02 August 2022 | Cannabis

Empowering cannabis workers, the limitless world of edibles, and the future failures of cannabis.

By Jay

The ROI of empowering your cannabis workers

The cannabis industry has an alarmingly high turnover rate.

Headset found that in the U.S. and Canada, 55% of budtenders who worked at any point over the previous 12 months left the job by the end of that time period. This data was gathered by analyzing the budtender’s POS sales in the retail stores that Headset tracks.

In another set of data, Headset identified that stores experiencing a “very high” rate of growth (40% growth) experience a higher turnover rate than stores who’ve seen a “medium” rate of growth at 20-40%. 📈

This might indicate that companies that are rapidly growing can lead to more employees burning out.

- 40% of the budtenders who stopped reporting sales didn’t make it even one month at the job

- Only 14% of employees who quit lasted longer than three months, emphasizing the importance of comprehensive onboarding training

Considering most employees leave bosses, not the job itself: Azam’s post hits the nail on the head – investing in your cannabis workers is of critical importance.

And as Azam said, it should extend beyond the basics of on-the-job training. This is especially true in a high-growth & high-pressure industry like cannabis where burnout is ripe.

What I’m Thinking 🧠

Being a cannabis professional is stressful and challenging. Headset’s data highlights budtenders, but even mid-level and senior employees face similar challenges.

Just working in the space can lead to financial consequences like being denied a home loan. Some industry workers are even ostracized by their families for having a job in cannabis.

There’s also the day-to-day stress of operating in a federally illegal space – will our bank accounts close down today and I have to spend 6 hours I don’t have on the phone with people? Etc.

Teams who are highly engaged perform at 21% greater profitability – across all industries, company sizes, locations, and economic circumstances. U.S. companies lose an estimated $550 billion in potential profits from a lack of productivity and innovation.

Operators who make it a priority to help their staff refine decision-making skills, time management skills, self-development, and more will curate & a loyal and productive staff that can adapt to the challenging cannabis industry for years to come.

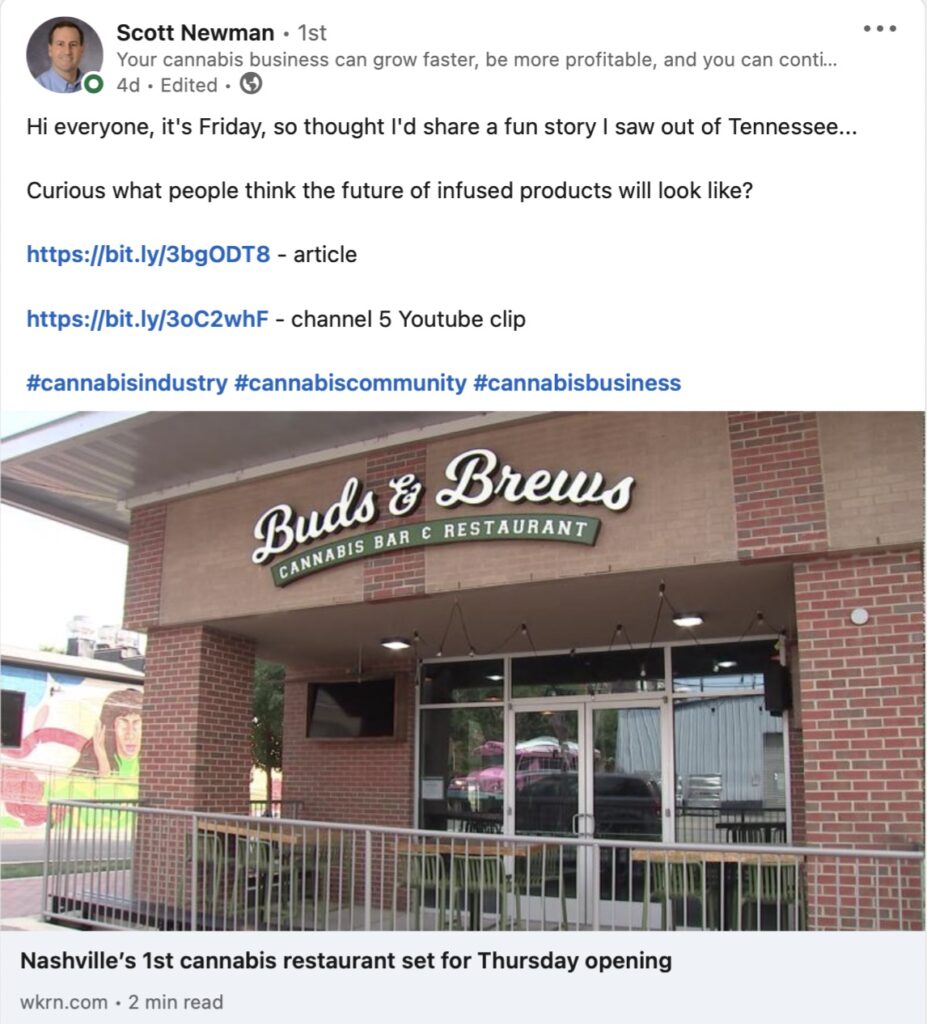

The limitless world of edibles

Nashville’s first cannabis restaurant is about to open. It features a “special sauce” infused with hemp-extracted THC.

Cannabis is not legal in Tennessee, for medical or recreational purposes. The restaurant’s special sauce meets the state and federal 0.3% THC limit by weight.

More and more Republican states are broadcasting their support for cannabis in various ways.

I just talked about Texas & a few different pushes happening in my home state. Now Tennessee’s cannabis restaurant is set to open soon.

As far as the future of infused foods: the product category is growing more every single year. I know I’m a devout edibles eater (is that a thing?) but I didn’t always like them because I’d only tried illicit products.

Now that I can monitor my dose, edibles are the cherry on top of my nighttime routine. I take 2 of Wana’s blueberry gummies!

A 2022 Flowhub report found that edibles are the third-highest selling cannabis product category, claiming 9% of sales. Concentrates claim 22% of sales and flower remains Queen at 61% of all sales.

BDSA predicts a 2.2x market spend increase on edibles by 2026, after identifying that edibles made up roughly 15% of total market spending this year.

What I’m Thinking 🧠

I did not have a cannabis restaurant in Tennessee on my 2022 Bingo board – I’ll tell ya that. It definitely makes the edibles world feel limitless.

Edibles are the primary product format for 35% of American consumers between 21 and 54. 38% of those consuming at least one week or more, indicating the true potential of this product category.

Cannabis-infused foods can touch the medical and recreational market, so there are hundreds of options. Ultimately, it will be up to the consumer to determine what sticks.

I predict more infused restaurants will pop up for recreational consumers, while medical consumers will stick to smaller & lighter portions like gummies.

The fall of MedMen is a glimpse into the future of future failed operators.

I wrote about MedMen’s mansion & masseuse-filled downfall here if you want to read about it. It’s quite the story.

While other operators might not go down in the same way MedMen’s did (the company itself is actually still running) their failure is inevitable.

“Even the ones that were heralded as the next big thing, even the ones that raised astronomical sums of money, even the ones who sold lots of product,” Brian’s post says.

As it stands, 37% of U.S. cannabis operators aren’t making a profit. I quote this statistic all the time, but it speaks volumes about the current state of our industry.

Burdensome regulations coupled with bad operators make for unprofitable and failing cannabis businesses. Period.

It’s easy to lump all multistate operators into one group and paint them as future failures – but I don’t think it’s that simple.

All operators are at risk of failing and executing bad strategies and unfortunately, large businesses are the ones with extra cash to dig themselves out of a hole.

What I’m Thinking 🧠

As Brian says, all cannabis companies should keep their blinders on and keep building. The ones who fail usually exhibit bad behavior that impacts all of us.

But the future failures of cannabis won’t just be large operators. It will be businesses of all shapes and sizes.

Yes, corporate cannabis giants notoriously suck. But I promise you: they aren’t the only ones.

There are plenty of small-town operators who don’t know a thing about cannabis but want to make money & make bad decisions.

The cannabis businesses that succeed will have the perfect blend of cannabis and business know-how. It’s the only way to thrive in a highly-regulated, culturally-rich, and first-of-its-kind industry.