07 October 2022 |

Own the Pipes

By

Good afternoon! I have become fascinated by ‘pipes’ companies. There are a few companies out there that own the rails the world’s biggest businesses run on. Taiwan Semiconductor (TSMC), Amazon Web Services (AWS), Stripe — companies that build products so important, entire industries rely on them.

Which also puts them on the shortlist of most valuable companies in the world. At scale these companies are worth $100B+ and are as vital as electricity to the companies that rely on them.

You could even go so far as to say that without these companies, or companies like them, personal computers, fintech, even the internet might not exist.

So I started wondering… What do these companies have in common? And can I predict where the next Stripe will come from?

Well… Maybe.

Today we’re diving into the playbook for building a $100B+ infrastructure juggernaut.

Breaking the Hourglass

Tobi Lutke, the founder of Shopify, has a metaphor for infrastructure that I love. In his own words, from the Invest Like the Best podcast with Patrick O’Shaughnessy:

Here’s something I learned about infrastructure, which might sound very abstract, but maybe it’s useful.

If you imagine an hourglass. An hourglass has sort of a narrow waist at some point, maybe a comic book version of an hour glass is like two triangles, inverted pointing at each other. Great infrastructure can be done when you can define what this sort of narrow waist is between the triangles.

For instance, let’s use Stripe because it makes this point I think quite well. There’s one triangle on top, which is the internet, and all the engineers, and all the developers. They have a set of desires. They want to accomplish tasks, which involve movement of money.

And then there’s a bottom triangle, which is like a world of COBOL code in banks. There’s a lot going on. And a lot of things you need to know, but if you manage to create a thin waist in this case, in the form of an API, now you have an agreement in the middle. This almost acts as a protocol.

Here’s the fantastic thing. Once this protocol exists, it actually allows the two triangles to be replaced over time.

– Tobi Lutke, Founder and CEO of Shopify on Invest Like the Best

Two parties that want to build something new but can’t because the software that runs the underlying banking system is too damn complicated and hard to deal with.

Could a few big companies build great payments integrations without Stripe? Sure. Could a startup with a non-existent budget? I mean… Good luck.

But with Stripe all you need is 6 lines of code and you can accept credit card payments all over the world — from London to Tokyo and back. No banks required, just a 2.9% per transaction fee to Stripe.

Infrastructure makes hard things easy. It erases barriers to entry. By taking a super high up front cost that everyone in the industry must do, and turning it into a subscription service, they become a platform for new companies to launch off of.

Own the Pipes: TSMC → AWS → SpaceX

To go deeper we can look at the playbook run by three more of world’s best pipes companies — TSMC, AWS, SpaceX.

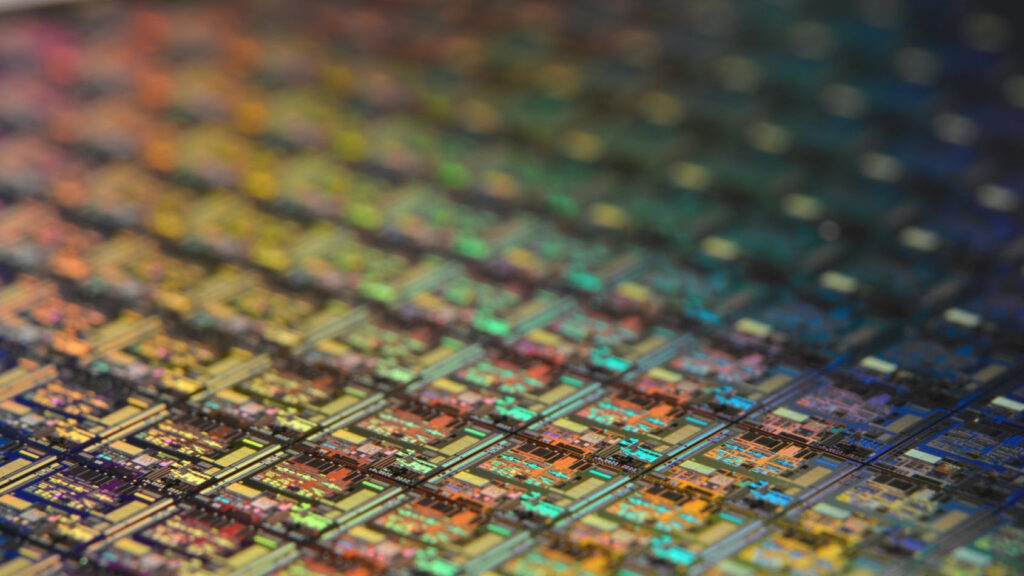

TSMC is the best silicon chip maker in the world. The world’s 9th largest company, valued at $620B with $38B in cash on hand their customers for silicon chips include Apple, Tesla, GM, Microsoft, Toyota… virtually everyone.

They did it by building silicon chip foundries in the ‘90s to fuel the personal computer boom. Before TSMC every computer company had to build its own chip foundries to turn sand into microprocessors. TSMC outsourced that massively expensive and complex process, unlocking the a new arena for dozens of startups. Today Apple designs its own chips but TSMC still manufactures them.

AWS invented the cloud. Today the cloud giant inside Amazon does $74B a year in revenue.

In the early 2000s when Amazon was building it’s own servers to support it’s growing marketplace business Jeff Bezos decided to turn that cost into a business in its own right – renting out server space to other companies. It was early — AWS launched their cloud in 2006, two years before Google Cloud in 2008 and 4 years before Microsoft Azure in 2010.

But by eliminating the headache and cost of building servers they became the cloud of choice for the coming internet giants of the ‘00s. AirBnB was one of their earliest customers.

SpaceX’s cheap and frequent launches have unlocked access to space, emboldening an army of space startups to strive to build the next trillion-dollar industry — in orbit. I’m not sure if Space will be the next internet but SpaceX is the perfect example of a killer pipes company. Before SpaceX ride-sharing there was nothing with a higher CapEx than getting to space.

Now SpaceX launches 3 rockets to space in a weekend. More importantly, it’s the only company in the world that can.

The AWS Playbook for Building a Hundred-Billion-Dollar Company

1. Find a new, booming industry

2. Find a high CapEx problem that prevents companies from starting or scaling

3. Sell the solution as a subscription, the easier the better

4. Iterate over and over and over again until no one can ever catch you

en and David over at Acquired recently described these kinds of businesses as unregulated utilities. They’re as necessary as internet connection but with none of that pesky government interference.

In this Acquired bonus episode, David references Jeff Bezos’ talk at Y Combinator in 2008 where Jeff tells founders to “Focus on making your beer taste better.”

It’s a reference to breweries in Germany at the turn of the 19th century that started to innovate by generating their own electricity using windmills and waterwheels. The headlines of the day said that the backwards breweries that bought electricity from a utility were going to be left in the dust of progress.

But it turns out, generating your own electricity doesn’t make your beer taste better. So who won? The breweries that focused on their beer and not making electricity.

The thinking goes that YC founders should focus on their product and not building servers.

Of course Bezos while telling founders to focus on their beer, Bezos was building the electricity company.

A 10X Better Product

It would be ridiculously hard to beat Stripe at payments or SpaceX at rocket launch. They doubled down on their early lead and iterated on the product over and over again until they were 10x better than competitors. Then they kept iterating and building economies of scale until no one could ever catch them.

To give a concrete example from a Wall Street Journal article titled Dear Rivals, TSMC Can and Will Outspend You All:

“Taiwan Semiconductor Manufacturing Co. spent a record $30 billion last year on factories that churn out the world’s most-advanced chips. It seems that wasn’t enough. This year, it’s decided to up the ante by forecasting a budget of as much as $44 billion. Rivals better watch out.”

The reason the product has to be so good is because these businesses don’t work the same way if there are 20 competitors on the market with products that are nearly identical and just as good. You go from being AWS to a commodity. Like a bank. There are lots of banks and banking is not a bad business. But it’s different.

So good no one could ever catch them… If super high quality search became incredibly simple with off the shelf technology, could startups disrupt Google’s search business?

One thing that disrupts monopolies is tech paradigm shifts. Gas lighting to electricity. Mainframe computers to personal computers to mobile. Blockchain enthusiasts would tell you social networks to web3 token-based networks.

What Pipes Companies are NOT

A tools company, a marketplace, or a network

Zoom is a tools company. SasS companies are typically really good tools. For communication (Slack and Zoom), for productivity (Notion and Asana), and for accounting (Quickbooks). They have killer margins great retention and, in some cases, viral product-led growth mechanics, but they’re rarely core infrastructure that’s central to production. In the way that say, silicon chips are to Apple.

Google on the other hand is a pipes business. It is the infrastructure that the internet runs on, at least for consumers, and it’s probably the best one.

Google checks every box:

- 10X better product. We see you Bing.

- Google was founded in 1998 to make the internet discoverable to users on their new personal computers. I think the internet counts as an industry that ‘boomed’.

- Search was a really hard problem when Google got started. It still is we just don’t notice because we use Google.

- Not a subscription but free with advertising which is arguably even better (A subscription suppresses growth whereas anyone and everyone can use free)

You could argue Facebook is too — with a B2B advertising lens. Facebook and Google are the only places to spend ad budget.

Where Will the Next Great Pipes Company Come From?

The answer depends on what you think the next massive industries will be. Web3? AI? Clean energy? Biotech? In my next essay, I’m writing about one company that might be the next great pipes company in biotech.

Culture Bio is the TSMC of protein engineering. Founded by a former Google X engineer working on wild deep tech projects, Culture is building the infrastructure for the next revolution in biology.

For a sneak peek you can check out the podcast with Culture Bio here.

But let me know where you think the next great infrastructure company might get built? What’s the next big industry? Who should we be watching?