08 February 2023 | Media

The Worst Part of Media Businesses

By Adam Ryan

Newsletter businesses have gotten a lot of love in the last 5 years.

Companies like Industry Dive, Morning Brew, Axios, and The Hustle have all had exits that sparked the likeness of newsletters.

Many of the benefits of newsletters I’ve outlined before.

This deep dive will talk about the crappy part of these businesses.

The misunderstood basics

Newsletters are a predictable business to build. The model, by and large, is easy to imitate.

At the base level, you need to measure 3 metrics:

Subscribers: How many people are actively engaged with the newsletter

Churn: How many people unsubscribe and stop reading the newsletter after 60 days, month over month

CPM: How much ad revenue do you make per 1,000 sends

Churn is incredibly misunderstood in the industry. I was advising a deal not too long ago where the Founder claimed they had a 1.2% monthly churn. I called bullshit immediately.

The reality was they were calculating only subscribers who clicked unsubscribe, not folks who stopped opening the newsletter.

Keeping a clean list is essential for various reasons, but the most crucial reason is it shows the actual churn rate.

If you automatically remove readers who stopped opening 60 days (sometimes 90), then you have a clear picture of how the health of the audience is doing. Without it, you will have a leaky bucket problem.

The leaky bucket problem

Let’s give an example of a real newsletter at Workweek (that’s doing incredibly well):

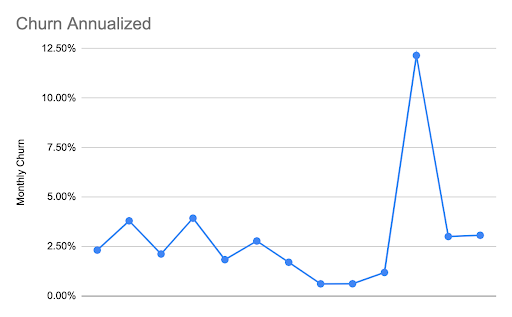

In the first 10 months, churn was only those who hit unsubscribe. In Month 11, the list was cleaned with anyone who hadn’t opened in 60 days. The following two months we automated this process.

Without that churn happening in Month 11, the monthly churn rate would be 50% lower. Spread that over 3 years with a 1M+ list, and you’re talking about the difference between a 2M list or a 1M person list.

Yikes.

The metric that matters

Today, investors refuse to put money into media businesses, specifically those with advertising as their only source of revenue. And if they do, it’s at low valuations.

Comparison of revenue multiples

- Snowflake (Enterprise Software): trades at 42x revenue ($1.2B in revenue in 2022 & currently at $51B market cap).

- Netflix: trades at 5x revenue ($31.6B in revenue in 2022 & currently at $160B market cap)

- Buzzfeed: trades at 0.6X in revenue ($400M in revenue with $258M in market cap)

The lagging indicator to show this is if you look at the list of “unicorns,” there are only 2 publishers on the extensive list, Vice and Vox. Vice, who raised at a $5.7B valuation, is selling for less than $1B and Vox who previously raised at $1B now just raised at $500M.

No matter how you slice it, media businesses simply don’t capture large valuations.

What is the driving cause of this? What makes software businesses so investable?

Enter the metric that matters the most.

- Net-retention revenue (NRR): the cumulative total of retained, contracted, and expanded revenue over a set period, typically one month or one year

- NRR formula: (Contraction MRR – (Churn MRR + Expansion MRR)) / Starting MRR

- If you need an example to understand this, think about Slack.

Slack has a Net-Retention Revenue of 143%. For every dollar they make, they expect an additional 43 cents the following year on that revenue.

If you think about it, it makes sense. Less than 1% of customers churn annually from Slack, and the average customers expand how many seats they have (due to employee growth).

This single metric makes it easy to understand the growth of a business.

P.S. Want to know why Snowflake is valued at 42x revenue? It has a 160% NRR!

Now let’s look at a media business that is ads based

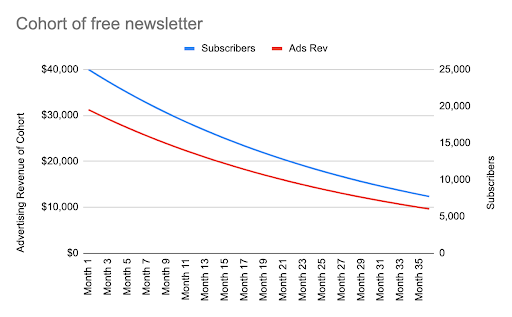

In this example, it assumes the cohort starts at 25,000 subscribers, has a 3.3% monthly churn rate (this is pretty good), 10 newsletter sends/month and $125 CPM of ads.

Throughout a 3 year-window, the revenue of that cohort goes down by nearly 66%. There’s no foundation to build a scalable business because the product simply isn’t sticky enough. This problem is only getting harder with the saturation of newsletters.

This is why media companies aren’t scaling, investors are avoiding writing checks, and why the industry can’t innovate its way out of the hole it dug itself in.

Media businesses continue to be leaky buckets, and no one wants to be holding the empty bucket at the end.

How do you overcome this?

Lower churn

Let’s look at a company you could argue is the most successful content publisher of our era, Netflix.

So why did Netflix make it big? Their monthly churn is ~0.15%. They invested in better content and data-driven decision-making to lower their churn by 50% from 2014 to 2019.

This is why they’re valued much higher than Buzzfeed, Vox, and others. They have incredible churn numbers due to content advantages.

This is where focusing on powerful niches, high-quality content, and taking care of your talent pays off.

Addressable market

Sometimes churn is incredibly hard to combat. One way to get over it? Sell to more people.

Newsletter businesses like theSkimm and Industry Dive have had huge addressable markets, so their business can afford this churn. Recognize it’s still potentially a leaky bucket, but it buys you enough time and audience size to find other ways to diversify the business.

Direct Purchases

This is probably the most obvious, best solution and the hardest to solve. You can sell products to your audience to make up for churn.

Barstool has done this with the merchandise. Politico did with enterprise subscriptions. You could argue Disney does it with cruise ships, amusement parks, and streaming platforms.

The more your audience purchases from you, the more you can make up for the churn.

Final thoughts

Whenever I write a newsletter like this, I get a lot of responses from some incredibly capable operators that say, “Why is a $1B media company needed? Success can be $30M in revenue with $10M in profits!”

You’re right. I’m incredibly happy for anyone with that outcome. I’m not trying to minimize your accomplishments.

What I’m trying to do is push our industry to build a business model that allows our influence to be equitable to our valuations.

Imagine If all 10,000 of us reading this newsletter got together and said, “let’s publish X tomorrow.”

It would be a cultural moment. It would reach a large portion of the world. It could tip the world a different way.

Yet, Snowflake, a company that 99% of people on this list won’t know, has a 42X multiple, when most media businesses struggle to get 5X.

It’s time for us operators to stop complaining, being complacent, and start innovating.

We need a media company to solve the leaky bucket problem. We need a media company that has a positive NRR. We need a new blueprint to push the industry forward. We need a media model that can scale to $10B+.

If you think you’re doing this or innovating in the space, write me back, and I’ll have you on my podcast. The industry needs to hear from you.