26 May 2022 | Media

Make learning easier

By

This was piece was done by Alan Soclof. Give him a follow on Twitter!

Warren Buffett and Jeff Bezos are/were historically known for crafting annual reports that were closer to an MBA course than your average shareholder letter. Especially for those in digital media, it is time that you add the New York Times Annual Report to your reading list.

The insight and exposure that the company gives to the transition from paper/legacy media to digital, consumer trends, and how to actually be profitable in the digital media space is second to none.

Here were 4 key stats shared in the Annual Report:

- New York Times eclipsed the 10M digital subscriber mark in 2021 – adding 1.3M net new subscribers YoY, representing their second best year ever in net new subs

- Established 15M digital subscription goal by 2027, representing more than 2xing the subscriber number from end of last year

- There were 125M average monthly global unique visitors to nytimes.com

- Earned $219M in 2021 net income vs. $100M in 2020 and $140M in 2019

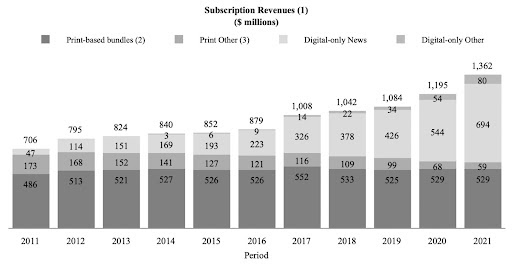

I also found this graph below incredibly interesting:

As you can see, Print-based bundles was historically the biggest revenue source for NYT until 2020 when Digital-only News became #1 and will hold this spot moving forward.

The most interesting component to this graph in my eyes is the fact that print-based bundles are actually generating more revenue than they did in 2019 – even going against difficult secular trends. Check out these stats regarding the decline in number of print based subs:

- End of 2019: 443K weekday subs & 918K Sunday subs

- End of 2021: 343K weekday subs & 820K Sunday subs

So how has the times been able to increase revenue in this category? By bundling their digital subscriptions with the print subscriptions. Not only does this increase revenue but likely lowers churn as well.

Additionally, there is still serious strength for the Times in their print advertising space as according to MediaRadar, the Times had the largest market share compared to USA Today and The Wall Street Journal.

Finally, it is important to not the collapse of the Print Other Category (Single Copy & NYT International sales). There was a ~ 13K subscriber decline YoY in international markets, from 104,800 to 91,100. This represented a significant deceleration of subscriber churn from 2020 to 2021 where subscribers decreased by ~59K, from ~164,000 to 104,800.

If you want to learn more about NYT’s 2021, attached here is the link to the 2021 Annual Report.

Also in a couple weeks, I might just be back breaking down NYT and their acquisition of The Athletic and why acquisitions like this are going to become more common.

Thanks for the read – Alan.