27 June 2022 | Investments

Deel: An Acquisition From Down Under

By

Hey everyone!

Over the weekend, I watched the movie “Margin Call.”

I definitely enjoyed it but could not stop thinking just how much better it could have been. The Big Short is much better!

Also – for those wondering, the second Invitae piece is dropping on Thursday! Get pumped.

Showtime!

Want to get these in your inbox to never miss an edition? Subscribe to The Crossover today!

Deel

Last week, we saw something really interesting go down in the global markets – a private, VC backed company acquire a publicly traded company.

Deel is a privately held, venture backed company that is a provider of payroll and compliance software for companies looking to hire employees & contractors overseas.

Deel creates local entities in international countries, navigating the various employment laws, enabling enterprises to hire employees seamlessly on their platform.

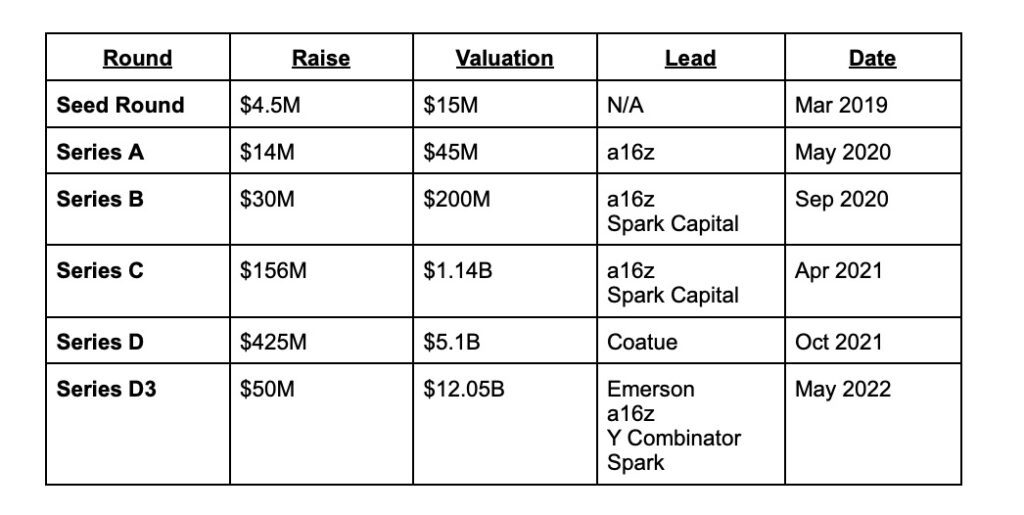

The company was founded in 2013 by two MIT students: Alex Bouziz (CEO) and Shuo Wang (CRO) and was in the Y Combinator accelerator program in 2019 kicking off a powerful run in the private markets:

A couple takeaways:

First, just look at the names of the investors backing this company. a16z, Spark Capital, Emerson. Their cap table is just as stacked as an NBA All-Star-Team.

Second, in almost exactly a year, the company 12xd their valuation from ~$1B to $12B and raised almost $600M in the process as well.

The raise in valuation was extraordinary warranted as the company displayed breathtaking growth fueled by the explosion of remote work over COVID.

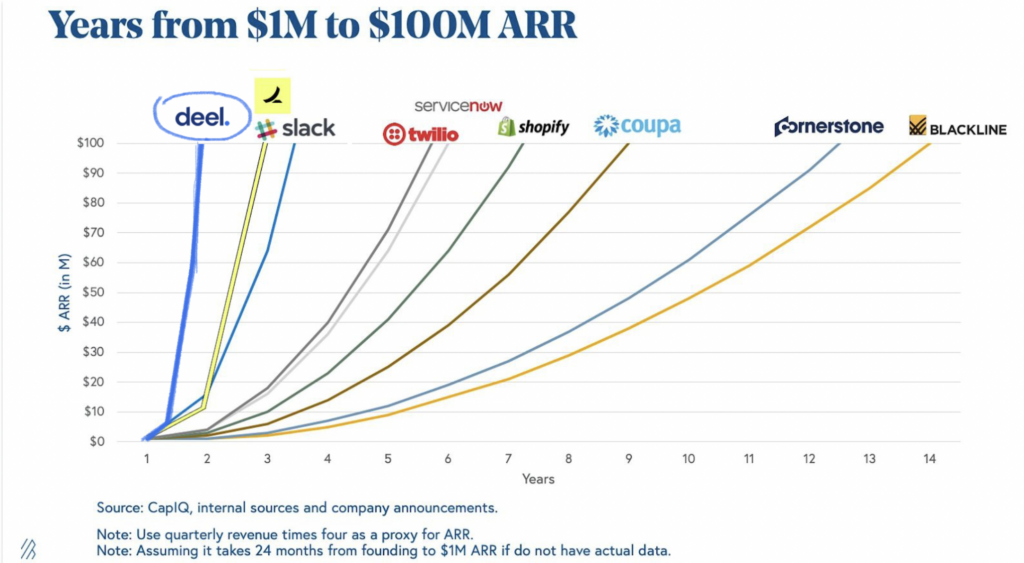

At the beginning of 2021, Deel had $4M in ARR and with strong execution during the pandemic, scaled to over $50M. Fast forward to April 2022, and the company is doing over $100M in ARR.

Increasing ARR by 25x at that scale in ~15 months is breathtaking and makes a 120x ARR multiple look not too crazy than you might have initially thought.

Check out this interesting chart that Deel shared breaking down just how quickly the company went from $1M to $100M in ARR:

Beating out Slack, Twilio, Shopify is not a bad place to be.

Acquisition

Last week, Deel announced a big acquisition of PayGroup, a publicly traded Australian payroll company.

PayGroup is a leading global provider of payroll management that has a significant presence in the Asian Pacific region processing around $AU 11B for over 2,800 businesses.

Deel acquired the company for $AU 119.3M ($83M USD) @ $1 a share, representing a 174% premium to its closing price on June 22 of $0.365.

Not only does this acquisition give Deel a significant boost in the APAC region, but also the acquisition was done, in my eyes, at very reasonable terms.

Here are some key financial statistics reported last month for PayGroup in $AU:

- Revenue: $27.2M, 68% YoY growth

- Exit ARR: $39.1M, 44% YoY growth

- Gross Margins: 53.7% vs. 52.5% 2021

- Net Profit After Tax: $.1M vs. ($.5M) 2021

As you can see, Deel scooped up PayGroup, a profitable, fast growing company with strong margins, for just less than 3x ARR.

Now that is a good deal.

Alan’s Angle

To this point, we have mostly been discussing the concept of crossover investing through the lens of individual investors and specific crossover funds looking to capitalize off of inefficiencies between the two markets.

However, as you can see, this is something that is creeping into other arenas with VC backed companies acquiring publicly held companies.

With companies staying private for longer, the rise of VC backed companies acquiring publicly traded companies is going to become more and more common.

Why are these companies staying private longer? Three reasons:

- There is serious funding available in the private markets from massive VC funds

- Companies do not have to deal with volatility of markets

- Companies can be long term focused and not be subject to analyst & media criticism as well as the need to hit quarterly objectives

We will also see private equity companies like Thoma Bravo continue to be very aggressive in the public equities markets.

Specifically, keep your eye out on PE shops as well as other publicly traded companies becoming more active in the SPAC markets – not as a sponsor but as an acquirer.

Bloomberg wrote a great piece late last week breaking down how there are many companies/funds looking to acquire imploded SPACs at pennies on the dollar of their original valuations. Here are two examples:

- MetroMile – After once trading @ over $17 a share, auto insurer MetroMile, now trading @ under $1, was recently acquired by Lemonade

- Soc Telemedicine – went public via SPAC in Nov ‘22 @ $10 a share and was recently acquired for just $3 a share by PE firm Patient Square Capital

The intersection between the private & public markets is crossing over more and more in this unique economic environment, and I can’t wait to keep on breaking it down with you all!

In The News: VC Q2 Correction

TL;DR: Venture Capital deal count is down 23% from Q1 to Q2

4 Key Points:

- Not only is deal count down significantly but so is the amount of money invested, which has decreased 27% quarter to quarter

- The drop from Q4 to Q1 was only 1.4%

- CB Insights had originally predicted a 19% drop in Q2

- Funding in Series D rounds and beyond are down 43%

Key Quote: By early 2022, so many companies were raising at valuations of $1 billion or more that a new “unicorn” company was minted about twice a day. Over the past three months, however, the number of deals and the total funding raised have dropped to their lowest levels since late 2020.”ning, but said she can’t say more due to regulations.”

Chart of the Day: South African Surge

- South African VC funding has grown from $1.4B Rand to $12.5B Rand ($832M) representing 9x increase in 6 years

- 122 VC deals were completed in South Africa in 2021

- VC backed companies are not expected to IPO when they reach scale but rather be bought by publicly traded companies due to size of economy

Golden Nuggets

- This NBA rookie thinks Lebron has to prove to him that he is better than him. What?!?!

- I am incredibly confused yet intrigued by this bike

- Watching the Colorado Avalanche celebrate winning the Stanley Cup is everything

- I loved this article on an investor sharing his thoughts on passing on investing in Berkshire Hathaway in 1982

Meme of the Day

(More like fun fact!)

Thanks for the read! Let me know what you thought by replying back to this email. See you in your inbox every Monday and Thursday.

— Alan

Disclaimer: This analysis is for educational and entertainment purposes solely and is not professional investment advice. The author of this piece and/or members of Workweek media could be invested in companies discussed.