09 October 2022 | Climate Tech

Steely deals

By

It was a promising week in deals for hardware and innovating new industrial processes. We won’t get to all of the relevant deals that fall into that category – Molten is an honorable mention – but we’ll get to a few key ones. To start, Electra raised $85M to reduce iron from iron ore without the high heat typically characteristic of that industrial process (think 1400° C). That’s a huge opportunity – steel production accounts for 7% of global emissions annually, and steel is obviously not going anywhere.

Of course, success will depend on a lot more than just proving out the technology. Steel production represents up to 1% of global GDP. Making inroads and commercializing a fundamentally different production process for a massive industry like that will take time.

But perhaps we’ll look back on Electra’s innovation a century from now the way we do with something like the Haber Bosch process. Which is to say that industrial techniques can have serious staying power when they’re efficient. Comparable efficacy and ease are required of any attempt to convert manufacturers from existing practices to zero-emission ones.

On to the next deal. Maybe Electra can team up with Form Energy, who raised a whopping $450M for their iron-air batteries this week. Adding more energy storage to the grid is one of several vital components to electrification – the other critical ones that come instantly to mind are more renewable and zero-emission energy production and more transmission to move energy around.

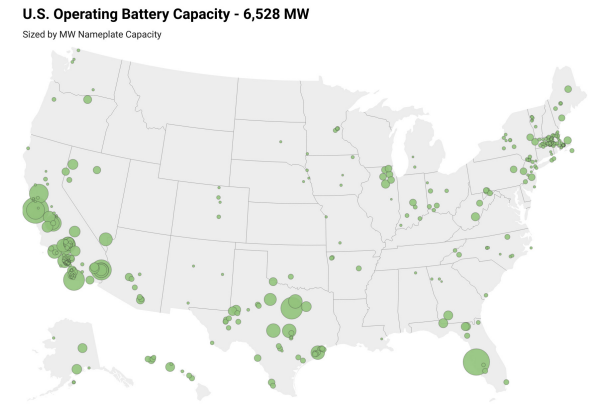

Battery energy storage systems (‘BESS’) are already taking off in many places as an excellent complement to energy generation from solar and wind. A first-of-its-kind hybrid wind, solar, and battery energy storage system power plant recently opened in Oregon. On the whole, California is leading the charge in terms of BESS capacity. During recent heat waves and peak load periods, batteries supplied more than 3 GWs back to the grid, more than 5% of California’s peak electricity demand.

Still, batteries have a long way to go. Most utility-scale energy storage in the U.S. is still based on gravity, not batteries – there’s nothing wrong with pumped hydrogen. Still, it’s not always feasible to site, especially when the western U.S. is already in the midst of a megadrought. And many batteries are dependent on increasingly expensive materials like lithium. That’s why Form Energy’s iron-air batteries are promising. Given the size of the iron and steel industries, there are fewer supply chain constraints building that type of battery.

The basic mechanic of the battery is based on rusting. To charge the battery, electricity is applied to turn rust into iron. To discharge the electricity, the battery is exposed to air, allowing it to rust again—pretty damn neat way to create multi-day energy storage. You can read in more depth on Form’s website here.

The net-net

As much as software businesses often make for more ‘investable’ companies (they lend themselves to the margins and growth rates venture investors clamor for), hardware engineering is the backbone of the climate economic transition.

You can have as many companies as you want that make selling, financing, or monitoring hardware easier. The need for new industrial processes and scalable, efficient, cheap technologies that perform critical functions without emissions, pollution, or a ton of waste will remain. For the wave of investing in climate technologies to drive actual climate results beyond purely financial ones, it’s essential that it funds the Form Energy’s and Electra’s of the world rather than over-concentrating on, say, EVs or carbon capture.