01 August 2022 | Investments

The Crossover Portfolio & Toast 2.0

By

Hello!

First & foremost, I want to wish a happy birthday month to my amazing mother! My mom is so great that we dedicate the whole month of August to her!

Also, today is a very special day at The Crossover as we have officially launched “The Crossover Portfolio.”

The Crossover Portfolio is a portfolio of stocks managed by yours truly and gives the Crossover fam insight into how I would be allocating a fund’s resources.

I have big plans for the portfolio and what it can do for you all and the newsletter so stay tuned.

Showtime.

Want to get these in your inbox to never miss an edition? Subscribe to The Crossover today!

Toast 2.0

Private Markets

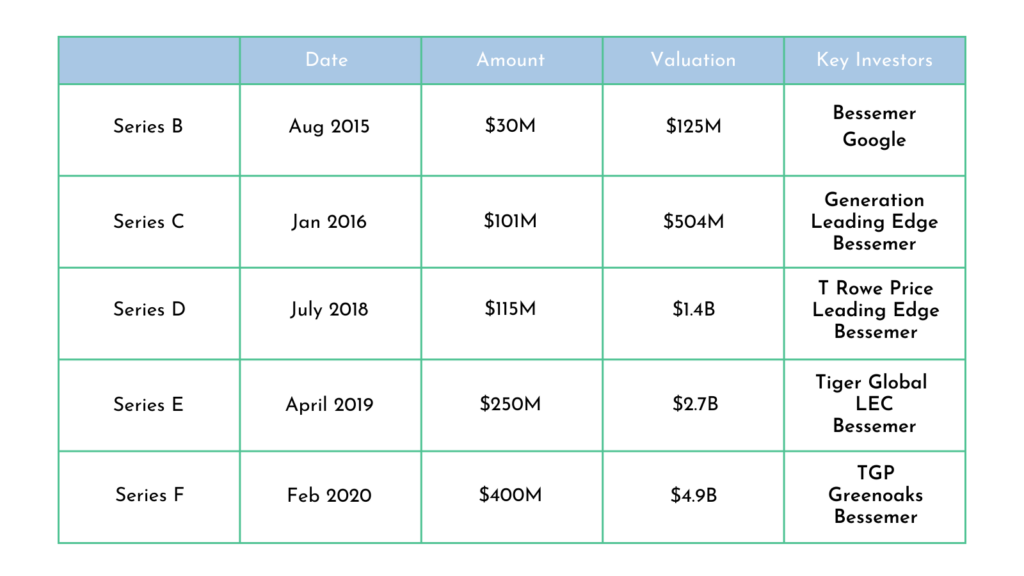

Before getting back into the public market thesis for Toast, let’s see how we got here & which crossover investors were significant players in Toast’s private journey.

Toast was an absolute grand slam for any investor that got involved at any stage in the investment journey pre-IPO. As we discussed last time, Toast IPOd @ $20B, a 4x from the company’s Series F & a mind blowing ~160x its Series B.

Our crossover friends Bessemer, Leading Edge, Tiger Global, and T Rowe Price were big big winners.

Let’s take a look at how Tiger has handled the stock since its IPO.

Tiger Global

At the end of Q3 ‘21, just 8 days after Toast’s IPO, Tiger had 1.25M shares of Toast valued @ around $65M. I am assuming these shares were a percentage of Tiger’s initial investment, as according to Pitchbook, we know that Tiger held onto a portion of their shares into the IPO.

As the stock dropped around 30% in Q4 ‘21 to around $35 a share, Tiger increased their position in Toast by over 3M shares to a value of over $156M. In Q1 ‘22, Toast’s free fall continued, dropping another 40% leading Tiger to add another 8M shares bringing up the company’s total position to over $275M.

TL;DR – Tiger has been extremely aggressive. What are they looking at and why might I disagree?

As discussed in the last newsletter, Toast is seeing significant growth any way you look at it:

- GMV – $17.8B (Q1 ‘22) vs. $9B (Q1 ‘21)

- Restaurants – 62K (Q1 ‘22) vs. 43K (Q1 ‘21)

- 4+ Products – 60% (Q1 ‘22) vs. 51% (Q1 ‘21)

- ARR – $154M (Q1 ‘22) vs. $86M (Q1 ‘21)

However, 12x ARR multiples does seem pretty aggressive in the current macro markets. Specifically in an industry that would likely be hit hard by inflation, supply chain, and macro economic issues.

Specifically, the lack of profitability, even with a strong ARR base is also concerning for me. Over the past 3 quarters, Toast has posted FCF of:

- ($53M)

- ($17M)

- ($19M)

Additionally, the company raised guidance at the end of Q1 for full year 2022 for adjusted EBITDA to be between -$175M & -$195M. So it looks like profitability is not around the corner to say the least.

Outside of the likely very long term investment horizon for Tiger, what alternative angles could they be looking at to give them confidence at these valuation levels?

I have 3 theories:

- R&D/ G&A

- FinTech Solutions (Optimization/Efficiency)

- International Opportunity

R&D/G&A – in the Q1 earnings call, when CFO Elana Gomez was asked about the long term profitability profile of Toast outside of strong unit economics, she highlighted the R&D investment and “really getting scale in our G&A” as ways of getting a more profitable model.

This is a growth company now, however, as the company matures and achieves “scale” the ability to decrease spend on R&D & G&A, which both grew to $160M & $530M respectively in Q1 is not only obvious but also realistic.

FinTech Solutions – I can’t help myself but think that as the company continues to establish themselves as the #1 restaurant POS & builds a significant moat that there will be room to increase margins whether it is on the “small” fee per transaction or the percentage it charges on a total transaction basis.

International Opportunity – the company has barely even scratched the surface of the explosive $110B international opportunity. On the call, management shared that “we’ve seeded an initial investment in international this year and are only live and have “a few” customers live. This is considered a “multi-year journey” before seeing a “meaningful impact on P&L.” If Toast can succeed internationally like they did domestically, this stock can be a grand slam and likely a big reason why Tiger is so bullish on the company.

Wrapping It Up

I love Toast as a company, I do think the software will be in restaurants everywhere. I do think the stock will perform nicely in the long run. However, this stock for me is not a strong buy due to valuation concerns.

Originally writing this piece, I was going to share that Toast was 100% not a buy. However, with the launch of The Crossover Portfolio, this gives me the opportunity to buy a very small position in the stock and not make a more binary decision.

If the stock drops, I will continue to build a position in the company.

As time goes on and my investing maturation process continues, I can’t help but think about Warren Buffett’s quote regarding how in investing, unlike in baseball, there is no such thing as called strikes.

You can wait all day for your perfect pitch. The complexity of this investment @ these valuations with so many moving variables makes this not my perfect pitch and not worthy of building a full position.

This is especially true when I think about a company like $FIGS whose business trajectory is so clear, is trading @ low single digit sales multiples, high gross margins, and FCF positive.

For today at least, it looks like a majority of my snacking will be on FIGS and not Toast.

-Alan

In The News: A SPAC Moving in the Right Direction

Article: Verra Mobility’s CEO will be happy to leave the SPAC phenomenon behind

TL;DR: Most SPACs have crumbled, but Verra Mobility is actually one seeing significant success.

3 Key Points:

- Verra Mobility went public via SPAC in 2018 via merger with Gores Holding II

- Verra has actually seen significant success since SPACing and is now trading @ over $16 a share, significantly greater than the SPAC price of $10

- How have they pulled this off? Going public @ a fair valuation, generating hundreds of millions of dollars of revenue, FCF, share buybacks, and acquisitions. All things that we will likely not see from many of the SPACs that went public a couple years after Verra

Fun Fact: Gores Holding I was the vehicle used to bring Hostess Brands, the company behind Twinkies, public!

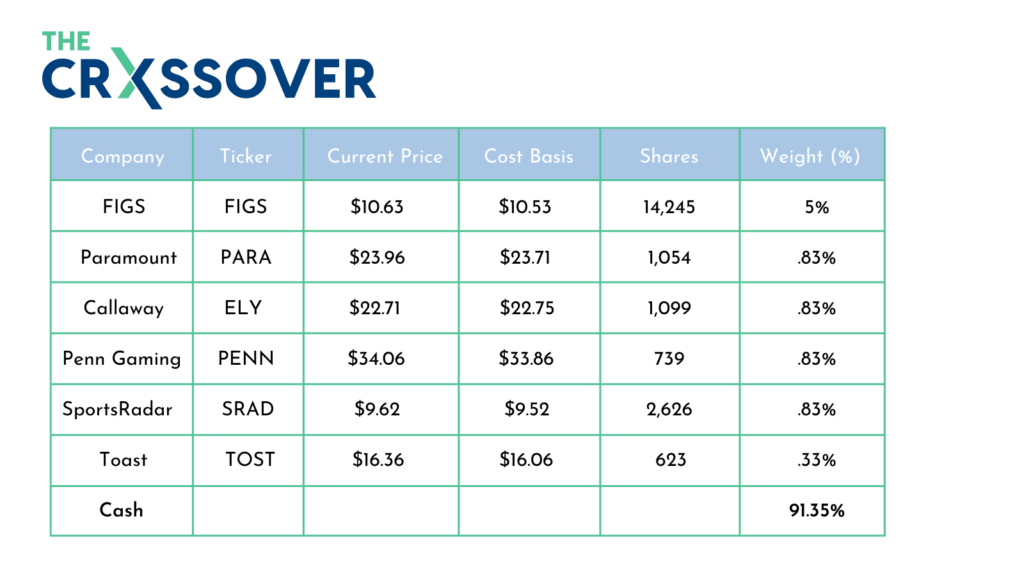

The Crossover Portfolio

Last week’s piece on Altimeter Capital and Brad Gerstner inspired me to launch a mock portfolio, something that I have been wanting to do since we started! Gerstner launched a $3M, highly concentrated fund in 2008 and that is what I am looking to do as well.

Once a week, the portfolio update will be shared in this section as well as any moves I made and news related to the company. This has been in the works for a while, and I am pumped to get this thing on the road!

Side note – Gerstner to Priceline might just be Alan to FIGS. Stay tuned.

Last week, I made one set of transactions establishing a 5% position in $FIGS as well as just under a 1% position in a few other company’s that I really like (and am excited to share analysis on in the coming weeks)

Next week, pre-earnings for many of these companies I will be looking to double my position in each company and leave the remaining amount in cash.

All Crossover trades will be shared from the official Crossover Twitter account that you can find here.

Golden Nuggets

- Baseball is a kids sport. Apparently baseball fans have the sense of humor of a kid too

- Really enjoyed this article from a couple years back on Thomas Tull & $FIGS

- B.W Carlin makes me laugh all the time. Does anyone else walk through the door like this?

- Very interesting article on why “Netflix’s most expensive movie’s keep getting worse”

- RIP to NBA Legend Bill Russell. GOAT.

Meme of the Day

Thanks for the read! Let me know what you thought by replying back to this email. See you in your inbox every Monday and Thursday.

— Alan

Disclaimer: This analysis is for educational and entertainment purposes solely and is not professional investment advice. The author of this piece and/or members of Workweek media could be invested in companies discussed.