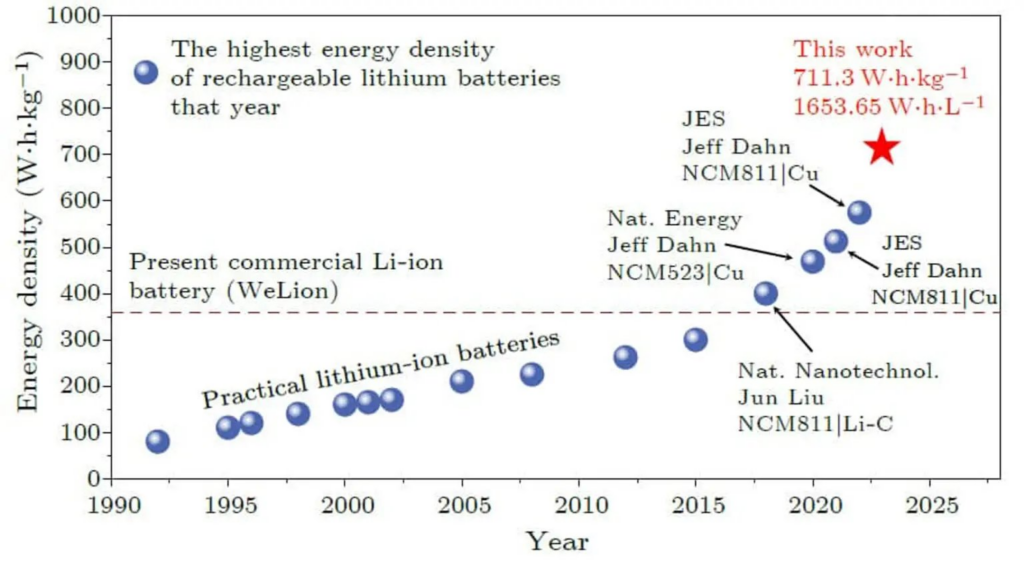

Judging by the up-and-to-the-right nature of the chart, something has changed in the battery landscape. A lot of what’s changed has to do with greater achievements in the energy density of lithium-based batteries:

And going from EV batteries to utility-scale energy storage is a whole ‘nother beast.

Utility-scale battery energy storage has a ways to go before it hits price and performance metrics that make it a viable cure-all for the variability of wind and solar power.

Most battery energy storage systems deployed today feature four-hour storage duration, i.e., the amount of time the systems can discharge at their power capacity before depleting their energy. A battery with a 1 MW capacity and four-hour storage has a total of 4 MWh of usable energy.

Four-hour storage duration is often enough to meet additional power demand during evening peaks. But it can’t replace the always-on nature of, say, a thermal power plant in, say, Indiana in the middle of the winter. Increasingly, some eight-hour battery energy storage systems are getting deployed, but for now, those are exceptions to the rule.

In the same way batteries had to improve significantly before EVs became attractive to consumers, battery energy storage has a ways to go, especially on the cost front, before integrating it with renewable energy as a rule makes sense (and cents) for developers.

What folks are working on in 2023

There are many other forms of energy storage beyond batteries:

- Mechanical: Compressed and liquid air energy storage store energy by compressing air or converting water into a liquid state. For CAES, to discharge energy, compressed air passes through air turbines that generate electricity from the flow of high-pressure air.

- Gravitational: Storing energy in height. Pumped hydro is the most common form of utility-scale energy storage in the U.S., and other firms, like Renewell, are exploring different forms of gravitational energy storage.

- Chemical: Using renewable energy in electrolysis to split water into oxygen and hydrogen (storing energy in the H2 form).

And there are plenty of companies rushing in to fill white space, either with different battery chemistries or other tried and true approaches to energy storage:

- De-rusting the rust belt: This year, Form Energy announced it will invest $760M to build its first manufacturing facility in West Virginia to make utility-scale iron-air batteries, a cheaper battery chemistry than lithium-ion that works by rusting & de-rusting.

- The heavyweight incumbent: Earlier this year, rPlus Hydro made a final regulatory filing for a new 1,000-MW pumped hydro energy storage facility in White Pine County, Nevada. Pumped hydro is far and away still the number one source of long-duration energy storage in the U.S. This facility will offer eight hours of storage duration at 1 GW capacity (that’s big!).

- Early-stage innovation: I’m keenly watching (perhaps more accurately, stalking) what the folks at lightcell are developing. The founder, Danielle Fong, previously ran a compressed air energy storage business and seems to have something new up her sleeves.

Still, all this work will take time. Form Energy plans to deliver its first batteries to clients in 2028.

The net-net

Transmission went from an undiscussed talking point, save for inside the most wonkish of industry circles, to a hot-button issue in 2023. Everyone’s talking about poles and wires now!

In addition to power plants and transmission, energy storage is the third pillar in the triumvirate of the power grid. Insufficient innovation in and deployment of energy storage deployment could seriously hamstring renewable energy. Which would hurt decarbonization goals and hamper the solar and wind industries. Energy storage should get the front-cover-of-the-magazines treatment, too!

To put a pin in it, one of my favorite tweets of 2022 read:

The politics of the grid, the economics of the grid, and the engineering of the grid, are three circles with very, very, very little overlap.

If I were jotting down a short list of things that need to sit in the sliver of overlap at the center of those three concentric circles, I’d put energy storage on it.