18 October 2022 | Climate Tech

The name’s bond. Green bond.

By

In recent weeks, there’s been more chatter about green and sustainability-linked bonds in climate finance circles. The two sound similar but can be markedly different in structure as well as in impact:

- Green bonds are debt instruments that raise money for ‘green’ projects, whether building renewable energy or pursuing other forms of decarbonization.

- Sustainability-linked bonds, meanwhile, refer to any bond that includes a covenant (fancy word for rule or commitment) related to sustainability in some way (a lot broader than green bonds).

Bonds are a form of debt financing; when companies issue them, the capital they receive from investors isn’t in exchange for equity. Instead, the issuing company promises to repay the amount borrowed at a later date, plus interest along the way, and usually commits to other covenants (i.e., that it will do certain things and won’t do certain other things until it has repaid its debts) as well.

While green bonds raise money for more concrete projects and real-world applications, the less stringent sustainability-linked bonds tend only to require some sustainability goal or target from the issuer. In practice, depending on how ambitious these bonds’ covenants are, some are indeed quite impactful, whereas others are ‘sustainability-linked’ in name only.

There are, unfortunately, plenty of examples of companies setting soft targets that aren’t hard for them to attain while still extolling the virtues of their ‘sustainable’ debt issuance. One study found that of recently issued sustainability-linked bonds, only 47% included targets that were core to the issuer’s business. For a concrete example, Bloomberg dug in this week and cautioned against a new issuance by Carrefour, a multinational retailer, saying its covenants offered little in the way of meaningful climate action.

Onwards. Focusing back in on the more impactful green bonds, the past week and month in particular have been big for new issuance and announcements.

On the company side, two renewable energy developers, Adani Green Energy and Tata Power, both out of India, announced their intent to raise money for new renewable energy projects via green bonds. Together, their bond issuance will total more than $1.3B. Nor is this either companies’ first issuance.

And green bonds are a thing for U.S. companies, too. Last month, Union Pacific, the railroad giant, raised money via green bonds for its decarbonization efforts, which include reducing Scope 1 and Scope 2 emissions 26% by 2030 (from a 2018 baseline).

On the sovereign side, the sovereign wealth fund of Saudi Arabia raised $3B last week in its first foray into green bond issuance. It will use the capital to invest in renewable energy development (while maintaining significant stakes in oil and gas companies, like Saudi Aramco, in parallel). And India plans to issue its first green bonds later this year. Almost 40 countries (~20% of all sovereigns) have issued green bonds in recent years.

Why am I reading this now?

Why do companies care about issuing green or sustainability-linked bonds in the first place? The answer is that it can offer cheaper financing than equity or traditional debt, especially in this volatile macro market environment.

For one, there are big pools of capital globally earmarked for ‘green’ investments. There’s also a whole realm of concessionary capital, i.e., capital for which investors explicitly acknowledge they’re willing to pursue lesser returns in service of other ends, like sustainability. Further, while equity market volatility has made investors more parsimonious, green bonds and sustainability-linked ones are easier vehicles with which to raise funds. This dynamic is likely driven by the fact that investor appetite in climate tech and renewable energy has largely withstood the shocks roiling the rest of the market.

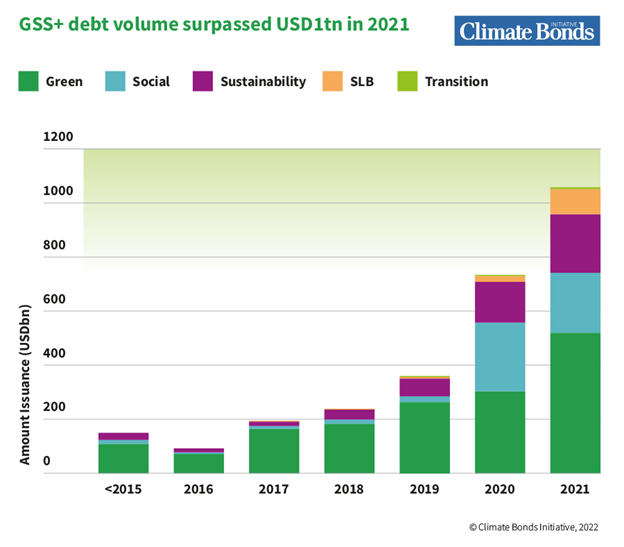

If this seems like a niche area of climate finance, it isn’t. While it was a small pocket of international finance a decade ago, green bonds have enjoyed a meteoric rise since then. In 2021, entities issued more than $1T in green + other ESG-linked debt. And green bond sales have been strong in recent months.

The net-net

Green bonds and sustainability-linked ones are critical financial tools for the energy transition and climate tech. Debt markets globally are bigger than equity markets; it’s always been surprising to me how the reverse is true in media coverage. It’s also critical, however, that these bonds come with ambitious goals (not just a checkbox for companies to pass with flying colors). That requires investors and bond rating agencies to review them more judiciously… which spells opportunity for platforms to provide better data and evaluative tools. Who’s building global green bond diligence software?

Watching different global regions engage more with this fundraising mechanism is also interesting. Seeing India plan its first green bond issuance makes me wonder whether there isn’t a more significant opportunity here. I’m thinking along the lines of using bonds as a middle ground between the climate reparations many developing countries would like developed countries to pay them and what developed countries are willing to commit to.

In practice, it’s been hard to get any countries to pay. But buying sovereign bonds is already commonplace for countries’ banking systems. Perhaps bonds with low-interest rates are the next best thing versus just being gifted money outright. We’ll see if anyone’s discussing that at COP 27 this year. If not, maybe we’ll have to pitch the concept next year at COP 28.