16 June 2022 | Investments

Exclusive: $14M Series A Investment Opportunity

By

By: Alan Soclof

Hey everyone!

We have a very special edition today where Crossover readers have the opportunity to invest in a $10M+ Series A, connect with the founder, and view the company’s pitch deck.

Shoot me an email if this is something you enjoyed and want to see more of.

Also, the Celtics took my advice and figured out how to shut down Steph, but it still was not enough. The Celtics might be in trouble…

Showtime!

Want to get these in your inbox to never miss an edition? Subscribe to The Crossover today!

Interview W/ Curastory

Last week, I caught up with Tiffany Kelly, CEO of Curastory. Curastory is a trailblazing platform in the creator economy and is currently raising a $14M Series A. (The interview is edited for length and clarity.)

Alan Soclof: Hi Tiffany! Why don’t you start off by telling me what Curastory is all about and the company’s journey.

Tiffany Kelly: Curastory is a creator economy tools company that has created an all-in-one platform for creators. We have free editing, free music licensing, and monetization features that allow creators to build businesses around their videos.

Specifically, regarding monetization, just like podcasters do their own ads, we enable video creators to create their own ads and bake them into their videos. From Curastory, creators can distribute their content to all of their channels including TikTok, YouTube, Reels, IGTV, Facebook Watch, etc.

The creators then get paid as the video is performing for their baked in ads. We are debiting the brands on behalf of the creators ad performance and taking a small fee from the videos’ gross earnings.

AS: What do you think makes Curastory different from competitors and alternative platforms on the market?

TK: The main way that we are different is how we make money. Creators in their own voices are making ads for their videos which is very very different from influencer marketing, fully sponsored content, and the entire video owned by a third party brand.

Creators in our model, the only thing that is sponsored is the one minute segment, very similar to a podcast. In many ways, we are doing what Spotify did for podcast advertising for hosts.

AS: What has the initial traction looked like on the platform?

TK: It has been awesome! I used to work at a small company called ESPN, and I have really been using my network since we launched last year. We are currently up to 38,000 sports and fitness creators. We have only been focusing on that vertical and have many professional athletes and olympians on the platform.

We are currently focusing on student athletes, gamers, fitness instructor YouTubers. Also, it is important to note that we have spent $0 on paid media. It has been all word of mouth and search engine discovery, not paid SEO.

AS: You are raising a $14M Series A. What is your vision with the raise?

TK: To date we have only raised $2.3M. From the onset, we have been very intentional with how we use every dollar. So much of our hiring early on was strategic. Every single person on our team right now is touching sports or fitness in some way. For example, our customer success manager’s husband is a famous gaming creator. Our lead product designer led all of the fitness instructors at Pure Barre NYC and we are closing a deal with them and Equinox talent.

The $14M will allow us to hire and expand to all other verticals, but we will continue to look for network effects in our hiring and be meticulous with every dollar spent. It is time to add some fuel to the fire.

AS: I love how you mention how intentional you are with every dollar. I think a lot of that meticulousness comes from your education and early on in your career. Would you be able to share with the readers about some of your early years?

TK: My former life? Yes! I was a data scientist. Calculus, computer programming, database management, and a degree in sports analytics. My first internship was with the Miami Heat where I did analytics for them in the front office.

I actually did the analytical analysis for the Goran Dragic trade with the Heat. That was super fun. After that experience, I built an algorithm that calculated how many points are produced on the offensive end and then the defensive end. I ended up presenting at MIT Sloan where ESPN hired me to be a data scientist and an analyst.

AS: That is awesome. Such cool experiences. Thank you so much for the time Tiffany! Can’t wait to talk soon.

TK: This was a blast Alan. Talk soon!

Alan’s Angle:

1. Right place. Right time: There is no better place to be right now than at the forefront of the creator economy. Specifically, the most difficult creators to work with are professional athletes and Curastory is making it look easy. Both NFL Star WR Tyreek Hill and former NBA All-Star Isaiah Thomas are on the platform as well as several olympians and other accomplished athletes. With a strong athletics base and a phenomenal platform, I expect the company to crush it as they look to expand to other verticals using their Series A.

2. Intentional Hiring: Whenever Tiffany and Co. were looking to hire, they were intentional and thought about what connections each hire would bring to the table on top of their skillset. I love this as using resources responsibly and efficiently is a secret to success. If I were an investor in Curastory, the fact that Tiffany is looking to keep this principle at the forefront as the company grows is massive. How easy would it be with $14M to leave this principle behind? Too easy. This should be music to investors’ ears.

3. Experience. Experience. Experience: Back when I was writing the Just Raised newsletter, I shared a piece breaking down how the most successful entrepreneurs happen to be later in their career (40’s & 50’s) – a piece I will be resharing here in a couple of weeks! Although initially surprising, when you think about it, it makes a lot of sense. People later in their careers are more experienced, knowledge, connections, etc. Although Tiffany is much younger, her experience with the Heat and ESPN have been instrumental to her ventures success and drives home the importance of just how beneficial experience can be.

Round Details:

-Pitch Deck: Click here

-Round size: $14M Series A

-Check Size: $50K Minimum

-Email: [email protected]

Chart of The Day

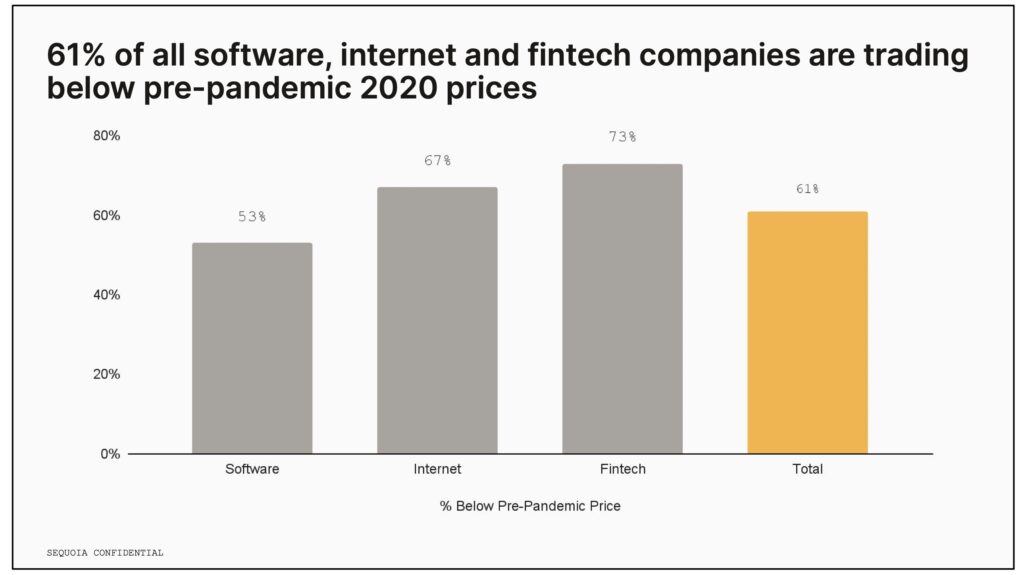

Stocks vs. Pre-COVID Prices

- ⅓ of Software, Internet, and Fintech companies are also trading below COVID lows

- Growth at all costs are no longer being rewarded as EV/ Revenue Multiples are 6% below 10 year average

- While the NASDAQ is down 28% in the past 5 months while Morgan Stanley’s unprofitable stock index is down 64%

In The News

The First EV SPAC Fails

TL;DR: On Monday, EV maker Electric Last Mile Solutions (went public via SPAC), announced that they would be filing for Chapter 7 Bankruptcy.

3 Key Points:

- SPACd in June of 2021 through a $1.4B merger with Forum Merger III

- Pre-revenue company without a car manufactured at time of SPAC and projected $630M in revenue for 2022

- In February, the founder and chairman as well as the CEO left the company due to an internal investigation that showed the companies financial statements were unreliable

Key Quote:

“In addition to Electric Last Mile Solutions, other EV makers to go public by merging with a SPAC over the last couple of years — including Faraday Future, Lordstown Motors, Lucid Motors, Nikola and Canoo — have faced SEC investigations, Nasdaq de-listings, executive resignations and other delays and road blocks in their journeys to bring a vehicle to market.”

Things are not looking good in EV SPAC land. Check out this interesting thread on how ev SPACs have fortuned in the public markets.

Golden Nuggets

- A hotel room on the 3rd hole of a serious golf tournament? Sign me up!

- My Cleveland Guardians almost gave me a heart attack in this absolutely crazy rundown

- Alex Sherman from CNBC wrote a rock solid piece on Netflix slowly becoming more and more like Legacy media

- What a catch by Cleveland’s own Steven Kwan. Is this the catch of the year

- Check out this stat: 42% of BNPL made late payments toward those loans (per CNBC)

Meme of the Day

“Compounding is hard because a bad month can feel longer than a good decade.” – Morgan Housel

Thanks for the read! Let me know what you thought by replying back to this email. Still haven’t signed up yet? Click here to do so!

— Alan

Disclaimer: This analysis is for educational and entertainment purposes solely and is not professional investment advice. The author of this piece and/or members of Workweek media could be invested in companies discussed.