10 January 2023 | FinTech

$100M Fund for Diverse Fintech Founders

By

Few funds have moved millions of dollars in the direction of diverse founders in fintech.

But last week, Latinx and women-founded Mendoza Ventures announced its first close on its third fund. The $100 million fund will back fintech, artificial intelligence, and cybersecurity companies focusing on women and diverse founders and teams.

Can I get a, hell ya?

The anchor funding comes from Bank of America as part of their commitment to advancing racial equality and economic opportunity, of which over $400 million is allocated to investments in mission-focused venture funds. Bank of America has also backed firms like Serena Williams‘s Serena Ventures and Harlem Capital.

Led by Senofer and Adrian Mendoza (with an assist from Senior Partner Asya Bradley), the Boston-based venture capital firm says it allocated 80% of its second fund to underrepresented CEOs.

The VC has put its money behind startups like Listo, which delivers financial-services products, including loans and insurance to the Latin American community, and Daylight, a neobank that serves the LGBTQIA+ community.

Why It Matters

Often, founders or investors may start their companies or funds with the vision of serving an underserved population, but the pressure to scale and become profitable can be so enormous it distracts from the original mission.

Mendoza’s leadership understands that scale and inclusion are not binary choices.

“The good thing about inclusion is you can include people in almost anything, especially fast-growing companies,” Senofer shared with me over email. “The fastest path to inclusive success is open the door to someone unlike yourself as part of the fabric of your company.”

What happens when inclusion is at the core of your company?

When it’s part of your raise, it will become your board.

When it’s part of your hiring and retention, it will become your company.

“Prioritize it. If that is seen as a potential barrier to success, I would argue that commitment was lacking, to begin with,” she said.

*drops mic* 🎤

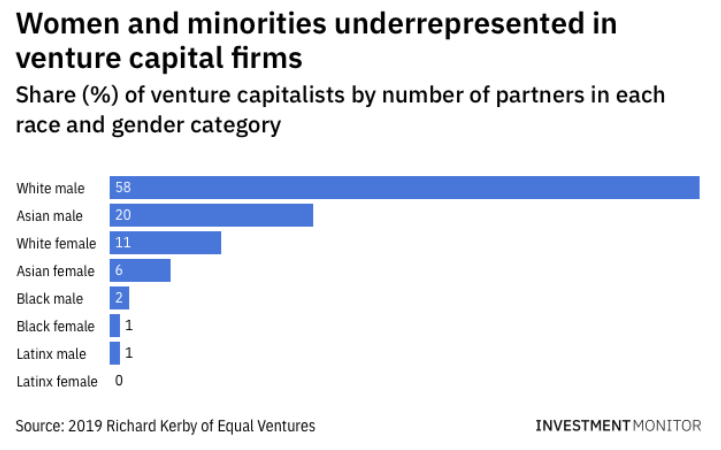

Venture capital still looks something like this 👇🏽

Mendoza Ventures proves that intentional inclusion at a firm’s core is 1. Possible, and 2. Profitable.

But when leadership at VCs needs more diverse perspectives, inclusionary practices are more challenging to implement.

Civil rights protections are vital to the fabric of our society. Therefore, industry leaders should extend those civil rights protections to the consideration of an investment decision.

Then extend those protections to the hiring processes. If that happened, there would be a diverse practice and investment portfolio.

But since that isn’t explicitly stated in law, the industry’s culture is severely at stake.

That’s because when a majority of funding dollars (over 70%) go to white-male founders, it causes everyone else to have a scarcity mindset.

That is one of the biggest threats to cultures because successful – diverse – people are placed in a position where they have something to defend instead of feeling like they have something to share.

Mendoza is here to remove that scarcity mindset for the next fund manager or founder.

That’s the impact and where leaders focus their attention because the venture capital system was designed as something other than an inclusionary system.

But we’re trying to make it one.

Advice for Founders

Ok, so how do fintech founders power through? Senofer has some critical pieces of advice.

Remember good numbers. You must recognize a product that fits your customer base and makes you money. Unfortunately, there are a lot of empty promises in fintech. So if you can get yourself to product-market fit as quickly as possible and prove what you’re doing, you will survive this market.

Take a tech break. “Stop LinkedIn scrolling for five minutes,” she said. Instead, focus on what you can do today to ensure you have a business tomorrow. If you do two quality things today to ensure you have a better business tomorrow, that’s a good day. Just keep doing that, and you will end up ahead of the class.

As for policymakers, it’s hopeful to see regulation around venture capital at the federal level. Reducing barriers to entry for women and underrepresented groups looking to enter the ecosystem is essential.

A few immediate steps can be taken at the federal level to meet the needs of women and diverse groups:

Education: Prioritize early access to financial and investment education for girls and students of color. This is central to ensuring a pipeline of entrepreneurs and venture professionals ready to step into partner-level positions.

Reducing barriers that limit the participation of women and minorities, such as the high cost of child care and networking with established VCs, will help promote new entrants into the industry.

Disclose demographic data: Require firms to disclose demographic data connected to their hiring, promotion, and deal-sourcing practices that can boost accountability and communicate a firm’s priorities.

Future Investments

2023 is the year fintech meets the real world, an exciting development because it signifies the maturity of our industry.

“Revenue-positive, healthy companies will thrive as the well-funded academic exploration of a market will fall by the wayside,” Senofer said.

The VC is anticipating lots of development in climate tech, a space they are actively exploring as a firm.

Inclusive tech is also here to stay.

“As the idea that everyone needs a bank account, an ability to spend, save, and budget, is not revolutionary, we are excited to see fintech meet the population as institutions and startups continue to partner proactively,” she said.