06 September 2022 | Investments

Paramount Global: The Momentum Continues

By

Partnering With:

Hello from London, England (again)!

What a trip it has been. Arsenal game, National Gallery, Churchill War Rooms, (too much) great food, and a whole lot more.

Quick (bad) England inspired joke before we get started:

“If American websites use cookies, do British websites use biscuits?”

Showtime!

Want to get these in your inbox to never miss an edition? Subscribe to The Crossover today!

Paramount Global

Introduction

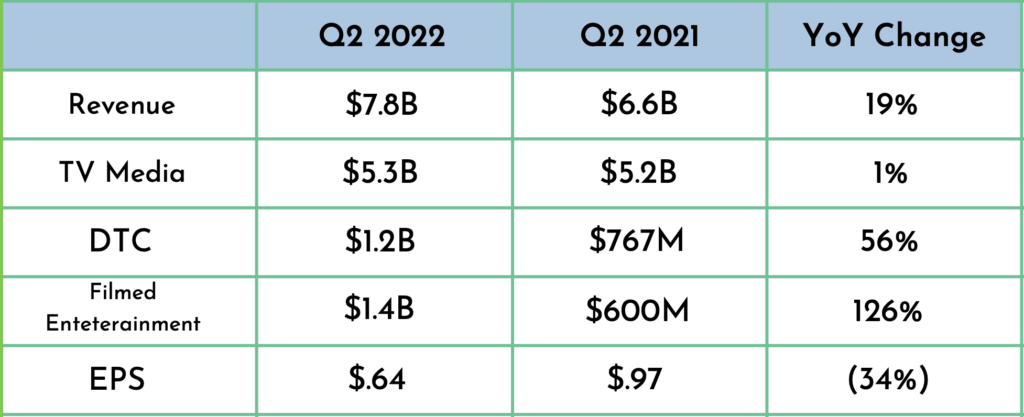

Let’s take a quick look at Paramount Global’s Q2 earnings:

Overall, it was a very strong quarter for Paramount:

- Revenues grew 19% YoY (Thank you TopGun!)

- TV Media was consistent, DTC revenue saw strong growth

- EPS as expected continues to be impacted by streaming – where $PARA lost almost $450M in the Q alone

Although the investment in streaming is expensive, the company is showing significant momentum.

Paramount’s DTC subscribers grew to 64M, reflecting the addition of 5.2M subs and a removal of 3.9M Russia subs.

Specifically, Paramount+ added 4.9M of the new subs and the total is over 43M, representing more than 2x the amount of subs the service had at the end of Q2 ‘21 (21.4M).

Additionally, PlutoTV, Paramount’s FAST (Free Ad Supported Streaming Television) service hit nearly 70M subs.

Two other thoughts before we go back to the bigger picture thesis on Paramount, specifically regarding international.

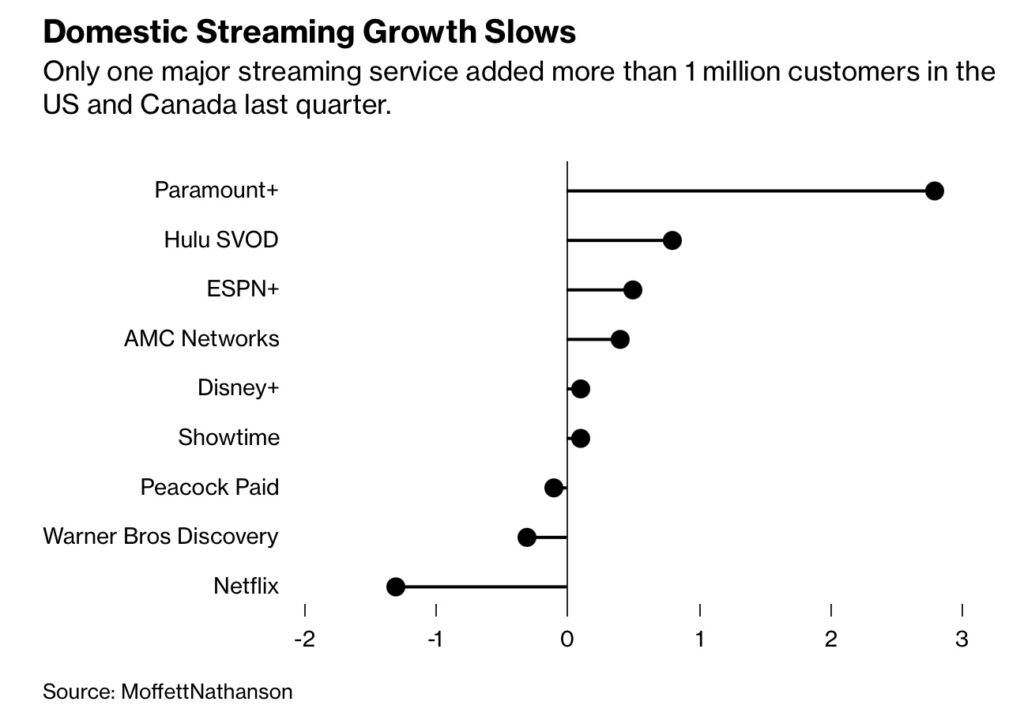

1. Domestic Growth

As you can see, Paramount+ has great momentum in the US domestically compared to other streamers. Yes, many of them already have significant scale, but specifically when you look at Peacock, P+ is showing they are on a whole different level.

2. The Fourth Quarter

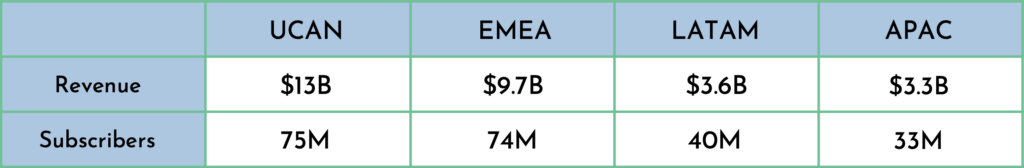

Despite what you might have heard at Disney World, we live in a very big world – specifically when it comes to streaming.

Let’s take a look at the breakdown of Netflix’s revenue by region for FY ‘21:

As you can see, more than half of Netflix’s revenue comes from overseas. It makes sense why we are all focused on the domestic Streaming Wars, but the real Streaming Wars are overseas and Paramount is poised to thrive.

Side note: I have noted before, but want to reiterate for the new subs just how strong P+ internationally is. Not only does it have all of the domestic P+ content, but also all of the Showtime content, Paramount Pictures films, as well as the key licensed content domestically like Yellowstone, SouthPark, etc.

Paramount is using a “hard bundling” model to access a critical mass of subscribers in the “flip of a switch.” They are partnering with some of their biggest partners in international countries to scale quickly and efficiently.

Some of the examples of these partnerships include Canal+ in France & Sky in the UK.

The bears would argue that this hurts the upside of the revenue that Paramount can achieve by using this distribution model, but I am much more focused on the speed and low cost that this model allows.

Paramount+ has launched:

- 2021 – LatAm, Australia, Canada, Nordics

- 2022 – UK, South Korea, Italy (Sep), Germany, Switzerland, France (Dec)

- 2023 – India

The speed of these launches are also important when you think of the competitive landscape – specifically with HBO Max/Discovery’s (Warner Bros. Discovery) international launch plans.

WBD planned launches:

- 2023 Fall – LatAm (39 countries)

- 2024 Early – Europe (20)

- 2024 Mid – APAC (7)

- 2024 Fall – “New Markets” (4)

Yes. The merger has a big part to do with why we will not see $WBD’s streamer oversees for a while, but it is so integral just how ahead Paramount is than the fierce WBD offering.

Paramount Global has set themselves up to truly be global.

Distribution

“If you look at the history of the company, you see that we’ve long been a believer in ubiquitous distribution and executed in that way. And so as we look at the D2C space, we believe ubiquitous distribution is a powerful lever to pull to drive access to largest potential TAM.”

-CEO Bob Bakish 4Q

Paramount Global has been on a tear signing trailblazing distribution deals with key partners.

Well, the first two weren’t trailblazing but important nonetheless.

- T-Mobile – In November ‘21, Paramount signed a deal with T-Mobile giving the 110M TMO (not to be confused with Timofy Mozgov. An incredibly niche joke.) subs a free year on Paramount+ on the ad supported plan.

- Amazon Channels – Paramount+ has consistently offered deep discounts on Amazon Channels and even doubled down while services like HBO Max started to pull their 5M subs off of channel to try and control the whole DTC relationship (something that Zaslav is changing). Paramount’s consistency with Amazon Channels enabled them to go even deeper with Bezos’s Baby (former baby?) by offering live channels on Amazon Prime Video’s homepage.

Here are the two trailblazing ones.

Walmart– Paramount+ and Walmart agreed to a deal that would give Walmart+ members Paramount+ access for free. The deal also included an exclusivity pact where Parmaount+ would be the only streamer that Walmart will do a deal with in the near future. This is a big time endorsement from Walmart.

Roku– Paramount+ would officially be carried as a premium subscription in The Roku Channel, but more importantly, will be a dedicated TV guide to all of Paramount+’s live channels. This means that it will be easy as 1-2-3 for consumers to watch the NFL or Champions League in an easy to discover manner.

Simply put – Bob Bakish & Tom Ryan (CEO of Paramount Streaming) are zigging while everyone is zagging, executing beautifully, and creating significant value regardless of what the market has to say.

Dividend & GARP

In a perfect world, I see GARP (Growth At A Reasonable Price) stocks with a nice dividend being a significant part of my investing philosophy. Why?

Because it makes too much sense.

If you can consistently find stocks at a 50% discount to true value with a low to mid single digit annual dividend, you will be an incredibly successful investor.

If this stock doubles, you will have a 15% CAGR over a five year period from principle alone and a few percent yield on top of that.

Again, you would be on your way to being the next Warren Buffett.

Who is BTW totally not Chamath Palihapitiya. If “King of SPACs” or “super hero to Robinhood crowd on Reddit” is what you call yourself, it is not you.

The issue with finding stocks like these is that they are very very difficult to find. If they were easy, everyone would be invested in.

Often times, GARP dividend stocks can be value traps, like many think $PARA is, however, the stability of legacy revenues, rapid growth in streaming, and consistent payout of the dividend gives me the contrary belief to the masses.

Until the market (hopefully) sees what I see, I will gladly collect my 4% yield and wait.

Speaking of Warren Buffett, Berkshire Hathaway acquired another 9.5M shares in Paramount Global in the quarter giving him around 78M shares in the company.

With Uncle Warren behind me, I feel very good about this investment and why this is the second biggest holding in The Crossover Portfolio.

-Alan

Chart of the Day

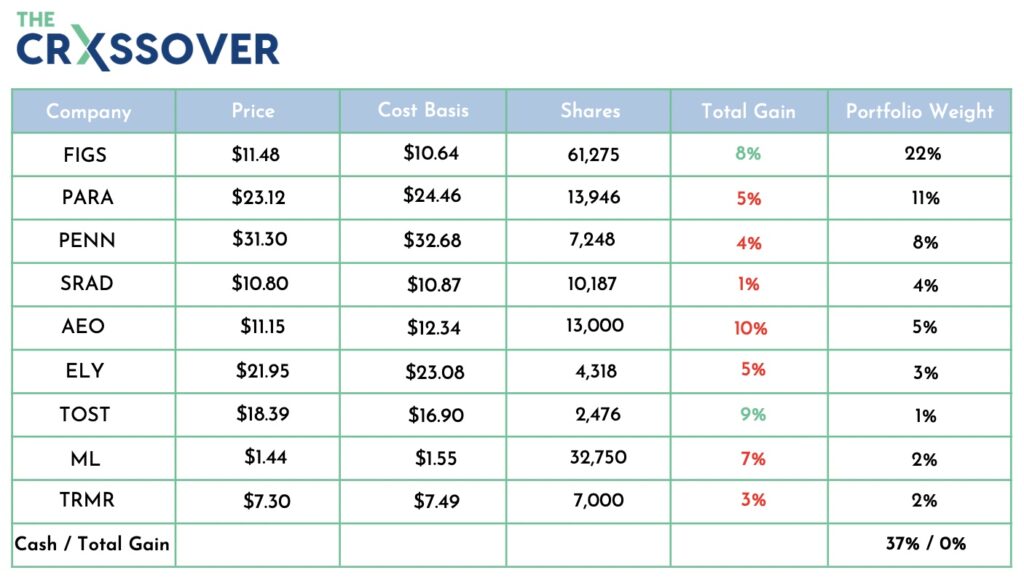

- Over the past week, we have continued to deploy capital into our current holdings as well as adding $TRMR to the portfolio.

- I have not figured out how to add the private investments into the portfolio without making it too long, so I wanted to share the investments here. We will go deeper on each of them @ a later date

- Lasso = $25K @ $16M valuation (10% discount) , SEQL = $40K @ 15M valuation, Barcode = $30K @ $25M valuation, The Zone = $30K @ $8M valuation.

In The News: US Dollar > Euro

The Rundown: For the first time in over 20 years, the US dollar is worth more than the Euro

3 Key Points:

- This move was triggered due to Russia sharing that they would be cutting off their main gas supply line to Europe indefinitely.

- The dollar index which compares the dollar to 6 major currencies also hit a two decade high

- Experts believe that struggles in global economy could continue to help US dollar and be deflationary for the USD.

Alan’s Angle:

This is a pretty big deal. The global geopolitical/economic landscape is incredibly unique with a ton of uncertainty baked in. There are two key thoughts that pop into my head after reading this article.

1. There is an opportunity for the US economy to stabilize and reassert ourselves and our dollar as the global standard.

2. Being in Europe currently, even with all of the bad news, it is hard to imagine a massive global recession. Yes it is obviously possible and many people smarter than me think it is a lock, but when you have your boots on the ground, it is clear the streets are full and the people are spending their money.

Golden Nuggets

- My fantasy draft could not have gone more differently than I expected, but I am very excited with the results!

- Picture of me @ The Emirates (Arsenal’s Stadium)

- Bought my first pair of Allbirds in London. Anyone else think they are a little too warm?

- Literally cannot believe what Albert Pujols is up to right now! Why is he retiring!

- The situation @ Klarna continues to worsen as losses quadruple

Meme of the Day

Thanks for the read! Let me know what you thought by replying back to this email. See you in your inbox every Monday and Thursday.

— Alan

Disclaimer: This analysis is for educational and entertainment purposes solely and is not professional investment advice. The author of this piece and/or members of Workweek media could be invested in companies discussed.