18 August 2022 | Investments

A Sweet Q2 for FIGS!

By

Hello!

Three points to kick things off:

1. Boom! How about Portfolio Pick $SRAD’s earnings baby! Raise in guidance & a 10% pop! I love it.

2. Anyone else watching Hard Knocks? I am absolutely hooked & need to find a way to get Dan Campbell to follow me around all day to pump me up

3. Also, Shoutout to my other sister for finally signing up for The Crossover! It is so nice to feel so much love from those closest to me!

Showtime!

Want to get these in your inbox to never miss an edition? Subscribe to The Crossover today!

A Sweet Q2 for FIGS!

Introduction

There are two groups of people that cannot stop talking about FIGS:

- Healthcare professionals

- Alan Soclof

Well, I guess I am technically not a “group of people,” luckily for you all, but you get the point.

FIGS had a very strong quarter in a very difficult macro environment.

The company posted:

- Revenue: $122M vs. $118M expected

- EPS: $0.03 vs. est. $0.02

FIGS earnings represent 21% revenue growth YoY as well as 18% growth in EBITDA margin.

In the quarter, FIGS also reaffirmed their long term guidance of $1B in sales by 2025 and achieved gross margins of 70.6%. Two of my other favorite stats from the call include that marketing expense is only 17% of revenues & 70% of sales are from repeat customers.

Sweetness.

After confirming the short term thesis is intact, let’s take a look at the bigger picture.

FIGS x LULU

In the past, I have hinted to the fact that I think FIGS has a shot at becoming the next Lululemon.

You might be thinking: Alan! How the heck can FIGS become the next $LULU when 99.99% of the world never wear scrubs?

Great question.

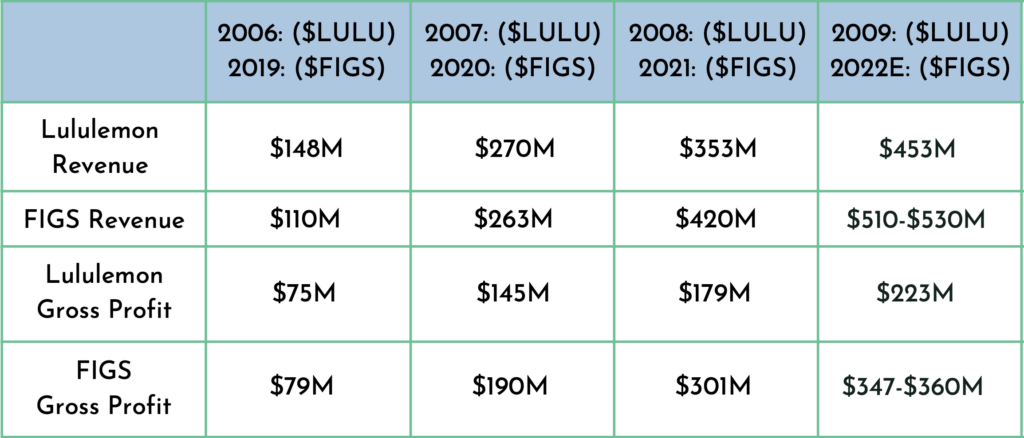

First, check out this chart I put together.

As you will see, FIGS is not only growing at a faster rate than LULU was at this stage in their journey, but they are actually more profitable:

On June 1, 2009, LULU was trading @ ~$8.85 a share & today are trading @ ~$320 a share representing a 3,500% increase over the next 12 years. Not bad.

If FIGS can achieve just half of those returns, we at The Crossover will be celebrating like we won the Super Bowl – something which I might need some tips on because Cleveland Browns ya know.

Also, another point comparing the two slick clothing brands, Lululemon hit $1B in revenue in FY11 & as I mentioned earlier, FIGS is focused on hitting $1B in FY 2024 – tracking Lululemon’s trajectory perfectly.

So back to our original question. How can FIGS pull this off without scrubs becoming something that people wear on a night out?

The opportunity in the healthcare space is so massive they might never need to leave it.

There are over 20M healthcare professionals in the US & 120M in the world. Interestingly, 92% of the company’s revenues are from the US while 8% is from overseas.

The company is just starting to shift their focus to international.

Before this quarter, they were in Australia, UK, and Canada. In Q2, the company did a soft launch in 7 countries in the EU and were “extremely pleased” with the early results even with “minimal” marketing efforts.

International sales will be a key growth lever and something to watch closely.

Also, FIGS feels there is a significant opportunity still in the US. FIGS has identified 4 key US cities to set up “pop up shops” including Seattle, Houston, Philadelphia, and Chicago.

The pop up shop in Houston had over 600 guests a day!

With the company only having 2M active customers, there is still room for serious growth both domestically and internationally.

FIGS Pro & Lifestyle

On top of this, the company is also looking to grow their “lifestyle” sales, sales outside of classic scrubs, significantly.

Currently, non scrubwear makes up just 15% of sales & the company is looking to grow this aggressively through the launches of shoes, hoodies, jackets, etc. This line of business grew 70% YoY!

The company also shared a key fact that lifestyle purchases are not replacing scrubs purchases but increasing the size of the order significantly.

Check out this quote:

“We continue to find that our lifestyle pieces are additive as orders containing these items had a 27% higher APT in the second quarter than orders without lifestyle pieces included.”

Beast.

FIGS also announced this quarter the launch of FIGS PRO, a brand new line launched this quarter focused on hospital administrators, researchers, etc. with polos, labcoats, button downs, the whole 9 yards!

As you can see, there are serious growth levers being pulled everywhere outside of the core scrub line domestically.

Management

Trina Spear (CEO & Co-Founder), Heather Hasson (Executive Chair & Co-Founder), and Daniella Turenshine (CFO) are phenomenal.

Whether it is the culture of putting healthcare workers first, being focused on their fiduciary responsibility of high growth partnered with profitability, their focus on constant innovation, or long term mindset, it is all palpable & genuine.

Two examples I want to touch on.

At the end of 2021, FIGS had $197M in cash & no debt. The company saw the early signs of the supply chain issues & decided to switch from freight transportation to air transportation. This move incurred greater cost on FIGS but getting their “Awesome Humans” their scrubs was priority #1 and from an LTV perspective, a great move too.

Additionally, the company aggressively increased their inventories by stocking up on core models to ensure that consumers did not see the impacts of the global supply chan issues.

The company’s cash balance has decreased by $27M over the past two quarters but inventories are up over $40M. The cash is still coming in for FIGS, but you have to look at inventories to reflect it.

If you have cash on the books, use it. Even if it means you have to report an FCF loss or decrease in cash in consecutive quarters.

Also, at the end of the quarterly call, FIGS takes shareholder questions & tough ones too. This quarter, the questions surrounded:

- The company’s stock price

- Competitors/cheaper knockoffs

Phenomenal.

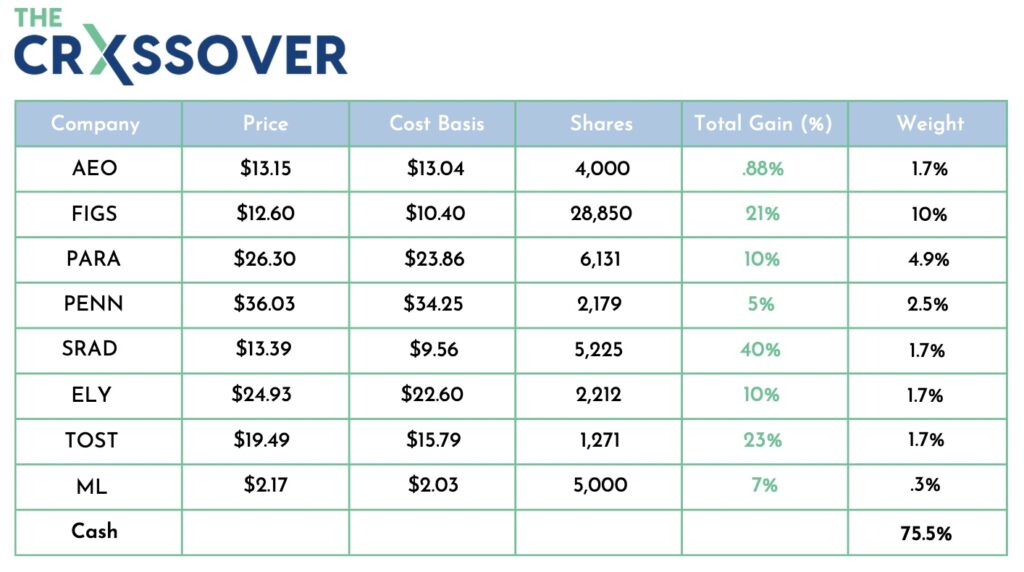

The great management, fundamentals, and expanding TAM are big reasons that this stock is 10% of The Crossover Portfolio.

Only time will tell if our assets are allocated properly, but something just tells me FIGS will be a sweet investment!

-Alan

The Crossover Portfolio

- A new portfolio pick is live! American Eagle! Yup. You read that right! I think $AEO is significantly undervalued and is paying a 5.5% dividend that feels pretty safe. Expect a full breakdown in the not to distant future

In The News: HiBob is Going Higher!

The Rundown:

Cloud based HR platform HiBob raised $150M Series B @ a $2.45B valuation

3 Key Points:

- HiBob provides HR professionals tools to manage their employees like time off approvals, onboarding, etc.

- 50% increase to Series C 10 months ago

- Round led by General Capital & included Bessemer

Alan’s Angle:

- There is some serious money headed towards HR Tech platforms not only with HiBob, but also one of their key rivals, Personio, raised $200M @ a $8.5B valuation. This has me thinking how to find exposure to this space in the public markets, as I am sure, this sector would be overlooked. If you have any names send them my way!

Golden Nuggets

- I could not be more excited about Jacob Espinoza’s (Workweek teammate) launch of his leadership newsletter! Jacob is awesome, and I can’t wait to start learning. Dame time!

- Loved this wisdom from legendary investor Seth Klarman

- I am a big believer in A.J Dillion this year in fantasy. Aaron Rodgers latest comments give me just another reason why!

- Man do I love my Cleveland Guardians. Man do I love Steven Kwan. Look at this energy! Some would say, that is what I looked like after hearing the recent news about Buffett

Meme of the Day

Thanks for the read! Let me know what you thought by replying back to this email. See you in your inbox every Monday and Thursday.

— Alan

Disclaimer: This analysis is for educational and entertainment purposes solely and is not professional investment advice. The author of this piece and/or members of Workweek media could be invested in companies discussed.