14 July 2022 | Investments

Why Are the Knicks So Cheap?

By

Hello from New York, New York!

In honor of being in the (very hot) Big Apple, I thought it would be the perfect time to feature Madison Square Garden Sports ($MSGS) — one of the most interesting intersections between the public & private markets.

Showtime!

Want to get these in your inbox to never miss an edition? Subscribe to The Crossover today!

$MSGS: The Walled Garden?

Madison Square Garden Sports

Madison Square Garden Sports ($MSGS) represents one of the handful of opportunities for people like you and me (I don’t think we have any billionaires reading the newsletter yet!) to own a part of a professional sports team through the public markets.

A share of $MSGS would represent a partial ownership of multiple professional sports franchises including: The New York Knicks (NBA), New York Rangers (NHL), Westchester Knicks (G League), Hartford Wolf Pack (AHL).

$MSGS also has some pretty serious esports exposure through the ownership of Knicks Gaming, an esports franchise in the NBA 2K League as well as a controlling interest in Counter Logic Gaming, a North American esports organization.

Quite the portfolio to say the least.

Private Markets

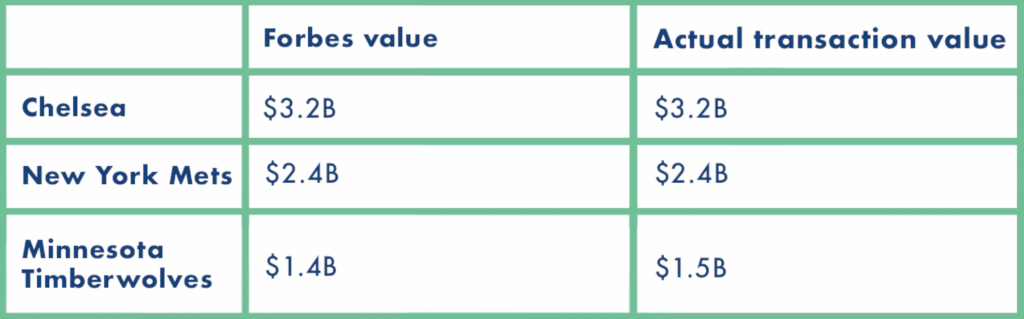

The highest respected valuation authority when it comes to professional sports teams is Forbes.

Every year, Forbes receives access to confidential financial information on franchises, analyzes the economic landscape, and has conversations with all the right people to create valuations on sports teams – and they are really really good.

Here are three examples displaying how accurate Forbes is at coming up with these valuations:

Bang.

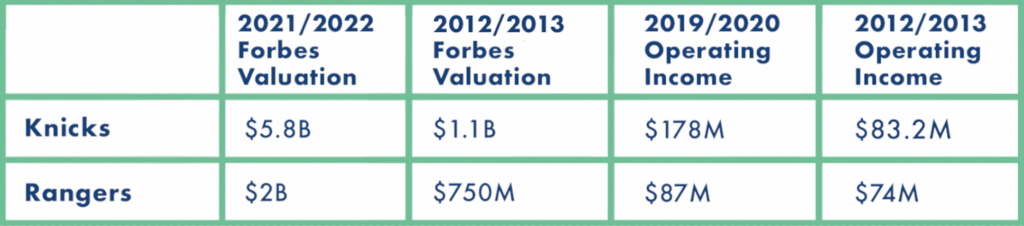

So let’s check out how Forbes would break down the valuation of the two key $MSGS assets to see what a valuation would look like:

Two Takeaways:

According to Forbes, the two franchises together should be worth ~$7.8B.

The valuations for both franchises have skyrocketed with the Knicks more than 5x and Rangers nearly 3x over the past ~10 years.

Ready to hear how much the asset is worth in the public markets?

$3.5B. Yup. Just $3.5B when the valuation of the Rangers and Knicks alone is more than 2x that.

Why the discrepancy? What are we missing?

Valuation

First & foremost, it is important to recognize the disconnect between the fundamentals of the business and the valuation. The Knicks for example are trading @ ~30x operating income while the Rangers are trading @ ~23x operating income. Very very expensive.

A sports team is a luxury asset and therefore what people acquire assets for are not tied to the fundamentals. Additionally, historically, sports teams have struggled to be profitable and rather are funded by their multi-billion dollar owners.

This makes things difficult from a stock perspective as the likelihood of dividends, share buybacks, and increase in cash flows is unlikely and therefore the stock is missing a major catalyst to move the equity valuation higher.

Arguably the simplest way to actualize the fair equity value would be to sell the asset. However, if you were to own the Knicks, why would you ever sell them?

Check out these interesting comments that James Dolan, majority owner of the Knicks/Rangers, shared in 2019:

“You have a responsibility as the guy who runs the place to deliver on that for them; that’s being open and transparent. And so in that position, I could never say that I wouldn’t consider selling the Knicks. Now, my family is not in that position, and they are the majority shareholders. They hold the majority of the vote.

“As a majority owner, I don’t want to sell, either. As the head of the public company, you can’t say you can’t sell, because then you’re telling your shareholders that your own personal feelings about your assets are more important than their money. And they won’t invest with you if you do that.”

So if I got things right he knows that he has to sell, does not want to sell, and hasn’t sold. Not much to work with.

Since these comments, the Forbes valuation of the two franchises is up at least $2.5B. Taking everything into account, I would expect that something would have to happen over the next couple of years or institutional investors will make some serious noise.

I would expect Dolan to either take the franchise or sell a portion of it, likely the portion owned by the public shareholders.

The current situation with $MSGS & lack of insight into a sale has not held back legendary value investors, Ariel Investments & Mario Gabelli (GAMCO & Gabelli Funds) continuing to grow their stake in $MSGS in Q1:

- Ariel Investments picked up an additional ~55K shares taking their stake in $MSGS up to 4.6% of the company

- Gabelli, across his two funds increased their stake in $MSGS by over 3K shares, taking his ownership in the company up to 4.3%

Mr. Dolan should be expecting calls from Ariel & Gabelli soon – if he is not receiving them already.

-Alan

In The News: End of an Era

Article: Bill Ackman shutting SPAC, will return $4 billion to shareholders

TL;DR: SPAC Pershing Square Tontine Holdings Ltd. said Monday it will cease all operations and return $4 billion to shareholders after July 26 due to its inability to find a good deal for investors

3 Key Points:

- The SPAC was originally focused on taking a 10% stake in Universal Music Group before the deal fell apart

- The company will redeem all class A stock at an expected $20.05 per share on July 26, and will not be completing an IPO.

- CEO Bill Ackman is expecting to launch Pershing Square SPARC Holdings Ltd, which intends to issue publicly traded, long-term warrants called SPARs.

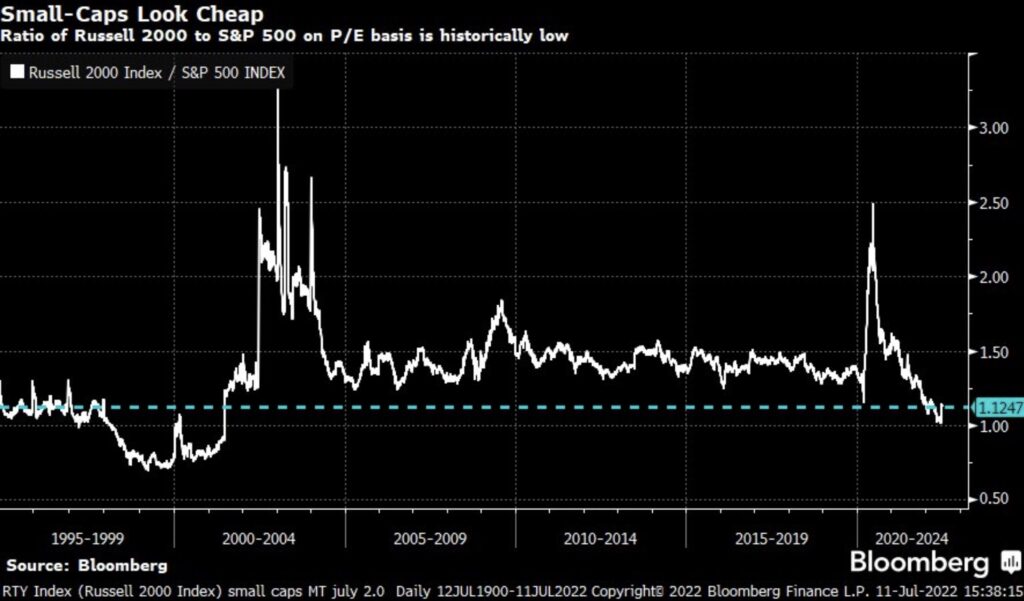

Chart of the Day: A Small Cap Opprotunity?

- The Price/Earnings Ratio of small caps is at a historical low when compared to the P/E of the S&P 500.

- The P/E of the Russell 2000 (an index of small-cap companies) is only 1.1247 times the P/E of the S&P 500.

- One thing to keep in mind regarding this chart is that many Russell 2000 companies do not even have earnings…interesting.

Golden Nuggets

- Incredibly intrigued by Netflix’s decision to choose Microsoft to help facilitate their push into advertising

- I cannot wait to see Albert Pujols in this year’s HR Derby! For old times sake!

- Seeing how a key actually works never gets old

- JP Morgan had a rough quarter

Meme of the Day

Thanks for the read! Let me know what you thought by replying back to this email. See you in your inbox every Monday and Thursday.

— Alan

Disclaimer: This analysis is for educational and entertainment purposes solely and is not professional investment advice. The author of this piece and/or members of Workweek media could be invested in companies discussed.