25 July 2022 | Investments

Toast: A Compounder in the Making?

By

How was everyone’s weekend?!

I wanted to kick off today’s newsletter with this video of a duck running in the Long Island Marathon. So inspirational, and I could not be more proud of Wrinkle The Duck.

Showtime!

Want to get these in your inbox to never miss an edition? Subscribe to The Crossover today!

Toast: A Compounder in the Making?

Introduction

Some of my best investments over the years have followed one of my principles I call “investing with your eyes.” I define this as identifying trends in society and figuring out if there is a way to invest in them.

This approach has served me well, helping me identify National Beverage Company (La Croix), Square, and Lululemon. All the companies I did well on, but as my grandmother does not let me forget, I sold way, way too early.

Today, we take a look at another company that fits my criteria of “investing with your eyes” Toast Inc. ($TOST) – a once high flying venture backed company with fingerprints of crossover investors all over it.

This is part one of a two part breakdown.

Spoiler alert – Toast is not a buy for me. At least not yet.

Overview

Toast is an all-in-one digital technology platform that offers a suite of SaaS products & FinTech solutions for restaurants. The company’s revolutionary technology helps connect front house and back house operations and everything in between.

Next time you are at a restaurant and ordering at the counter, don’t be surprised if you see the Toast logo in front of you!

In the company’s S-1 in June ‘21, the company shared that their total TAM was $110B, but is focused on a $15B SAM that mostly comprises the 860K US restaurants. At the time, the company was in 48K restaurants & processed $38B in gross payment volume on its platform in the twelve trailing months prior.

On September 21, 2022, Toast Inc. IPO’d at $40 a share @ a $20B valuation. The stock skyrocketed up 56% on the first day, reaching $62 a share and a valuation of over $30B.

Fast forward 9 months to the last week of July and the stock finds itself at $14 a share, down 80% from ATHs, trading at a valuation of $7B. What the heck happened here?

What if I told you that revenue also grew by over 100% in 2021 to ~$1.7B. 5.5x sales for a rapidly growing FinTech company? This must be a steal? Not so fast.

Business

If you were to look at Toast’s SEC Filings, you would see that the company has 4 lines of revenue:

- Subscription Services – Fees charged for customers to access SaaS like POS, kitchen display system, invoice management, digital ordering, etc.

- Financial Technology Solutions – (Mostly) fees paid by Toast customers to facilitate the transactions on the platform. Includes a percentage of the total value of transactions processed as well as a small basic fixed fee.

- Hardware Revenue – Revenue earned from the sale of of terminals, tablets, handhelds, and other Toast accessories

- Professional Services – Services that Toast provide when new restaurants join platform or existing Toast customers add new products to their

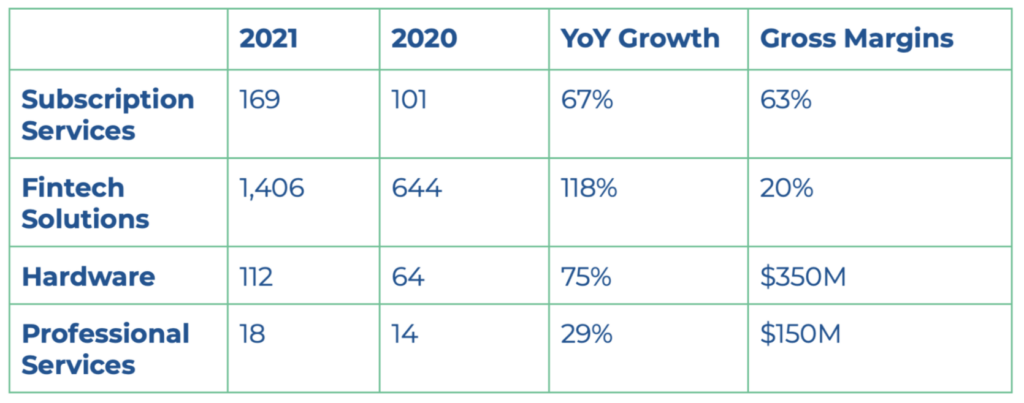

Here is the financial breakdown of these respective revenue lines:

As you can see there is a lot going on & things are messy:

- The revenue line that makes up ~80% of sales only has 20% margins

- Two of the revenue lines have negative, significantly negative margins

- The sexyness is the SaaS revenues, but that is only 10% of revenues

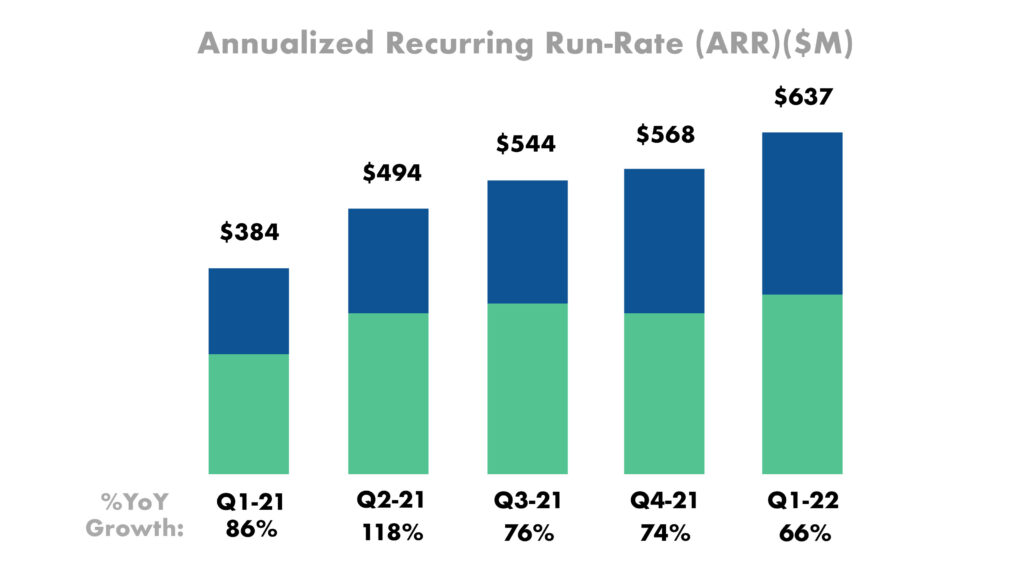

Toast is well aware of the confusion that this income statement provides and therefore asks investors to look at their Annualized Recurring Run-Rate (ARR) which is represented by the Subscription Service revenues & the gross profit from the FinTech Solutions.

At the end of Q1, the company had ARR of $637M, representing 66% growth year over year. This also means that the company is trading @ just under 12x LTM ARR, a reasonable, yet very different figure than the 5.5x sales multiple shared earlier.

SaaS Growth

There are two clear & obvious ways for Toast to increase their ARR:

- Bringing new restaurants onto the platform

- Selling more products from the company’s SaaS suite to existing customers. Toast is executing on both fronts beautifully.

Regarding new locations, Toast has increased from 43K to 62K from Q1 ‘21 through Q2 ‘22 while also in Q4 ‘21 achieving its first quarter of over 5K new locations added to the platform.

In the Q1 call, management shared that they are scaling back up their sales team after trimming it during COVID which should lead to a continued penetration of the market.

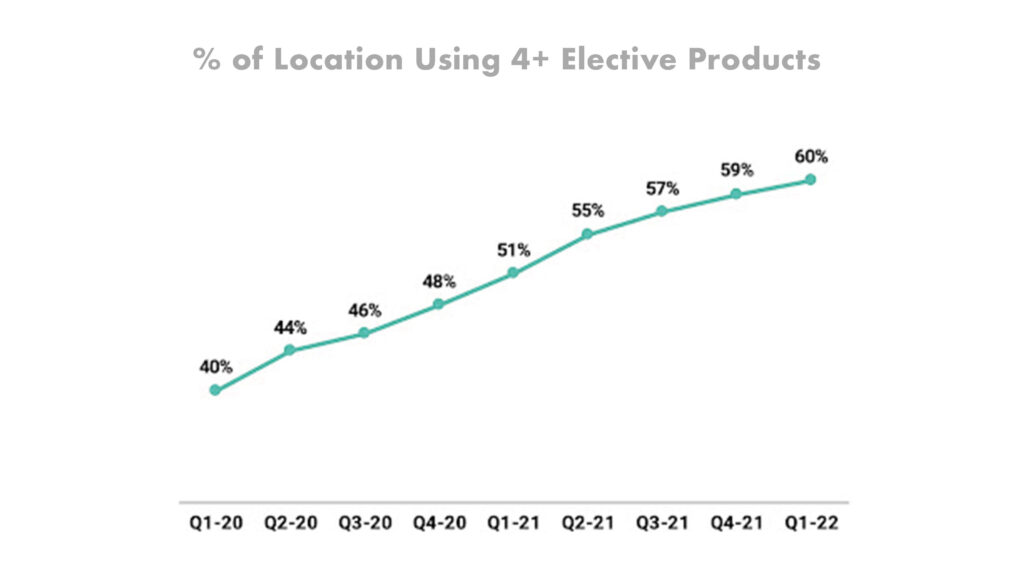

From a “selling additional products perspective,” check out this chart below:

Beast. From an execution perspective, Toast is burning the competition.

Not only is Toast increasing the amount of customers that are using 4 products more, they are actively looking to create even more products for customers and make the average products used even higher.

An intriguing example of this is Toast for Hotel Restaurants, a new solution targeting specific needs for restaurants at hotels that include features like being able to charge the bill directly to your room. A simple, obvious, yet integral tool that would be a must own for hotels.

Wrapping It Up

As you can see, Toast is quite an interesting stock. The opportunity is massive, the growth is massive, but like any equity it comes down to valuation.

In the next newsletter, I will be breaking down the company’s profitability and my thoughts on its valuation, which crossover investors are big players in Toast, and a whole lot more.

Stay Tuned!

-Alan

In The News: The Snap of a Finger

TL;DR: Snapchat’s second-quarter earnings fell far below expectations along with Twitter, both of whom rely on advertising for revenue. This has left investors concerned about social media’s ability to monetize its platforms through advertising.

3 Key Points:

- Shares of Snap have lost almost two-thirds of their value since the beginning of the year, in large part due to their earnings misses

- This massive decline has to do with both the current economic environment – external companies are cutting their digital advertising budgets amid rising economic uncertainty and inflationary pressure – and Apple’s privacy changes, which have made targeting advertising more difficult.

- The rise of Tiktok, along with the increased market uncertainty, will push social media advertisers to adapt their offerings – Snap launched Snapchat+, and Facebook is focusing on Facebook Reels, which follows the model of Tiktok, to try and retain profits.

Key Quote:

“We’re really looking for founders who want to build long-term, transformational, category-defining companies … that carve out a new market. There is no one we’d rule out, but it’s more about the scale of ambiti“Angelo Zino, vice president and technology equity analyst at CFRA Research, said in a research note on Thursday that CFRA had cut its 12-month price target for Snap from $18 to $15 per share—but his long-term outlook for the company compared to other firms in the space remains positive.”

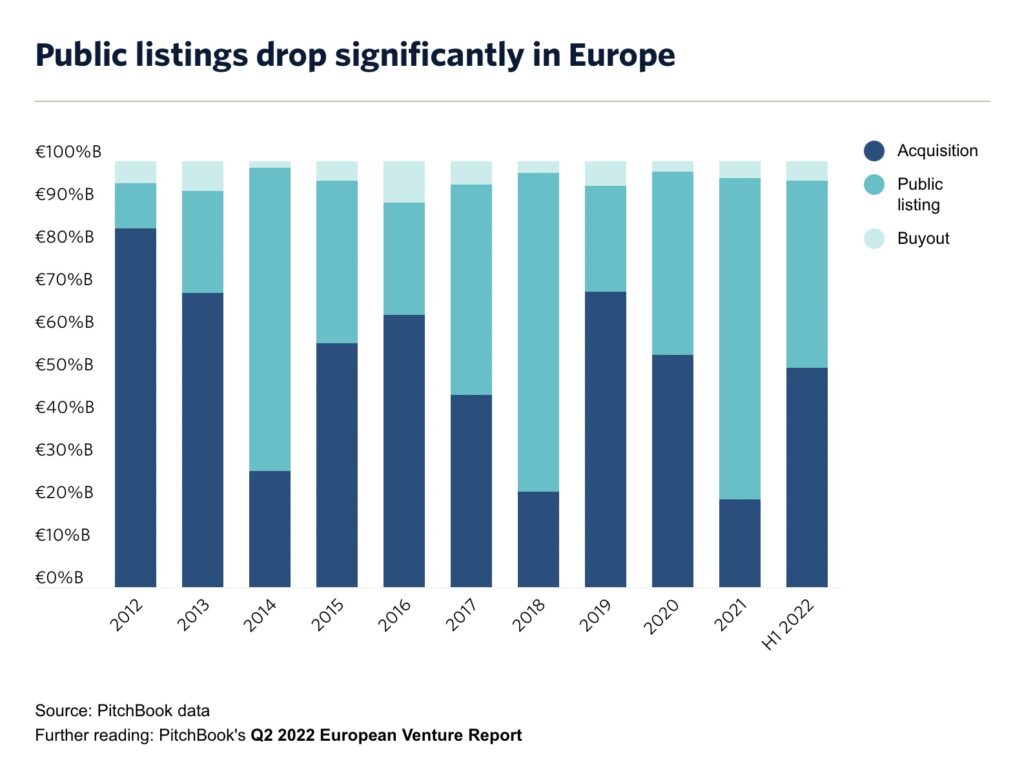

Chart of the Day: An Update on Europe

- Public listings suffered most from a more cautious attitude toward exits, as tech sell-offs occurred across the globe.

- In H1 2022, 34 public listings generated €11.3 billion as opposed to 110 worth €41 billion in the same period last year.

- Overall, European exit value fell back to pre-2021 levels in H1, while exit count remained healthy with 657 deals completed, worth a total of €25.8 billion.

Golden Nuggets

- This child is officially cooler than I ever was. Now that is how you get off a bike!

- One of the weirder baseball moments I have seen in a long long time

- Love this investing wisdom from Charlie Munger

- Another streaming service is officially live. This time the NFL is behind it and the name is, you guessed it, NFL+

Meme of the Day

Thanks for the read! Let me know what you thought by replying back to this email. See you in your inbox every Monday and Thursday.

— Alan

Disclaimer: This analysis is for educational and entertainment purposes solely and is not professional investment advice. The author of this piece and/or members of Workweek media could be invested in companies discussed.