19 January 2023 | Climate Tech

No Panaceas

By

DEEP DIVE

The first time I started thinking about climate tech with this framing in mind was when Russia invaded Ukraine in 2022. In many ways, Russia timed its brazen invasion to coincide with European energy shortages. Considering how much natural gas Russia exported to Europe, at some level, Putin likely calculated that he’d get less blowback than if Europe were energy independent.

That’s a benefit climate technologies can ideally offer alongside mitigating climate change. They can reduce how often the age-old question of “Who has access to what resources?” comes up.

Hundreds of years ago, countries with access to rich coal reserves had a massive advantage when industrializing. Coal is a more energy-dense fuel than wood – which people relied on for energy generation until then – and it’s perfect for various industrial processes. Nor is it all that hard to move.

People were aware of the significant advantage access to coal conferred to countries and economies. In her book Coal, Barbara Freese describes an American theologian who extolled the virtues of America’s coal reserves:

…scattered by the hand of the Creator with very judicious care, as precious seed, buried long… destined to spring up at last, & bring forth a glorious harvest.

Similarly, countries with significant oil reserves, like the Middle East, the U.S., Russia, and Norway enjoy a lot more wealth (and leverage) on average. While analysts have often predicted peak oil, oil demand is still set to grow in 2023.

A lot has changed over the 300+ years since the U.K. first kickstarted the industrialization revolution, thanks to its abundant coal fields. But not that much has changed. Humans will still mine, move, and burn 8 billion tons of coal this year. Even as renewable energy grows globally, coal demand hasn’t peaked.

If an alien species came and looked at our planet and energy habits, they’d probably find our fossil fuel dependence a bit archaic. Photosynthetic organisms produce 6x more energy than all of mankind across all energy sources. All without moving mass. And that’s just one potential energy source.

Harnessing more solar energy ourselves is a start to improve resilience and reduce inequities inherent to natural resources. Rooftop solar is a practical, appreciable example at the level of the household. Installing solar panels can vastly heighten your personal energy independence, saving you money. Add energy storage, and suddenly you can operate ‘off grid’ a lot of the time.

Granted, there’s still a lot of variance regarding which countries have the best opportunity to harness energy sources like solar. The rooftop solar opportunity in Germany is not the same as in Southern Australia. Still, it’s a start.

New technologies, new constraints

To be sure, there are almost always some constraints to new technologies, even if they are an improvement over previous ones.

I keep a close eye on the most common refrains from the anti-clean energy peanut gallery on Twitter. Right now, they like to point to the amount of metals and minerals needed for climate tech, especially for batteries.

While often wildly dramatized, there’s plenty of reason to be concerned about the environmental impact of mining and whether global supply chains can accommodate exponential growth in EVs and renewable energy.

For one, IEA estimates that demand for critical minerals for clean energy technologies could increase 2x by 2030 and 4x by 2040 from present levels.

And estimates for emissions from the mining sector range as high as 7% of total global totals. If you quadruple mining intensity in coming decades, you’re also producing a lot more emissions, even if you’re displacing them elsewhere.

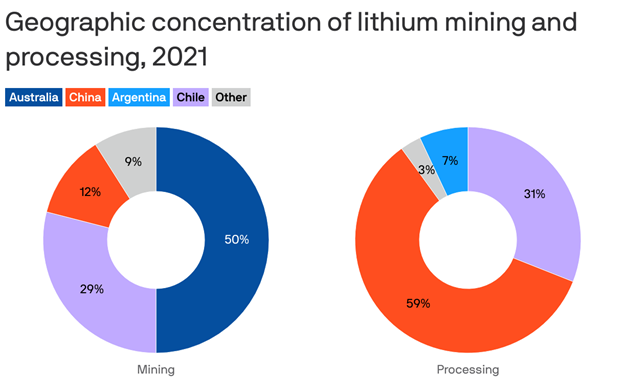

Further, as with coal and oil, key minerals and metals aren’t evenly distributed globally. Far from it, mining and processing and both highly concentrated:

Even further, geopolitics, as well as human rights concerns, also feature substantially in these considerations. In the same way that it dominates lithium processing, China dominates manufacturing of solar panels. And not all Chinese solar panel manufacturers play by the ‘rules’ the rest of the world does.

Since Biden enacted a forced-labor law last year to penalize Chinese manufacturers using Uyghur labor, $1.3B worth of solar panels imported to the U.S. have been seized.

All of this is to say that concerns about minerals, metals, and concentrated supply chains are super validand will require a ton of innovation and work.

On the bright side

You’re going to give us some good news again, right Nick? …Right?

Fear not. One thing I like to point out is that when you build a battery, wind turbine, or solar panel, you get to use it for 15-25 years. When you drill for oil or mine coal, you only get to use it once. Then it’s CO2 in the atmosphere.

There’s a profound difference between materials that work for you for decades versus one-time-use ones. Plus, many battery materials can be recycled at the end of their life. There’s a lot of work to do to scale that in practice, and hopefully we get better at doing the same with solar panels and wind turbines.

To double down on why that’s important, note that moving fossil fuels around represents nearly 40% of annual global shipping volumes. And shipping itself relies almost exclusively on fossil fuels. So beyond a certain ‘tipping point,’ reducing coal and oil use becomes reflexive: If you reduce fossil fuel demand, suddenly you need to move much less stuff around the world. Then moving less stuff around reduces fossil fuel demand even more.

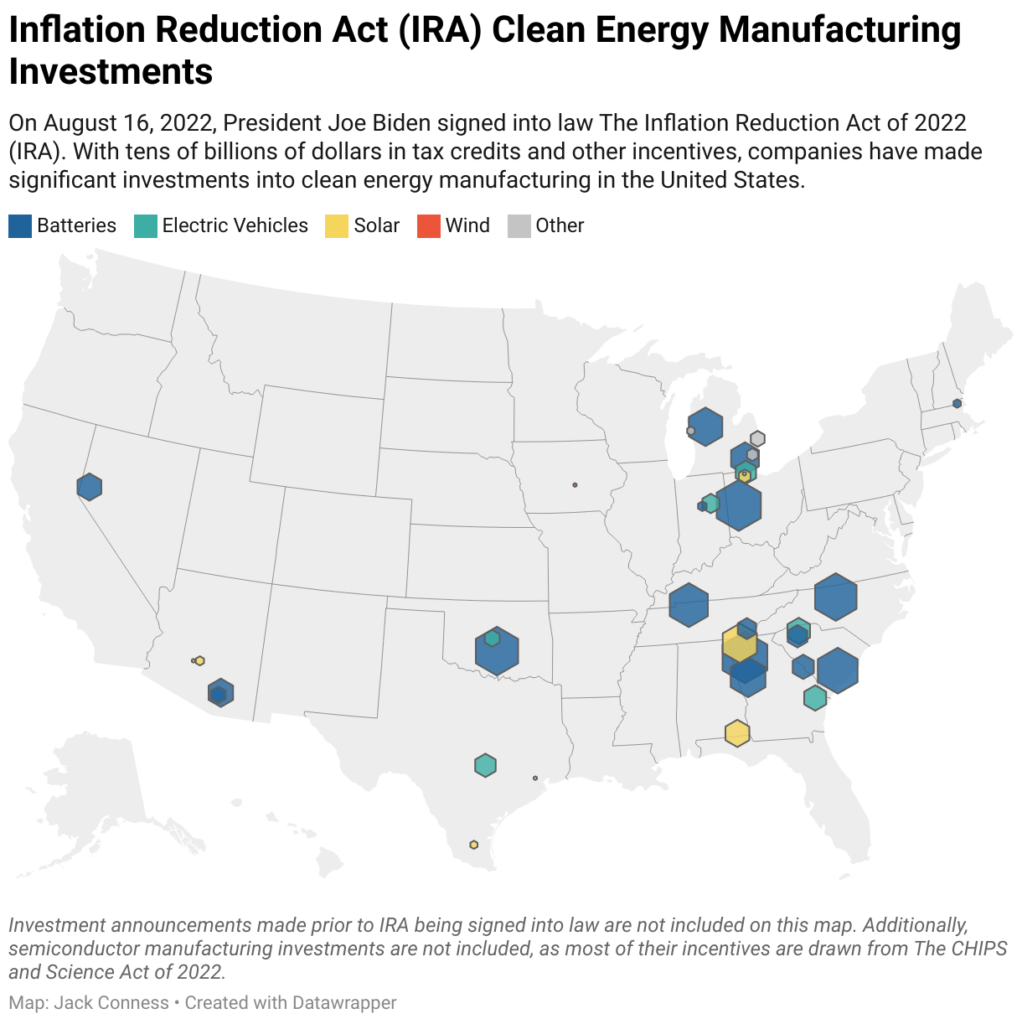

Further, on the supply chain concentration front, many countries’ public and private sectors are working hard to shore up domestic supply chains. The DOE doled out funding en masse for domestic metal and material producers and battery companies last year and has been actively making grants to companies exploring new battery chemistries for EVs this year.

And as we covered at the end of December, the Inflation Reduction Act has ignited a manufacturing miracle with companies bringing their manufacturing, especially for batteries, back onshore. Since that newsletter a few weeks ago, there have been another handful of billion-dollar factory announcements.

Nor is the U.S. the only country focused on stimulating investment in companies building out domestic material supply chains. Northvolt, a European battery production company, took home the largest round of venture funding of any company in 2022 ($1.1B).

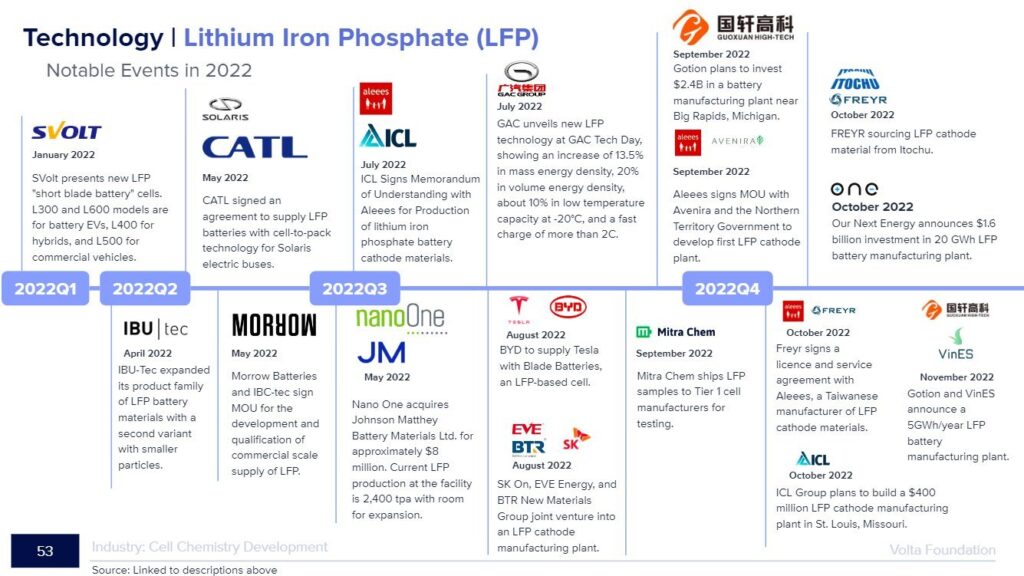

The most acute shortages will also spur innovation. Perhaps the most concentrated metal globally is cobalt – 70%+ comes from the Congo. That’s why EV manufacturers are increasingly scaling battery chemistries that omit cobalt altogether. Last year, more than half of new Tesla’s included lithium-iron-phosphate batteries. And Ford is following suit, as are all of the companies in the below graphic from Volta Foundation’s 2022 battery report:

The net-net

Regardless which climate technologies scale, we’ll never be out of the woods in terms of material and supply chain constraints. Frankly, we’re just entering the woods with respect to metals and minerals.

But climate tech is all about responding to foundational constraints. The chief among them being that we can’t burn fossil fuels forever.

Regarding which solutions to prioritize, there are no panaceas, just tradeoffs. Some tradeoffs offer net benefits. Quantifying those net benefits isn’t easy, and they can change over time. 20 years ago, the net benefit of a solar panel was much lower than it is today. People have gotten better at building them since.

Onwards, with an ever-open mind.