23 February 2023 | Climate Tech

Not on time and not on budget

By

If you’ve stuck around for enough of my newsletters, you’ve (hopefully) gathered that I’m a ‘big tent’ guy when it comes to climate tech. While I pick favorites and write critically about others at times, I think we should build and deploy almost everything that mitigates emissions, reduces plastic waste or air pollution, remediates environments, etc.

Why? You can run all the analyses and projections you want for any technology, controlling for variables like cost, emissions-mitigation potential, and other climate impacts. But you’ll still be left with many known unknowns and unknown unknowns.

Take solar, for instance. 10-20 years ago, solar photovoltaics were less competitive than they are today. Folks knew conceptually that investing in R&D would unlock new efficiencies, both in the tech itself and in its production. Still, people underestimated how much better we’d get at building solar panels and how much solar we’d deploy by 2023. Improvements have beat expectations, as have deployments:

Suffice to say it’s hard to predict progress, especially when progress is exponential. That alone is reason not to abandon other technologies that a) haven’t taken off yet, like tidal power or b) have stalled out somewhat, like nuclear power.

Nuclear power is an interesting case. While it’s been around for 50+ years, we haven’t gotten much better at deploying it in the last 20+ years, at least in the U.S. People once thought nuclear power would continue getting cheaper and would eventually be ‘too cheap to meter.’ Unfortunately, that hasn’t come true. It’s not that the technology hasn’t improved at all or that there aren’t enterprising new startups working in the space. But a mix of setbacks – not confined to the most famous nuclear accidents – have hamstrung investment and progress on policy.

Safety setbacks

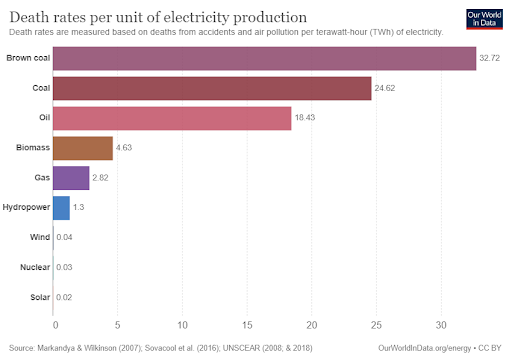

You’ve heard about the obvious moments that set the nuclear power industry back. Chornobyl, Fukushima, Three Mile Island. On average, nuclear power is much safer than other types of power generation. But the aforementioned events crystallized that averages don’t matter here.

The risk in nuclear fission is mostly tail risk (i.e., risk of low likelihood, high fallout events that aren’t well represented in a normal distribution). While the odds of a disastrous nuclear accident may be infinitesimally small, the potential consequences of nuclear fallout loom large in our collective imagination.

And imagination is often more persuasive than statistics. To that end, there never had to be a ‘true’ nuclear accident in the U.S. for some people to lose trust in the industry. Even before Fukushima in Japan in 2011, mishaps at nuclear power plants in the early and late aughts in the U.S. were enough to turn the tide of public sentiment.

For one example, take the David-Besse nuclear power station in Ohio. According to the Nuclear Regulatory Commission (‘NRC’), two of the five most dangerous safety incidents in U.S. nuclear power history happened at David-Besse. In particular, in 2002, engineers discovered that corrosion had opened up a sizable hole in the reactor’s containment dome, posing a massive radiation risk had anything else gone with the reactor. Subsequently, the NRC had to go to Congress with its tail between its legs to explain shortcomings in oversight:

“The unexpected discovery in March 2002 of extensive corrosion and a pineapple-size cavity in the reactor vessel head—one of the vital barriers preventing a radioactive release—at the Davis-Besse nuclear power plant in Ohio led NRC to reexamine its safety oversight and other regulatory processes to determine how such corrosion could have been missed…” (from a 2006 report to Congress)

For another example, at the ‘Yankee’ nuclear power plant that used to provide up to 70% of Vermont’s electricity, a cooling tower collapsed in 2007. While this didn’t present as much of an immediate safety risk (though concerns about groundwater leakage persist to this day), it didn’t do wonders for local confidence in the power plant and its operators. A few years later, the Vermont Senate voted to shutter the plant.

Suffice to say that policymakers and the general public alike have had reason to question the nuclear power industry’s track record in the U.S., which is discourse that we’ve lost sight of to some extent when talking about nuclear power in the present day.

$$$ setbacks

Beyond perceptions surrounding safety, another impediment to nuclear power’s progress has been the cost and time needed to build new reactors. Especially in the West, developers have struggled to build reactors on time and on budget.

Just last week, two nuclear power stations announced budget and timeline setbacks. Georgia Power Co. noted that two new reactors scheduled to come online at Plant Vogtle in Georgia in 2023 will be delayed further and require an additional $200M. The two new units are already more than five years late and $15B over budget.

Meanwhile, Electricite de France SA, a French multinational utility, increased its cost forecast for the nuclear power plant it’s building in the U.K. by nearly 25%, up to £32B (~$38.5M). Completion of the power station, named Hinkley Point C, may also be delayed into 2028 or even 2029, whereas the previous timeline forecast power generation by 2027. This is the second major delay and cost increase EDF has announced for Hinkley since construction started in 2018.

Suffice to say it remains challenging to develop new nuclear power stations. Analysts I respect locate much of the blame on onerous regulation and oversight and the fact that the domestic policy environment heavily favors renewable energy. Indeed, those are hugely salient factors, but we’ll have to leave them for another newsletter.

Regardless, it’s hard to curry favor if you’re not hitting your own targets.

All that said, all isn’t lost. Significant investment has poured into companies developing ‘next-generation’ reactors to reduce costs and development time. New incentives in the IRA have also raised the possibility of extending the life of nuclear power plants like Diablo Canyon and have spurred new investments in other plants.

This week, the energy firm Constellation announced it will invest $800M to expand the capacity of its Braidwood and Byron nuclear power plants in Illinois by 135 MW. While these aren’t net new reactors, the investment in them represents a significant ‘uprate’ and expansion of dispatchable, clean power. The IRA also includes incentives for nuclear power, which these capacity expansions will take advantage of.

The net-net

The world would benefit from new nuclear reactors. We’re not operating from a place of energy abundance. Almost ~1B people in the world don’t have access to power. And for most who do, costs have been going up for years. Further, we’re still trying to figure out how to transition the lion’s share of our power generation off fossil fuels. To this end, we can’t rule out the valuable role nuclear power can play.

That said, nuclear power needs to get out of its own way a bit, so to speak. While the tide of public opinion may be shifting favorably, the more the phrases “not on time” and “not on budget” are in the news the more momentum the industry loses. As costs pass through to taxpayers, politicians and policymakers alike are less likely to go out on a limb to support nuclear power. And for developers, the path of least resistance is still monetizing solar and wind.

Whether or not the intense regulation and scrutiny nuclear power is subject to is ‘fair,’ every public setback risks translating into fewer terawatt hours of clean power in 2030 (and beyond.)