30 June 2022 | Investments

Invitae: Why am I a Believer?

By

Hey everyone!

Good afternoon!

As we all get ready for our 4th of July weekends and stare the realities of inflation straight in the face, just remember that the Fed Reserve has our backs and everything is under control (sarcasm):

“I think we now better understand how little we understand about inflation.”

-Fed Chair Jay Powell

I still cannot believe these words left Powell’s mouth yesterday.

Also, make sure to check out today’s meme at the bottom featuring a bunny. It originally was going to be J-Pow related, but I did not think he was deserving!

Showtime!

Want to get these in your inbox to never miss an edition? Subscribe to The Crossover today!

Invitae: Why am I a Believer?

Introduction:

“Be fearful when others are greedy, and greedy when others are fearful.”

-Warren Buffett

There is nothing harder in investing than being greedy when others are fearful. When the masses have written off a stock, there is likely a good reason they are doing so.

However, when you can find the opportunities where the masses are wrong, there is some serious money to be made.

Invitae could not be more discarded by the general public currently, however, I have put on my blinders, borrowed two of my roommates ear plugs, and decided to take a deeper look – a look through my own eyes.

(Side Note – Warren Buffett would never invest in a company losing this much money. I feel a little like crypto bull Anthony “Pomp” Pompliano using a Buffett quote out of context, but unlike crypto, I think this quote is much more warranted with Invitae.)

Invitae:

Let’s take a look at a few of the reasons I am bullish on Invitae.

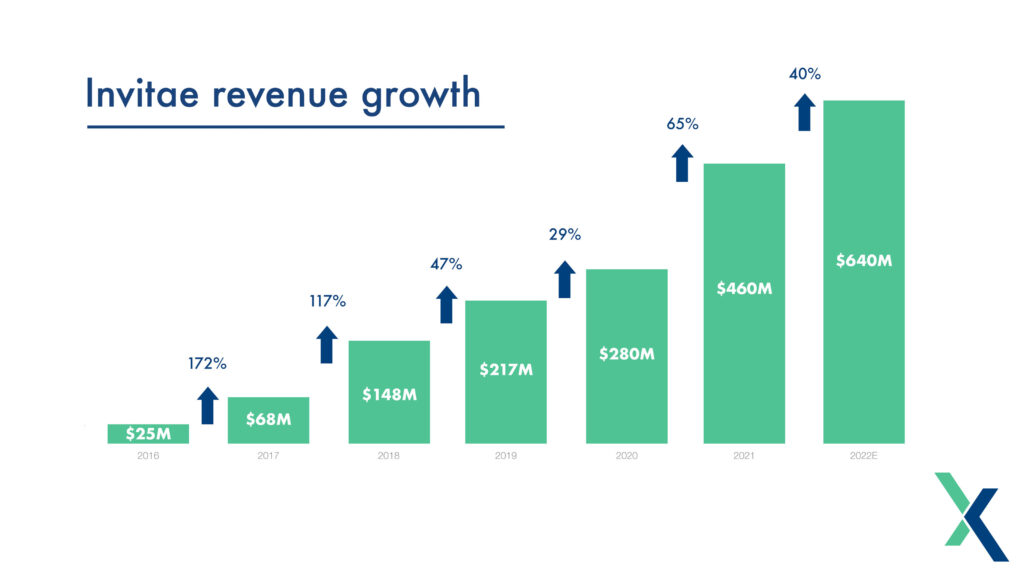

As you can see, Invitae has seen explosive revenue growth from $25M in 2016 to around ~$640M in expected revenue in 2022.

When the first piece on Invitae was released on June 20th, Invitae’s market cap was ~$525M, meaning Invitae was trading at less than 1x sales.

It is also not like the company is projecting the revenue to be low margin – actually, quite the opposite with gross margins leaving the year @ a 45% margin, with long term margins expected to be ~50%.

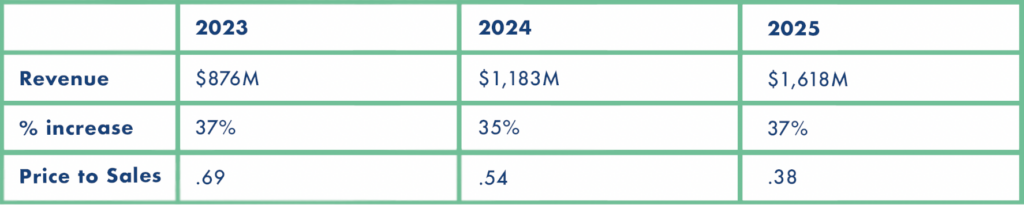

Additionally, with the industry of genomics being in the first inning, analysts project serious revenue growth for the company over the next several years:

Based on how early we are in the genomic revolution, partnered with the fact that these revenues have strong gross margins, the future revenues of Invitae should be trading @ multiples of their expected performance – not less than 1x.

The reasoning that the company is likely trading this low is due to the risk of bankruptcy and further dilution – something that I also broke down in the first piece and find highly unlikely.

Why?

The company has extended its runway through the end of 2023 while still having a $400M shelf offering as “insurance.” At the same time, I think Invitae is looking to avoid using that shelf as CEO Sean George in early June @ the William & Blair conference shared this:

“We are making the active moves to make sure that we can reduce our burn & not be subject to the capital market conditions today.”

Sounds like Sean recognizes what the dilution would look like for their long term institutional shareholders & that is something the company is looking to avoid.

Even if the shelf is executed, including the dilution, Invitae would be trading @ less than 2x 2022 sales.

Hidden Gem:

One of my favorite investing strategies in my investing philosophy is trying to discover misunderstood & under discussed assets embedded within a company.

Invitae has one of these golden nuggets and they call it Platform and Data Services.

Check out what CEO Sean said on the companies Q2 call on this revenue stream:

“This category includes data management and analytics, interpretation and data-as-a-service, certain biopharma programs and patient identification efforts, among others.

We anticipate this part of the business will be one of the fastest-growing elements of our business over the next five years, fueled by our continued building across disease areas and acquiring new capabilities, combined with access to the rapidly growing number of new patients entering our ecosystem at all stages of life.

Revenues derived from those services were about 2% of total three years ago, but they’ve been growing rapidly in this past quarter, moved past 8% of total revenue.”

-Invitae CEO Sean George

Powerful. Later in the Q2 2021 call, Sean discussed how this is a “high gross margin” component to the business and down the road they are planning to launch a subscription type of service for different stakeholders to access the consumer-controlled data.

Simply put, it looks like Invitae has a SaaS margin-like business hidden within the greater entity—and that grabs my attention.

In the Q4 earnings report, Invitae shared some quantitative data on just how fast this revenue line is growing:

- 2019: $15M

- 2020: $26M

- 2021: $39M

This represents 42% YoY growth from 2019-2020 and 50% YoY growth from 2020 to 2021 – note how the revenue growth accelerated last year.

A crazy way to think about Invitae is that they are trading at ~13x (trailing) platform revenue alone.

Sean George:

Sean George.

This investment will either soar or crash & burn because of Sean. If I am willing to be this contrarian about a company sold off as much as it has been, I must really like this guy.

I do.

On April 8, 2015, Sean George spoke @ a Stanford entrepreneurship seminar. I think this is not only a phenomenal watch for those not only considering Invitae as an investment, but also anyone that has a passion for startups, entrepreneurship, and the private markets.

Sean shares the journey of Invitae & is incredibly transparent the whole way through sharing his vision for the company & the various times the company was on the brink of failure.

He is down to earth. Honest. Rational. Big heart. Small ego. Recognizes what he is & what he isn’t.

I absolutely love all of that.

Originally, I was planning on making this section a whole lot longer with quotes and various moments from the call, however, in my eyes, it dilutes the power of the speech.

Next time you are going for a run, a stroll in the park, or kicking back on your hammock looking for a podcast, give this seminar a listen.

You will see why, specifically with where the fundamentals lie currently, I am a big believer in Sean & Invitae.

-Alan

***I am currently long shares of Invitae stock and plan on continuing to add to the position***

In The News: Chinese Stocks > US Stocks?

Article: How China’s Internet stocks outperformed the US bear market

TL;DR: As US and European markets slump due to high gas prices and interest rates, China’s public tech companies are becoming increasingly more enticing as investments.

3 Key Points:

- In March, the consensus of most major banks was that investing in Chinese stocks was a mistake, citing “rising geopolitical and macroeconomic risks.”

- However, now the consensus has changed to be bullish on the Chinese markets, driving the MSCI China Index, the broadest measure of China stocks on mainland and offshore markets, up more than 20% since March 15.

- There is still risk in investing in China though – China still has a zero-tolerance approach to containing COVID, apartment and housing sales have fallen in China on a year-on-year basis for 11 months straight, and regulatory risks abound, whether from US or Chinese government officials.

Key Quote: “Goldman Sachs China strategist Kinger Lau now says the worst may be over for China shares. In a June 13 report, he argued that the recent recovery is “on par” with earlier China market corrections and may yet have room to run. Lau’s upbeat take is notable because he and colleague Timothy Moe were among the first analysts to use the [word ‘uninvestable’] in connection with China.”

Quick Thought:

I personally do not invest in Chinese stocks. There are so many intriguing opportunities in the public markets, domestically that I just do not see a point of taking any risks with the geopolitical landscape in China.

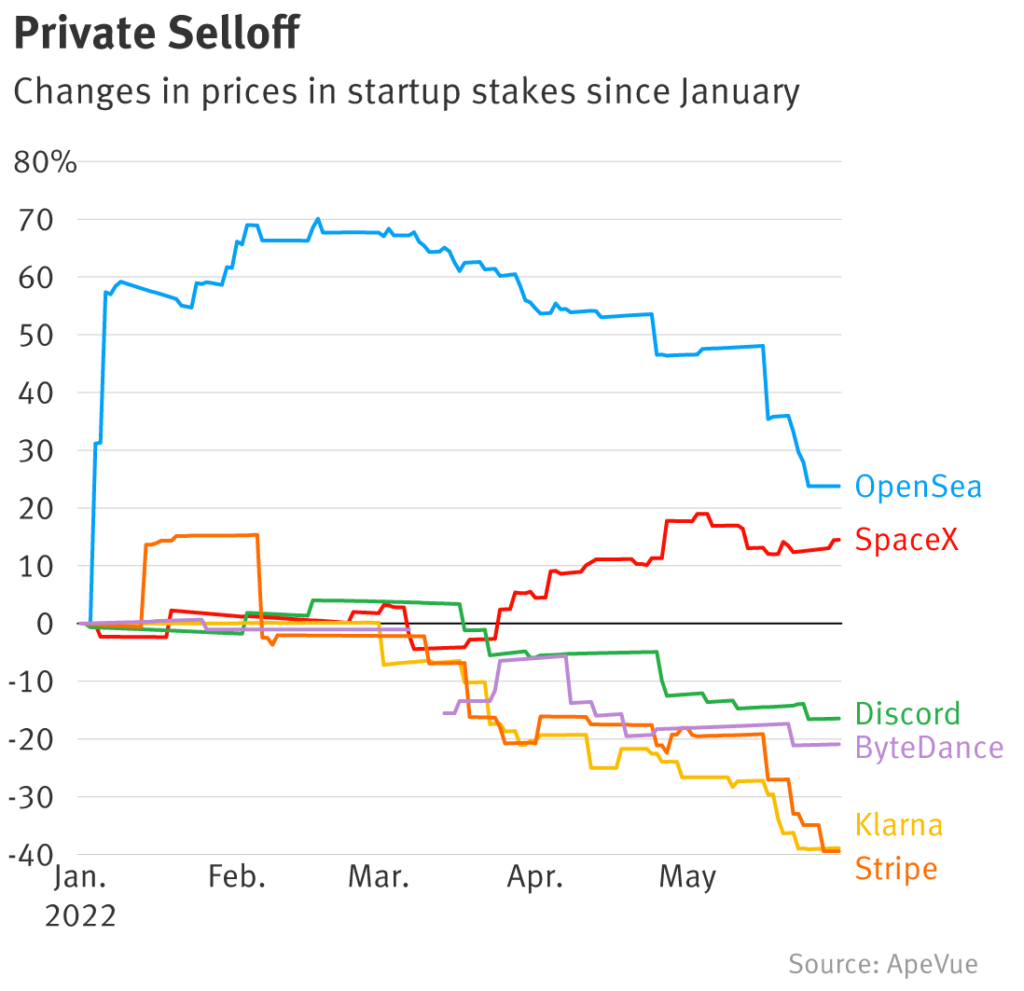

Chart of the Day: Private Markets Get Interesting

- I love this chart by ApeVue that was featured in Anand Sanwal’s recent newsletter

- With the strength of TikTok, I anticipate that ByteDance will actually see their valuation bounce back in a strong way over time

- Also, I think that OpenSea will continue to see their valuation drop significantly as the crypto winter sets in

- What jumps out to you about this chart?

Golden Nuggets

- I just can’t get over this video of David Robertson getting his first career hit after 14 seasons in the MLB.

- The media SPAC market has been a disaster. Rich Greenfield had a great tweet breaking down just how ugly it is

- Amazon is creating a feature that can synthesize people’s voices, allowing people to talk to their dead family members. I don’t think this is it.

- The emotions that LAD 1B Freddie Freeman showed in his return to Braves Stadium is what it is all about

Meme of the Day

The bunnies in Boston are absolute savages. Zero regard for the rules.

(Picture taken by yours truly.)

Thanks for the read! Let me know what you thought by replying back to this email. See you in your inbox every Monday and Thursday.

— Alan

Disclaimer: This analysis is for educational and entertainment purposes solely and is not professional investment advice. The author of this piece and/or members of Workweek media could be invested in companies discussed.