27 September 2022 |

Canva’s Platform Ambitions

By

DESIGN

Canva’s Platform Ambitions

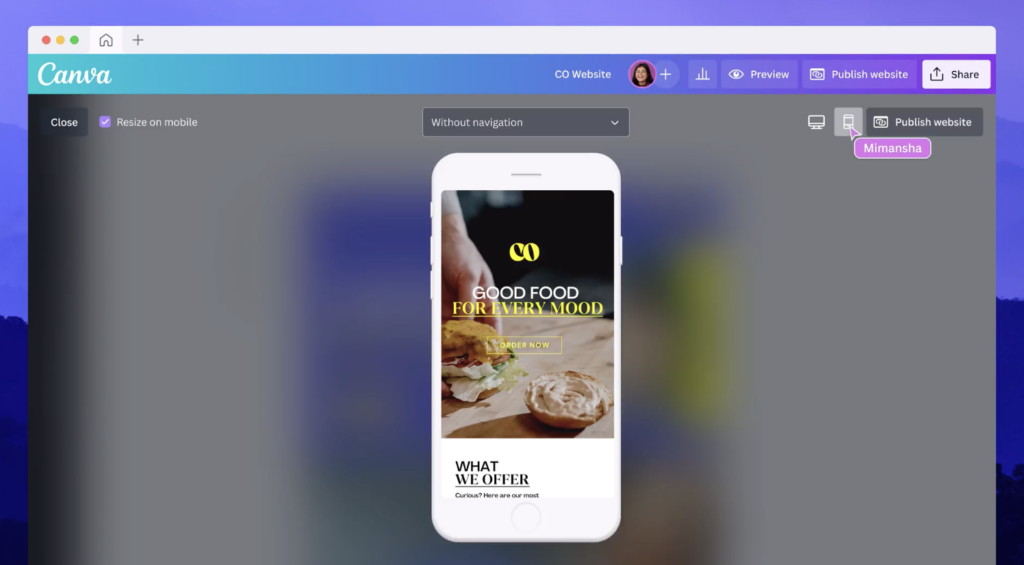

- Canva announces Visual Worksuite, a new set of tools expanding into Docs, Websites, Video, Slides, and Physical Products

- After Adobe’s $20B acquisition of Figma, Canva is the largest independent design platform

- The scope of Visual Worksuite is ambitious and sets Canva up to compete with google Microsoft, Google Docs, WordPress, Squarespace, and maybe even Shopify one day. It’s clearly management’s vision for the next stage of growth at the company.

Design Everything

Canva is design on easy mode. That’s not an insult, it’s a compliment. I wouldn’t learn to use Photoshop to write this newsletter but I use Canva for almost every single one.

It’s the design tool for non-designers. The long tail of people who didn’t major in design, who can’t use Photoshop, but who find themselves needing some visual thing for their job. Like me.

Now they’re expanding from ultra-simple design tools to a ton of new products.

Instant websites. Graphs and animations from data. Physical products like mugs, t-shirts, and posters delivered direct to your doorstep. It’s a big step and clearly management’s vision for the next stage of growth at the company.

What’s interesting is it’s also implementing the same mechanics we see from almost every tools company with ambitions to become a broader platform.

Canva’s Platform Playbook

Three best-in-class business mechanics Canva is embracing with this expansion:

Multiplayer: Like Figma, Canva was one of the first native web apps and is designed for collaboration. That creates team lock-in and a kind of virality that’s becoming a must-have for would-be platform companies. I was introduced to Canva by someone on my team years ago. Since I’ve introduced at least 3 people to it. A couple more if you count this newsletter.

User → Businesses Owner: Canva’s Creator Marketplace empowers users to share and sell designs, elevating users to build their own businesses on top of Canva. Great platforms are like little economies. Look at the $30B+ Youtube has paid out to creators in the last 4 years.

APIs and Developers — The new Developer Marketplace and API empowers developers to build new tools into Canva’s design system. Probably inspired by Shopify apps, Canva’s developer marketplace will create all sorts of new features for users and unlock another path for businesses to get built on Canva.

The Price of Doing Business: Canva will of course take a fee from all businesses that sell on the platform, User or Developer. Shopify charges app developers 20%. Apple charges app devs 30%. If platforms are little economies it’s good to be the tax man.

Tellingly, these mechanics are the same ones embedded in Roblox’s recent announcements — expanded social/team features for users, expansion of the creator marketplace, and investment into the developer ecosystem. Both companies are taking strides to become larger platforms.

All Canva’s missing is the last piece of mature platforms: ads.

Simple VS Powerful

While I use Canva and you probably do too, professional designers don’t. They use photoshop because there’s so much more you can do with it. That’s the core tension of product design: Simple or Powerful?

If you build too many features you have Photoshop — extremely powerful but not accessible and ridiculously hard to learn. If you build too few it doesn’t solve your customers’ problems.

Threading the Needle: So far Canva has threaded the needle perfectly and built a tool used by 85M users. The question is whether they can maintain that simplicity while building products powerful enough to compete with Microsoft and Google. Or while building a marketplace of tools built by independent developers?

If yes, Canva’s future looks very bright.

Note: Excel is the perfect example of a tool that’s simple but powerful. It’s why as Packy McCormick said in one of his first big posts: Excel Never Dies

FINTECH

$5 Real Estate

- Landa just raised $25M from NFX and 83North for a new consumer real estate investing platform where customers can buy shares of a single family home for as little as $5.

- Fintech startups are raising in droves to reinvent consumer real estate. Forerunner and Jeff Bezos just backed Arrived which does the same thing — selling shares in single-family rentals for as little as $100.

- Pacaso, a fractional real-estate platform where you can actually stay in the homes you invest in has raised $215M in less than 2 years.

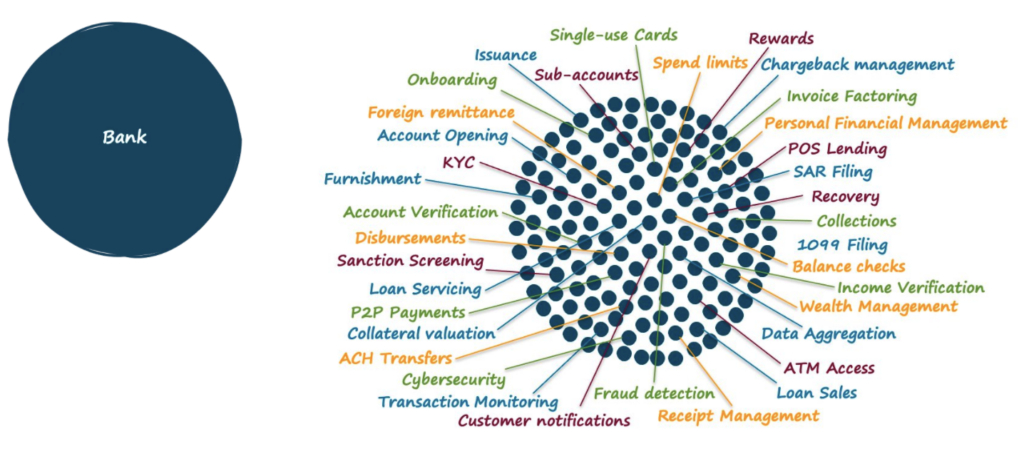

The Great Unbundling

Finance is getting atomized. Once there were banks. Now there are hundreds of fintechs competing for every single product banks provide.

SoFi got its start in student loan refinancing. Robinhood is a stock brokerage. Chime does consumer checking accounts. Mercury does business checking accounts. Everyone does credit cards.

I guess it’s not surprising that if companies like Whatnot and Alt that sell Pokemon cards are raising hundreds of millions you’d see the same unbundling in consumer real estate investing.

A RIET By Any Other Name…

Has the same return profile. Landa and Arrived are basically consumer REITs.

REIT — Real Estate Investment Trusts are companies that buy real estate, lease it, and then pay out rental income to their investors.

Publicly traded REITS own ~2.5T in assets and own or manage over 500,000 properties. Historically they have a better return profile than bonds and are less risky than stocks.

What makes Arrived and Landa a little different is that instead of invest in a pool of real-estate (boring!) consumers can invest in specific homes. That lets you bet on a property and a market like Miami or Austin.

For the Landa and Arrived though, the mechanics are exactly the same as managing a REIT — they get paid a management fee on every property.

Pacaso is different, they let you buy a fractional share of a vacation home and actually go stay in it based on how much you own.

For example, for just under $800k you can buy 1/8th of a $5M mansion in Breckenridge CO. You can only use it for 6.5 weeks a year but how often are you going to be in Colorado anyway?

Most importantly, you can sell your share when you want liquidity.

Like Landa and Arrived it’s a new take on an existing experience that’s currently full of friction. In this case, fractional ownership of vacation homes, which is already pretty common is ski resort towns like Breckenridge. It’s basically a new-age time share.

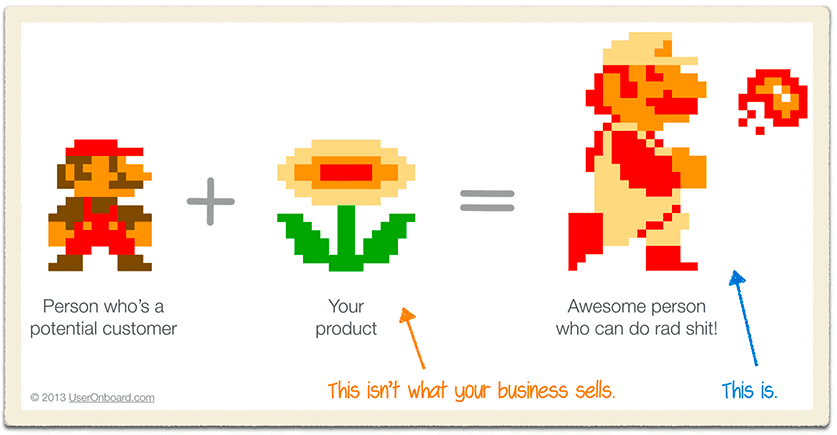

Takeaway: Like most fintechs these startups aren’t inventing anything new. They’re putting a new wrapper on existing financial products.

That isn’t to say they won’t be successful. You could make an argument Amazon just put a new wrapper on Sears or Barnes and Noble.

What is unique is how they’re making these products accessible to consumers. The low barrier to start investing — just $5! — and the consumer-friendly brands make it possible for anyone to invest in real estate this way. That may be worth investing in.

In Other News…

Big tech is making cuts. Meta plans to ‘cut costs by 10%‘ and Microsoft CEO Sundar Pichai wants the company to be 20% more efficient. Is this the end of big tech’s free sushi lunches?

Youtube is going to start paying Shorts creators in a bid to compete with TikTok. Any creator on Youtube Shorts — Youtube’s short form video TikTok clone — with over 10M views in 90 days can earn 45% of advertising revenue seen during their shorts

Elon Musk was supposed to be deposed by Twitter lawyers today. Twitter canceled but the trial is on for October 17th. If Twitter wins Elon will be forced to buy them for $44B.

Tencent is NOT selling shares in Meituan and Didi. Over the past two decades, Tencent’s management team has made some of the best investments of any company. They own stakes in Epic games the make of Fortnite, Discord, Flipkart, Reddit, and Roblox.

Chamath Palihapitiya unwinds two SPACs. On the All-In podcast he pointed out that SPACs take months to identify and at least 6 months to close. In today’s market know one knows what a fair price will be in 12 months.

ByteDance’s announces a new VR headset. Bytedance seems insistent on competing with Meta on every possible dimension. Their new Pico VR headset will sell in every market except the US and be $425 compared to $1,000+ for Meta’s next Oculus.

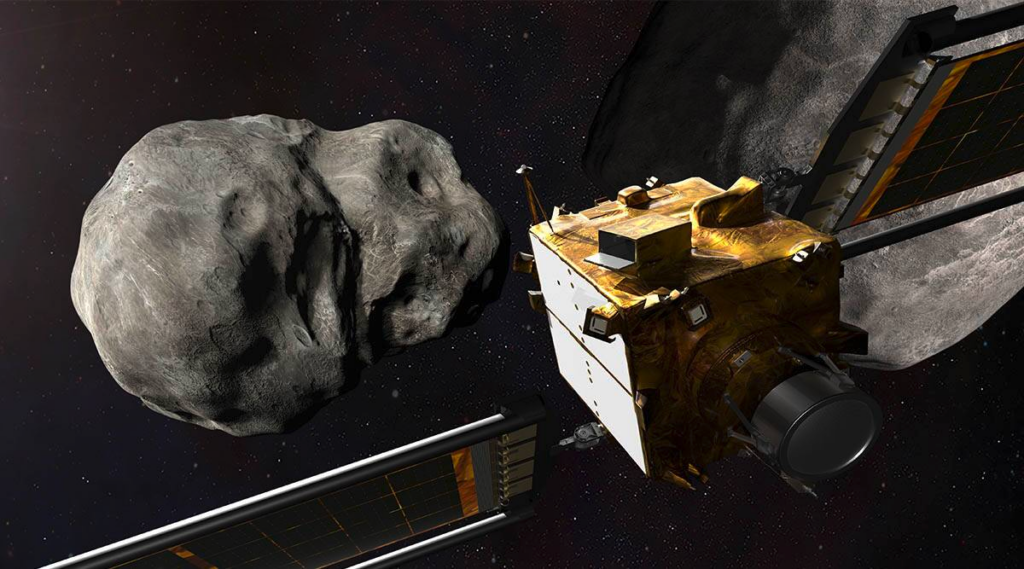

NASA’s DART spacecraft crashed into an asteroid yesterday — on purpose. It was the first test of a planetary defense system designed to redirect asteroids. So we won’t go out the way the dinosaurs did. It worked perfectly and everything blew up.

TWO FUN THINGS

How to build the best ecommerce site on the web. Hint: Ultra-simplistic design.

On the topic of housing, generative AI is rapidly advancing and may just be the next big wave in tech. My favorite project I’ve stumbled on so far: This House Does Not Exist.