30 April 2023 | Climate Tech

Making fission and fusion smaller

By

I read into almost every coincidence in my life. Perhaps too much. Sometimes though, even climate tech fundraising announcements align in ways that allow me to entertain this habit all the more.

This week, two nuclear energy firms making tiny nuclear reactors announced new funding rounds. And on the same day, no less, which made my job picking deals to write about easier.

Avalanche Energy and Radiant have at least two things in common. For one, they announced $40M funding rounds, though Avalanche’s was a Series A and Radiant’s a Series B.

The investors who led their rounds are also some of the most recognizable names in VC. Andreessen Horowitz led Radiant’s round as part of its increasing focus to diversify from software and crypto to ‘American Dynamism,’ i.e., ‘real-world’-focused investments in America’s physical future. And Lowercarbon Capital, perhaps the most recognizable climate tech venture investor, led Avalanche’s round.

The more important commonality between the two firms is that they want to make really small nuclear reactors. We’re not talking about conventional ‘small modular reactors‘ here, a category that encapsulates nuclear fission reactors up to 300 MW in size.

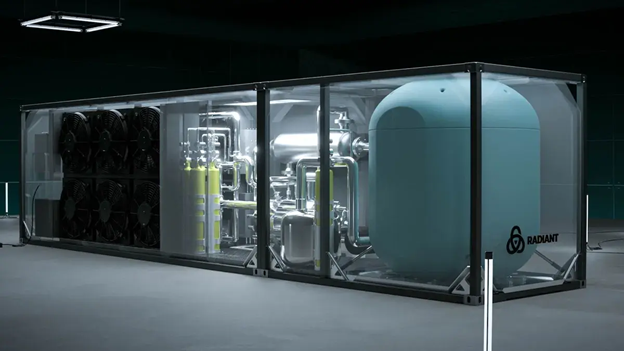

Radiant wants to make 1 MW, shipping-sized nuclear fission reactors. That’s really small in the grand scheme of things and lends itself to applications where there is no power grid (e.g., a military base) or where additional resilience is needed (think diesel-backup generators for hospitals).

Then there’s Avalanche Energy, which wants to make lunch-pail-sized nuclear fusion reactors.

Absent those similarities, the two companies are working with entirely different power generation techniques. Nuclear fission (Radiant) involves splitting atoms. Nuclear fusion (Avalanche) involves, well, fusing them together.

There’s a world of difference between the two. Nuclear fission already generates nearly 20% of the U.S.’s power, almost as much as all other renewable resources combined. Nuclear fusion will not generate any grid-connected clean energy for at least another decade.

Still, both sectors have enjoyed significant attention and investment of late, though. But can they unlock the potential benefits of making both work on a smaller scale?

Splitting up? Fusing together? Either way, keep it small

We’ve previously covered the envisioned benefits of making traditional nuclear reactors smaller. Look no further than the state of Georgia to see why people are a bit tired of big, GW-sized nuclear reactors. The U.S.’s newest nuclear reactors at Plant Vogtle have seen both billion-dollar and decadal-long cost and time overruns as they inch towards the finish line of grid connection this year.

Engineers, developers, and investors alike hope making reactors more modular (like a shipping container) and smaller can help with the cost, time to deploy, and onerous regulatory hurdles.

On the fission front, Radiant is going after the diesel-dominated industry of backup power generation. Whether it’s for disaster relief or ensuring always on power access in places like hospitals, diesel generators are a mainstay of reliability.

But they’re also dirty, nor is their reliability perfect. Famously, the backup diesel generators that were in place to keep cooling the reactor at Fukushima in 2011 got flooded by the same tidal waves that knocked out power for the plant. That was a key problem that contributed to a reactor meltdown.

I can’t say for sure whether a backup nuclear reactor like Radiant’s would have worked perfectly in the same scenario and kept its big cousin in Fukushima cool. And other companies, like Sesame Solar, are targeting the same market with a combination of renewables, hydrogen, and battery energy storage. But the market for diesel generators is plenty big for a variety of other players, whether from a dollars or emissions perspective.

On the fusion front, Avalanche Energy wants to make a smaller reactor in hopes it can reduce the complexities of achieving viable fusion energy while offering some of the same modular benefits as Radiant’s shipping-container-sized reactors.

Whether they target magnetic confinement or feature a tokamak, most fusion reactor designs have been large. Tens of billions of dollars have been shoveled into projects like ITER in France, where engineers have long been working on massive magnetic confinement fusion reactors.

Avalanche Energy’s proposed fusion reactor design builds on top of the orbitrap, tech that is readily available in labs and is used to confine ions in an electrostatic field. Orbitrap’s energy confinement mechanism could be leveraged to attempt to create conditions for fusion. All fusion techniques involve some form of holding atoms in place (so they can be bombarded with energy), whether via magnets (magnetic confinement), hardware (inertial confinement), or now, in Avalanche’s case, electrostatic energy.

If they can build them, Avalanche Energy’s lunch-pail-sized fusion reactors could work well for a whole host of applications, whether in road, air, or maritime transport.

To connect or not to connect

For both Avalanche and Radiant, if their tech pans out, it’s also conceivable one could stack many of their reactors in a series or array for more generating capacity (much like solar panels are rarely deployed alone).

However, not connecting to the U.S. power grid is also likely part of the appeal of making smaller reactor designs.

Today, the backlog in the U.S. interconnection queue, i.e., the queue of proposed or in-process projects that want to connect to the grid, eclipses more than 1 TW of generating capacity. Wait times are growing as the line does. Here’s how the average time spent in the interconnection queue for completed projects has changed in the past 15 years.

- Projects completed in 2022: ~5 years in queue

- Projects completed in 2015: ~3 years in queue

- Projects completed in 2008: <2 years in queue

A variety of factors are driving these lengthy wait times. For one, more projects are being developed as the IRA catalyzes growth in renewable energy capacity. Secondly, permitting and environmental reviews for new projects have become more onerous. Thirdly, there isn’t always enough transmission capacity for interconnection, which acts as an additional bottleneck on projects.

Regardless of the main driving forces behind the gargantuan interconnection queue, the line is what it is. And its length is one reason only ~20-30% of projects in queue ever get completed.

As a result, for many developers, including ones named Google, sidestepping the queue entirely is an increasingly preferred strategy.

The net-net

There are three open questions we haven’t touched on here still.

The first is tech viability. I do think fusion is no longer twenty years away, as folks have long quipped it always seems to be. I reckon companies like Helion Energy will demonstrate significant breakthroughs this decade (at least, that’s where I’d put my money).

Regarding Radiant and Avalanche, it’s tough to say how close they are to rolling our functional reactors for customers. The precedent for Radiant’s tech is certainly there; nuclear submarines have long used small fission reactors (e.g., ~35 MW designs).

For Avalanche? They’re, of course, in completely uncharted territory.

Secondly, there’s cost. What effective sale price of energy will systems like these need to achieve now and in the future for commercial viability?

Thirdly, we haven’t touched on safety. The 37th anniversary of the Chernobyl disaster came and went this week. And while nuclear energy is very safe across almost all measurements when you work with averages, fission will always present a tail risk (which is always hard to quantify).

Nuclear fusion is a self-limiting process. Unlike fission, it doesn’t self-perpetuate in chain reactions that can precipitate ‘meltdowns.’ That helps explain why investors seemingly have as much interest in fusion, a technology entirely without precedent, as in fission, which is entirely with precedent.