06 July 2022 | Investments

FTX: Robinhood’s Savior?

By

Hey everyone!

How was your 4th of July Weekend???

I spent Sunday with some old friends from college and childhood that I haven’t seen in way too long. It was electric.

I am very happy I got this newsletter done on Friday as my head is still throbbing from the weekend. (Yes Mom. That is a hangover joke!).

Two housekeeping notes:

1. Make sure to check out my favorite Minion meme at the bottom!

2. I went live on Twitter Spaces with Austin Leiberman of CommonStock & we discussed $NVTA, crypto, current market conditions, & more!

Showtime!

Want to get these in your inbox to never miss an edition? Subscribe to The Crossover today!

FTX x Robinhood

Introduction:

Last week, I put together a piece on Deel (VC backed private company) acquiring PayGroup (an Australian publicly traded company. As part of my analysis, I wrote:

“With companies staying private for longer, the rise of VC backed companies acquiring publicly traded companies is going to become more and more common.”

Just hours later, news broke that FTX (VC backed private company) was looking into acquiring Robinhood (publicly traded company).

Can I see the future? Absolutely not.

If I could, I would be on a beach sipping some whiskey on the rocks, and not here writing to you all, but hey, this is more fun, right? 😉

Crossover investing is a fast growing trend but the writing for my prediction above was on the wall.

Today, I look forward to sharing my thoughts on FTXs pursuit of Robinhood.

Robinhood:

“Right now it is unraveling… God is getting just.”

-Charlie Munger on Robinhood @ the 2022 Berkshire Annual Meeting

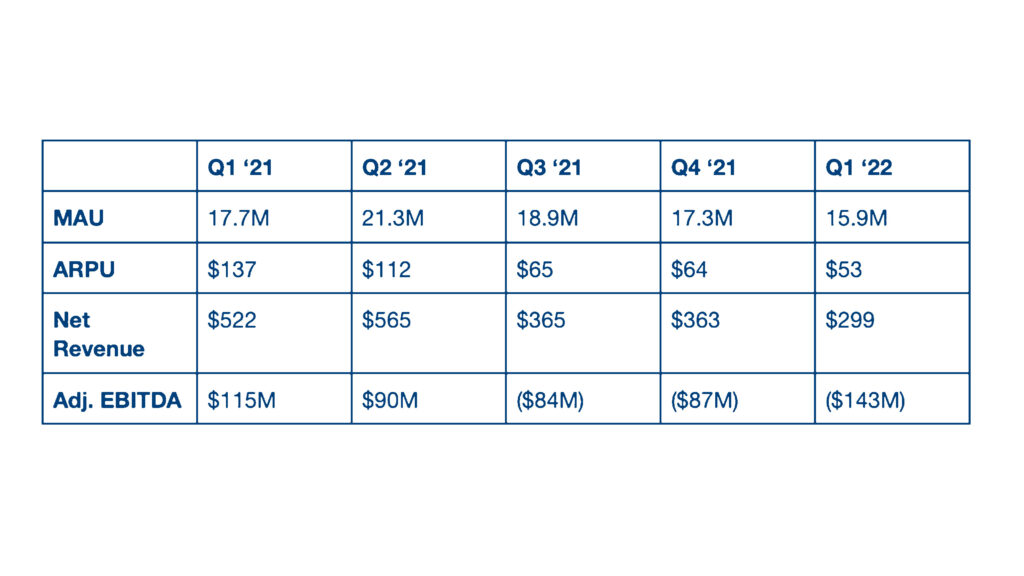

Kicking things off, Robinhood is in some serious trouble. Check out these stats below:

Takeaways:

- MAU’s are collapsing, decreasing ~5.5M since Q2 ‘21

- ARPU is down more than 60% from highs

- Revenue is down

- EBITDA has gone from over $100M in profit to over $100M in loss

Over time, it has become clear that Robinhood was much closer to operating a casino in the public markets than a platform for long term investing.

Historically low interest rates & trillions of dollars being pumped into theeconomy made making money in the markets easy.

This led to millions of new customers pouring into Robinhood to make a quick buck, however, as the markets collapsed, it has become clear that the quick buck was always the new user’s intentions and have left the app accordingly.

Additionally, it is important to recognize just how “weak” Robinhood’s revenues are.

In Q1 ‘22, $127M out of $299M in revenue came from options trading, representing 42% of total revenue.

I anticipate Interest in options trading will continue to decline due to theincredibly high risk nature of the vehicles and lack of understanding around them – even some of the greatest investors do not engage in options trading.

From a valuation perspective, Robinhood is trading @ around a market cap of ~$8B. To put this into perspective, the company IPO’d @ a $32B valuation. An even crazier stat is the fact that they have raised ~$7.5B in private markets – nearly the same amount as its current valuation.

Finally, a whopping 72% of Robinhood revenue in Q1 came from “Payment From Order Flow” where institutions like Citadel pay Robinhood for access to the traders data.

SEC Chair Gary Gensler has discussed banning the ability for trading platforms to engage in this process which would obviously be a significant, maybe even existential, blow to Robinhood.

What is one major positive that Robinhood does have going for them?

Their cash balance. At the end of Q1, the company had over $6B in cash on the books and this would likely be the main reason the company would look to avoid an M&A push by FTX.

FTX

FTX is one of the largest crypto trading platforms in the world & most recently raised $500M @ a $32B valuation in January ‘22.

The company was founded in 2018 by Samuel Bankman-Fried, one of themost influential voices in the crypto community today.

Something that differentiates FTX from other crypto exchanges is the fact that they are profitable. Check that. Wildly profitable.

The company has historically worked closely with larger and more sophisticated crypto investors as well as having significantly fewer employees/overhead than competitors.

These are two of the reasons the company has remained profitable while companies like Coinbase have seen their net income turn into a net loss.

The company shared that in 2021, they anticipated that they would earn around $800M in profits.

These profits, partnered with over $2B in VC funding, has enabled thecompany to be active in the M&A market & support various struggling crypto exchanges through debt facilities like $250m for BlockFii & $500M for Voyager.

As Bloomberg reported last week, FTX might be working on an acquisition of Robinhood. Even though FTX responded with this to these reports:

“We are excited about Robinhood’s business prospects and potential ways we could partner with them, and I have always been impressed by the business that Vlad and his team have built. That being said there are no active M&A conversations with Robinhood.”

I am thinking that this is an example of where there’s smoke there is fire. Why?

In early May, San Bankman-Fried acquired a 7.5% stake in Robinhood for $648M in the public markets. The SEC filing disclosing this purchase included commentary that Bankman-Fried acquired the shares because they represent an attractive investment opportunity.

I think you can find 100 more intriguing investment opportunities than Robinhood, and it has me thinking that Bankman-Fried is taking a play out of Elon Musk’s playbook.

Additionally, an acquisition of Robinhood by FTX would be phenomenal from a strategic perspective. The company would position themselves to be thetrading platform for the next generation investor offering crypto and stock trading capabilities under a strong brand.

From a competitive perspective, it would put them significantly ahead of Coinbase & other crypto exchanges.

Although I think something might be up here, I wanted to share theperspective of JP Morgan’s Devin Ryan who shared that FTX would need to pay a “really material premium” to acquire Robinhood.

Ryan cited the company’s $6B cash balance as well as the fact that “Robinhood’s founders have voting rights that give them 10 to 1 on their Class B shares. So they own 15% of the stock but they have over 60% of the voting power.”

Wrapping It Up

Back when I was writing for Just Raised, I was tasked with making some pretty bold predictions. I think it would be fun if I started bringing that energy to “The Crossover” and will kick it off with a prediction here.

Prediction: FTX will acquire Robinhood, but not until late 2023

As Devin Ryan shared above, there is a high likelihood that Robinhood will look to fight off any acquisition offers in the near term. However, the rapidly decaying fundamentals point will start eating to that cash balance and reality could start setting in that the future of Robinhood looks pretty poor.

I also think that the SEC will be looking to take some power back from thecrypto/investment markets, and cutting down on Payment For Order Flow is a real possibility.

This will definitely be an interesting one to watch, and I can’t wait to keep you all updated.

In The News: Going on Sale

Article: Put Up the For-Sale Sign,’ More VCs Tell Founders as Market Sours

TL;DR: As the economy worsens, VCs recommend that founders stop their “grow at all costs” mindset, and instead work on becoming profitable, raising additional capital, and, if all else fails, selling to a strategic partner at a discount.

3 Key Points:

- Profitability is now the name of the game, and if companies are unable to change with the times, pursuing an acquisition is preferable to going belly up.

- The head of M&A at Union Square Advisors says that many startups short on capital are trying to sell their company and raise capital simultaneously, hoping that the corporations looking into investing in them will buy the startup outright.

Key Quote:

“[If a startup is] at risk of running out of cash in 12 months or less, then some investors are telling companies to resort to even more drastic measures: try to sell to a strategic buyer at a discount rather than risk going out of business.

‘I’ve called founders [to say], ‘I think you should sell,’’ said Chris Farmer, a partner and CEO at early-stage firm SignalFire. ‘A sale could be attractive to founders because they don’t have to lay off everyone, and investors can get some or all their money back. It’s a soft landing.“

Chart of the Day: Private Markets Get Interesting

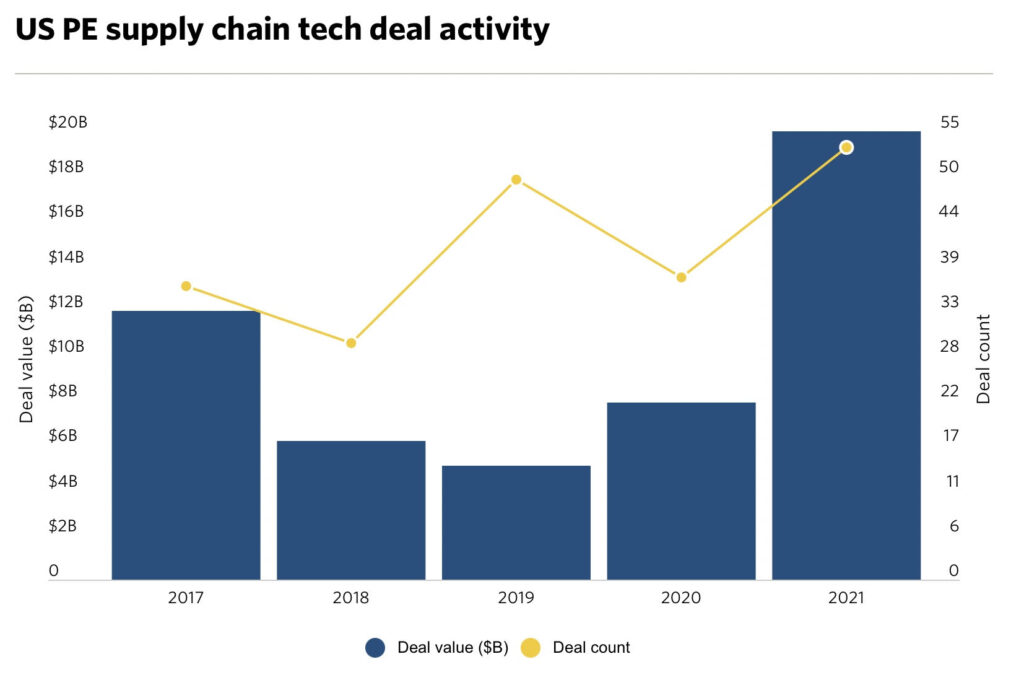

- Private equity investments in the US supply chain have grown substantially in the past year in response to the weaknesses in theglobal supply chain exposed over COVID.

- In 2021, 53 PE deals in the US supply chain sector accounted for $20 billion in total deal value, up from 37 deals totaling $7.9 billion in 2020, according to PitchBook data. In 2019, deal value totaled only $5.1 billion.

- However, current market turbulence and fears of a recession can hinder private equity deals in this sector.

Golden Nuggets

- This video of LAD P Clayton Kershaw perfectly in sync with the crowd doing the wave is so cool

- Very proud of this meme I made. Very not proud of my spelling however.

- New Zealand Air is installing sleeping pods for economy class flights – Legends.

- This pass by Jason Kidd over Yao Ming with the game on the line from back in the day was incredible

- Freddie Freeman’s press conference after he returned to Atlanta gave me all of the emotions. Sports.

Meme of the Day

Minions.

Thanks for the read! Let me know what you thought by replying back to this email. See you in your inbox every Monday and Thursday.

— Alan

Disclaimer: This analysis is for educational and entertainment purposes solely and is not professional investment advice. The author of this piece and/or members of Workweek media could be invested in companies discussed.