01 October 2022 | Climate Tech

Adding to the solar queue

By

For today’s deals in focus section, we take a detour from typical venture financing deals to explore a more significantly sized deal (in terms of watts and dollars, at least) from the world of project financing. Venture capital is but one slice of the climate tech capital stack. As we explored in this piece on Enduring Planet, a revenue-based financing firm for climate tech co’s, many other options exist for companies’ growth.

Most of the funding we focus on in this newsletter is at the level of the company; companies sell a portion of their equity in exchange for funds. There’s no reason individual projects can’t be financed as stand-alone entities, however. That’s essentially what project financing is. With project financing, the project in question is typically turned into a legal entity with its own capital structure. Financing projects themselves can lower the cost of capital for the project; lending to a company that manages many projects is complex. Lending to a single project can be more straightforward and less risky.

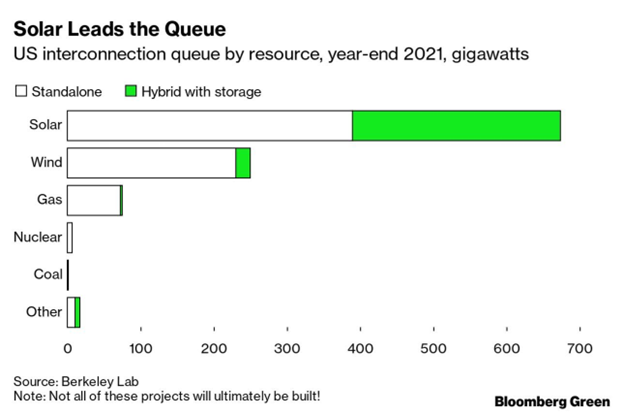

The assets for which Intersect secured new funding will amount to more than 2 GWs across solar capacity and battery storage. Add that to a queue of solar projects in the U.S. that amounts to more than half a TW of capacity:

The ‘interconnection queue’ refers to projects’ status as awaiting hookups to the grid. That doesn’t necessarily mean they’ve already been built or are even under construction. For perspective, the world only passed a TW of installed solar capacity this year. Globally, another TW will probably get built in the next 3-5 years, even though the first TW took about seven decades to materialize.

That said, it will take a while before all the projects in the pipeline in the U.S. get developed; permitting reform has been a hot topic, and the latest effort to overhaul legislation and expedite permitting reviews is dead in the water for now. Need a case study on why the U.S. needs permitting reform? Look no further than news out of New York this week. The Port of Albany forwent ~$30M in federal funding because the permitting process the project would have been subject to, given the presence of public funds, would have taken too long.

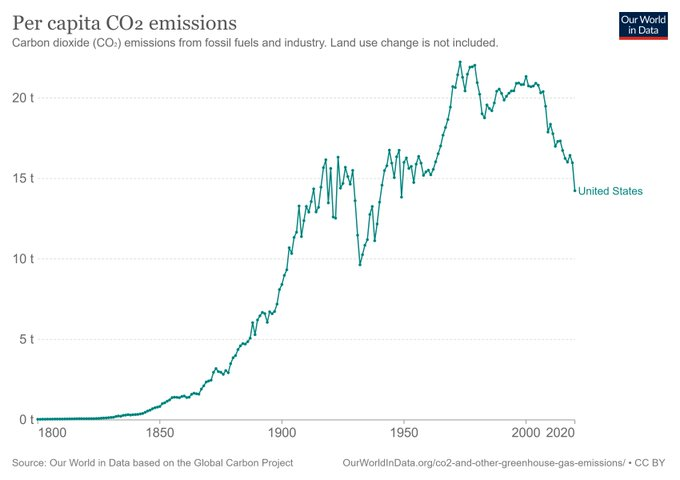

In any case, with project financing, Intersect should be able to sidestep some of the pitfalls the Port of Albany sought to avoid in forgoing federal funding. Most importantly, the massive amount of renewable projects coming online in the U.S. over the next decade, including Intersect’s, should drive a second wave of emissions reductions. The first wave of reductions in the U.S. (see below) was driven mostly by replacing coal with natural gas.

Now, when coal plants shutter, renewables are the ones to pick up their slack. A green wave of energy projects is here, driven mostly by non-venture funding.