25 August 2022 | Investments

Beyond Meat (Public) vs. Meati (Private)

By

Partnering With:

Good Morning from New York, NY!

I am in the Big Apple for a sweet interview/demo of a venture doing something big in the sports world. Excited to share the piece in a couple weeks!

Warning: If you are already getting hungry for lunch, today’s edition will make you even hungrier. Let’s do this!

Showtime!

Want to get these in your inbox to never miss an edition? Subscribe to The Crossover today!

Beyond Meat vs. Meati

Introduction

On July 22, I read about a VC deal that was initially very confusing to me – Meati Foods raising a $150M Series C @ a $660M valuation led by Revolution Growth (Ted Leonsis & Steve Case).

Meati Foods is a company looking to compete with Beyond Meat & Impossible Foods in the alternative protein space. What makes Meati unique is that they are specifically focuseon chicken (currently) and their protein is made from 95% mushroom root.

Meati has shared their goal that they want to be the #1 market share leader in the US alternative meat market by the end of 2025.

The funds from the raise will be used to:

- Complete their 100K square foot facility

- Start shipping product in late

- Creating national omni channel footprint by the end of ‘23

So again. Why was I confused by this raise?

Let’s take a look at Beyond Meat and you will start to see why for yourself!

Beyond Meat

Beyond Meat, the meat alternative food company, was started in 2009 by Ethan Brown (a fellow University of Maryland alum!).

The company raised just under $200M in the private markets before IPOing in May ’19 @ a $1.5B valuation that netted ~$250M in cash.

After the IPO, the stock exploded out of the gates reaching a $13B valuation in just 3 months representing a 859% increase from the IPO price.

Remarkably, 3 years later, Beyond Meat finds themselves @ around a $2B valuation, $33 a share.

How? A confluence of factors including:

- Inflation/rising interest rates

- Increased competition (more on this soon!)

- Recessionary fears

When times get tough, people relay on old habits and look to hunker down. For a company like Beyond Meat looking to change the mind of the average consumer is especially a tough task in this environment.

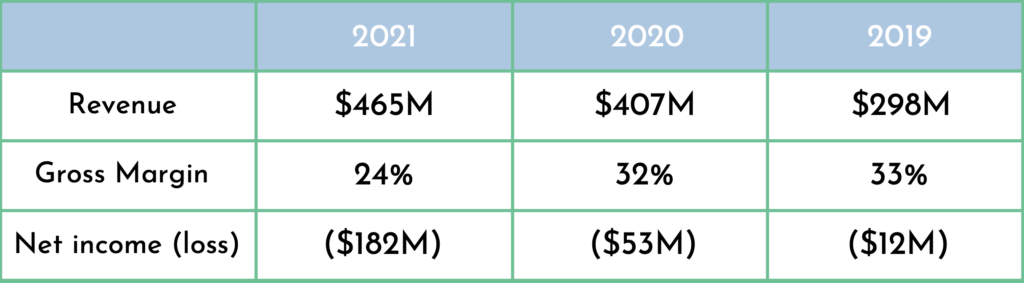

Next, let’s look at the company’s financials from the 3 past years:

As you can see, growth is slowing and losses are rising – you want the formula to be going the other direction.

Things in the first half of ‘22 have continued to get worse for Beyond Meat as they:

- Lowered revenue guidance significantly from $560-$620M to $470M-$520M

- Have lost $235M from operating activities in the first half of ‘22 (have $454M in cash remaining & $1.1B in debt)

- Announced 4% layoff of workforce

TL;DR – This is a tough time to be in the alternative meat space, even if you are at scale.

Not only will Meati have to compete against the juggernauts of Beyond Meat & Impossible Foods, but there is also serious competition from the big food conglomerates & smaller players as well.

Food Conglomerates:

- Kellogg ($23B) – Morningstar Farms/IncogMeato, $400M in US retail revenue in 2021

- Congara Brands ($17B) – Gardien – $140M in retail revenue in 2021, up 33% since 2019

Morningstar & Gardien are two giants in the food space backed by conglomerates that know food and know how to make money.

Another company to keep your eye on in the space is Quorn, a UK based meatless protein manufacturer.

Quorn is owned by Monde Nissin Corp, a Phillipeans based food conglomerate who had a $1B IPO in March ‘21. Over $335M in proceeds from the IPO are being used to fuel the company’s growth efforts in the US.

A lot of money is being spent to win the alternative protein wars and it has yet to be seen if there are profits to be reaped.

Alan’s Angle

Steve Case & Ted Leonsis are two of the smartest billionaires to ever walk the planet – and two people I had the privilege of hearing speak IRL. Thank you UMD!

Their VC fund is stupid good too. Their list of successful investments is filled with household names including: Draft Kings, StockX, BigCommerce, Clear, Cava, Custom Ink, Clear, and many more. Not bad.

Revolution is well aware of the concerns in this space and then some. So what could be their thought process?

Three theories:

1. Health

Believe it or not, Beyond Meat patties actually are not that much better for you than meat patties and in some ways are actually worse. Beyond Meat patties have 5x the amount of sodium as meat patties and a lot of chemicals too to mimic the meaty taste.

All of Meati’s PR emphasizes the health benefits to being a natural, 95% mushroom root based product high in protein and fiber. Revolution likely loves this.

2. Chipotle Ventures

Yup. You read that right. The greatest venture job in the world has officially been created with the launch of a Chipotle VC fund & Meati is one of their first investments. If Meati can execute and deliver a great product, we can all expect to see Meati in Chipotles everywhere, which would mean a ton of money and quick for investors.

3. Second Mover Advantage

Some of the greatest companies ever were actually not the first movers in a certain industry, but rather, the second movers. Second movers are able to learn from the journeys and mistakes of their predecessors and create a much more sound business on a whole lot less money.

Fun Fact: Amazon & Facebook are second movers in their own right.

Although I probably would have been to chicken to make this investment, I definitely can see the case of why someone would. I will make sure to keep you all posted on Meati’s trajectory as the company continues to scale.

P.S – I had real chicken for dinner last night, and now I feel guilty. Have a great day!

-Alan

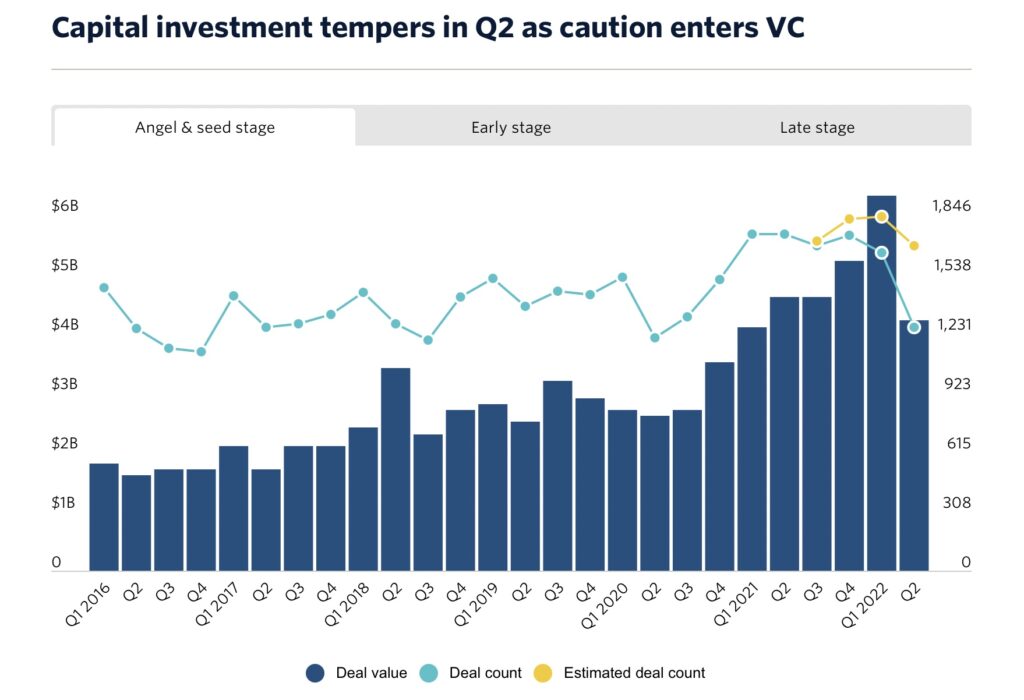

Chart of the Day

- Pitchbook has hooked us up with this great chart showing the trends in the angel & seed stage investment arena

- In total there was ~$4.2B invested in the US in Q2 in around ~1,250 deals

- This represents a significant decrease Q/Q, but from a historical perspective, the investments in the private markets are still strong!

- We are making some aesthetic changes to the portfolio. Will be back on Monday!

In The News: Julian Robertson Passes Away @ 90

The Rundown: Robertson was the founder of Tiger Management who turned $8.8M in 1980 into over $22B in 1998 through 32% annual returns

3 Key Points:

- Julian was responsible for teaching & mentoring the “Tiger Cubs,” a group of former Tiger employees that went to launch their own funds like Chase Coleman (Tiger Global), Philippe Laffont (Coatue)

- Ran the Tiger Foundation that provided more than $250M to help schools

- Where does the name Tiger come from? When Julian couldn’t remember someone’s name he would simply just call them “Tiger.”

Alan’s Angle:

Julian is someone I just started learning more about. He was a true stock picker and much of the current investing, specifically crossover investing landscape, was inspired by him.

As I discuss in the golden nuggets, I look forward to starting his book. Thoughts & prayers to the whole Robertson family. Rest In Peace.

Golden Nuggets

- John Adams, the legendary drummer @ Cleveland Indians/Guardians games growing up, was just inducted to the Guardians Hall of Fame. I am not crying I promise…

- Tiger Woods & Rory Mcllroy are launching a new next gen golf league

- Very excited to start reading this book about Julian Robertson’s professional career & Tiger’s secrets

- Shoutout to Kevin Carpenter for giving The Crossover a shoutout on our FIGS piece as well as his interesting analysis on Buffett & $OXY

Meme of the Day

Thanks for the read! Let me know what you thought by replying back to this email. See you in your inbox every Monday and Thursday.

— Alan

Disclaimer: This analysis is for educational and entertainment purposes solely and is not professional investment advice. The author of this piece and/or members of Workweek media could be invested in companies discussed.