29 September 2022 | Investments

Kim Kardashian Takes PE

By

PRIVATE EQUITY

Kim K Takes PE

Kim Kardashian and Kris Jenner have launched a private equity firm with Jay Sammons, a 16-year veteran of The Carlyle Group, one of the world’s largest PE mega-funds

They haven’t announced a fund size yet and are actively raising but we can assume Skky Partners will invest in consumer products like the ones the Kardashian’s have built already

Skims was most recently valued at $3.2 billion and in 2019 Kylie Jenner sold 51% of Kylie Cosmetics to beauty giant Coty for $600M

Distribution is Everything

The key to a winning direct-to-consumer brand is low customer acquisition costs (CAC). You have to get customers to buy your product but not break the bank on marketing.

Lulu Lemon famously spent almost nothing on marketing, instead connecting with local yoga studios and partnering with brand ambassadors to create an organic social media machine that spread the word to new prospective customers.

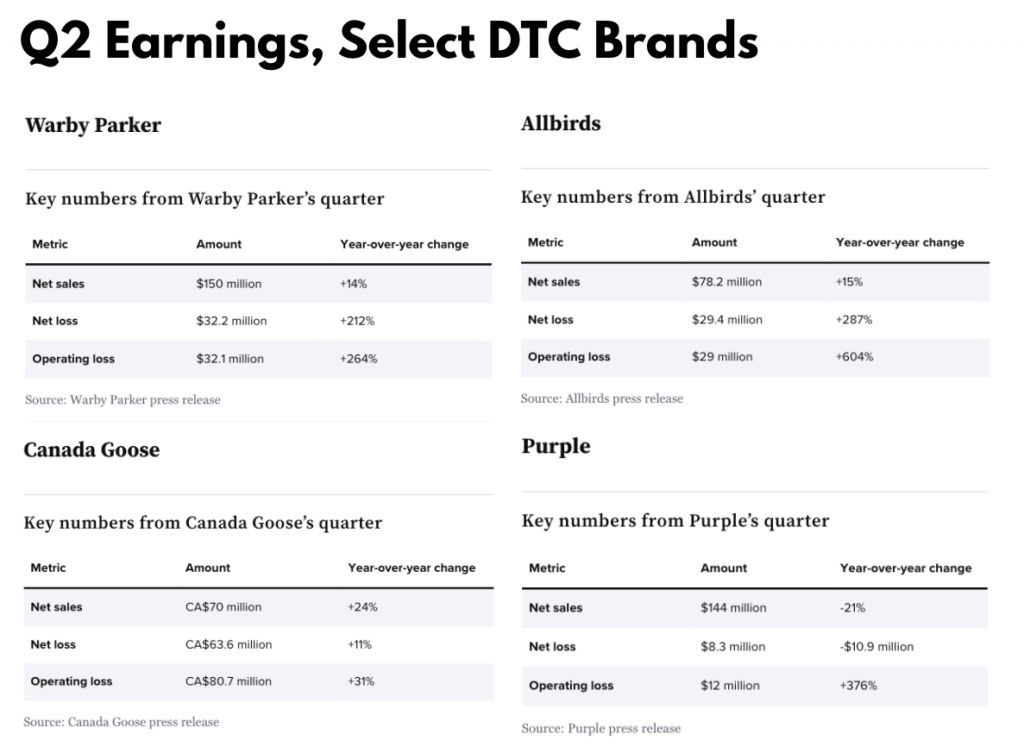

Lately, that kind of guerrilla brand building appears to have been forgotten by DTC investors and CEOs. Instead of slow, deliberate growth, DTC companies have opted for ‘blitz scaling’ — opening dozens of new stores and pouring capital into the marketing funnel — regardless of actual demand or nuisances like unit economics or profits.

The challenge is to not just grow but grow efficiently. But if you’re not going to spend millions on Facebook and Google ads, how do you get your product in front of new customers?

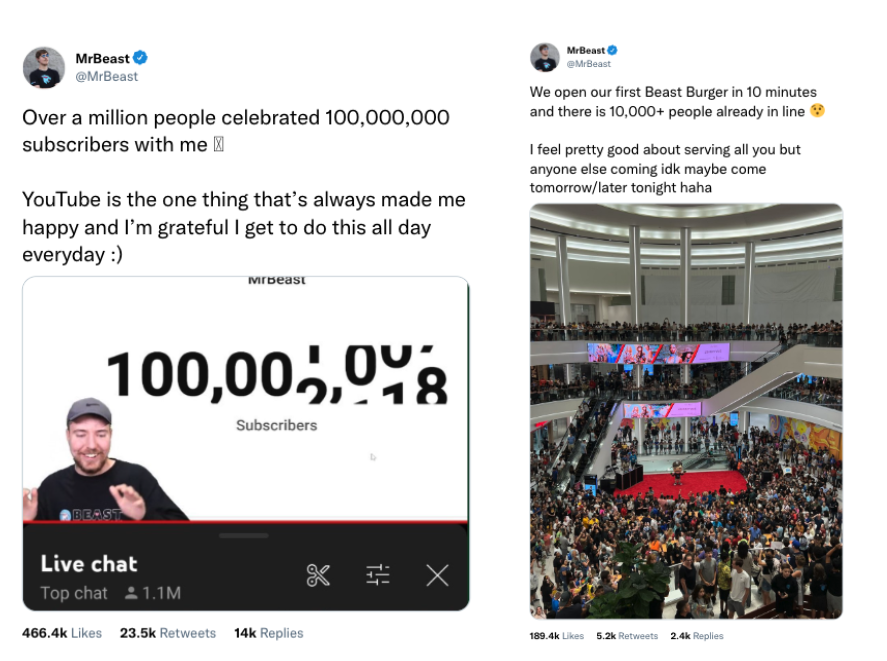

We’ve all seen stories about TikTokers selling out products but the influencer-ecommerce wave shouldn’t be underestimated.

With huge audiences, they can sell products more efficiently than any brand. When done right influencers are growth hack: higher sales and lower CAC.

As proof look at celebrity brands. The Rock’s Teremana Tequila sold 600,000 in its first full calendar year. It’s the fastest growing spirits brand in history because the Rock is the most loved man in America.

George Clooney’s Casa Migos sold for $1 billion in 2017. In 2014 Apple acquired Beats by Dre for $3B.

The greatest at this content-to-commerce trend is of course the Kardashians. When Skims launched in 2019 they sold in 10 minutes, netting $2M in profit. Three years later it was valued at over $3B.

The Kardashians are famous for reality TV but their real stardom probably came from Instagram, where they were first movers, adopting the platform aggressively way back in 2010. They mastered the art of the influencer before the coin was termed.

Now they’ve used that social media stardom to launch dozens of successful brands. Just as important, they’ve built an army of ecommerce, branding, and social media operators who can launch and scale just about any consumer product you could imagine.

Plus, private equity makes sense for DTC brands. Unlike VC’s that are looking for massive Facebook-esque returns on every investment (to offset the majority of VC investments that fail), PE firms are engineered for a lower risk/return profile. They also specialize in non-tech businesses which means they understand the COGS for physical consumer businesses and can skillfully lever up debt where useful.

VCs on the other hand specialize in pure software or mostly software with zero marginal costs. At least they used to. These days growth VCs and PE is blurring together.

Follow the Community

Last, there’s an argument to be made that building distribution — the audience — is the hard part of a DTC company. Amassing an engaged following of hundreds of millions is a lot harder than physically manufacturing a new line cereal or tequila or clothing line.

And it’s not just consumer brands that could benefit from influencer’s distribution. With the right audience any product could benefit from effective influencer marketing.

So maybe ‘community’ is a worthy investment thesis for VCs?

TLDR: Kim Kardashian is launching into PE to apply the Kardashian money printing machine to new consumer companies.

With an engaged audience of hundreds of millions and a seasoned team of social media and ecommerce operators her new firm could be a kingmaker for the next generation of consumer brands.

In Other News…

Reels comes up short. A new report from the Wallstreet Journal says Instagram users spend just 17.6 million hours a day watching Reels while TikTok users spend 197.8 million hours per day on the platform.

Starbucks launches a new rewards program with Polygon to bring loyalty points on-chain. This looks like it will be the largest deployment of NFTs and crypto by an incumbent non-crypto consumer company to date.

iOS 16 is ready to download. If you have an iPhone you’ll now be able to edit text messages and customize your lock screen. Not exactly Steve-Jobs-era revolutionary but an edit button is always nice. I wish I had one for this newsletter.

In November 2021, former Uber founder Travis Kalanick raised $850M for his new company, CloudKitchens and it looks like Microsoft joined the round, making them the only former Uber investor to do so except for the Saudi Arabian sovereign wealth fund. Not the best company.

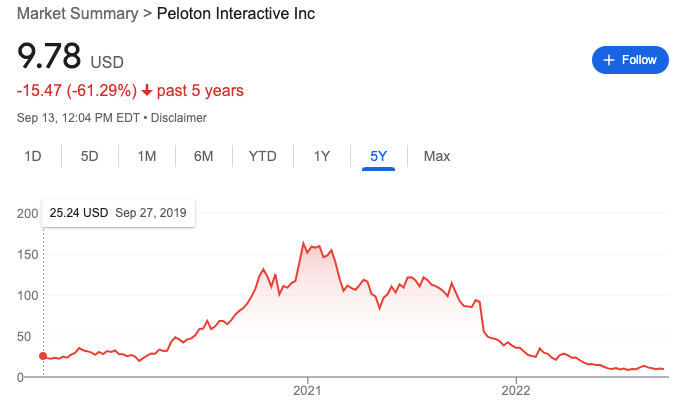

Peloton founder John Foley resigns as Chairman of the Board. Foley is a visionary who built Peloton but with revenue down 28% last quarter, on top of massive stock declines, it’s understandable to be looking for a change.

VC FUNDING

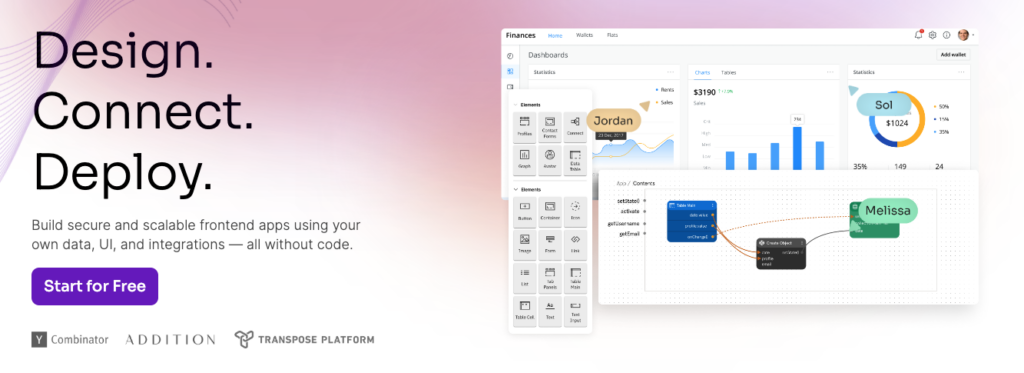

Raise: $15M from Addition

Addition: Lee Fixel made billions in early investments into Peloton and Flipkart at Tiger Global. In 2020 he left to start VC fund, Addition. Addition is a repeat backer in Uiflow after funding the $5.2M seed which is a serious vote of confidence.

One Liner: Automated front-end development

AI is coming for software developers and the first casualty will be front-end devs. Front-end development is everything a user sees. Websites and apps. Designers mockup what the app will look like and front-end devs put it into production.

But it isn’t terribly complex and for that reason companies have been chipping away at font-end for years. Wordpress, Squarespace, and Shopify all make it easy for non-developers to launch websites.

Addition is betting that Uiflow is the next step in that evolution. No-code tools for not only landing pages but any complex app. All backed by Uiflow’s complex AI.

Raise: $300M Series B from FTX

Including: A16Z Crypto, Jump Crypto, Binance Labs, Coinbase Ventures

One Liner: Tools for crypto developers

Consumers have taken center stage in the headlines about the crypto craze but the secret truth in Silicon Valley is that crypto is for developers.

The ability to write money into code is surprisingly new. Stripe built a whole toolset so developers never have to see credit card information in-app, freeing them from the brutal regulatory process that comes with managing consumer financial data. Even in fintech apps where moving money is the whole point, transfers between banks run on the ancient ACH system and takes 3 business days to process.

With crypto developers can write apps that move millions of dollars in an instant. That’s new.

Mysten is a product for them. They’re building yet another new blockchain designed to scale better than Ethereum and a coding language for writing smart contracts.

Raise: $38.5M from Emergence

Including: Homebrew, Inspired Capital, Founder Collective

One Liner: Phone call advertisements

Texts are the next great marketing channel. Text messages average a 90%+ open rate — which is wildly high and means text messages convert to clicks and purchases better than any other kind of ads.

Regal is another tool going after SMS but also outbound phone calls. Smart sales calls are so rare for consumers there’s a business to be built here.

In general, this sucks for consumers like us because it means we’re going to get a lot more texts and calls from brands. Regal is just is one of half a dozen startups that have gotten funded this year building text-based ads.

It makes you wonder, will consumers stop opening text messages if this becomes prevalent enough? Then how will we communicate?

ONE FUN THING: Chicken on Sundays

My friend the Wolf has a thing for franchises and he’s got an idea for a food truck…