28 July 2022 | Investments

Altimeter Capital: From $3M to $1B in 5 years

By

Hello!

On Monday, I went to Fenway to cheer on my Cleveland Guardians, and it was a great time. Easily, the highlight of the game for everyone was oddly the rain delay. I am not kidding.

The music was electric and fans were dancing on the big screen. It was a blast.

However, it is a big problem for baseball when the game being delayed is actually a good thing for the fan experience!

Also, due to some housekeeping, the Toast 2.0 piece will be dropping on Monday

Showtime!

Want to get these in your inbox to never miss an edition? Subscribe to The Crossover today!

Altimeter Capital’s Rise to Fame

Introduction

Today I am going to be breaking down one of the most interesting crossover funds in the game, Altimeter Capital.

Instead of doing a classic profile on the fund, I thought I would do something we will call “Alan’s Angle,” inspired by the great Terry Pluto’s, Terry’s Talkin – a style where he writes as if he is interviewing himself!

Terry is a legendary writer for The Plain Dealer (Cleveland) who made reading about the Cleveland Browns fun, even though there was literally nothing fun to write about.

Let me know what you think.

Alan’s Angle

“I was intrigued by this idea of public market investors also doing private market investing. We did not call it Crossover at the time, but it reminded me of the throwback partnerships that Buffett & Munger had. They did not look at something as public or private investment. It was simply a good investment or bad investment with certain liquidity characteristics associated with it.”

-Brad Gerstner, Altimeter Capital

Question: How are you feeling after listening to two podcasts (multiple times each), reading several articles, and sifting through 13Fs on Altimeter Capital?

Answer: Overwhelmed, but not why you might think. Altimeter is so impressive in so many ways and it will be hard to squeeze all of my thoughts into 1k words.

Question: If you think you will be on a word crunch, why are you using words to explain how you are feeling instead of just jumping right in?

Answer: (Silence)

Question: Okay then. What jumps out to you the most about Altimeter’s journey?

Answer: Easily the origins of the fund. Brad Gerstner raised (just) a $3M hedge fund in 2008 during the depths of the Great Financial Crisis from family & friends. Everyone thought he was “crazy.”

I think launching the fund wasn’t actually crazy, but rather brilliant. The best time to launch a fund is after a serious market correction & when there is serious uncertainty in the air – even though it will likely be and feel the hardest time to do so.

What in my eyes is crazy is the fact that Brad invested nearly half the fund into Priceline, the online travel site.

Question: How did the investment playout?

Answer: Unbelievably well. Brad invested in Priceline @ about $45 a shareand 5 years later, the stock was over $1000, representing a 24x return on the invested capital in just a few years.

Brad used the momentum and success from his big bet to grow Altimeter’s AUM to over $1B by 2013. Later in 2013, Brad looked to continue to capitalize off his success and launched his first $75M private fund focused on internet and software companies.

Question: No way his VC fund has had any successes that could match the likes of the Priceline investment. Right?

Answer: Yes way and quite a few of them. Altimeter hit an absolute grand slam when they led Snowflake’s 2016 $76M Series C @ only a $260M post-money valuation and continued to invest in the cloud warehouse storage company’s Series D, E, and F.

After Snowflake 2xd on the initial IPO, Altimeter at one point saw their stake valued in $SNOW alone grow to over $8B. With other successes in the private markets like Hubspot, Confluent, Twilio, Expedia, Uber, as well as 13F returns that grew 30% annually from 2011-2020, Altimeter & Brad Gerstner and their now ~$15B AUM have become household names in the crossover arena.

Question: There are rumors swirling that you might have had to double check that Brad’s interviews were investment focused and not philosophy focused. Care to explain?

Answer: Gerstner spent a lot of time discussing the concept of “Essentialism” which represents in many ways his philosophy on life & business.

Essentialism is a concept by Greg Mckeown that emphasizes the idea of not stretching yourself too thin, and rather focusing on doing less and “enriching” what you choose to spend your time on.

This has significant impacts on both Brad’s personal life and Altimeter’s investing style. Personally, this means less time traveling and going to dinners but more time in nature and with his family.

Professionally, this means focusing on fewer companies, industries, and management teams and rather making concentrated investments on just a handful of companies. This concentration and idea of Essentialism leads to expertise on specific industries, companies, and big bets.

Brad specifically shared that “At any given moment in time in the public markets, we might have 75% of our portfolio in our top 4 or 5 ideas. If you look through our private investments you will also see much more significant concentration than you would in typical venture funds. In a $400M fund we might have 10 investments.”

Quite the interesting approach.

Question: Was there one take that you felt that Brad made that was particularly interesting?

Answer: So Altimeter Capital is incredibly bullish on Meta (Facebook) – even though the company is an early investor in Bytedance (5 years ago), the parent company of TikTok.

He is bullish on both, which to many could see as being contradicting. The bullishness on TikTok is obvious, but Meta not so much. There are 3 reasons why Altimeter is a believer in Meta:

- Founder led – Zuckerberg has done several visionary acquisitions like Whatsapp & Instagram

- Social Recommendation to AI recommendation engine – TikTok was an AI disruption of social media and this is what Facebook is looking to do as he just shared publicly that “they will be combining social recommendation with AI recommendation” building one of the strongest AI discovery engines on the planet that will have big impacts on Reels, Whatsapp, Facebook, etc. Gerstner also notes that they are still growing their users! Additionally, Gerstner feels that Meta could be building a revolutionary social/ai engine that could be revolutionary to the business like AWS was to Bezos – even though the significant investment into AWS drove great criticism from analysts.

- Strong Fundamentals & An AWS? – Below 20x FCF, exit year growth over 20%, 7.5x EBITDA all while investing $20B+ in Capex (building the social/ai recommendation model.

Wrapping It Up

There is a wealth of lessons to be learned from Brad Gerstner & Altimeter’s journey. You can expect to hear more about Brad and some of his investments soon in The Crossover!

Attached below are some of the articles and podcasts I used to help put this piece together!

-Alan

Podcasts:

- Investing with Altimeter Capital’s Brad Gerstner (Goldman Sachs) – 6/17/22

- Brad Gerstner – Public & Private Investing (Patrick O’Shaughnessy) 6/23/20

Articles:

In The News: SpaceX Has Some Competition

Article: Eutelsat, OneWeb Agree $3.4 Billion Deal to Rival SpaceX

TL;DR: Eutelsat Communications SA, a French satellite operator, and OneWeb, a UK satellite operator are set to combine in an all-share deal valuing OneWeb at $3.4 billion, a step toward creating a European champion to rival the likes of Elon Musk’s SpaceX.

3 Key Points:

- While shareholders will split the newly merged company, Eutelsat CEO Eva Berneke will run the company, and Eutelsat’s chairman, Dominique D’Hinnin, is set to be chairman of the company, with his OneWeb counterpart, Sunil Bharti Mittal, set to be co-chair and vice president.

- News of the merger has not been met with much enthusiasm in the public markets, as Eutelsat stock has actually gone down 18% since announcing deal talks.

- While the merger is supposed to generate 1.5 billion Euros along with investments and cost synergies for Eutelsat, many worry about the short-term cash burn and the contrasting relationships with Russia between the two companies. Eutelsat continues to provide satellite services to nearly 50% of Russia’s population, while OneWeb uses SpaceX to launch their satellites since Russia’s invasion of Ukraine.

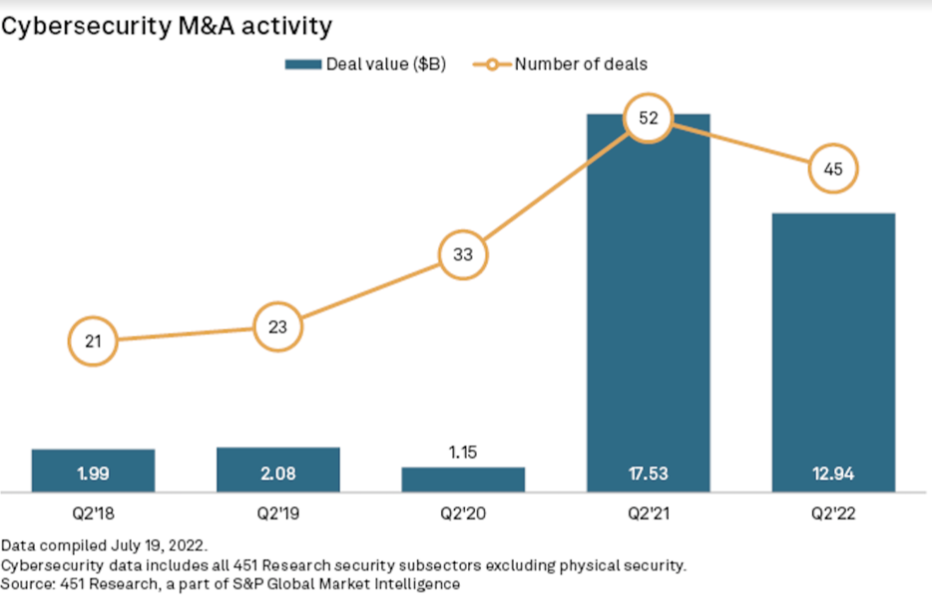

Chart of the Day: Cybersecurity is Hot!

- 45 cybersecurity deal announcements totaling $12.94 billion in transaction value took place in the second quarter of 2022.

- The number of deals was slightly lower than the 52 announcements reported in the same period last year, but it remained “well above the second-quarter volume seen in 2020, 2019 and 2018,” according to 451 Research.

Golden Nuggets

- This meme/video by Trung on TikTok vs. all other social media is just too good

- Mets CP Edwin Diaz running into the trumpets against the Yankees is everything.

- Everyone always talks about the new FinTech companies on the scene, but Visa just keeps on crushing it

- Loved listening to the Belloni & Shaw pod featuring a streaming war Intellectual property draft!

Meme of the Day

Thanks for the read! Let me know what you thought by replying back to this email. See you in your inbox every Monday and Thursday.

— Alan

Disclaimer: This analysis is for educational and entertainment purposes solely and is not professional investment advice. The author of this piece and/or members of Workweek media could be invested in companies discussed.