08 August 2022 | Investments

Is Sportradar on Our Radar?

By

Hello!

Over the weekend, I binged the first few episodes of “Captain,” the Derek Jeter documentary on ESPN. It is excellent.

Man do I miss baseball in the early 2000’s. There truly was nothing better. These days, if I can enjoy 10 minutes of a game I am proud of myself.

Showtime!

Want to get these in your inbox to never miss an edition? Subscribe to The Crossover today!

Leading Off: Tiger Global Update

The Rundown:

Tiger Global’s long only fund & flagship fund are down 63.6% & 50%respectively after fees.

3 Key Points:

- In a letter to investors, Tiger blamed their poor performance on “underestimating” the impact of inflation & entering 2022 with “too much exposure.”

- The company’s crossover fund was down 37% in the first half of ’22 as well

- Tiger raised the annual redemption limits from 25% to 33% for clients that are interested in taking out more money.

Alan’s Angle:

- Off the bat, yes a lot of baseball puns today, sorry, Tiger has had a disastrous year – but so has everyone else too. What is remarkable to me regarding Tiger is just how much they were “listening to the music” in 2021 setting up for a disastrous 2022.

- It appears as quality of diligence deteriorated at Tiger as at the end of Q4 ’21 the company had 169 holdings, a sharp increase to the 97 holdings at the end of Q4 ’20

- While Tiger’s flagship fund is up 15% annually since inception in 2001, their long only fund launched in 2013 is up only 4% annually. Yikes.

Sportradar: A Pick & Shovel Play

Introduction

Last week, in our discussion regarding PrizePicks, Underdog, and DraftKings, two things became abundantly clear:

- Sports gambling is exploding in the US

- Sportsbooks are losing a ton of money

Being recently burnt badly by a “growth-at-all-costs” model (Yes, Invitae. I am most definitely talking about you), the last place I want to invest in the sports gambling arena is in another high-cash-burning company.

I want a company that works in the trenches, but is often overlooked – think, a stud NFL O-lineman that does all of the dirty work and receives none of the credit.

That company is SportRadar.

SportRadar

SportRadar is a cutting edge technology platform that provides B2B solutions to the global sports betting industry.

SportRadar’s claims to fame:

- Provides exclusive data collection services for 250 sports leagues globally, including exclusive relationships with the NBA, NHL, and UEFA

- Works with 900 sports betting operators globally

- Creates/compiles lives stats for 890K events annually in 92 sports

- Provides key statistics and data to 500 media companies as well as audiovisual content/analysis from stadiums, OTT streaming solutions & more

I still need to check if they provide stats to ESPN — some of those random stats are just the worst. If $SRAD is ESPN’s plug, that might be a thesis breaker. (I’m obviously kidding…I think.)

What are some examples of services that $SRAD provides to these gambling operators?

Pre-match data odds, live odds, managed platform services (liability management software), and virtual games, to name a few.

The company is truly the “pick & axe” to the sports gambling industry and fulfills their duties profitably too – an incredible concept.

Financials

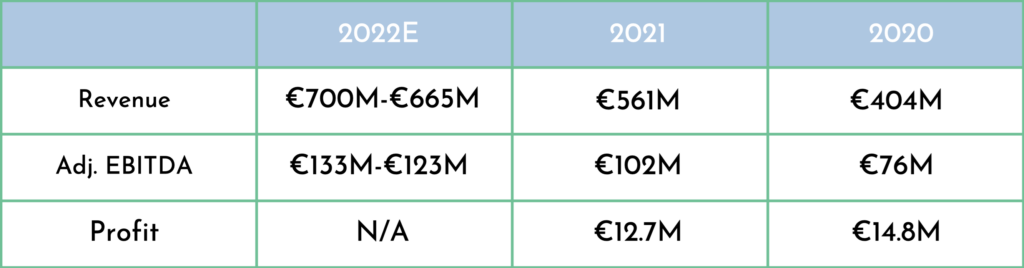

Let’s take a look at Sportradar’s financials – note that the financials are in Euros as Sportradar is a Swiss company.

Sportradar had a very strong 2021, posting revenue growth and adj. EBTIDA growth of 39% & 33% YoY respectively. Also, the company’s 2022 guidance implies 18%-25% top line growth and 21%-30% bottom line growth

Beast.

$SRAD also had a great Q4 where they “smashed” through Wall St. Projections posting a $15M beat on the top line and $3M beat on bottom line.

I absolutely love the energy by CEO Carsten Karl. He is an incredibly accomplished & competitive professional and a big reason for my belief in the company. More on Carsten in the future.

Looking at the high level financials, the company is a bit expensive – maybe even too expensive to warrant a buy. A market cap of €2.6B? That implies a forward sales multiple of 4x & EBITDA multiple of 20x.

Alan. Just tell them what they’re missing already and why it might not be overpriced!

Okay. First, SRAD is a company whose operations are generating cash vs. requiring cash.

€15M in cash generation, while still seeing strong growth, is a powerful engine – and a common trait in The Crossover Portfolio picks.

This cash generation continues to add to SRAD’s strong balance sheet of $740M in cash & $430M in debt (leaving FY21). This enables the company to be very active in the M&A market, an area where Sportradar crushes it.

I also want to touch on the company’s Dollar-Based-Net-Revenue-Retention-Rate (DBNER). Thank the heavens for the acronym as that takes more effort to write out than it does to write Giannis Antetokounmpo – quite the statement.

DBNER is the percentage of revenue a client spends with a company YoY, which for SRAD was 125%.

Not only do customers come back to do business with SRAD – they want access to more of their products too. Powerful.

USA Opportunity

According to Statista, sports betting revenue in the US for sportsbooks was $2.1B last year and expected to more than 4x by 2026 to reach more than $8B.

SRAD is investing aggressively to seize this opportunity:

Takeaways:

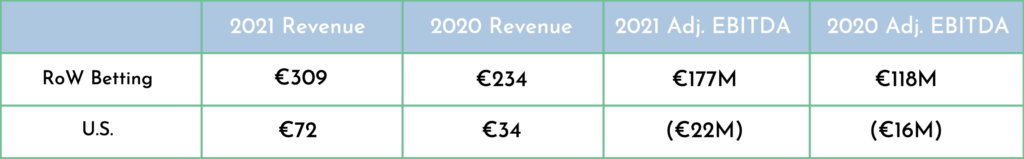

RoW Betting (Outside of US) is not only growing at a fast rate of 32%, but also is incredibly profitable with Adj. EBITDA margins of 57%.

United States revenue grew over 100% YoY, but the move into the US requires significant investment leading to an adj. EBITDA loss of 22M.

TL;DR – SRADs top level financials do not show how profitable this business can be at scale.

If Sportradar decided to forgo the US opportunity, the company would likely have added $15-$20M in bottom line additional profit, but like any good business, are focused on the long term.

Check out this quick quote from one of Sportradar’s recent conference calls:

“We provide sports data in many cases as a sole provider to 70% of the total in-play market in the United States, who, in turn, manages nearly every legal sports bet placed in the U.S. by sport betters.”

Sportradar is off to a great start in the US and just getting started too!

Wrapping It Up

The Sportradar thesis is complex and multi faceted – a big reason why I am intrigued.

Next time we discuss the company, we will break down the company’s CEO and their newest silo of business, Sports Solutions, which was created through two recent acquisitions.

One of the two acquisitions was a company called Synergy Sports, an analytics software I worked with closely when I was pushing towards a sports analytics career. The technology is incredible.

Due to valuation concerns, we will likely not continue to add to the $SRAD position unless there is a pretty serious drop in valuation.

At the same time, we think $SRAD is a winner and just like a good offensive lineman, a core and integral piece, to achieve what we are trying to accomplish! Alpha!

-Alan

The Crossover Portfolio

- Since we last connected, a lot went down for Crossover Portfolio picks. FIGS, PARA, ELY, PENN, all released earnings and overall they were rock solid. We will break it all down in the coming weeks

- We added 3K more shares to PARA due to one key word: Dividend

- We continue to feel that PARA is significantly undervalued & misunderstood. Gathering a 4% yield annually until PARA proves themselves, to me, is a slam dunk

Golden Nuggets

- Laughed out loud watching this clip showing what an episode of The Office looked like after Michael saw Top Gun: Maverick

- This kid talking about his love for corn is everything

- I was thinking NYG QB Daniel Jones could be a very deep sleeper in fantasy this year because of Brian Daboll. After seeing this throw, I am thinking this was a very bad take

- Great tweet about Warren Buffett & the power of tuning out the noise

Meme of the Day

Thanks for the read! Let me know what you thought by replying back to this email. See you in your inbox every Monday and Thursday.

— Alan

Disclaimer: This analysis is for educational and entertainment purposes solely and is not professional investment advice. The author of this piece and/or members of Workweek media could be invested in companies discussed.