22 August 2022 | Investments

Dragoneer: A Scorching Hot Crossover Fund

By

Hello!

How was everybody’s weekend?

As the summer is (unbelievably) dwindling away, it was awesome spending hours at the pool with some friends the past couple days.

In honor of the launch of House of Dragons (Game of Thrones prequel) yesterday, I thought it would be a great time to introduce you all to Dragoneer, the crossover fund with a similar name!

Showtime!

Want to get these in your inbox to never miss an edition? Subscribe to The Crossover today!

Dragoneer: A Scorching Hot Crossover Fund

Introduction

The more time I spend covering the crossover investing space, there is a common trait between many funds: They love to move in silence.

The last public interview I could find from Phillipe Laffont of Coatue is from 9 years ago. Tiger Global Chase Coleman’s? I still haven’t found one.

I absolutely love the “move in silence” mentality. Work hard. Stay in your lane. Don’t do it for the attention and fan fare.

Outside of the irony that I write a newsletter to a couple thousand people, it is something I believe in deeply.

Today, I want to introduce you to another crossover fund that loves operating under the radar: Dragoneer Investment Group.

Dragoneer

Dragoneer Investment Group was founded in 2012 by Marc Staad, a Stanford MBA alum who had prior experience working @ TPG Capital & Mckinsey.

According to Pitchbook, the San Francisco based Dragoneer has ~$24B in AUM. With over ~$5B in dry powder & ~$4B in public equities, ~$15B is invested in the private markets.

Stadd’s fund has done most of their serious damage in the growth equity space. Here are some of the funds’ notable investments:

- AirBnB – Invested $75M in $475M Series D in 2014 @ a $10B valuation. AirBnB ultimately IPOd @ a ~$40B valuation in 2020

- Instacart – Participated in $220M Series C in 2014 @ a ~$2B valuation. Instacart is expected to IPO later this year @ around a ~$20B valuation

- Uber – Participated in $8B private investment valuing Uber @ a $48B valuation in 2018. Uber IPOd in 2019 @ a $75B valuation

Other notable hits include: Spotify, Strava, Slack, Roblox, DoorDash, and many many more.

TL;DR – Dragoneer is stupid good.

Public Investments

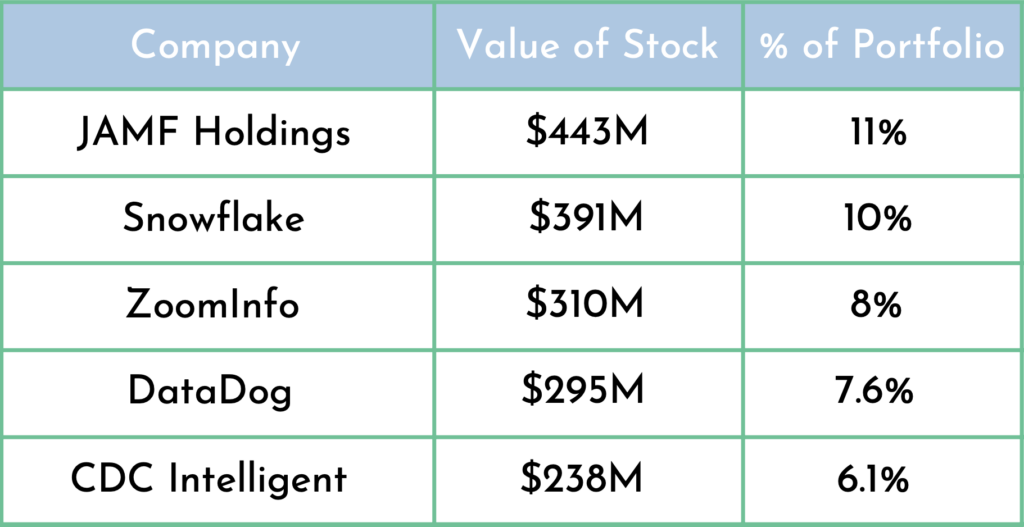

We know that Dragoneer has crushed it in the private markets, now let’s see where their bets are currently placed in the public markets.

As we mentioned earlier, Dragoneer has about $4B in public equities tied up in 39 holdings. Like many other crossover funds, Dragoneer has been tightening up their portfolio as the market took a turn for the worst as the 39 positions are a stark contrast to the 72 positions held in Q3 ‘21.

I specifically think the company’s bets on JAMF & ZoomInfo are incredibly interesting. Let’s double click on them.

JAMF & ZoomInfo

JAMF Holdings is a cloud software and security solution provider for organizations operating on the Apple infrastructure. JAMF helps their clients deploy Apple devices to clients and help enterprises get the most out of their Apple products.

Dragoneer originally purchased $50M of JAMF stock when they IPOd in July ‘20 @ around a ~$3B valuation. After buying significantly more shares post IPO, Dragoneer has an average cost basis of $34.67 currently.

The stock now has a $3B market cap and is trading @ around 10x sales (which are growing 30% annually consistently).

Some of their biggest clients include Salesforce, IBM, and GE. However, Apple launched “Apple Business Solutions,’ a competing service to JAMF putting significant pressure on the stock and could be a reason why Dragoneer sold 1.5M shares this past quarter.

Fighting against Apple, especially when you are reliant on their devices, is a dangerous game.

Barron’s had a great piece on the company a few months back if you want to learn more.

What is even more interesting to me is Dragoneer’s significant position in ZoomInfo – the information database company. After originally buying the stock in Q2 ‘20, Dragoneer nearly doubled their position in the company in Q2 adding more than 5M shares, taking their total to 9.3M.

Here are some key stats on ZoomInfo:

- Market Cap: $20B

- Revenue: $747M (2021) growing @ 57% annually

- Gross Margins: 80%

- Free Cash Flow: Positive since 2018!

Looking deeper at the company’s first quarter, they have continued to crush it going into ’22

The company posted:

- Revenue: $241M, (58% YoY growth)

- EPS: $.18 (actual) vs. $.15 (projected)

- Unlevered FCF: $126M (29% YoY)

The company also raised their guidance in Q1 to reach $1.06B -$1.07B in revenue this year & to earn $435M-$445M of FCF (27% YoY FCF growth at high end of guidance).

It is very rare to find a stock growing this fast both on the top line and bottom line and it is clear that Dragoneer thinks this company can be a cash cow.

If the stock keeps going down, I guarantee you Dragoneer will continue to be buying.

Wrapping It Up

As you can see, Dragoneer is one of the best in the game. I specifically am excited to do some deeper DD on JAMF & ZoomInfo. If Dragoneer is so confident about these two picks, we should likely all be paying attention too.

See you all on Thursday when we will be comparing Beyond Meat (Public) to Meati (Private). It is going to be sweet.

Side note: How little is public regarding Dragoneer? Check out their website here! There is literally nothing there other than an email lol. Move. In. Silence.

-Alan

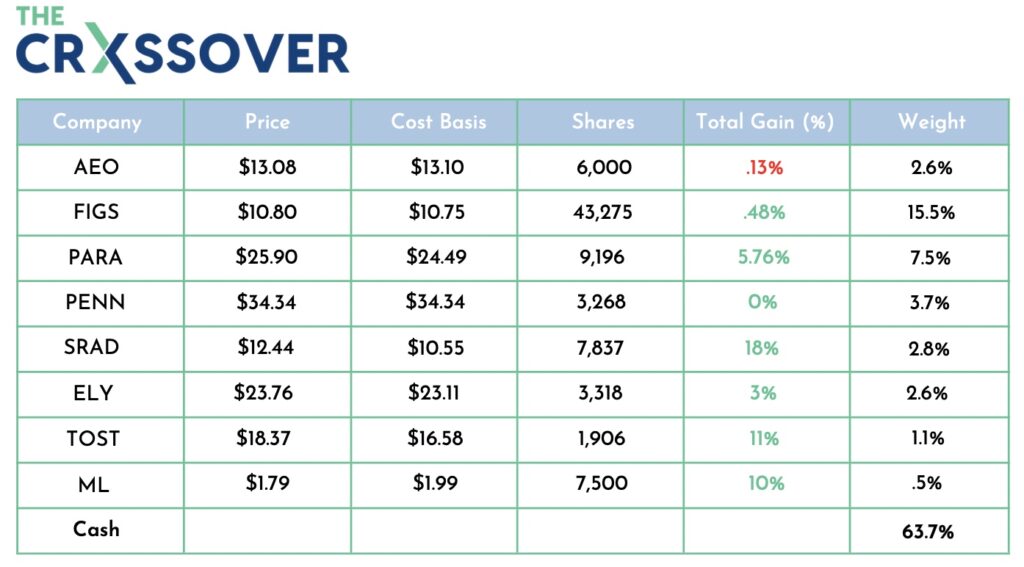

The Crossover Portfolio

- On Friday, we took advantage of the rough day in the market and increased our positions in each of our holdings by 50%

- Although this increased our cost basis, we are laser focused on performance in the long run and will continue to be pulling for lower prices (in the short run of course!)

- Our cash balance is down to 63.7% or 59.6% including our private investments

In The News: HiBob is Going Higher!

The Rundown:

Audited Documents leaked that showed FTX did over $1B in revenue in 2021 & $272M in operating income

3 Key Points:

- This represented over 1,000% revenue growth for FTX who did $89M in revenue during 2020

- The company is projected to do ~$1.1B in revenue during 2022 after doing $270M in Q1

- FTX ended the year with $2.5B in cash after last raising $400M @ a $32B valuation in January

Alan’s Angle:

I am not the biggest crypto guy in the world as I am cut more from the Warren Buffett cloth. At the same time, I love following the space closely & think all of the developments are incredibly fascinating.

FTX in my eyes will continue to be a big winner in the space for multiple reasons that include: its focus on institutional investors vs. retail (compared to Coinbase), the fact that FTX US is only ~5% of revenues, and the huge profits rolling in.

It is interesting to note how the growth is slowing down significantly as the tough times in crypto have hit. As the CNBC article cited states, I would love to see the company’s Q2 financials! Now those would be really interesting.

Golden Nuggets

- Loved this article in the WSJ breaking down PE’s push into the car wash industry

- USMNT’s Brendan Aaronson scoring a goal against Chelsea! Inject it into my veins!

- A Ferris Bueller Day Off spin-off is on its way!

- Why is Albert Pujols retiring? The dude is on fire! 700 here we come!

- The first quadruple play in baseball history. LLWS does it again.

Meme of the Day

Thanks for the read! Let me know what you thought by replying back to this email. See you in your inbox every Monday and Thursday.

— Alan

Disclaimer: This analysis is for educational and entertainment purposes solely and is not professional investment advice. The author of this piece and/or members of Workweek media could be invested in companies discussed.