13 June 2022 |

PlutoTV: The Center of the Universe

By

Hey everyone!

How sweet was Game 4 of the NBA Finals on Friday night?!

As a die-hard Cleveland sports fan currently living in Boston, it is hard to put into words how much I want to see the Celtics take this one home.

One piece of Advice for the Celtics: Defend Steph Curry.

Showtime!

Want to get these in your inbox to never miss an edition? Subscribe to The Crossover today!

PlutoTV

PlutoTV is a 100% free streaming service that is reminiscent of the TV experience that we all grew up with.

PlutoTV offers 250 live, curated channels with some of your favorite content from every genre. There are channels that promise 24/7 reality shows like Hell’s Kitchen or Deal or No Deal; sports and poker championships; classic children’s channels like Nickelodeon; and so much more.

If the service is free, how does the company make money?

Ads. Just like the good ol’ days, if a show is slotted for an hour, 43 minutes are content and 17 minutes are ads.

Industry experts have used the acronym FAST (Free-Ad-Supported-Television), to describe the rapidly growing sector led by Pluto and its competitors Tubi, Xumo, Vudu, and many more!

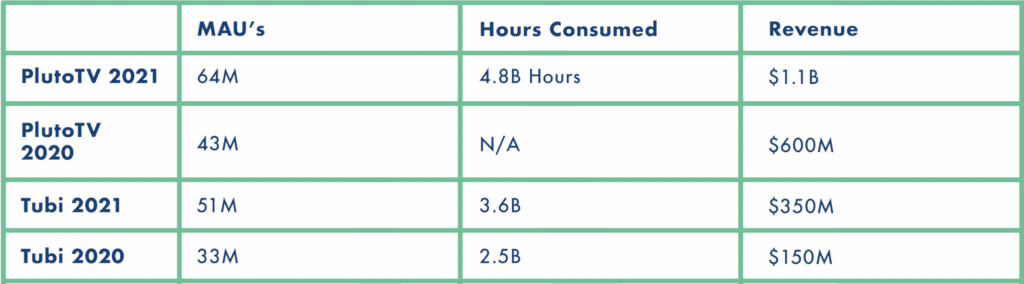

Here are Pluto’s key financials from the past two years along with their #1 competitor, Tubi (owned by Fox):

As you can see, PlutoTV is the #1 leading FAST service in the world, leading by over 1B hours consumed and $750M in revenue. At the same time, Tubi is also on an explosive trajectory, adding 18M MAUs YoY and increasing revenue by 133% YoY.

Pluto is continuing to expand their global presence by recently launching in the Nordics as well as announcing the launch of the service in Canada later this year.

Game Time: How much do you think Pluto and Tubi would be valued if they were independent entities in the public markets? How much do you think Paramount and Fox paid for these services in 2019?

Private Days

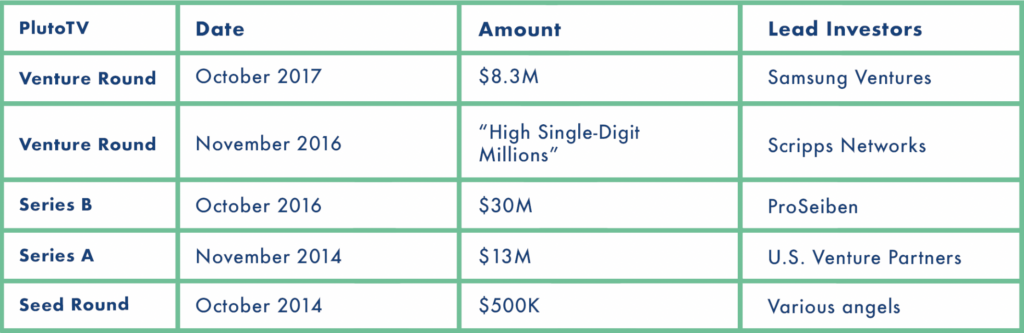

PlutoTV was founded in 2014 by entrepreneur Tom Ryan. In the private markets, the company raised ~$60M and received investments from key stakeholders over the years.

Only five years after being founded, the company was acquired by Viacom (now Paramount Global) for $340M. At the time of the acquisition, Pluto had just 12MMAUs and ~$70M in revenue.

Yes. This means that the company went from $0 in revenue to over $1B in just 7 years. Remarkable and confirming the fact that PlutoTV is a rocketship.

Alan’s Angle:

1. Contrarian Thinking – When Pluto announced the launch of their service, it happened to be on April 1. People literally thought it was an April Fool’s joke. That is how contrarian Pluto’s thinking is/was. In a world dominated by Linear TV, and the rise of Netflix planting the roots for streaming, who would have thought anyone would want an ad-supported old school experience like Pluto? Apparently tens of millions of people did globally and Pluto recognized this. Often, the greatest opportunities can be found when thinking through a contrarian lens, and the FAST industry as a whole is the perfect example of this.

2. Stakeholder Investors – A common theme we’ll touch on in The Crossover is the value of stakeholder investment. When powerful entities in the content space like Scripps (Food Network, HGTV, Travel Channel) or TV manufacturing space like Samsung Ventures (parent company Samsung) invest in your company, those stakeholders have a serious incentive to see your company succeed. The giants can then leverage their significant resources to take your company to another level. For example, PlutoTV is the native FAST app on Samsung TV Plus, the company’s native OS for TVs, something that has been of great benefit to both parties.

3. When To Sell – A common conversation that founders and investors have to chew on is when the right time to sell is. For PlutoTV, selling to a company like Viacom made so much sense as Viacom could license (or even give away) their deep library content like MTV, Comedy Central, VH1, BET, Paramount Pictures, and more for pennies on the dollar. Add onto this the financing, tech stack, and advertising capabilities (and a nice paycheck!), and selling to Viacom was a no brainer.

4. Tom Ryan – So often, founders fear that when they are acquired, they can lose control of their venture either literally, strategically, or creatively. PlutoTV Founder Tom Ryan is the perfect example that just the opposite can occur too — you can thrive post acquisition. Ryan was promoted from CEO of PlutoTV to CEO of Streaming at Paramount, managing a portfolio that includes the likes of PlutoTV, Paramount+, Showtime, BET+, and more. The creative Mr. Contrarian himself is responsible for creating the storied Paramount Global’s next chapter – an opportunity of a lifetime. If you ever wonder if things can workout post acquisition, think of Mr. Ryan.

In The News

Last week, Bloomberg shared some key nuggets from Cathie Wood’s interview with Bloomberg TV.

TL;DR: Massive inventories held by US corporations will lead to significant deflation

3 Key Points:

- After selling Tesla for 4 quarters and the stock being down 50%, ARK is buying Tesla again

- ARK feels Zoom is extraordinary undervalued due to lack of understanding around the enterprise business

- Cathie shared that everyone is focused on inflation but the greater risk to the economy is deflation

Key Quote: “Wood also hinted at a new “crossover fund” she’s planning, but said she can’t say more due to regulations.”

Thoughts:

I am a big fan of Cathie Wood. There are many things I disagree with ARK on like their vision for crypto, but at the same time, her focus on disruptive innovation is something I admire. Also, her confidence in her analysis and ability to be bold is something I admire as well.

Cathie hinting to the launch of a crossover fund is big news for this newsletter for obvious reasons. Cathie’s long term perspective and passion for finding disruptive technology, in many ways, is incredibly well suited for the private markets.

With the ability to now invest and take advantage of arbitrages between the two markets, Cathie and Co. should crush it! A lot more coming soon on ARK’s jump into the crossover world.

The Rise of the Solo Capitalist

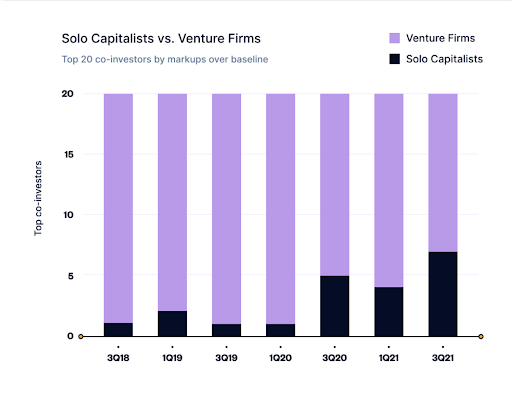

- The Term “Solo Capitalist” coined by Nikhil Trivedi, refers to venture funds that have only one general partner and usually have some sort of celebrity/professional status.

- 7 of the top 20 external co-investors on the AngelList platform were solo capitalists, not venture firms.

- AngelList highlighted a few reasons why this can be the case:

- Solo capitalists can deploy capital faster than traditional venture firms, as they don’t need to discuss decisions with GPs.

- Founders like working with other founders, and most solo capitalists are former founders.

- Solo capitalists have a great personal brand, which can lead to more exposure for their portfolio companies.

Golden Nuggets

- Great article on how SEC Chair Gary Gensler is thinking of regulator changes coming to the market post meme stock era.

- Steph Curry’s Game 4 performance was nothing short of historic. Here are the highlights in case you missed it or want to relive it!

- Very interesting piece on the rising risks of NFT ownership

- How about this athletic play by my Cleveland Guardians pitcher Zach Plesac. Who says pitchers aren’t athletes?

Meme Of The Day

Thanks for the read! Let me know what you thought by replying back to this email. See you in your inbox every Monday and Thursday.

— Alan

Disclaimer: This analysis is for educational and entertainment purposes solely and is not professional investment advice. The author of this piece and/or members of Workweek media could be invested in companies discussed.